Market brief 26/05/2023

VIETNAM STOCK MARKET

1,063.76

1D -0.08%

YTD 5.63%

1,060.81

1D -0.13%

YTD 5.53%

217.64

1D 0.40%

YTD 6.01%

80.58

1D -0.16%

YTD 12.46%

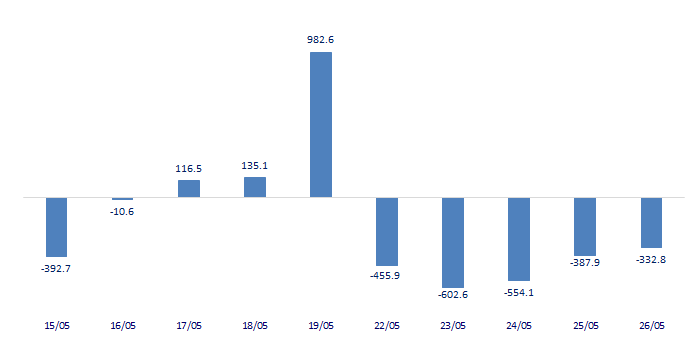

-332.78

1D 0.00%

YTD 0.00%

13,207.88

1D -5.98%

YTD 53.30%

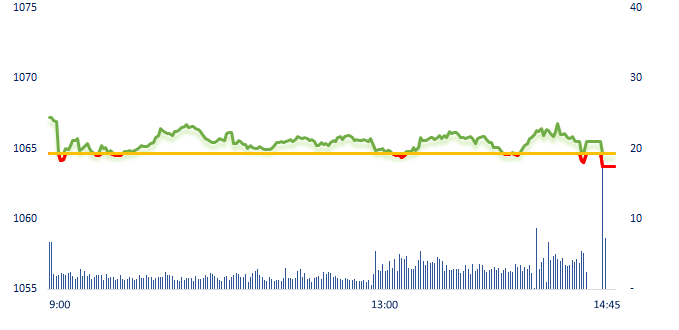

The market excitedly rallied right from the ATO session, but then, the hesitation gradually appeared in today's session, when the market traded in narrow range, just over 4 points. Foreign investors continued to have the 5th consecutive with a value of VND388 billion.

ETF & DERIVATIVES

18,050

1D -0.22%

YTD 4.15%

12,520

1D -0.16%

YTD 5.03%

13,030

1D 0.15%

YTD 4.41%

16,050

1D -0.25%

YTD 14.23%

16,050

1D -0.62%

YTD 11.85%

22,300

1D 0.50%

YTD -0.45%

13,520

1D -0.15%

YTD 4.40%

1,053

1D 0.35%

YTD 0.00%

1,053

1D 0.04%

YTD 0.00%

1,054

1D -0.08%

YTD 0.00%

1,057

1D -0.05%

YTD 0.00%

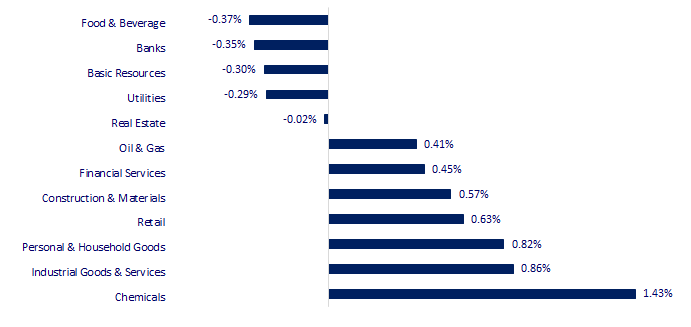

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

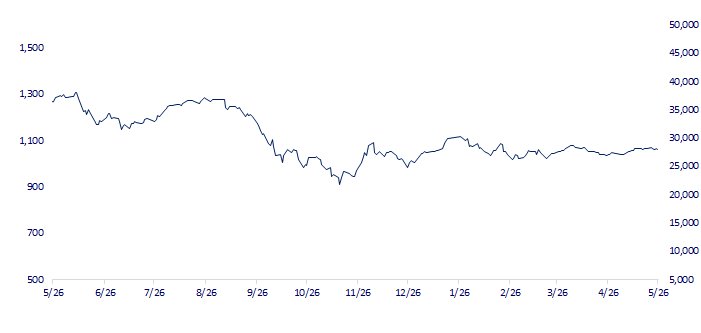

VNINDEX (12M)

GLOBAL MARKET

30,916.31

1D 0.37%

YTD 18.48%

3,212.50

1D 0.35%

YTD 3.99%

2,558.81

1D 0.16%

YTD 14.42%

18,746.92

1D 0.00%

YTD -5.23%

3,207.39

1D -0.01%

YTD -1.35%

1,530.84

1D -0.30%

YTD -8.35%

72.38

1D -4.75%

YTD -15.75%

1,953.11

1D 0.42%

YTD 6.95%

In the afternoon session of May 26, Asian stock markets mostly gained, amid hopes of an agreement to raise the debt ceiling in the US and the bounce of technology stocks.

VIETNAM ECONOMY

4.08%

1D (bps) -10

YTD (bps) -89

7.20%

YTD (bps) -20

2.84%

1D (bps) 7

YTD (bps) -195

3.07%

1D (bps) 5

YTD (bps) -183

23,692

1D (%) 0.20%

YTD (%) -0.29%

25,643

1D (%) -1.04%

YTD (%) -0.06%

3,396

1D (%) 0.30%

YTD (%) -2.55%

Since the beginning of the week, the SBV has injected a net of nearly VND40,000 billion into the market, not to mention VND20,000 billion last week. Thus, the State Bank has injected to the market more than half of the total amount of VND110,700 billion dong previously withdrawn through the treasury bill channel.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank has injected nearly VND60,000 billion back to the market, with abundant liquidity;

- The Ministry of Industry and Trade accelerates the removal of transitional renewable electricity;

- In the first three months of the year, non-cash payment transactions increased by 53.51% in volume;

- The probability of the Fed raising interest rates in June increased to 53%;

- US President Biden: USA will not default;

- China's aluminum imports from Russia increased by 200%.

VN30

BANK

92,000

1D -1.29%

5D -2.34%

Buy Vol. 529,030

Sell Vol. 628,460

43,400

1D -0.80%

5D -2.25%

Buy Vol. 766,499

Sell Vol. 1,132,202

27,800

1D 0.72%

5D -0.71%

Buy Vol. 5,890,496

Sell Vol. 4,240,179

29,900

1D 0.34%

5D 0.84%

Buy Vol. 3,690,914

Sell Vol. 3,710,207

19,150

1D -0.26%

5D -0.78%

Buy Vol. 11,878,228

Sell Vol. 14,841,777

18,450

1D 0.00%

5D -1.07%

Buy Vol. 9,212,890

Sell Vol. 10,817,538

19,500

1D 0.00%

5D 0.52%

Buy Vol. 2,549,303

Sell Vol. 2,912,676

23,650

1D 1.07%

5D 0.85%

Buy Vol. 3,448,470

Sell Vol. 2,542,943

27,200

1D 0.74%

5D -2.33%

Buy Vol. 30,308,128

Sell Vol. 22,597,318

21,050

1D 0.72%

5D -1.64%

Buy Vol. 5,939,869

Sell Vol. 4,631,471

25,000

1D -0.40%

5D 0.20%

Buy Vol. 13,850,344

Sell Vol. 13,410,826

TPB: SBV has just approved the increase in charter capital of TPBank by a maximum of VND6,198 billion in the form of ordinary shares according to the plan approved by TPBank's 2023 AGM. After completing the share issuance, TPBank's charter capital will increase from VND15,817 billion to VND22,016 billion.

REAL ESTATE

12,950

1D -1.89%

5D -1.89%

Buy Vol. 36,134,830

Sell Vol. 38,350,243

77,400

1D 0.00%

5D -0.64%

Buy Vol. 56,465

Sell Vol. 81,734

13,400

1D -1.11%

5D 0.37%

Buy Vol. 6,972,999

Sell Vol. 10,901,253

NVL: Restructuring plan: (1) negotiate with creditors to restructure debt repayment schedule, (2) focusing on develop key projects, and (3) consider possibilities ability to sell off assets.

OIL & GAS

93,700

1D -1.06%

5D -1.26%

Buy Vol. 727,957

Sell Vol. 919,671

13,600

1D 1.12%

5D 0.74%

Buy Vol. 17,821,505

Sell Vol. 15,385,232

37,650

1D 0.80%

5D 0.13%

Buy Vol. 1,362,922

Sell Vol. 1,780,137

GAS: GAS's AGM approved the plan to increase charter capital in 2023 through the issuance of shares. Specifically, the expected number of shares to be issued is 382.79 million shares (20%).

VINGROUP

52,000

1D -1.14%

5D -0.95%

Buy Vol. 2,359,393

Sell Vol. 2,986,809

55,000

1D 0.00%

5D 1.66%

Buy Vol. 2,553,917

Sell Vol. 3,010,462

27,700

1D 0.00%

5D -1.07%

Buy Vol. 3,043,619

Sell Vol. 3,583,051

VHM: VHM withdraws from Ham Nghi urban area project, Ha Tinh. Total estimated investment of the project is about VND23,545 billion (USD1 billion).

FOOD & BEVERAGE

67,100

1D 0.00%

5D -2.19%

Buy Vol. 1,888,890

Sell Vol. 2,494,528

72,000

1D 0.00%

5D -0.55%

Buy Vol. 1,358,124

Sell Vol. 1,379,416

155,500

1D -1.58%

5D -3.24%

Buy Vol. 146,998

Sell Vol. 185,841

MSN: Since acquiring WinCommerce, Masan has taken a step forward, improving its EBITDA margin from -7% in 2019 to 3% in 2022.

OTHERS

43,550

1D -1.25%

5D -1.69%

Buy Vol. 1,650,200

Sell Vol. 1,786,305

98,100

1D 0.10%

5D -0.61%

Buy Vol. 979,780

Sell Vol. 1,026,554

83,100

1D -0.12%

5D 0.36%

Buy Vol. 2,104,756

Sell Vol. 1,716,367

38,200

1D 0.53%

5D -0.26%

Buy Vol. 1,828,573

Sell Vol. 3,049,420

17,200

1D 2.69%

5D 5.85%

Buy Vol. 12,465,922

Sell Vol. 11,364,276

22,550

1D 0.22%

5D -1.53%

Buy Vol. 18,017,700

Sell Vol. 18,146,930

21,100

1D -0.47%

5D -3.21%

Buy Vol. 29,874,000

Sell Vol. 29,261,044

MWG: Online revenue in April increased by 26% compared to March, accounting for 20% of MWG and Dien May Xanh revenue. At the recent investor meeting, Chairman Nguyen Duc Tai said that MWG's online segment will grow stronger than the market growth, thanks to a competitive pricing strategy.

Market by numbers

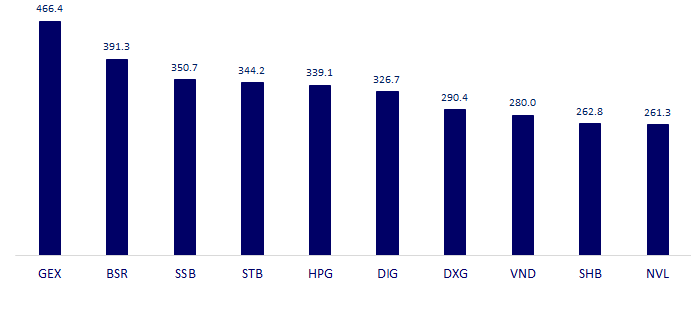

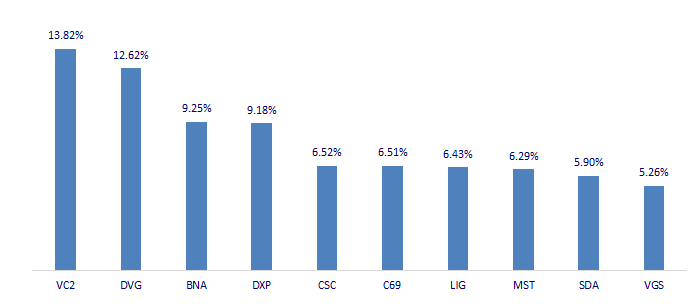

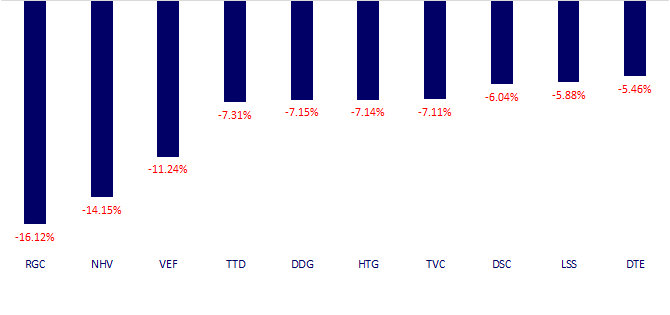

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.