Market brief 10/05/2023

VIETNAM STOCK MARKET

1,058.26

1D 0.43%

YTD 5.08%

1,054.99

1D 0.51%

YTD 4.95%

213.89

1D 0.92%

YTD 4.18%

78.84

1D 0.64%

YTD 10.03%

-28.85

1D 0.00%

YTD 0.00%

13,384.22

1D 19.79%

YTD 55.34%

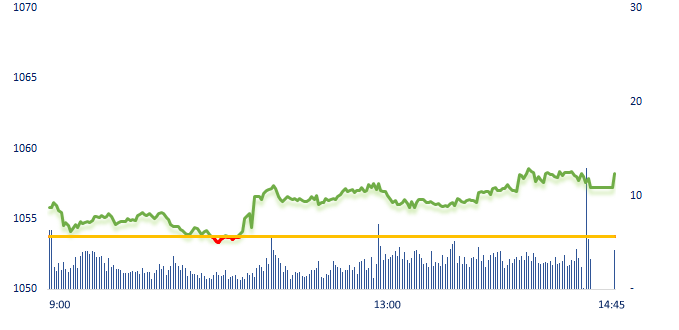

Today, VNIndex continued to trade in green. Investor sentiment is more optimistic in the short-term uptrend. Rubber stocks had remarkable trade today with representatives such as GVR (+4.3%), DPR (+3.6%), DRC (+1.4%), PHR (+1.2)…. GVR contributed 0.72 points to VNIndex and also represented the largest contributor.

ETF & DERIVATIVES

18,020

1D 0.11%

YTD 3.98%

12,450

1D 0.32%

YTD 4.45%

12,940

1D 0.00%

YTD 3.69%

16,010

1D -3.44%

YTD 13.95%

16,150

1D 1.32%

YTD 12.54%

22,300

1D 0.63%

YTD -0.45%

13,380

1D -0.45%

YTD 3.32%

1,044

1D 1.00%

YTD 0.00%

1,047

1D 0.83%

YTD 0.00%

1,049

1D 0.89%

YTD 0.00%

1,051

1D 0.81%

YTD 0.00%

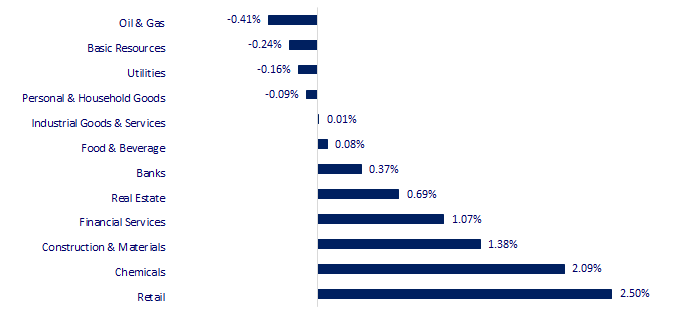

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

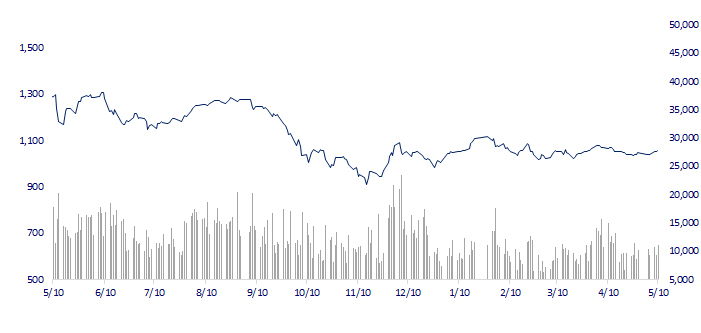

VNINDEX (12M)

GLOBAL MARKET

29,122.18

1D -0.41%

YTD 11.60%

3,319.15

1D -1.15%

YTD 7.44%

2,496.51

1D -0.54%

YTD 11.63%

19,762.20

1D -0.53%

YTD -0.10%

3,242.29

1D -0.02%

YTD -0.28%

1,569.56

1D 0.31%

YTD -6.03%

72.86

1D -5.61%

YTD -15.19%

2,038.65

1D -0.14%

YTD 11.63%

In the afternoon session of May 10, Asian stocks extended their losses as traders awaited US inflation data. Besides, investor sentiment was also under pressure due to a series of issues such as the US debt ceiling stalemate and the uncertainty of the banking industry.

VIETNAM ECONOMY

4.82%

1D (bps) -20

YTD (bps) -15

7.20%

YTD (bps) -20

2.89%

1D (bps) -9

YTD (bps) -190

3.06%

1D (bps) 5

YTD (bps) -184

23,680

1D (%) 0.19%

YTD (%) -0.34%

26,149

1D (%) -1.22%

YTD (%) 1.91%

3,459

1D (%) -0.06%

YTD (%) -0.75%

The State Bank will “intervene early” when a bank has a series of withdrawals leading to insolvency, or accumulated losses greater than 20% of charter capital and reserve funds.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- At the beginning of May, deposit interest rates continued to cool down;

- The SBV will 'intervene early' when the Bank suffers from a series of withdrawals;

- Mobilizing resources from the private sector into PPP projects;

- President Biden may cancel his trip to Asia when the US is about to default;

- The amount of gold hoarded by central banks is at a record high;

- OPEC+'s decision to cut output helps balance the oil market.

VN30

BANK

92,000

1D -0.33%

5D 1.66%

Buy Vol. 763,196

Sell Vol. 841,748

45,000

1D -0.22%

5D 3.45%

Buy Vol. 1,044,602

Sell Vol. 1,735,047

28,250

1D 0.89%

5D -2.08%

Buy Vol. 8,509,775

Sell Vol. 7,024,460

29,300

1D 0.00%

5D -0.68%

Buy Vol. 4,364,654

Sell Vol. 4,511,730

19,550

1D 0.51%

5D -1.76%

Buy Vol. 14,525,461

Sell Vol. 16,289,344

18,500

1D 1.09%

5D 0.27%

Buy Vol. 14,703,691

Sell Vol. 12,711,806

19,150

1D 0.52%

5D 1.86%

Buy Vol. 2,376,863

Sell Vol. 2,717,824

23,750

1D 0.85%

5D -0.21%

Buy Vol. 8,962,065

Sell Vol. 9,270,758

26,350

1D 2.33%

5D 4.15%

Buy Vol. 26,243,525

Sell Vol. 33,594,582

20,650

1D 1.98%

5D 0.73%

Buy Vol. 11,548,736

Sell Vol. 8,284,531

24,900

1D 0.00%

5D 2.89%

Buy Vol. 3,444,499

Sell Vol. 4,815,813

ACB: ACB's bad debt at the end of Q1 was VND4,003 billion, up 31% compared to the beginning of the year. In which, group 4 debt increased 149% to VND1,090 billion, group 3 debt increased 94% to VND859 billion. Group 5 debt decreased slightly by 5% to VND2,052 billion. The bank's bad debt ratio increased from 0.74% to 0.98%.

REAL ESTATE

13,300

1D 2.31%

5D -6.99%

Buy Vol. 29,711,674

Sell Vol. 26,172,429

77,600

1D -0.13%

5D -1.40%

Buy Vol. 136,870

Sell Vol. 159,252

13,750

1D 2.23%

5D -2.83%

Buy Vol. 11,205,846

Sell Vol. 11,704,993

PDR: Collecting shareholders' written opinions on the issuance of shares to shareholders at the rate of 30% and the price not lower than VND10,000 to increase charter capital.

OIL & GAS

93,200

1D -0.96%

5D 0.43%

Buy Vol. 458,217

Sell Vol. 647,365

13,400

1D 0.37%

5D 2.29%

Buy Vol. 10,234,709

Sell Vol. 14,971,825

37,750

1D -0.66%

5D 0.80%

Buy Vol. 1,056,847

Sell Vol. 1,445,957

PLX: At the end of the first quarter, PLX held more than VND9 trillion in cash and equivalents, and over VND7.3 trillion of held-to-maturity investments.

VINGROUP

50,600

1D 0.00%

5D -2.88%

Buy Vol. 1,951,197

Sell Vol. 2,429,999

49,350

1D 0.10%

5D -0.30%

Buy Vol. 1,140,173

Sell Vol. 1,264,786

27,800

1D 1.46%

5D 0.36%

Buy Vol. 6,578,052

Sell Vol. 5,759,849

VIC: In January, paying special consumption tax is VND146 billion, in February it is only VND16 billion; the whole quarter, decreased by VND600 billion.

FOOD & BEVERAGE

70,500

1D -0.28%

5D 0.71%

Buy Vol. 1,489,617

Sell Vol. 1,941,341

73,600

1D 0.00%

5D 0.68%

Buy Vol. 1,238,053

Sell Vol. 1,846,621

165,200

1D 0.06%

5D -3.95%

Buy Vol. 164,557

Sell Vol. 144,461

VNM: From the beginning of the year, Vinamilk has signed many large export contracts with a value of up to USD100 million, serving the demand for baby formula in the Middle East market.

OTHERS

45,950

1D -0.11%

5D 2.34%

Buy Vol. 731,791

Sell Vol. 861,559

96,800

1D 1.47%

5D -0.21%

Buy Vol. 363,848

Sell Vol. 350,247

79,000

1D 0.13%

5D 1.94%

Buy Vol. 1,305,300

Sell Vol. 1,308,394

39,000

1D 2.77%

5D -0.51%

Buy Vol. 4,306,524

Sell Vol. 3,892,505

16,850

1D 4.33%

5D 8.36%

Buy Vol. 14,718,007

Sell Vol. 12,559,034

22,500

1D 1.12%

5D 4.41%

Buy Vol. 37,529,086

Sell Vol. 42,309,146

21,700

1D -0.46%

5D 0.23%

Buy Vol. 17,531,578

Sell Vol. 26,268,587

MWG: According to information from MWG, in the first quarter of 2023, Bach Hoa Xanh Trading Joint Stock Company continued to report a loss of VND353.7 billion. Previously, Bach Hoa Xanh had continuously suffered losses from 2016 to 2022. The total loss after calculating the first quarter of 2023 was VND7,749 billion.

Market by numbers

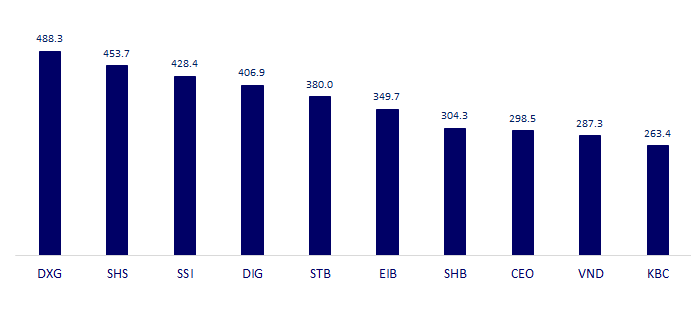

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

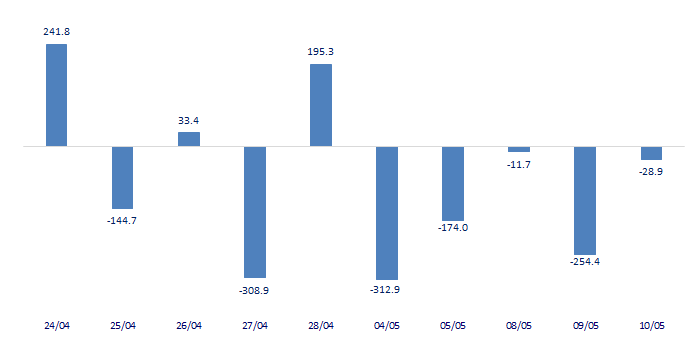

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

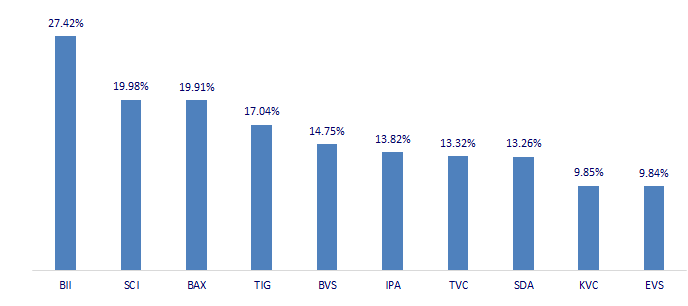

TOP INCREASES 3 CONSECUTIVE SESSIONS

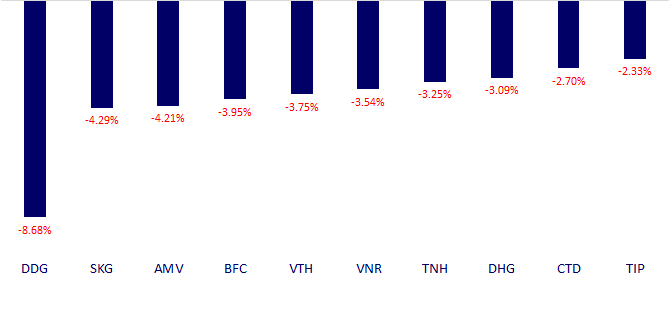

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.