Market brief 07/06/2023

VIETNAM STOCK MARKET

1,109.54

1D 0.11%

YTD 10.17%

1,105.68

1D 0.30%

YTD 10.00%

230.33

1D 0.70%

YTD 12.19%

84.56

1D 0.15%

YTD 18.02%

-173.28

1D 0.00%

YTD 0.00%

20,720.33

1D 11.01%

YTD 140.49%

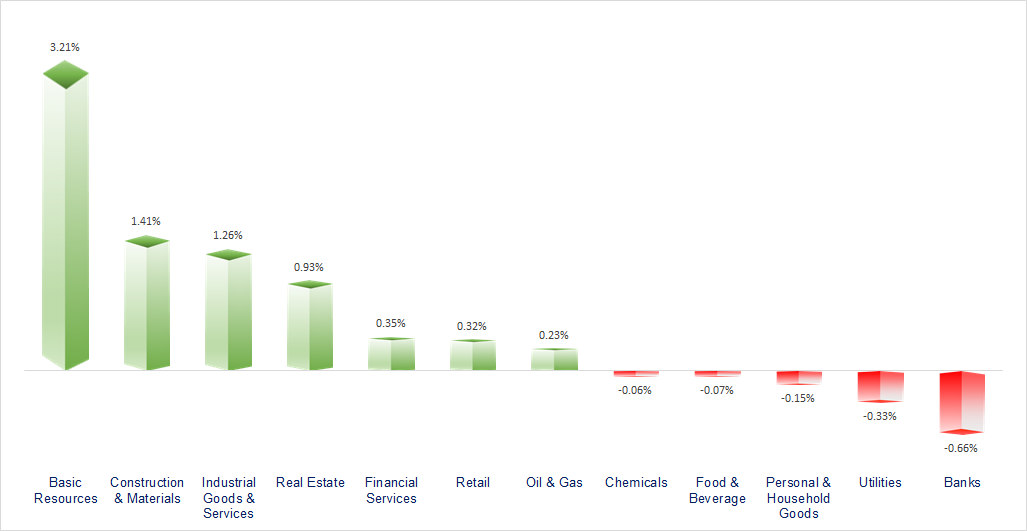

Vietnam stock market had a volatile session around the reference level, showing signs that parties started to take profits after a strong increase from last week. Basic resources, construction and real estates were the 3 most positive sectors today with some typical stocks such as HPG, NVL, PDR, HBC, etc.

ETF & DERIVATIVES

18,820

1D 0.97%

YTD 8.60%

13,090

1D 0.46%

YTD 9.82%

13,200

1D 0.30%

YTD 5.77%

16,570

1D 3.24%

YTD 17.94%

17,340

1D 0.46%

YTD 20.84%

23,510

1D 0.26%

YTD 4.96%

14,160

1D 0.28%

YTD 9.34%

1,080

1D 0.27%

YTD 0.00%

1,086

1D 0.25%

YTD 0.00%

1,095

1D 0.28%

YTD 0.00%

1,098

1D 0.17%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

31,913.74

1D -1.82%

YTD 22.30%

3,197.76

1D 0.08%

YTD 3.51%

2,615.60

1D 0.01%

YTD 16.96%

19,261.00

1D 0.85%

YTD -2.63%

3,177.38

1D -0.40%

YTD -2.27%

1,529.27

1D 0.05%

YTD -8.45%

76.36

1D 0.08%

YTD -11.12%

1,978.65

1D -0.18%

YTD 8.35%

Asian markets mostly rallied as investors await the outcome of the Fed's meeting at the end of next week. Meanwhile, Nikkei (Japan) fell sharply today after continuously recording a historic peak within 33 years.

VIETNAM ECONOMY

3.77%

YTD (bps) -120

7.20%

YTD (bps) -20

2.77%

1D (bps) 1

YTD (bps) -202

3.00%

1D (bps) -2

YTD (bps) -190

23,656

1D (%) 0.00%

YTD (%) -0.44%

25,844

1D (%) -0.06%

YTD (%) 0.72%

3,369

1D (%) 0.00%

YTD (%) -3.33%

According to the Ministry of Finance, compared with the plan assigned by the Prime Minister, the cumulative disbursement rate in 5 months reached 22.22%, decreasing slightly over the same period in 2022 (22.37%); in which domestic capital reached 22.64% (the same period in 2022 reached 23.53%), foreign capital reached 12.02% (the same period in 2022 reached 6.26%).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Many banks reduced deposit interest rates for the second time in less than half a month;

- Cambodia starts construction of a USD1.35 billion highway connecting with Vietnam;

- The Swedish shipping group wants to invest in a factory of more than VND800 billion in Vung Tau;

- SEC asks court to freeze Binance US assets globally;

- Russia expects 1% GDP growth for 2023;

- World Bank: Global economic growth has fallen to its lowest level since the 2008 financial crisis.

VN30

BANK

97,000

1D -2.02%

5D 3.19%

Buy Vol. 1,288,888

Sell Vol. 1,131,552

44,350

1D -1.00%

5D 0.80%

Buy Vol. 1,581,156

Sell Vol. 2,195,720

28,900

1D 0.70%

5D 3.21%

Buy Vol. 10,267,514

Sell Vol. 12,689,832

32,600

1D -0.31%

5D 8.85%

Buy Vol. 9,431,812

Sell Vol. 8,002,542

19,900

1D 0.25%

5D 3.11%

Buy Vol. 26,124,177

Sell Vol. 33,797,385

20,350

1D -0.49%

5D 9.41%

Buy Vol. 26,487,867

Sell Vol. 24,996,521

19,000

1D -1.04%

5D 3.26%

Buy Vol. 3,403,887

Sell Vol. 4,185,436

26,250

1D 1.74%

5D 5.00%

Buy Vol. 17,305,943

Sell Vol. 16,242,339

28,350

1D 0.18%

5D 2.35%

Buy Vol. 40,268,658

Sell Vol. 32,777,030

23,600

1D 0.00%

5D 10.28%

Buy Vol. 15,391,081

Sell Vol. 12,049,865

21,850

1D 0.23%

5D 2.99%

Buy Vol. 18,461,688

Sell Vol. 18,508,431

HDB: HDBank received a document from the State Bank of Vietnam approving this bank to increase its charter capital through stock dividends. Accordingly, the State Bank of Vietnam approved HDBank to increase its charter capital by a maximum of VND3,772 billion from accumulated undistributed profit after tax.

REAL ESTATE

14,550

1D 6.99%

5D 7.78%

Buy Vol. 106,214,887

Sell Vol. 95,383,805

79,600

1D 2.18%

5D 2.05%

Buy Vol. 492,289

Sell Vol. 410,555

15,950

1D 6.69%

5D 9.25%

Buy Vol. 52,655,253

Sell Vol. 26,711,193

BCM: Becamex IDC plans to issue 10,000 individual bonds, non-convertible, with collateral at the price of 100 million VND/bond, expected to mobilize VND1,000 billion.

OIL & GAS

94,500

1D -0.63%

5D 1.83%

Buy Vol. 1,180,712

Sell Vol. 1,471,025

13,750

1D -0.36%

5D 0.73%

Buy Vol. 16,911,325

Sell Vol. 19,309,723

38,900

1D 0.00%

5D 3.73%

Buy Vol. 2,243,249

Sell Vol. 2,239,071

Oil prices fell on Tuesday (June 6), on concerns that sluggish global economic growth could dampen energy demand.

VINGROUP

52,800

1D -0.75%

5D 1.54%

Buy Vol. 2,681,034

Sell Vol. 3,777,037

55,300

1D 0.55%

5D 3.36%

Buy Vol. 3,005,220

Sell Vol. 3,229,140

27,250

1D -0.37%

5D 0.55%

Buy Vol. 5,800,201

Sell Vol. 6,608,071

VHM: Vinhomes signed a cooperation agreement with Mitsubishi Corporation, distributing Glory Heights project.

FOOD & BEVERAGE

66,200

1D -0.30%

5D 0.15%

Buy Vol. 6,090,149

Sell Vol. 5,923,046

75,500

1D 2.58%

5D 4.86%

Buy Vol. 8,586,422

Sell Vol. 3,443,183

159,800

1D -0.13%

5D 1.14%

Buy Vol. 299,305

Sell Vol. 363,679

MSN: Nui Phao Mining and Mineral Processing Ltd (a subsidiary of Masan) has successfully issued 4 lots of bonds with a total par value of VND 2,600 billion.

OTHERS

44,650

1D -0.67%

5D 2.64%

Buy Vol. 1,152,528

Sell Vol. 1,623,131

96,600

1D -1.13%

5D -0.92%

Buy Vol. 770,298

Sell Vol. 679,126

85,000

1D -0.35%

5D 1.07%

Buy Vol. 1,248,171

Sell Vol. 1,382,539

41,800

1D 0.00%

5D 6.63%

Buy Vol. 10,996,321

Sell Vol. 8,040,081

18,550

1D -1.07%

5D 1.92%

Buy Vol. 5,766,398

Sell Vol. 6,221,874

25,100

1D -0.20%

5D 8.42%

Buy Vol. 35,320,828

Sell Vol. 35,482,151

22,600

1D 3.91%

5D 6.60%

Buy Vol. 107,415,067

Sell Vol. 97,307,528

HPG: My Hao Urban Company - a subsidiary of Hoa Phat Group is the only investor registered to implement Minh Hai - Phan Dinh Phung Urban Area with an investment scale of more than VND3 trillion.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.