Market brief 12/05/2023

VIETNAM STOCK MARKET

1,066.90

1D 0.93%

YTD 5.94%

1,066.44

1D 1.09%

YTD 6.09%

215.10

1D 0.32%

YTD 4.77%

80.05

1D 1.16%

YTD 11.72%

5.37

1D 0.00%

YTD 0.00%

14,128.82

1D 0.76%

YTD 63.98%

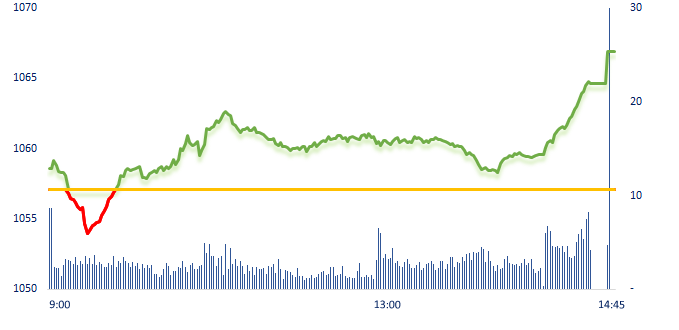

VNIndex dropped slightly at the beginning of the session but quickly recovered and closed at the highest level of the session. Steel gained the most in today session with a steady increase in representatives such as HPG (+2.8%), HSG (+1.2%), NKG (+1.3%), TLH (+6.3%), VGS (+2.7%)…

ETF & DERIVATIVES

18,160

1D 0.94%

YTD 4.79%

12,580

1D 1.04%

YTD 5.54%

12,920

1D 0.00%

YTD 3.53%

16,000

1D 1.27%

YTD 13.88%

16,200

1D 0.37%

YTD 12.89%

22,310

1D 0.22%

YTD -0.40%

13,500

1D 0.37%

YTD 4.25%

1,057

1D 1.09%

YTD 0.00%

1,057

1D 1.03%

YTD 0.00%

1,060

1D 0.96%

YTD 0.00%

1,065

1D 1.26%

YTD 0.00%

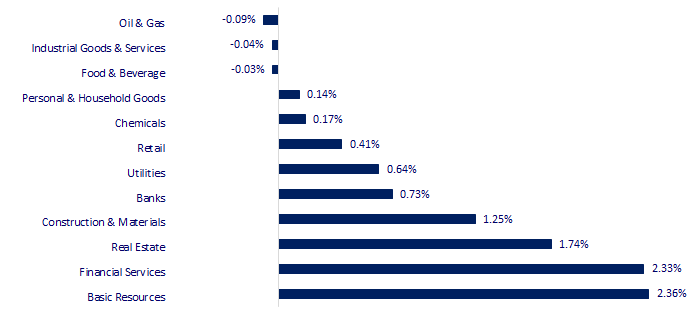

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

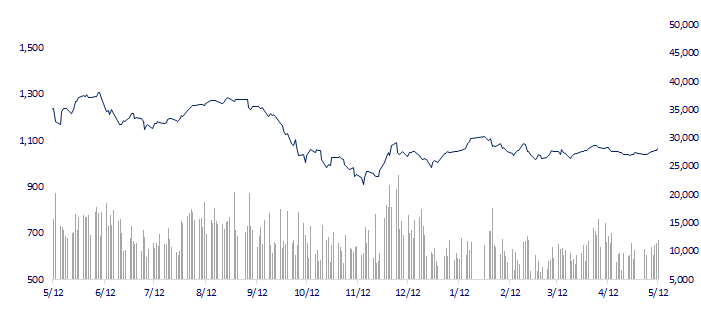

VNINDEX (12M)

GLOBAL MARKET

29,388.30

1D 0.90%

YTD 12.62%

3,272.36

1D -1.12%

YTD 5.93%

2,475.42

1D -0.63%

YTD 10.69%

19,627.24

1D -0.59%

YTD -0.78%

3,208.55

1D -0.65%

YTD -1.32%

1,561.35

1D -0.39%

YTD -6.53%

71.17

1D -5.13%

YTD -17.16%

2,011.15

1D -0.36%

YTD 10.13%

Asian stock markets continued to move up and down in a narrow range in the afternoon session of May 12, in the context of not having much positive information from the US and China markets.

VIETNAM ECONOMY

4.91%

1D (bps) 13

YTD (bps) -6

7.20%

YTD (bps) -20

2.86%

1D (bps) -4

YTD (bps) -193

3.04%

1D (bps) -6

YTD (bps) -186

23,670

1D (%) 0.11%

YTD (%) -0.38%

26,042

1D (%) -1.21%

YTD (%) 1.49%

3,446

1D (%) -0.06%

YTD (%) -1.12%

Yesterday (May 11), in the OMO market, the State Bank of Vietnam (SBV) offered bids for two terms of 07 days and 28 days, with the volume of VND10,000 billion/term with the interest rate of 5.0%. There is no winning volume in both terms; there are VND11,955.73 billion due. The SBV does not offer SBV bills, which have no maturity.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- China imported record shrimp in Q1, but imports from Vietnam dropped sharply;

- Deploying a package of VND120,000 billion for social housing loans;

- Governor: The State Bank will consider reducing the operating interest rate;

- BoE raised interest rates to 15-year highs;

- Russia does not fall into economic disaster, will continue to grow positively;

- Americans disagree about whether to let the country default.

VN30

BANK

92,800

1D 1.98%

5D 3.34%

Buy Vol. 1,046,216

Sell Vol. 1,114,280

45,000

1D 0.00%

5D 3.57%

Buy Vol. 956,684

Sell Vol. 960,603

28,400

1D 0.18%

5D 1.97%

Buy Vol. 6,405,301

Sell Vol. 6,544,640

29,300

1D 0.69%

5D 2.09%

Buy Vol. 5,056,872

Sell Vol. 5,169,143

19,750

1D -0.25%

5D 1.54%

Buy Vol. 11,859,363

Sell Vol. 17,778,615

18,650

1D 0.81%

5D 3.04%

Buy Vol. 14,829,599

Sell Vol. 15,024,516

19,400

1D 1.04%

5D 1.84%

Buy Vol. 2,883,338

Sell Vol. 3,362,845

23,550

1D -0.21%

5D 0.86%

Buy Vol. 3,445,492

Sell Vol. 4,509,552

26,800

1D 1.52%

5D 7.41%

Buy Vol. 40,368,064

Sell Vol. 35,996,627

20,500

1D -0.24%

5D 1.74%

Buy Vol. 7,829,002

Sell Vol. 8,915,552

25,000

1D 0.40%

5D 1.42%

Buy Vol. 4,399,542

Sell Vol. 5,561,841

According to VPBank's latest listed interest rates from May 12, interest rates for terms over 12 months have all decreased by 0.2 percentage points. In which, the highest interest rate applied for 12-13 term is only 8%/year, 15-36 month term is down to 7.2%/year. TPBank also reduced 0.1 - 0.2 percentage points of deposit interest rates for terms of 6 months or more. Currently, the highest interest rate applied by TPBank is 7.8%, for online depositors.

REAL ESTATE

13,700

1D -0.72%

5D 1.11%

Buy Vol. 28,674,853

Sell Vol. 43,656,663

77,500

1D 0.00%

5D -0.51%

Buy Vol. 125,462

Sell Vol. 191,214

13,950

1D 0.00%

5D 3.33%

Buy Vol. 11,359,929

Sell Vol. 14,427,685

NVL: Novaland is facing many difficulties with huge debts. Liabilities at the end of the first quarter were VND211,787 billion, 4.8 times more than equity.

OIL & GAS

92,500

1D 0.33%

5D 0.65%

Buy Vol. 786,636

Sell Vol. 528,043

13,400

1D 0.75%

5D 2.68%

Buy Vol. 10,699,852

Sell Vol. 14,092,243

37,550

1D -0.53%

5D -0.66%

Buy Vol. 986,301

Sell Vol. 1,178,654

PLX: 60% increase in financial revenue QoQ to VND513 billion thanks to an increase in foreign exchange gain (VND281 billion), Petrolimex's net profit reached VND620 billion, up 155% in Q1.2023

VINGROUP

51,700

1D 2.38%

5D 1.97%

Buy Vol. 3,641,636

Sell Vol. 4,357,864

51,200

1D 4.17%

5D 4.49%

Buy Vol. 2,424,080

Sell Vol. 2,072,164

28,150

1D 0.36%

5D 3.68%

Buy Vol. 5,083,446

Sell Vol. 5,491,056

VIC: VinFast reported April sales with good numbers. Specifically, VinFast has sold a total of 3,798 electric cars, more than 4 times higher than in March (915 cars).

FOOD & BEVERAGE

69,600

1D -0.57%

5D 1.16%

Buy Vol. 2,141,972

Sell Vol. 1,996,781

74,400

1D 0.81%

5D 1.92%

Buy Vol. 781,103

Sell Vol. 1,054,418

163,900

1D -0.36%

5D -0.97%

Buy Vol. 244,416

Sell Vol. 284,668

SAB: SAB will additionally pay the 2022 cash dividend (15%), bringing the total dividend payout ratio in 2022 to 50%. In addition, SAB shareholders will receive bonus shares at the ratio of 1:1.

OTHERS

46,000

1D 0.66%

5D 0.22%

Buy Vol. 1,537,709

Sell Vol. 939,571

97,200

1D 0.52%

5D 1.25%

Buy Vol. 487,911

Sell Vol. 462,303

80,500

1D 1.77%

5D 2.68%

Buy Vol. 2,413,922

Sell Vol. 1,759,777

39,000

1D 0.78%

5D 3.17%

Buy Vol. 3,426,262

Sell Vol. 3,835,498

16,800

1D 0.60%

5D 8.39%

Buy Vol. 8,762,044

Sell Vol. 8,977,064

23,250

1D 3.79%

5D 8.39%

Buy Vol. 52,059,352

Sell Vol. 45,191,449

22,350

1D 2.76%

5D 4.20%

Buy Vol. 79,132,185

Sell Vol. 80,336,839

BVH: The insurance business suffered a loss, but financial profit increased by 23% and the profit of associates was 2.6 times higher than the same period last year, helping BVH's net profit increase by 10% in Q1/2023, reaching more than VND528 billion.

Market by numbers

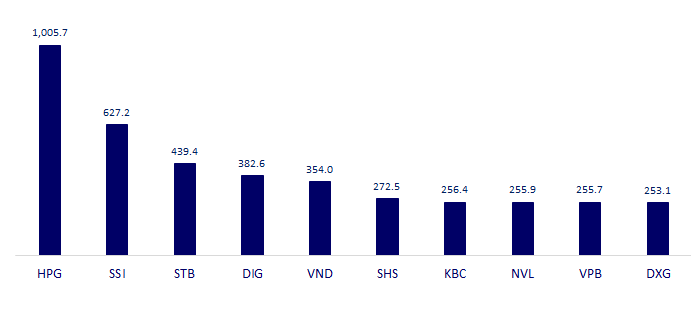

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

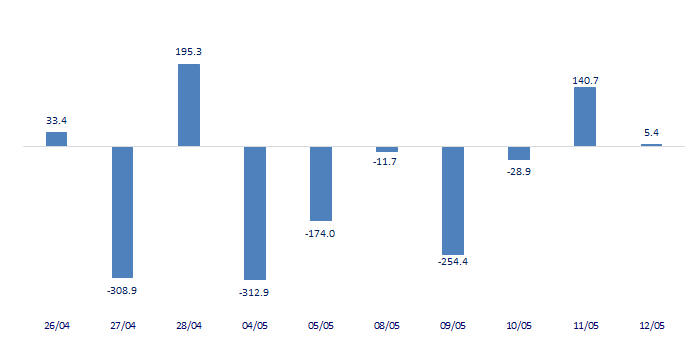

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

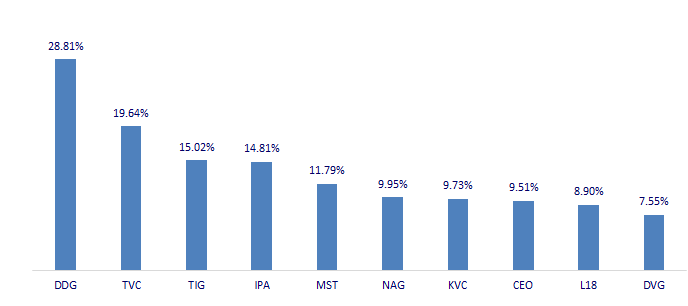

TOP INCREASES 3 CONSECUTIVE SESSIONS

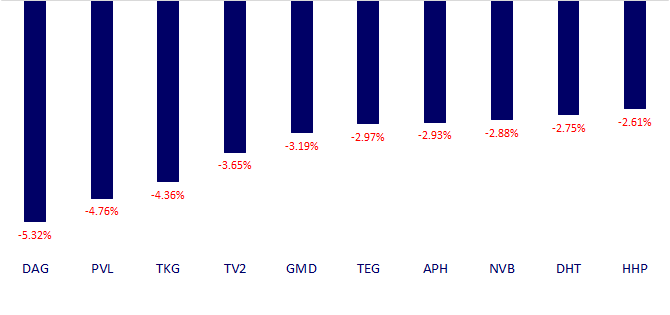

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.