Market brief 04/05/2023

VIETNAM STOCK MARKET

1,040.61

1D -0.81%

YTD 3.33%

1,039.64

1D -1.12%

YTD 3.43%

208.15

1D 0.32%

YTD 1.38%

77.27

1D -0.64%

YTD 7.84%

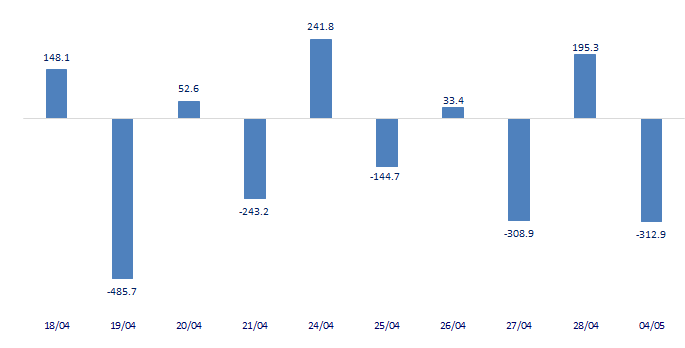

-312.91

1D 0.00%

YTD 0.00%

12,218.73

1D 3.44%

YTD 41.82%

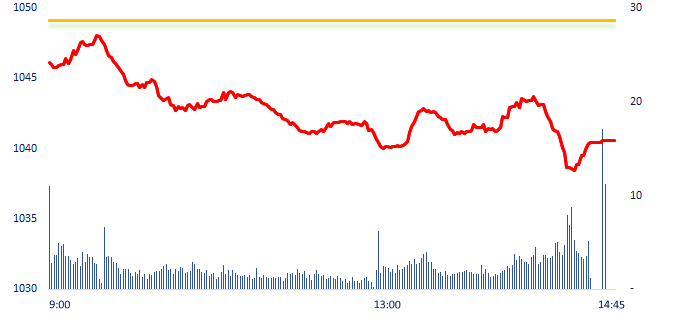

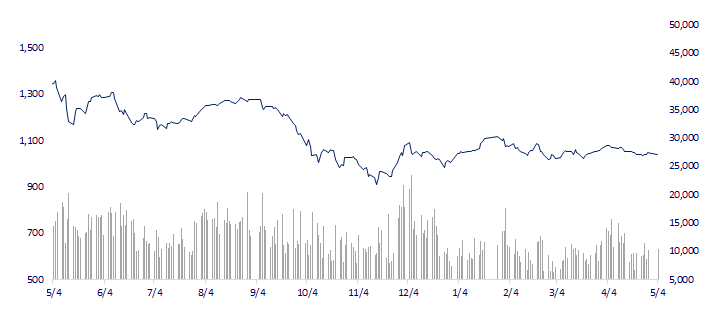

In the first trading session after the holiday, VNIndex dropped at the beginning of the morning session and remained in red throughout the session. Market liquidity continued to improve as it increased by nearly 10.8% compared to last week's session. Foreign investors turned to a net selling of nearly VND313 billion, focusing on VNM (-38 billion), CTG (-31 billion), STB (-30 billion), GMD (-29 billion), MSN (-25 billion)…

ETF & DERIVATIVES

17,930

1D -1.48%

YTD 3.46%

12,270

1D -1.29%

YTD 2.94%

12,640

1D -5.32%

YTD 1.28%

15,520

1D -5.94%

YTD 10.46%

15,840

1D -0.81%

YTD 10.38%

22,440

1D -1.15%

YTD 0.18%

13,290

1D -0.45%

YTD 2.63%

1,027

1D -0.47%

YTD 0.00%

1,028

1D -1.00%

YTD 0.00%

1,030

1D -0.25%

YTD 0.00%

1,035

1D -0.72%

YTD 0.00%

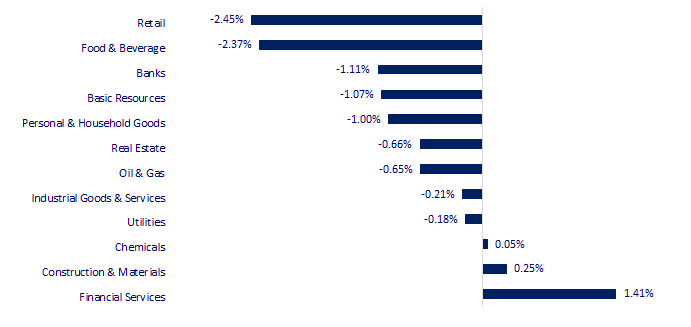

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

29,157.95

1D 1.04%

YTD 11.74%

3,350.46

1D 0.82%

YTD 8.46%

2,500.94

1D -0.02%

YTD 11.83%

19,948.73

1D 0.27%

YTD 0.85%

3,269.18

1D -0.04%

YTD 0.55%

1,533.30

1D 0.27%

YTD -8.21%

69.03

1D -5.28%

YTD -19.65%

2,039.62

1D -0.84%

YTD 11.69%

Most Asian stock markets rallied on May 4, after the US Fed raised interest rates to control inflation. At the end of the two-day meeting on May 2-3, the Fed raised the basic interest rate by 0.25 pbs to about 5-5.25%. This is the 10th consecutive rate hike by the Fed since March 2022. However, the Fed said it may pause raising interest rates to allow to assess the consequences of recent bank failures and monitor inflation.

VIETNAM ECONOMY

4.91%

1D (bps) 30

YTD (bps) -6

7.20%

1D (bps) -20

YTD (bps) -20

3.00%

1D (bps) 1

YTD (bps) -179

3.17%

1D (bps) 1

YTD (bps) -173

23,621

1D (%) -0.12%

YTD (%) -0.59%

26,650

1D (%) -0.31%

YTD (%) 3.86%

3,460

1D (%) -0.20%

YTD (%) -0.72%

On the domestic market, a survey of interest rates listed on the websites of 34 domestic banks in May 4 morning showed that some banks continued to reduce deposit interest rates. Excluding VPBank, large private banks have all lowered 12-month deposit interest rates to around 8%, such as SHB (7.9%), Techcombank (7.8%), ACB (7.75%), Sacombank (7.6%), MB (7.3%).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- PMI in April dropped to 46.7 points, businesses are still optimistic even though it is difficult to find new orders';

- Electricity price increases up to 3% from today;

- In the first 4 months of 2023, CPI increased by 3.84% over the same period last year; core inflation increased by 4.9%;

- The Fed raises interest rates for the 10th time in a row, signaling that the tightening cycle is 'coming to an end';

- White House: Default could cost more than 8 million jobs in the US;

- US: SEC passes regulation requiring private funds to increase transparency.

VN30

BANK

88,500

1D -2.21%

5D -1.67%

Buy Vol. 758,247

Sell Vol. 1,146,787

43,750

1D 0.57%

5D -0.34%

Buy Vol. 694,005

Sell Vol. 835,922

28,250

1D -2.08%

5D -0.35%

Buy Vol. 3,938,886

Sell Vol. 3,875,896

29,050

1D -1.53%

5D -2.84%

Buy Vol. 3,464,429

Sell Vol. 3,377,135

19,550

1D -1.76%

5D 0.77%

Buy Vol. 11,400,691

Sell Vol. 17,386,344

18,200

1D -1.36%

5D -1.09%

Buy Vol. 9,781,435

Sell Vol. 12,514,774

18,800

1D 0.00%

5D -1.05%

Buy Vol. 1,605,376

Sell Vol. 1,786,760

23,600

1D -0.84%

5D 2.39%

Buy Vol. 3,673,187

Sell Vol. 3,556,301

25,150

1D -0.59%

5D 0.00%

Buy Vol. 15,797,452

Sell Vol. 17,485,818

20,200

1D -1.46%

5D -0.25%

Buy Vol. 4,287,121

Sell Vol. 5,012,661

24,700

1D 2.07%

5D 2.28%

Buy Vol. 7,394,353

Sell Vol. 6,957,424

VCB: According to the financial report of the first quarter, the consolidated profit before tax and after tax of Vietcombank reached VND11,221 billion and VND8,992 billion, up nearly 13% over the same period last year. Vietcombank has approved the business plan for 2023 with the target that pre-tax profit will increase by at least 15% compared to 2022. Previously, this bank recorded a consolidated profit before tax of VND37,368 billion in 2022. Thus, in 2023, Vietcombank expects a minimum profit of about VND43 trillion.

REAL ESTATE

13,550

1D -5.24%

5D -3.90%

Buy Vol. 63,794,064

Sell Vol. 58,737,524

78,100

1D -0.76%

5D -0.51%

Buy Vol. 106,148

Sell Vol. 154,252

13,700

1D -3.18%

5D -0.36%

Buy Vol. 12,655,243

Sell Vol. 14,556,736

NVL: A project of Novaland that has been cleared of legal obstacles is The Grand Manhattan (District 1, Ho Chi Minh City) which has been re-constructed after a temporary pause.

OIL & GAS

92,000

1D -0.86%

5D -0.22%

Buy Vol. 415,586

Sell Vol. 434,386

13,000

1D -0.76%

5D 1.17%

Buy Vol. 33,848,834

Sell Vol. 17,739,587

37,450

1D 0.00%

5D 0.00%

Buy Vol. 1,072,018

Sell Vol. 1,758,169

PLX: In Q1, PLX's revenue increased slightly by 1%, to more than VND67.4 trillion. COGS decreased slightly by 1%, thereby helping PLX achieve a gross profit of nearly VND3.56 trillion, up 28% QoQ.

VINGROUP

51,300

1D -1.54%

5D 1.58%

Buy Vol. 2,292,509

Sell Vol. 2,997,023

49,500

1D 0.00%

5D 4.21%

Buy Vol. 2,235,015

Sell Vol. 2,023,594

27,250

1D -1.62%

5D 0.93%

Buy Vol. 2,894,824

Sell Vol. 2,802,084

VIC: In Q12023, Vingroup's real estate revenue accounted for 74%, is the main source of revenue of the group, with a contribution of nearly VND29,000 billion, approximately Q42022.

FOOD & BEVERAGE

68,600

1D -2.00%

5D -1.29%

Buy Vol. 3,890,501

Sell Vol. 3,674,151

70,600

1D -3.42%

5D -2.35%

Buy Vol. 1,452,516

Sell Vol. 1,537,755

166,600

1D -3.14%

5D -4.25%

Buy Vol. 194,007

Sell Vol. 284,721

MSN: Masan achieved revenue of VND18,706 billion in the first quarter of 2023, up 3% QoQ, despite the challenging macro environment.

OTHERS

45,250

1D 0.78%

5D 0.89%

Buy Vol. 714,306

Sell Vol. 596,367

95,500

1D -1.55%

5D 0.42%

Buy Vol. 301,966

Sell Vol. 392,926

78,500

1D 1.29%

5D 0.26%

Buy Vol. 1,359,897

Sell Vol. 870,165

37,900

1D -3.32%

5D -1.94%

Buy Vol. 3,854,096

Sell Vol. 4,538,774

15,700

1D 0.96%

5D 1.62%

Buy Vol. 4,784,882

Sell Vol. 5,328,718

21,750

1D 0.93%

5D 2.84%

Buy Vol. 28,985,458

Sell Vol. 31,390,916

21,300

1D -1.62%

5D -1.84%

Buy Vol. 30,938,151

Sell Vol. 29,839,740

VJC: According to the parent company's Q1/2023 business results report, Vietjet's air transportation revenue reached VND12,880 billion, profit after tax reached VND168 billion, up 286% and 320% respectively compared to the same period in 2022. In which, ancillary revenue reached VND4,312 billion, contributing more than 33% of total revenue.

Market by numbers

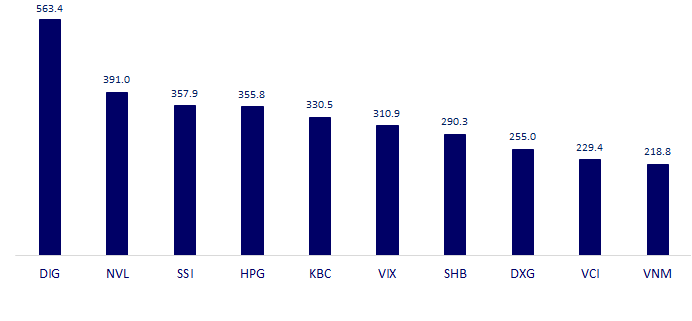

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

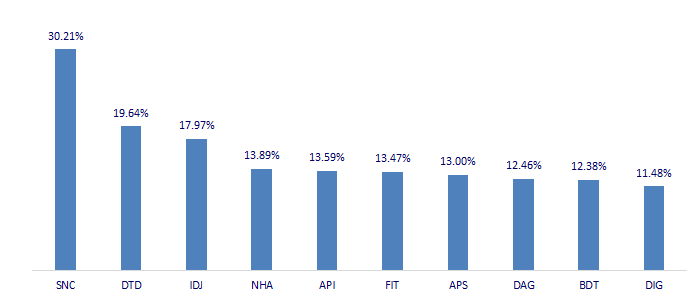

TOP INCREASES 3 CONSECUTIVE SESSIONS

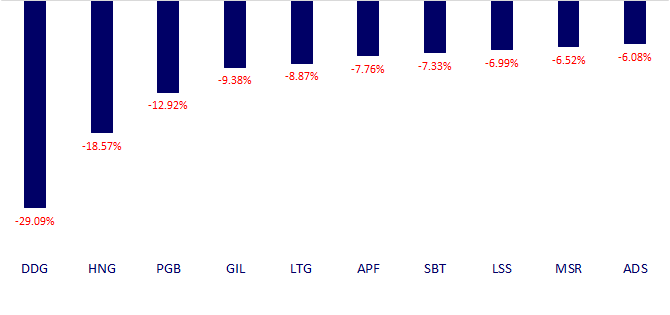

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.