Market brief 31/05/2023

VIETNAM STOCK MARKET

1,075.17

1D -0.27%

YTD 6.76%

1,066.33

1D -0.51%

YTD 6.08%

222.81

1D 0.67%

YTD 8.52%

82.05

1D 0.47%

YTD 14.52%

-431.30

1D 0.00%

YTD 0.00%

19,019.10

1D -1.62%

YTD 120.74%

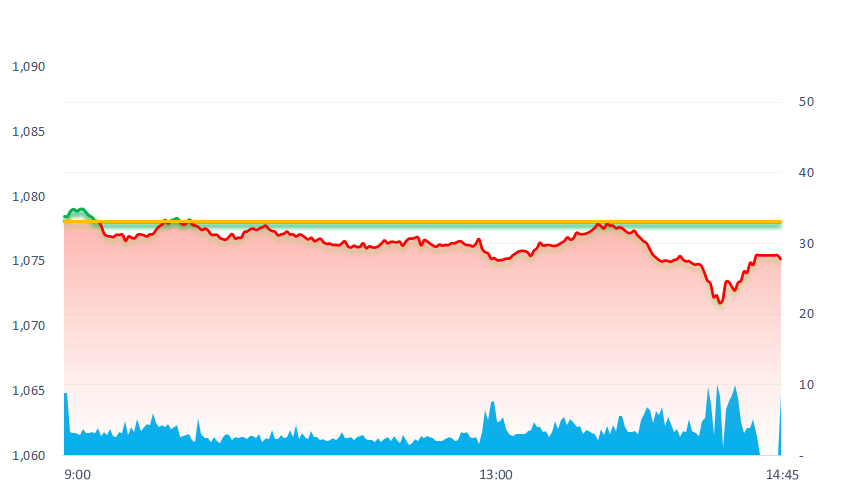

Today, the market only kept green at the beginning of the morning, then sellers dominated and pulled VNIndex down to the end of session. Trading value decreased slightly but trading volume was more than 1 million shares compared to yesterday.

ETF & DERIVATIVES

18,410

1D 0.88%

YTD 6.23%

12,620

1D -0.39%

YTD 5.87%

13,100

1D -0.15%

YTD 4.97%

16,370

1D -2.79%

YTD 16.51%

16,250

1D -1.40%

YTD 13.24%

22,750

1D 0.93%

YTD 1.56%

13,710

1D 0.44%

YTD 5.87%

1,058

1D -0.33%

YTD 0.00%

1,056

1D -0.70%

YTD 0.00%

1,059

1D -0.47%

YTD 0.00%

1,063

1D -0.52%

YTD 0.00%

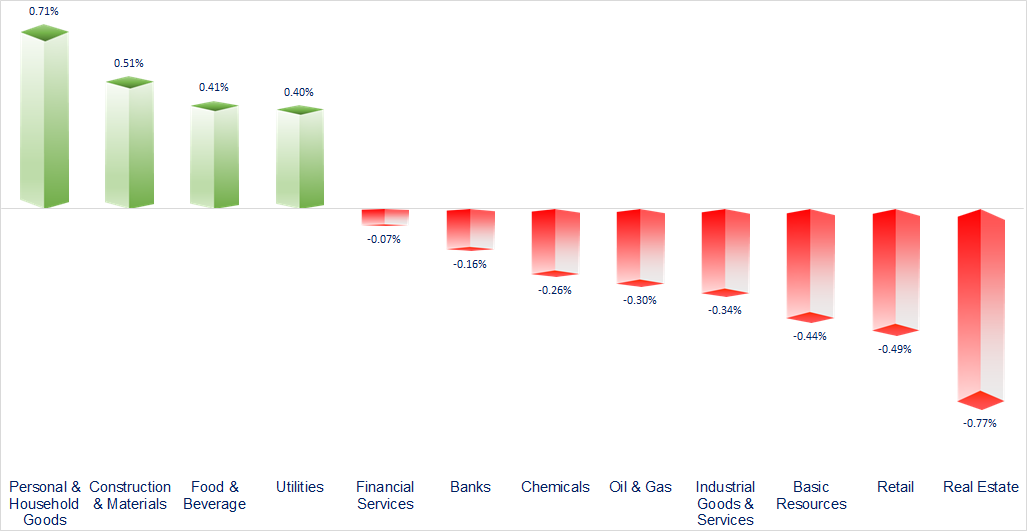

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

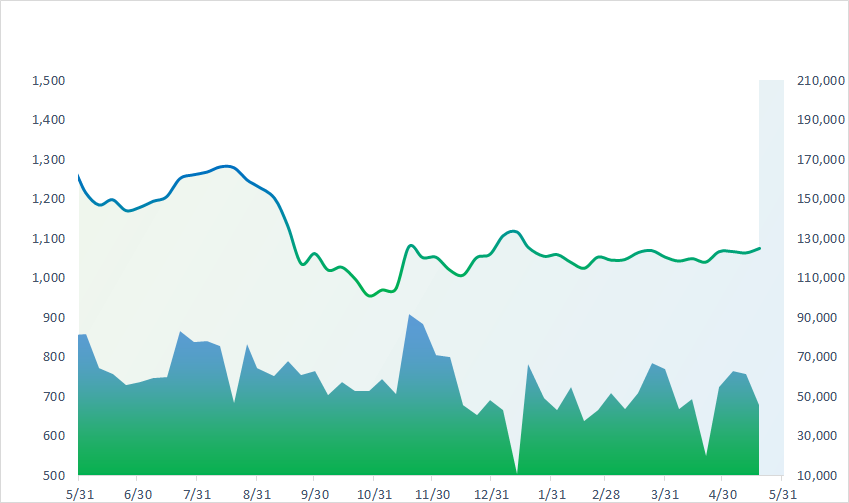

VNINDEX (12M)

GLOBAL MARKET

30,887.88

1D -1.41%

YTD 18.37%

3,204.56

1D -0.61%

YTD 3.73%

2,577.12

1D -0.32%

YTD 15.24%

18,234.27

1D -1.94%

YTD -7.82%

3,158.80

1D -0.90%

YTD -2.85%

1,533.54

1D -0.08%

YTD -8.19%

71.89

1D -2.46%

YTD -16.32%

1,956.95

1D -1.07%

YTD 7.16%

In the afternoon of May 31, Asian stock exchanges were in the red, due to concerns that Republican lawmakers might vote to reject the agreement to raise the US debt ceiling.

VIETNAM ECONOMY

3.98%

1D (bps) 21

YTD (bps) -99

7.20%

YTD (bps) -20

2.81%

1D (bps) 1

YTD (bps) -198

3.05%

1D (bps) -1

YTD (bps) -185

23,700

1D (%) 0.21%

YTD (%) -0.25%

25,516

1D (%) -1.61%

YTD (%) -0.56%

3,374

1D (%) -0.35%

YTD (%) -3.19%

In May 2023, realized investment capital from the State budget was estimated at VND45.1 trillion, up 18% over the same period last year, including: Central capital reached VND8.8 trillion, up 28.4%; Local capital is VND36.3 trillion, up 15.8%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Rice exports increased sharply;

- A series of real estate markets have cut loss up to 50%;

- Investment capital from the state budget in 5 months increased by 18.4%;

- Korea cuts import duties on some foods;

- China exports more cars globally than Japan;

- A Chinese real estate company is facing a lawsuit asking to sell properties to pay off debts.

VN30

BANK

94,000

1D -0.53%

5D 1.51%

Buy Vol. 716,970

Sell Vol. 776,594

44,000

1D 0.46%

5D 1.15%

Buy Vol. 1,449,860

Sell Vol. 1,388,990

28,000

1D -0.18%

5D 0.90%

Buy Vol. 5,292,738

Sell Vol. 6,270,187

29,950

1D -0.83%

5D 0.50%

Buy Vol. 6,218,970

Sell Vol. 6,672,858

19,300

1D -0.77%

5D -0.52%

Buy Vol. 12,003,044

Sell Vol. 17,516,712

18,600

1D -0.80%

5D 0.00%

Buy Vol. 11,533,415

Sell Vol. 17,960,337

18,400

1D -2.13%

5D -0.54%

Buy Vol. 3,353,987

Sell Vol. 4,487,299

25,000

1D 3.73%

5D 6.38%

Buy Vol. 19,075,697

Sell Vol. 13,148,256

27,700

1D 0.00%

5D 1.09%

Buy Vol. 38,612,095

Sell Vol. 26,622,670

21,400

1D 0.47%

5D 1.90%

Buy Vol. 12,031,255

Sell Vol. 12,268,486

25,400

1D 0.79%

5D 0.99%

Buy Vol. 43,232,054

Sell Vol. 36,637,019

VCB: The State Bank of Vietnam (SBV) has just approved in writing to Vietcombank to increase its charter capital from VND47,325 billion to VND55,891 billion, according to the plan to issue shares to pay dividends from the remaining profit in 2019, 2020 has been approved by the General Meeting of Shareholders.

REAL ESTATE

13,500

1D 1.12%

5D 1.89%

Buy Vol. 52,537,096

Sell Vol. 65,670,673

78,000

1D 0.00%

5D 1.30%

Buy Vol. 76,941

Sell Vol. 162,450

14,600

1D 0.69%

5D 6.96%

Buy Vol. 20,493,483

Sell Vol. 22,863,523

NVL: Prime Minister assigned the Minister of Construction to work directly with Novaland President Bui Thanh Nhon on dismantling projects in Dong Nai

OIL & GAS

92,800

1D -0.11%

5D 0.32%

Buy Vol. 809,475

Sell Vol. 789,640

13,650

1D 0.00%

5D 1.11%

Buy Vol. 20,507,072

Sell Vol. 26,142,147

37,500

1D -1.06%

5D 0.54%

Buy Vol. 1,534,125

Sell Vol. 1,776,357

GAS: Once completed, Thi Vai LNG Warehouse will have the largest scale in Vietnam, with a capacity of Phase 1 of 1 million tons of gas/year, then expanded to 3-6 million tons/year.

VINGROUP

52,000

1D -0.76%

5D -1.14%

Buy Vol. 3,191,350

Sell Vol. 3,790,339

53,500

1D -2.55%

5D -1.83%

Buy Vol. 2,229,721

Sell Vol. 2,640,552

27,100

1D -2.17%

5D -1.99%

Buy Vol. 8,114,347

Sell Vol. 8,526,357

VIC: According to VIC Chairman, it is expected that by the end of 2024, according to plan and the optimization of costs, VinFast can break even. By 2025, it will start to be profitable.

FOOD & BEVERAGE

66,100

1D -0.60%

5D -0.30%

Buy Vol. 2,794,395

Sell Vol. 3,170,947

72,000

1D -1.10%

5D 0.28%

Buy Vol. 1,326,040

Sell Vol. 1,677,966

158,000

1D 1.28%

5D -0.32%

Buy Vol. 301,958

Sell Vol. 438,589

SAB: Q1/2023, Sabeco's gross profit margin improved significantly to 30.7% from 29.6% in the same period last year and 27.8% in the previous quarter.

OTHERS

43,500

1D -0.68%

5D -2.14%

Buy Vol. 1,182,867

Sell Vol. 1,639,125

97,500

1D -1.02%

5D -0.91%

Buy Vol. 847,883

Sell Vol. 714,871

84,100

1D 0.12%

5D 3.44%

Buy Vol. 1,327,077

Sell Vol. 1,451,311

39,200

1D -0.51%

5D 3.29%

Buy Vol. 4,888,236

Sell Vol. 4,577,679

18,200

1D -1.09%

5D 13.04%

Buy Vol. 6,558,986

Sell Vol. 6,796,702

23,150

1D -0.86%

5D 1.98%

Buy Vol. 31,352,478

Sell Vol. 37,026,119

21,200

1D -0.70%

5D -0.47%

Buy Vol. 24,743,862

Sell Vol. 31,318,351

VJC: Vietjet wants to privately issue VND2,000 billion of bonds. Specifically, Vietjet will issue bonds with a par value of VND100 million with a term of 60 months (5 years). This is a non-convertible bond, without warrants and without collateral. The maximum fixed interest rate is 12%/year for the first two coupons.

Market by numbers

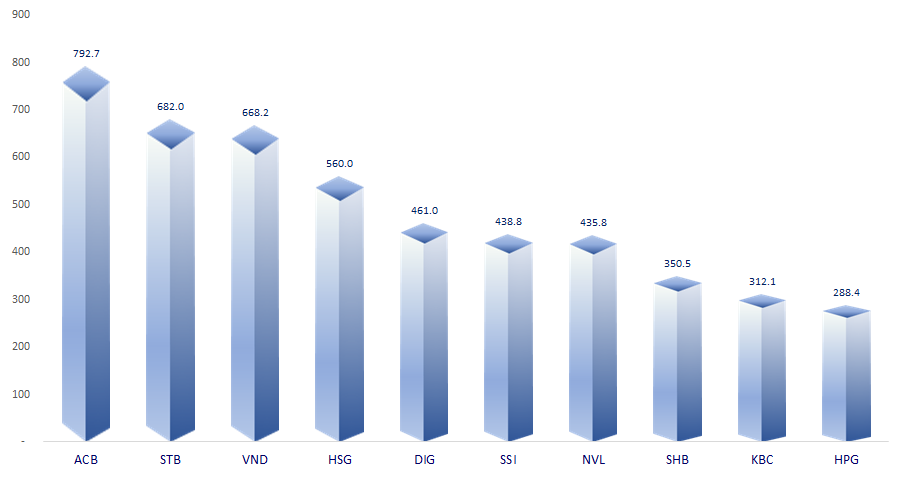

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

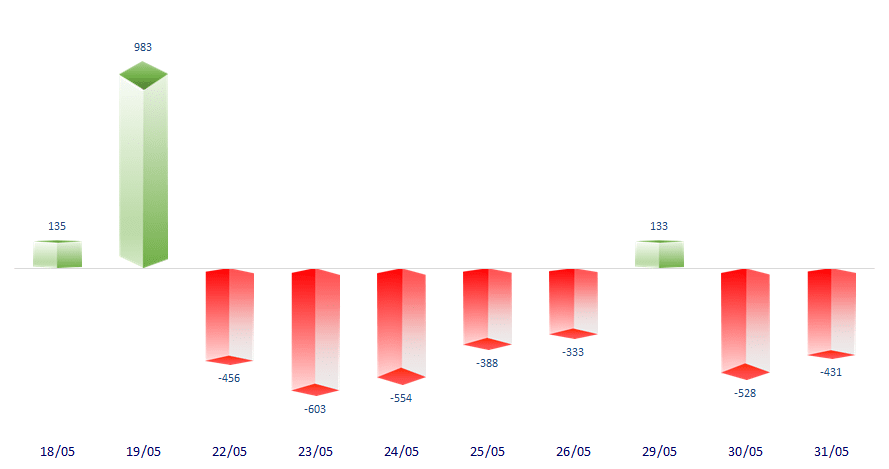

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

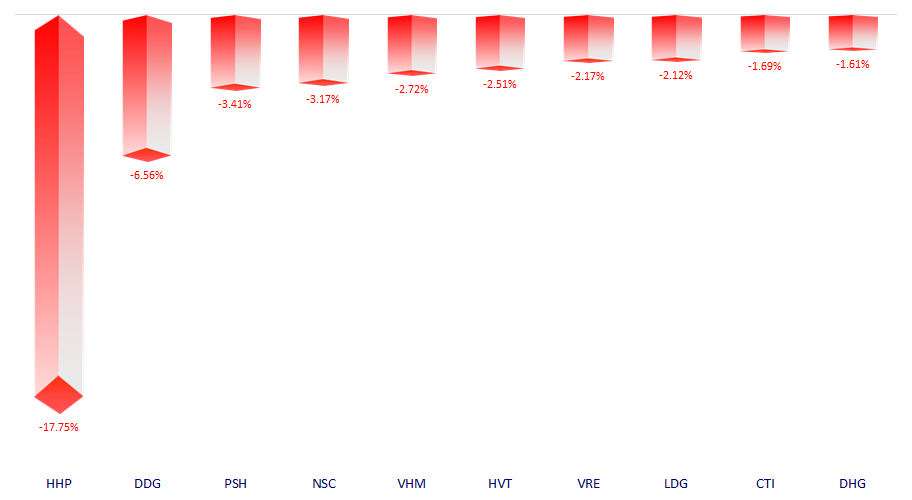

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.