Market brief 02/06/2023

VIETNAM STOCK MARKET

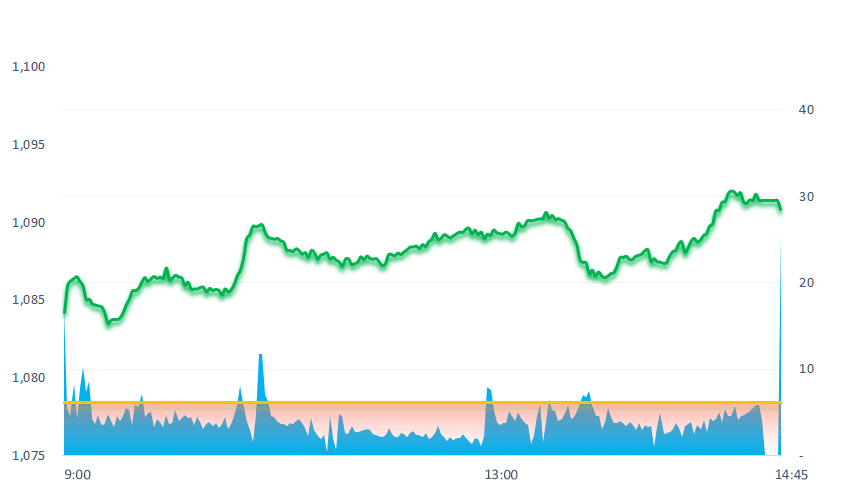

1,090.84

1D 1.15%

YTD 8.32%

1,086.96

1D 1.77%

YTD 8.13%

226.03

1D 0.92%

YTD 10.09%

83.96

1D 0.54%

YTD 17.18%

-252.61

1D 0.00%

YTD 0.00%

21,188.45

1D 27.95%

YTD 145.92%

The market continued the excitement from the US stock market, after the US House of Representatives passed the debt ceiling. The volume and trading value recorded a sudden increase in today with 1 billion shares and more than VND18,000 billion, respectively. This is the largest value since the beginning of the year so far.

ETF & DERIVATIVES

18,630

1D 2.36%

YTD 7.50%

12,900

1D 2.38%

YTD 8.22%

13,020

1D 0.00%

YTD 4.33%

16,430

1D 0.24%

YTD 16.94%

17,040

1D 5.19%

YTD 18.75%

22,820

1D 1.78%

YTD 1.88%

13,900

1D 1.76%

YTD 7.34%

1,070

1D 1.17%

YTD 0.00%

1,071

1D 1.06%

YTD 0.00%

1,078

1D 1.60%

YTD 0.00%

1,079

1D 1.30%

YTD 0.00%

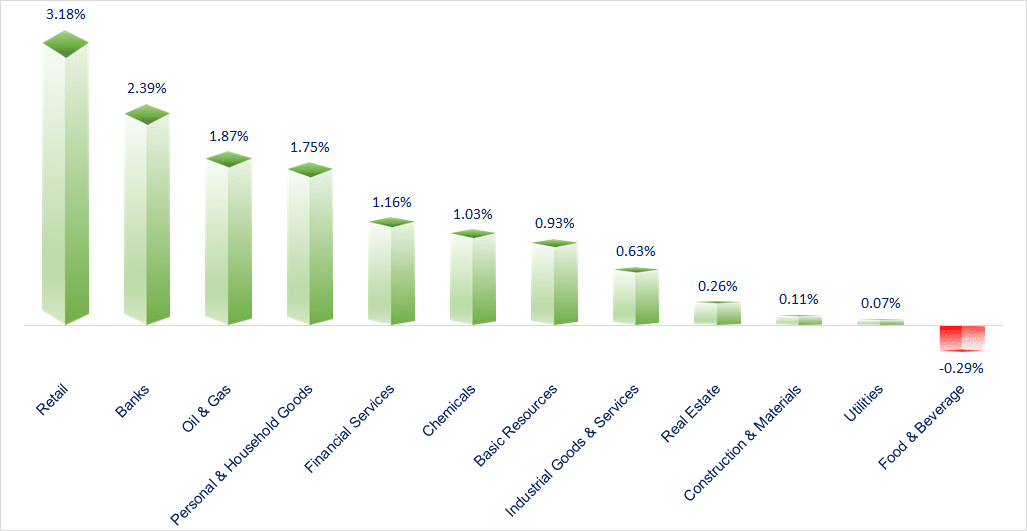

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

31,524.22

1D 1.21%

YTD 20.81%

3,230.07

1D 0.79%

YTD 4.56%

2,601.36

1D 1.25%

YTD 16.32%

18,949.94

1D 4.02%

YTD -4.20%

3,166.30

1D 0.00%

YTD -2.61%

1,531.20

1D 0.64%

YTD -8.33%

75.27

1D 1.16%

YTD -12.39%

1,995.50

1D 0.14%

YTD 9.27%

In the afternoon of June 2, Asian stock markets rose on hopes that the US Fed would not raise interest rates this month. Besides, the stock market also benefited, when concerns about the risk of US debt default ended.

VIETNAM ECONOMY

4.06%

1D (bps) 8

YTD (bps) -91

7.20%

YTD (bps) -20

2.76%

1D (bps) -8

YTD (bps) -203

2.99%

1D (bps) -10

YTD (bps) -191

23,690

1D (%) 0.21%

YTD (%) -0.29%

25,728

1D (%) -0.99%

YTD (%) 0.27%

3,397

1D (%) 0.59%

YTD (%) -2.53%

Weakened trade transactions, commodity exports continued to decline sharply in May compared to the same period last year, prompting economic researchers from Maybank Investment Banking Group (Maybank IBG) to lower their forecast for Vietnam's GDP growth in 2023 from 5.5% to 4%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam's exports will reach USD618 billion in 2030 with a growth rate of 7%/year;

- Maybank lowered its forecast for Vietnam's GDP growth in 2023;

- Minister of Finance: 2% VAT reduction for 6 months is appropriate;

- European inflation lowest since the beginning of the war in Ukraine;

- ECB warns BOJ policy change could affect global bond market;

- The BRICS wants to launch a common currency, ready to 'prevent' the domination of the USD.

VN30

BANK

94,900

1D 1.06%

5D 3.15%

Buy Vol. 1,308,944

Sell Vol. 1,272,517

44,700

1D 1.82%

5D 3.00%

Buy Vol. 2,676,449

Sell Vol. 2,444,897

28,650

1D 2.50%

5D 3.06%

Buy Vol. 16,245,775

Sell Vol. 16,407,854

32,200

1D 6.27%

5D 7.69%

Buy Vol. 27,048,482

Sell Vol. 21,700,939

19,850

1D 2.32%

5D 3.66%

Buy Vol. 40,866,866

Sell Vol. 45,132,321

19,700

1D 4.79%

5D 6.78%

Buy Vol. 75,408,639

Sell Vol. 55,667,620

19,050

1D 2.42%

5D 2.97%

Buy Vol. 7,867,492

Sell Vol. 9,443,829

26,300

1D 0.57%

5D 11.21%

Buy Vol. 25,459,637

Sell Vol. 18,386,834

28,300

1D 1.07%

5D 4.04%

Buy Vol. 38,663,270

Sell Vol. 33,541,446

23,050

1D 6.96%

5D 9.50%

Buy Vol. 42,405,923

Sell Vol. 27,174,911

21,800

1D 1.87%

5D 4.39%

Buy Vol. 32,608,397

Sell Vol. 23,528,519

HDB: On June 2nd, HDBank reduced 0.2 percentage points for terms of 6 months or more. Accordingly, the interest rate for term deposits of 6 months, 12 months, 13 months, etc. at this bank is only 7.9%/year. This is the interest rate applied to online savings.

REAL ESTATE

13,850

1D -0.36%

5D 6.95%

Buy Vol. 39,652,016

Sell Vol. 59,837,286

78,000

1D 0.39%

5D 0.78%

Buy Vol. 141,257

Sell Vol. 122,275

14,950

1D 0.34%

5D 11.57%

Buy Vol. 18,820,693

Sell Vol. 21,029,435

NVL: NVL is not expected to pay dividends for both 2022 and 2023 and NVL also proposes to cancel the plan to issue shares to pay dividends to increase capital.

OIL & GAS

92,000

1D 0.00%

5D -1.81%

Buy Vol. 811,778

Sell Vol. 979,031

13,650

1D 0.00%

5D 0.37%

Buy Vol. 16,613,718

Sell Vol. 16,800,587

38,250

1D 2.14%

5D 1.59%

Buy Vol. 2,115,064

Sell Vol. 2,214,126

GAS: In 2023, for construction targets, GAS plans to disburse VND2.58 trillion, of which more than VND2.13 trillion is equity.

VINGROUP

52,000

1D 0.00%

5D 0.00%

Buy Vol. 2,879,946

Sell Vol. 3,597,901

53,400

1D 0.75%

5D -2.91%

Buy Vol. 2,036,317

Sell Vol. 2,432,418

27,100

1D 0.93%

5D -2.17%

Buy Vol. 6,692,610

Sell Vol. 5,382,368

VIC: According to data published by the Climate Bonds Initiative, Vingroup is the largest issuer of sustainable development debt in Vietnam so far, with a value of USD1.325 billion.

FOOD & BEVERAGE

65,900

1D -0.30%

5D -1.79%

Buy Vol. 5,234,687

Sell Vol. 5,421,613

72,300

1D 0.70%

5D 0.42%

Buy Vol. 1,576,137

Sell Vol. 1,592,421

158,000

1D -0.13%

5D 1.61%

Buy Vol. 254,758

Sell Vol. 349,537

VNM: expects to cut greenhouse gas emissions by 15% by 2027, cut and neutralize emissions by 55% by 2035 and reach net zero by 2050

OTHERS

44,100

1D 1.03%

5D 1.26%

Buy Vol. 3,422,505

Sell Vol. 2,201,918

96,800

1D -0.72%

5D -1.33%

Buy Vol. 809,966

Sell Vol. 786,614

83,800

1D 0.36%

5D 0.84%

Buy Vol. 1,584,555

Sell Vol. 1,496,420

40,800

1D 3.82%

5D 6.81%

Buy Vol. 10,739,340

Sell Vol. 9,087,567

18,900

1D 0.53%

5D 9.88%

Buy Vol. 4,918,045

Sell Vol. 5,577,485

24,100

1D 2.77%

5D 6.87%

Buy Vol. 50,060,421

Sell Vol. 53,971,218

21,600

1D 0.93%

5D 2.37%

Buy Vol. 33,993,962

Sell Vol. 40,378,871

VJC: Vietjet wants to privately issue VND2,000 billion of bonds to supplement capital for production and business activities, pay operating expenses such as petrol, port, flight management, technology, salary, insurance, PDP and other expenses.

Market by numbers

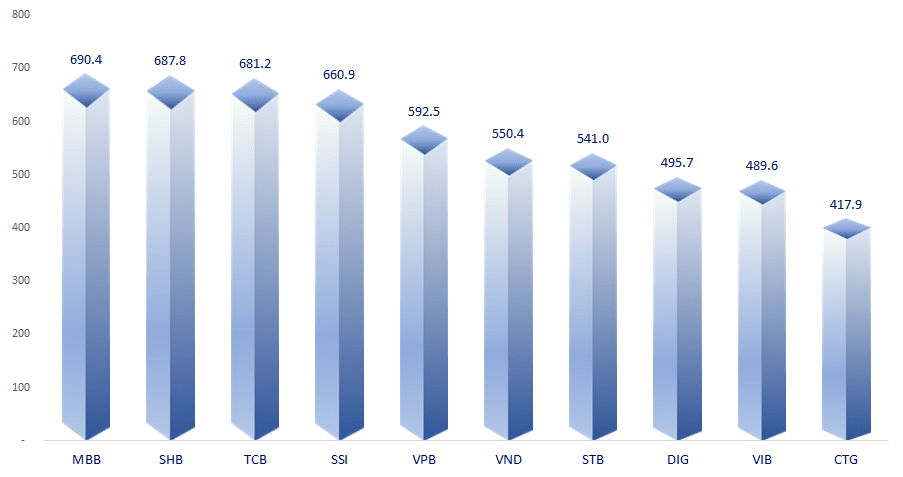

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

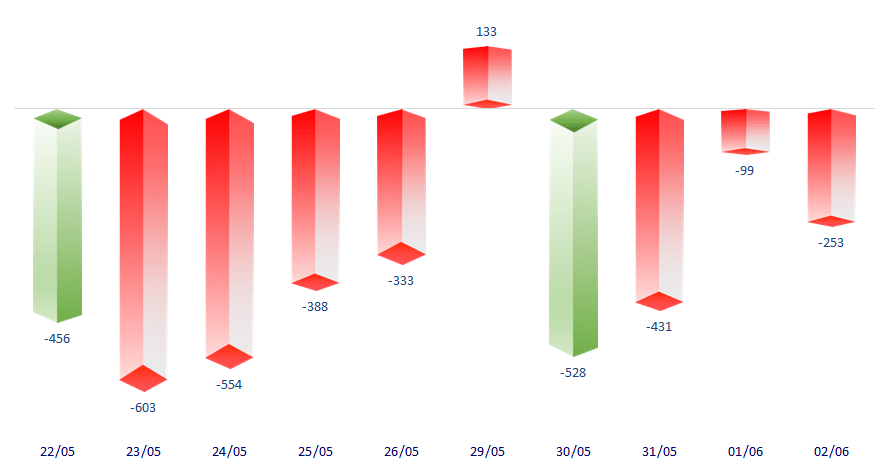

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

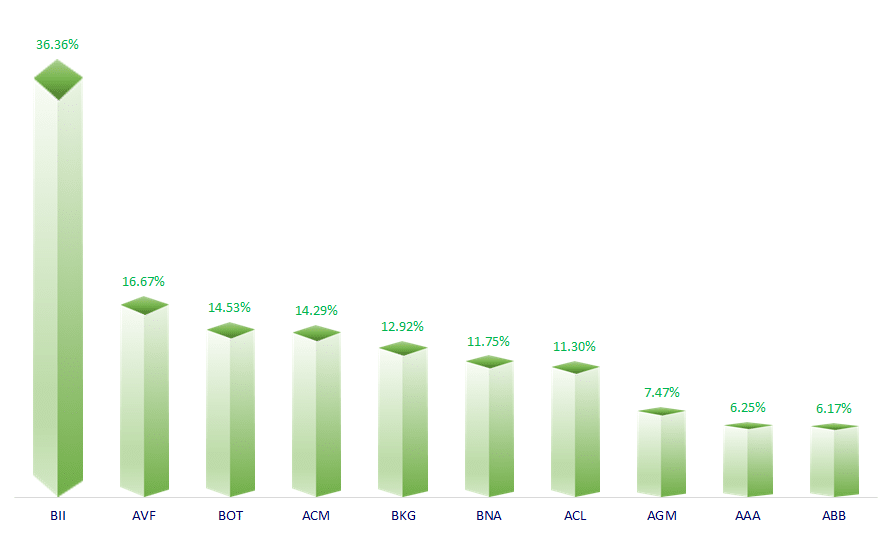

TOP INCREASES 3 CONSECUTIVE SESSIONS

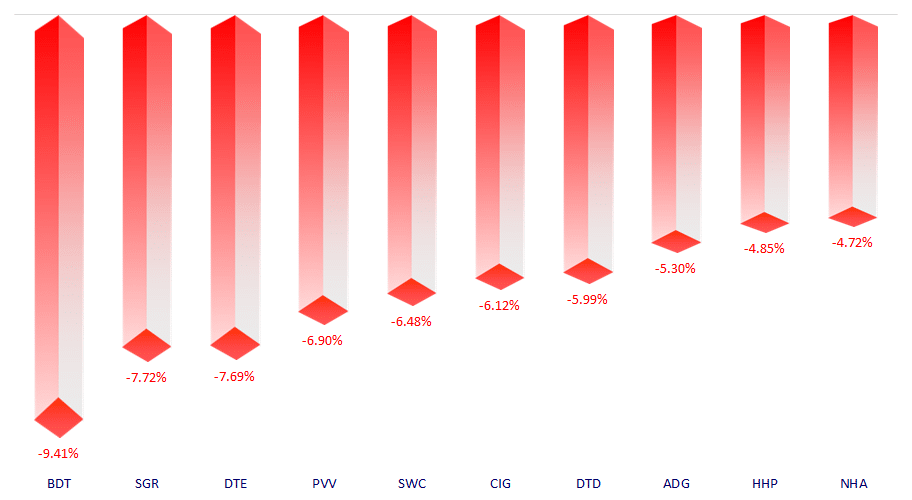

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.