Market brief 22/05/2023

VIETNAM STOCK MARKET

1,070.64

1D 0.33%

YTD 6.31%

1,073.74

1D 0.46%

YTD 6.82%

215.90

1D 0.93%

YTD 5.16%

81.21

1D 0.16%

YTD 13.34%

-456.32

1D 0.00%

YTD 0.00%

14,348.08

1D -8.72%

YTD 66.53%

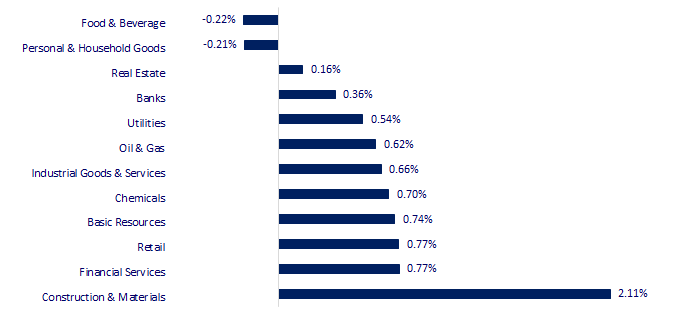

With public investment capital in April 2023 reaching VND39.3 trillion, up 16.4% over the same period last year, construction and materials stocks had a booming session. The most positive market can be mentioned as PLC, CII, HHV, HBC, FCN, etc. Besides, the positivity of the market also spread to other industry groups such as securities, banking, retail or steel.

ETF & DERIVATIVES

18,280

1D 0.44%

YTD 5.48%

12,680

1D 0.40%

YTD 6.38%

13,190

1D 1.54%

YTD 5.69%

16,000

1D -0.62%

YTD 13.88%

16,360

1D 0.37%

YTD 14.01%

22,380

1D 0.31%

YTD -0.09%

13,590

1D -0.37%

YTD 4.94%

1,061

1D 0.39%

YTD 0.00%

1,061

1D 0.25%

YTD 0.00%

1,062

1D 0.12%

YTD 0.00%

1,065

1D 0.26%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

31,086.82

1D 0.90%

YTD 19.13%

3,296.47

1D 0.39%

YTD 6.71%

2,557.08

1D 0.76%

YTD 14.34%

19,722.50

1D 1.40%

YTD -0.30%

3,205.06

1D 0.08%

YTD -1.42%

1,515.30

1D 0.03%

YTD -9.28%

75.55

1D 0.19%

YTD -12.06%

1,981.55

1D 0.01%

YTD 8.51%

Asian markets mostly gained in the first session of the week despite the possibility of US debt default in the near future. Nikkei 225 (Japan) continues to break historical peaks thanks to loosening monetary policies.

VIETNAM ECONOMY

4.41%

1D (bps) -3

YTD (bps) -56

7.20%

YTD (bps) -20

2.77%

1D (bps) -9

YTD (bps) -202

3.00%

1D (bps) -3

YTD (bps) -190

23,617

1D (%) -0.06%

YTD (%) -0.60%

26,057

1D (%) -0.20%

YTD (%) 1.55%

3,405

1D (%) -0.38%

YTD (%) -2.30%

During the trading session on May 22, domestic and international gold prices increased in the same direction. SJC gold bar price suddenly increased the most since the beginning of the month so far.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Opening the 5th session, the 15th National Assembly: Promote key infrastructure projects;

- Japan spends JPY50 billion to support Vietnam to recover after the COVID-19 pandemic;

- China's leading battery manufacturer wants to invest in Hai Duong;

- The White House rushes to negotiate with the Republican Party to avoid default;

- Banks in China kept lending interest rates unchanged for 9 consecutive months;

- BOJ Governor continues to hold a dovish monetary policy stance.

VN30

BANK

93,100

1D -1.17%

5D 1.53%

Buy Vol. 1,209,111

Sell Vol. 1,076,912

44,400

1D 0.00%

5D -1.11%

Buy Vol. 949,785

Sell Vol. 1,281,024

27,950

1D -0.18%

5D -0.53%

Buy Vol. 6,014,435

Sell Vol. 6,088,801

30,500

1D 2.87%

5D 2.01%

Buy Vol. 18,521,095

Sell Vol. 15,143,560

19,700

1D 2.07%

5D -0.51%

Buy Vol. 25,038,358

Sell Vol. 22,526,842

18,850

1D 1.07%

5D 0.00%

Buy Vol. 18,996,797

Sell Vol. 18,941,253

19,450

1D 0.26%

5D 0.26%

Buy Vol. 3,746,152

Sell Vol. 3,500,575

23,800

1D 1.49%

5D -0.42%

Buy Vol. 8,926,406

Sell Vol. 8,029,355

28,150

1D 1.08%

5D 4.26%

Buy Vol. 42,475,646

Sell Vol. 32,931,017

21,600

1D 0.93%

5D 3.60%

Buy Vol. 10,623,005

Sell Vol. 9,204,666

25,050

1D 0.40%

5D 0.20%

Buy Vol. 8,894,393

Sell Vol. 7,400,615

STB: Responding to the State Bank's message calling for lower lending rates to support stable economic growth, Sacombank continues to launch a preferential package of VND15,000 billion in loans to serve business production, applied until the end of December 31, 2023.

REAL ESTATE

13,350

1D 1.14%

5D -1.11%

Buy Vol. 23,651,794

Sell Vol. 25,167,296

77,800

1D -0.13%

5D 0.52%

Buy Vol. 117,815

Sell Vol. 133,050

13,400

1D 0.37%

5D -2.90%

Buy Vol. 9,350,536

Sell Vol. 9,121,327

PDR: Mr. Bui Quang Anh Vu - General Director of Phat Dat - registered to sell 18.7 million PDR shares for the purpose of portfolio restructuring.

OIL & GAS

94,700

1D -0.21%

5D 2.71%

Buy Vol. 889,061

Sell Vol. 916,809

13,600

1D 0.74%

5D 2.26%

Buy Vol. 21,010,828

Sell Vol. 21,169,643

37,750

1D 0.40%

5D -0.13%

Buy Vol. 917,418

Sell Vol. 1,264,585

POW: In April, POW recorded a total power output of 1,369 million kWh, completing 99% of the monthly plan. Accordingly, revenue is estimated at VND2,629 billion, also completing 99% of the plan.

VINGROUP

52,100

1D -0.76%

5D -4.23%

Buy Vol. 3,002,786

Sell Vol. 3,481,846

54,100

1D 0.00%

5D 4.64%

Buy Vol. 2,283,362

Sell Vol. 2,597,189

27,900

1D -0.36%

5D -1.76%

Buy Vol. 6,286,082

Sell Vol. 6,886,815

VIC: In addition to the super-small car, the owner of Vingroup revealed that VinFast is about to have an electric pickup truck.

FOOD & BEVERAGE

68,200

1D -0.58%

5D -1.16%

Buy Vol. 2,611,193

Sell Vol. 3,015,569

72,000

1D -0.55%

5D -2.83%

Buy Vol. 1,392,726

Sell Vol. 1,230,697

160,700

1D 0.00%

5D -2.07%

Buy Vol. 155,673

Sell Vol. 139,082

SAB: Sabeco signed a contract with Singapore energy group SP Group to install rooftop energy systems at 9 breweries in 2023, aiming for green growth.

OTHERS

43,800

1D -1.13%

5D -3.74%

Buy Vol. 1,762,871

Sell Vol. 1,562,424

99,200

1D 0.51%

5D 1.95%

Buy Vol. 1,369,619

Sell Vol. 1,334,922

82,500

1D -0.36%

5D 1.85%

Buy Vol. 1,182,295

Sell Vol. 1,485,053

38,550

1D 0.65%

5D -0.90%

Buy Vol. 2,952,176

Sell Vol. 3,207,307

16,500

1D 1.54%

5D 2.17%

Buy Vol. 4,847,955

Sell Vol. 5,626,390

22,900

1D 0.00%

5D 0.00%

Buy Vol. 26,412,638

Sell Vol. 32,816,825

21,900

1D 0.46%

5D -0.90%

Buy Vol. 31,116,501

Sell Vol. 31,169,088

FPT: According to the business results update report, in the first 4 months of 2023, FPT Joint Stock Company brought in VND15.749 billion in revenue and VND2,019 billion in net profit, up 21% and 20% respectively compared to the previous year.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.