Market brief 30/05/2023

VIETNAM STOCK MARKET

1,078.05

1D 0.29%

YTD 7.05%

1,071.82

1D 0.19%

YTD 6.63%

221.33

1D 0.46%

YTD 7.80%

81.67

1D 0.67%

YTD 13.98%

-528.23

1D 0.00%

YTD 0.00%

19,332.48

1D 19.02%

YTD 124.38%

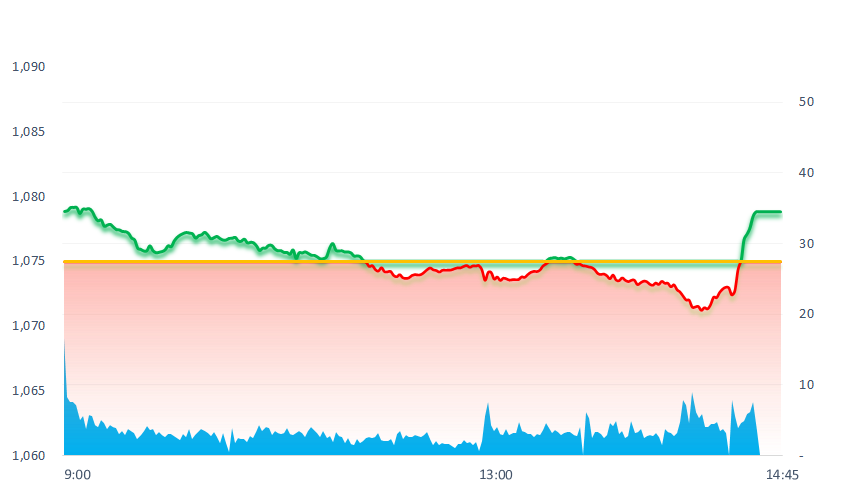

The market opened with the excitement of yesterday, but then the selling pressure gradually increased so the index was in red for most of the afternoon. However, at the end of the session, cash flow strongly into the market and pulled the index back up in just a few minutes, helping the trading volume and value reach 923 million shares and VND16,424 billion, respectively.

ETF & DERIVATIVES

18,250

1D 0.27%

YTD 5.31%

12,670

1D 0.40%

YTD 6.29%

13,120

1D -0.46%

YTD 5.13%

16,840

1D -0.24%

YTD 19.86%

16,480

1D 0.12%

YTD 14.84%

22,540

1D 0.81%

YTD 0.63%

13,650

1D 0.15%

YTD 5.41%

1,061

1D 0.00%

YTD 0.00%

1,063

1D 0.09%

YTD 0.00%

1,064

1D 0.04%

YTD 0.00%

1,068

1D 0.02%

YTD 0.00%

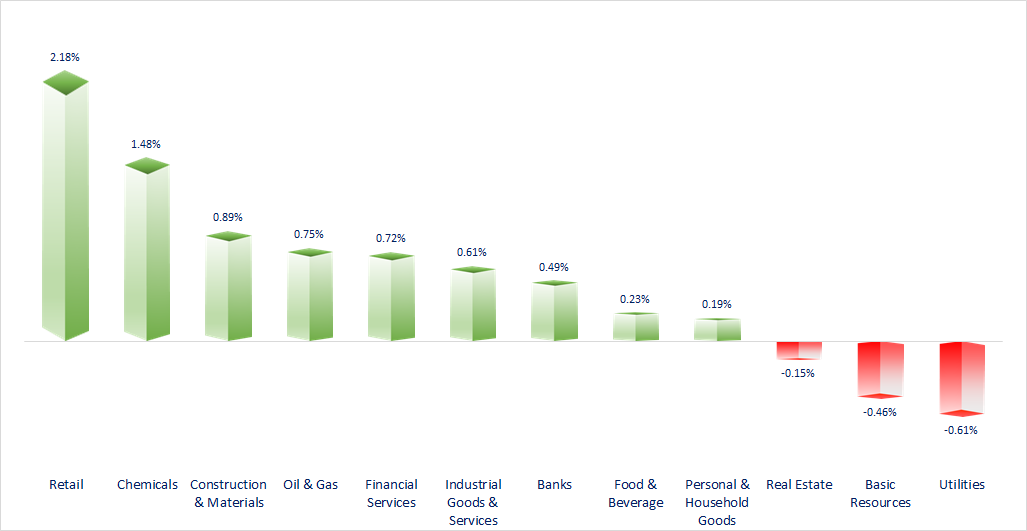

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

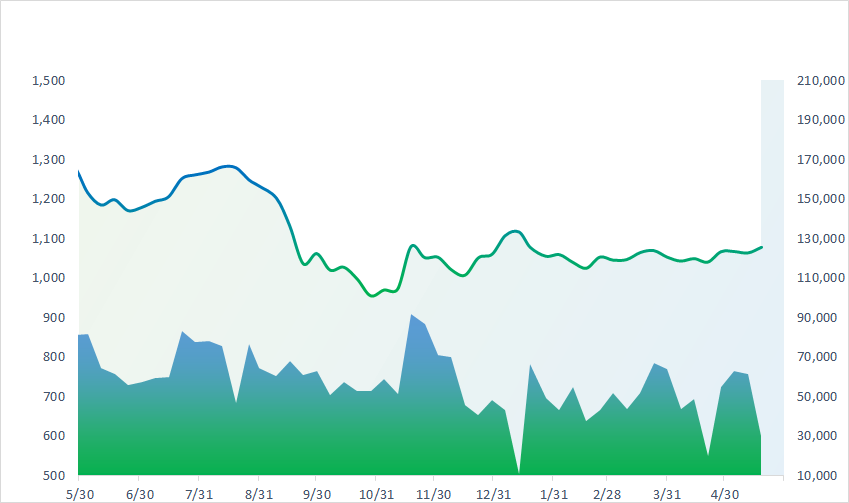

VNINDEX (12M)

GLOBAL MARKET

31,328.16

1D 0.30%

YTD 20.06%

3,224.21

1D 0.09%

YTD 4.37%

2,585.52

1D 1.04%

YTD 15.61%

18,595.78

1D 0.24%

YTD -5.99%

3,187.56

1D -0.24%

YTD -1.96%

1,534.81

1D -0.40%

YTD -8.12%

75.96

1D -1.71%

YTD -11.58%

1,955.64

1D -0.31%

YTD 7.09%

In the afternoon of May 30, Asian stock markets were mixed as investors worried before US lawmakers are expected to vote this week to pass a debt ceiling agreement to avoid a default.

VIETNAM ECONOMY

3.77%

1D (bps) -20

YTD (bps) -120

7.20%

YTD (bps) -20

2.80%

1D (bps) -1

YTD (bps) -199

3.06%

YTD (bps) -184

23,685

1D (%) 0.17%

YTD (%) -0.32%

25,633

1D (%) -1.00%

YTD (%) -0.10%

3,387

1D (%) -0.06%

YTD (%) -2.81%

According to the report of the GSO, the IIP in May 2023 was estimated to increase by 2.2% MoM and 0.1% over the same period last year. In which, compared to the same period last year, the processing and manufacturing industry decreased by 0.5%; mining industry decreased by 2.9%; electricity production and distribution decreased by 5%; water supply, management and treatment of waste and wastewater increased by 6.8%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- IIP in May increased by 2.2% over the previous month;

- Pangasius exports decreased by 41% in the first 4 months of the year;

- Total state budget revenue in 5 months of 2023 reached VND769.6 trillion, equaling 47.5% of the yearly estimate;

- IMF alarmed about the possibility of default of Korean enterprises;

- Electricity prices in some countries of the European Union fell to negative levels;

- The sharp drop in gas prices supported Europe after the energy crisis.

VN30

BANK

94,500

1D 1.50%

5D 1.83%

Buy Vol. 992,318

Sell Vol. 831,390

43,800

1D -0.23%

5D -0.11%

Buy Vol. 1,401,031

Sell Vol. 1,699,888

28,050

1D 0.18%

5D 0.54%

Buy Vol. 4,848,241

Sell Vol. 7,354,136

30,200

1D 0.00%

5D -0.49%

Buy Vol. 4,053,141

Sell Vol. 5,063,873

19,450

1D 0.52%

5D -0.51%

Buy Vol. 15,671,706

Sell Vol. 20,157,877

18,750

1D 0.00%

5D 0.00%

Buy Vol. 12,912,046

Sell Vol. 16,316,634

18,800

1D 0.00%

5D 1.62%

Buy Vol. 2,950,188

Sell Vol. 4,547,747

24,100

1D -0.82%

5D 1.69%

Buy Vol. 4,684,074

Sell Vol. 5,169,030

27,700

1D 0.00%

5D -0.89%

Buy Vol. 26,411,586

Sell Vol. 19,487,428

21,300

1D 0.00%

5D 0.00%

Buy Vol. 7,409,919

Sell Vol. 7,620,023

25,200

1D 0.20%

5D -0.59%

Buy Vol. 33,489,985

Sell Vol. 29,524,460

VCB: VCB stock increase sharply in recent months has helped Vietcombank's capitalization increase to over VND440,000 billion, equal to the total market value of the two following enterprises, BIDV and VHM, and also the highest capital level of innovation achieved by a domestic firm.

REAL ESTATE

13,350

1D 2.30%

5D 1.14%

Buy Vol. 46,650,662

Sell Vol. 56,480,060

78,000

1D 0.26%

5D 1.69%

Buy Vol. 77,469

Sell Vol. 81,719

14,500

1D 5.84%

5D 6.62%

Buy Vol. 48,722,711

Sell Vol. 41,304,479

PDR: Canceling written opinions of shareholders on the plan to issue shares to existing shareholders and the plan of private placement to strategic shareholders to increase charter capital

OIL & GAS

92,900

1D -0.96%

5D -0.32%

Buy Vol. 939,390

Sell Vol. 1,240,520

13,650

1D 0.37%

5D 0.00%

Buy Vol. 11,677,469

Sell Vol. 17,746,160

37,900

1D 0.00%

5D 1.07%

Buy Vol. 939,601

Sell Vol. 1,618,684

POW: has just been rated BB by Fitch Ratings with "Positive Outlook". This is the third year in a row that POW has been rated at this level by Fitch Ratings.

VINGROUP

52,400

1D -0.57%

5D -0.38%

Buy Vol. 2,500,228

Sell Vol. 2,910,630

54,900

1D -1.08%

5D 2.23%

Buy Vol. 2,122,730

Sell Vol. 2,261,223

27,700

1D 0.00%

5D 0.00%

Buy Vol. 4,452,243

Sell Vol. 5,784,106

VRE: In the next June review, VNM ETF and FTSE ETF may sell 2 million VRE shares

FOOD & BEVERAGE

66,500

1D -0.89%

5D -0.75%

Buy Vol. 3,378,194

Sell Vol. 3,896,855

72,800

1D 1.68%

5D 3.41%

Buy Vol. 1,591,211

Sell Vol. 1,718,539

156,000

1D 0.45%

5D -1.89%

Buy Vol. 254,242

Sell Vol. 305,493

VMN: Vinamilk Nghe An Dairy Factory and Vinamilk Nghe An Dairy Farm have become the first companies to achieve carbon neutrality according to PAS2060:2014 standard.

OTHERS

43,800

1D -0.34%

5D -1.79%

Buy Vol. 953,462

Sell Vol. 1,439,623

98,500

1D -1.01%

5D -0.20%

Buy Vol. 650,785

Sell Vol. 699,569

84,000

1D 1.08%

5D 2.44%

Buy Vol. 6,665,520

Sell Vol. 3,012,783

39,400

1D 1.81%

5D 3.01%

Buy Vol. 13,347,231

Sell Vol. 8,567,600

18,400

1D 1.10%

5D 12.20%

Buy Vol. 7,503,596

Sell Vol. 9,057,139

23,350

1D -0.21%

5D 2.19%

Buy Vol. 26,406,190

Sell Vol. 34,339,749

21,350

1D -0.47%

5D -1.61%

Buy Vol. 24,661,004

Sell Vol. 30,778,160

FPT: Listed more than 7.3 million ESOP shares, bringing the total number of shares after listing to more than 1,104 million shares. Effective date of listing: May 31, 2023

Market by numbers

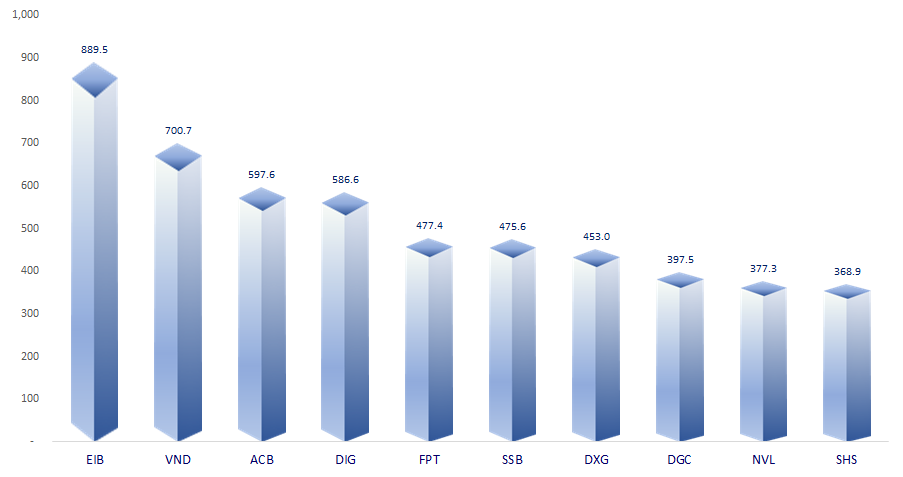

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

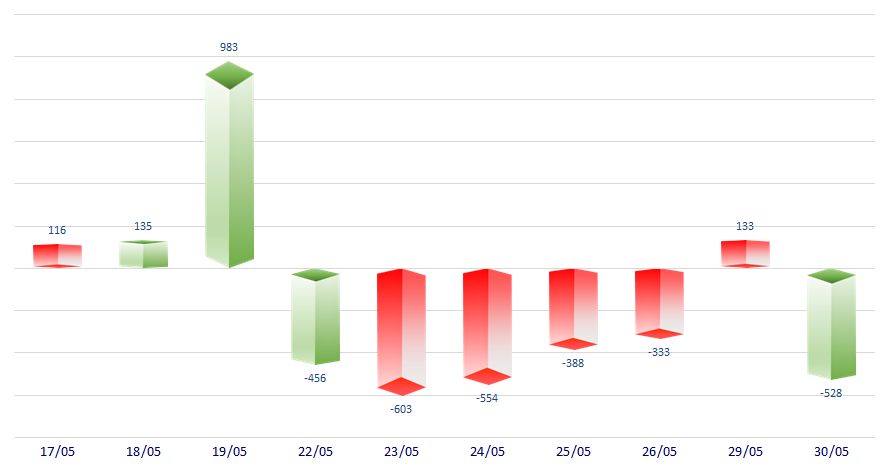

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

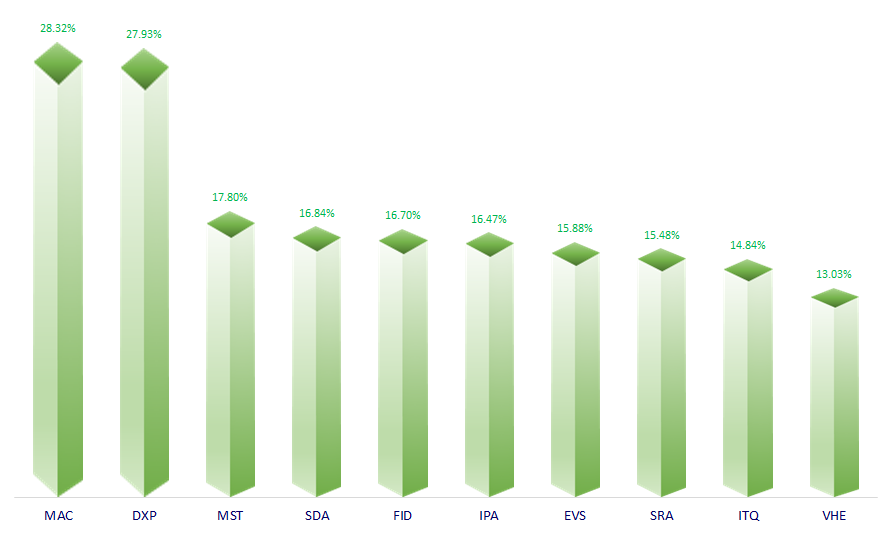

TOP INCREASES 3 CONSECUTIVE SESSIONS

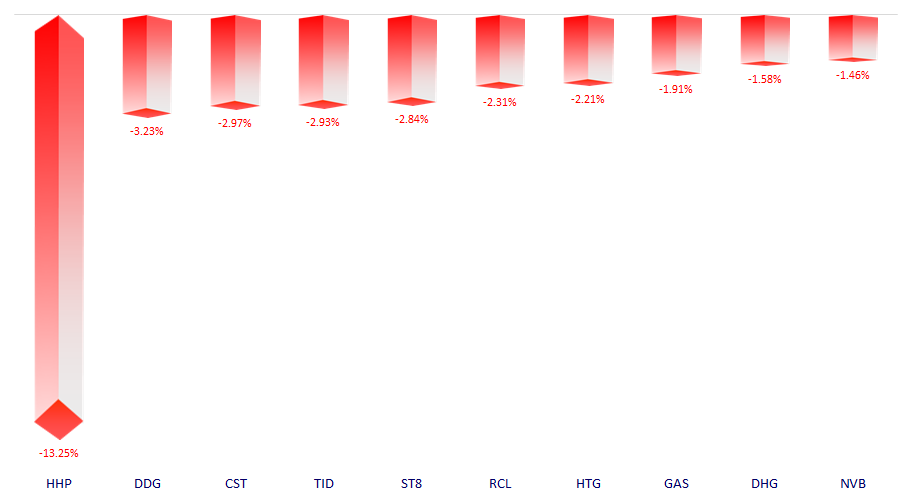

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.