Market brief 06/06/2023

VIETNAM STOCK MARKET

1,108.31

1D 0.96%

YTD 10.05%

1,102.32

1D 1.03%

YTD 9.66%

228.72

1D 0.95%

YTD 11.40%

84.43

1D 0.38%

YTD 17.84%

79.07

1D 0.00%

YTD 0.00%

18,664.87

1D -7.10%

YTD 116.63%

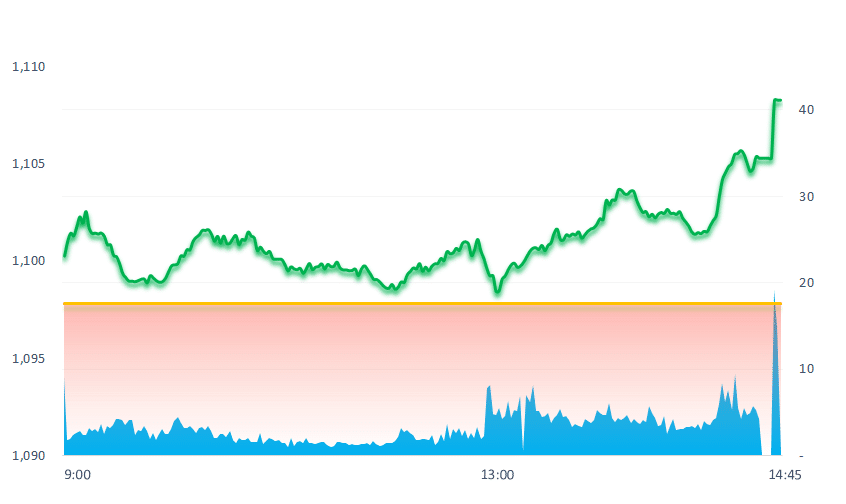

The stock market rallied quite conservatively in the morning, but towards the end of the session, the cash inflow gradually poured into the market, causing VNIndex increase strongly and close at the highest level of the session. Liquidity is showing signs of decreasing since since the recorded session on June 2

ETF & DERIVATIVES

18,640

1D 0.76%

YTD 7.56%

13,030

1D 0.77%

YTD 9.31%

13,160

1D 0.08%

YTD 5.45%

16,050

1D 0.75%

YTD 14.23%

17,260

1D 0.94%

YTD 20.28%

23,450

1D 0.64%

YTD 4.69%

14,120

1D 0.86%

YTD 9.03%

1,077

1D 0.40%

YTD 0.00%

1,084

1D 0.73%

YTD 0.00%

1,092

1D 0.78%

YTD 0.00%

1,096

1D 0.82%

YTD 0.00%

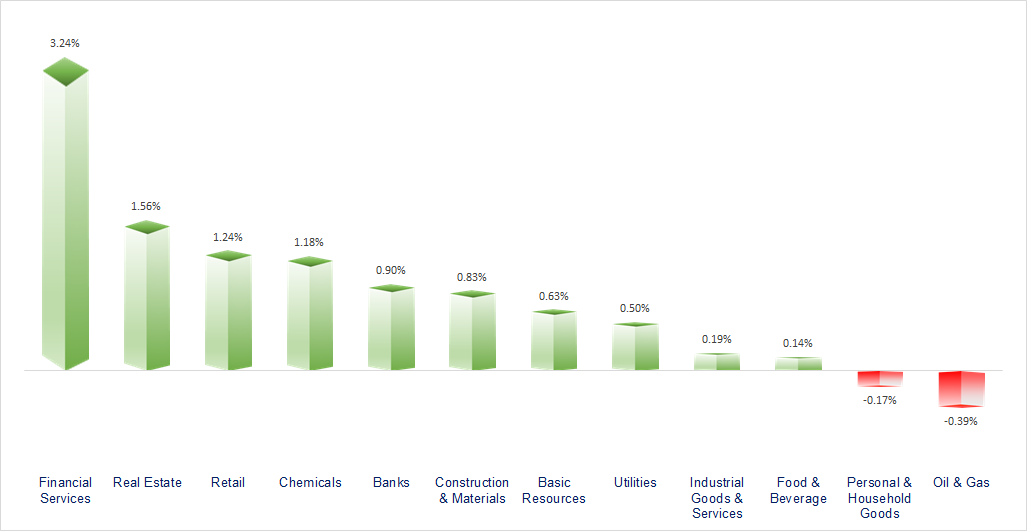

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

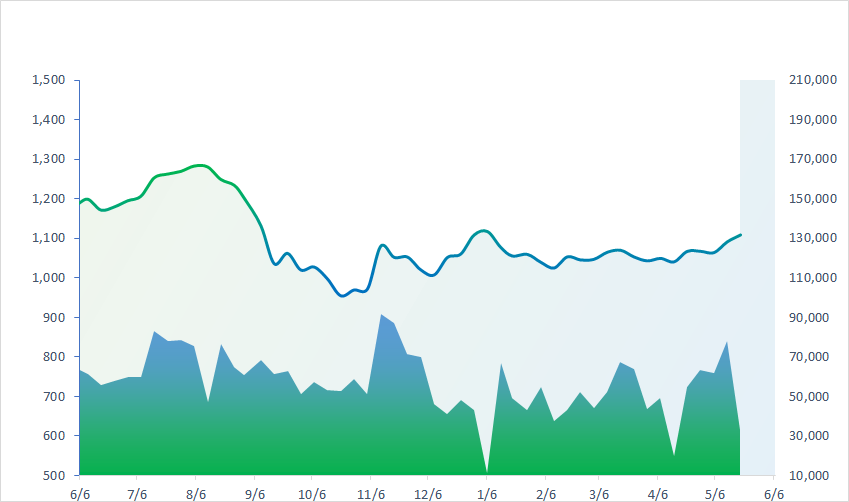

VNINDEX (12M)

GLOBAL MARKET

32,506.78

1D 0.90%

YTD 24.57%

3,195.34

1D -1.15%

YTD 3.43%

2,615.41

1D 0.00%

YTD 16.95%

19,099.28

1D -0.05%

YTD -3.45%

3,190.11

1D 0.11%

YTD -1.88%

1,528.54

1D -0.17%

YTD -8.49%

75.11

1D -1.60%

YTD -12.57%

1,964.38

1D -0.59%

YTD 7.57%

After the previous two gaining sessions, Asian stock markets showed signs of slowing down in the afternoon session of June 6 as traders began to take profits and investors wonder the possibility that the Federal Reserve The US state (Fed) did not raise interest rates this month.

VIETNAM ECONOMY

3.91%

YTD (bps) -106

7.20%

YTD (bps) -20

2.77%

YTD (bps) -202

3.02%

1D (bps) 3

YTD (bps) -188

23,697

1D (%) 0.14%

YTD (%) -0.27%

25,566

1D (%) -1.32%

YTD (%) -0.36%

3,369

1D (%) -0.27%

YTD (%) -3.33%

According to data released by the General Statistics Office on May 29, crude oil imports in five months increased by 39.9% over the same period in 2022, to 4.66 million tons. Coal imports also increased 27.9% to 15.56 million tons. Similarly, imports of liquefied petroleum gas (LPG) increased 29.8 percent to 914,000 tonnes.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Minister Ho Duc Phuc: Designing a support package of VND23 trillion to support workers;

- Electricity consumption nationwide continues to soar;

- Fuel imports increased sharply in the first 5 months of the year;

- EC extends restrictions on grain imports from Ukraine;

- Foreign investors do not need to register when buying shares in Korea;

- Russia expects GDP to grow by 1% this year.

VN30

BANK

99,000

1D 1.02%

5D 4.76%

Buy Vol. 1,079,504

Sell Vol. 1,180,997

44,800

1D 0.22%

5D 2.28%

Buy Vol. 1,450,337

Sell Vol. 1,751,938

28,700

1D -0.17%

5D 2.32%

Buy Vol. 8,320,620

Sell Vol. 11,997,363

32,700

1D 2.51%

5D 8.28%

Buy Vol. 14,742,175

Sell Vol. 10,198,042

19,850

1D 0.51%

5D 2.06%

Buy Vol. 27,102,537

Sell Vol. 30,269,428

20,450

1D 3.28%

5D 9.07%

Buy Vol. 49,526,598

Sell Vol. 34,306,323

19,200

1D 0.79%

5D 2.13%

Buy Vol. 5,248,889

Sell Vol. 5,602,958

25,800

1D -1.15%

5D 7.05%

Buy Vol. 21,433,469

Sell Vol. 14,812,288

28,300

1D 0.89%

5D 2.17%

Buy Vol. 44,278,095

Sell Vol. 24,859,390

23,600

1D 1.72%

5D 10.80%

Buy Vol. 19,190,231

Sell Vol. 15,628,750

21,800

1D 0.23%

5D 3.57%

Buy Vol. 17,749,036

Sell Vol. 19,256,418

TPB: TPB has just announced issuing shares to raise capital from equity. Specifically, TPBank plans to issue nearly 620 million shares, the exercise rate is 39.19%. The total value of issuance at par value is nearly VND6,199 billion. Last date for registration is 12/06/2023. The ex-rights date is 09/06/2023.

REAL ESTATE

13,600

1D 0.74%

5D 1.87%

Buy Vol. 30,548,282

Sell Vol. 31,354,954

77,900

1D 0.13%

5D -0.13%

Buy Vol. 84,871

Sell Vol. 139,693

14,950

1D 1.70%

5D 3.10%

Buy Vol. 23,738,990

Sell Vol. 20,530,909

NVL: SCID is discussing with Novaland to stop cooperating in the Saigon Co.op An Phu project (6.9ha) because it is completing the legality as the project investor.

OIL & GAS

95,100

1D 1.17%

5D 2.37%

Buy Vol. 1,430,092

Sell Vol. 1,931,301

13,800

1D -1.08%

5D 1.10%

Buy Vol. 17,271,544

Sell Vol. 18,910,449

38,900

1D -0.51%

5D 2.64%

Buy Vol. 1,194,976

Sell Vol. 1,510,195

PLX: PLX sets 2023 target of VND190,000 billion in consolidated revenue, down 38% YoY, and targeted consolidated pre-tax profit of VND3,228 billion, up 42% YoY.

VINGROUP

53,200

1D 2.11%

5D 1.53%

Buy Vol. 3,900,081

Sell Vol. 4,892,003

55,000

1D 2.42%

5D 0.18%

Buy Vol. 1,995,012

Sell Vol. 2,537,793

27,350

1D 0.92%

5D -1.26%

Buy Vol. 4,581,291

Sell Vol. 5,202,900

VHM: Vinhomes announced the Ocean City plan with a total area of nearly 1,200 hectares, the current population size is more than 60,000 people and is expected to to 200,000 people in the future.

FOOD & BEVERAGE

66,400

1D -0.15%

5D -0.15%

Buy Vol. 5,823,002

Sell Vol. 6,299,797

73,600

1D -0.67%

5D 1.10%

Buy Vol. 2,993,916

Sell Vol. 2,215,668

160,000

1D 0.38%

5D 2.56%

Buy Vol. 287,939

Sell Vol. 314,428

VNM, MSN, and SAB were all among the top foreign net sellers today with a value of VND145 billion, VND41 billion and VND4.5 billion, respectively.

OTHERS

44,950

1D 1.01%

5D 2.63%

Buy Vol. 2,160,611

Sell Vol. 2,290,095

97,700

1D 0.93%

5D -0.81%

Buy Vol. 690,528

Sell Vol. 650,862

85,300

1D 0.35%

5D 1.55%

Buy Vol. 1,061,961

Sell Vol. 1,250,126

41,800

1D 1.46%

5D 6.09%

Buy Vol. 9,487,636

Sell Vol. 7,907,654

18,750

1D 2.18%

5D 1.90%

Buy Vol. 6,681,252

Sell Vol. 4,609,093

25,150

1D 4.36%

5D 7.71%

Buy Vol. 65,249,480

Sell Vol. 57,986,077

21,750

1D 0.46%

5D 1.87%

Buy Vol. 22,486,876

Sell Vol. 27,902,010

HPG: In May 2023, Hoa Phat Group produced 565,000 tons of crude steel, down 27% over the same period last year. Sales of construction steel, hot rolled coil and billet reached 530,000 tons, down 20% compared to May 2022 but up 16% compared to April.

Market by numbers

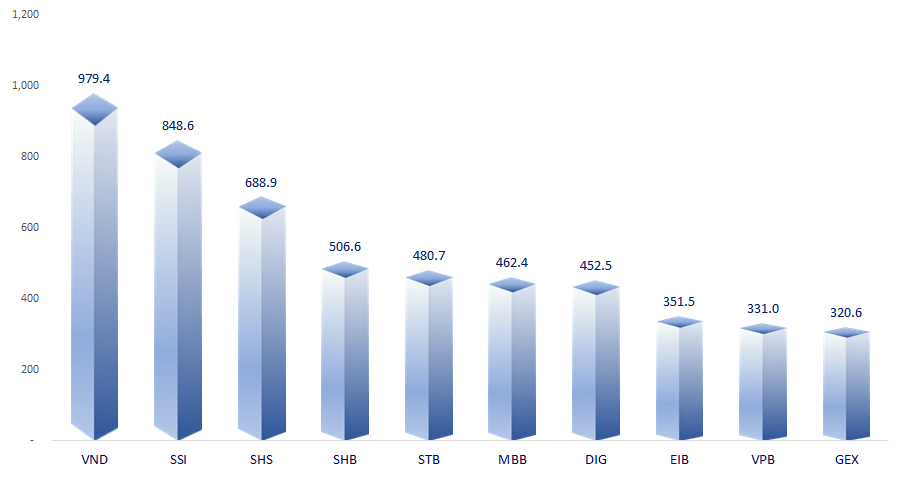

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

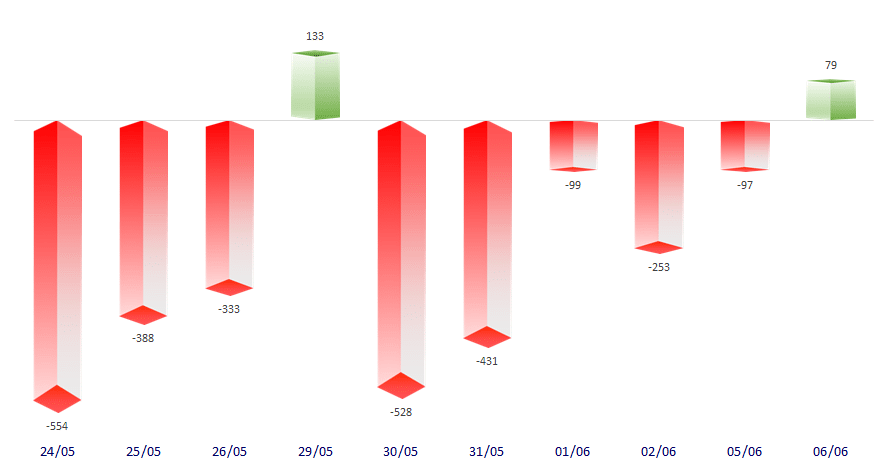

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

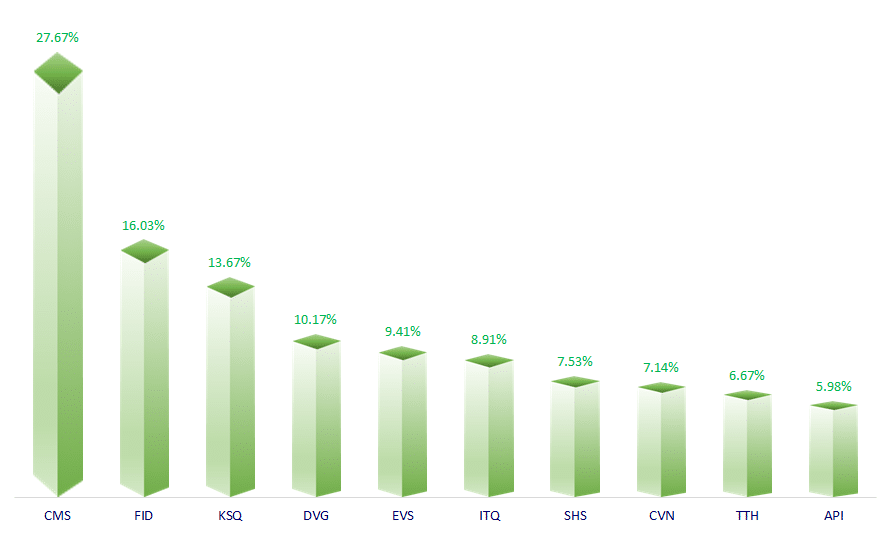

TOP INCREASES 3 CONSECUTIVE SESSIONS

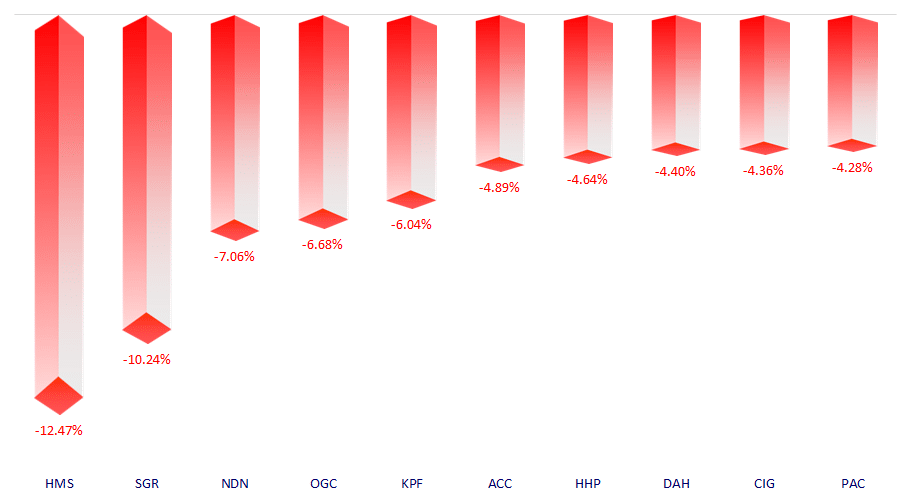

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.