Market brief 12/06/2023

VIETNAM STOCK MARKET

1,116.02

1D 0.77%

YTD 10.82%

1,109.63

1D 0.80%

YTD 10.39%

229.37

1D 0.78%

YTD 11.72%

84.53

1D 2.14%

YTD 17.98%

87.98

1D 0.00%

YTD 0.00%

18,100.16

1D -6.62%

YTD 110.08%

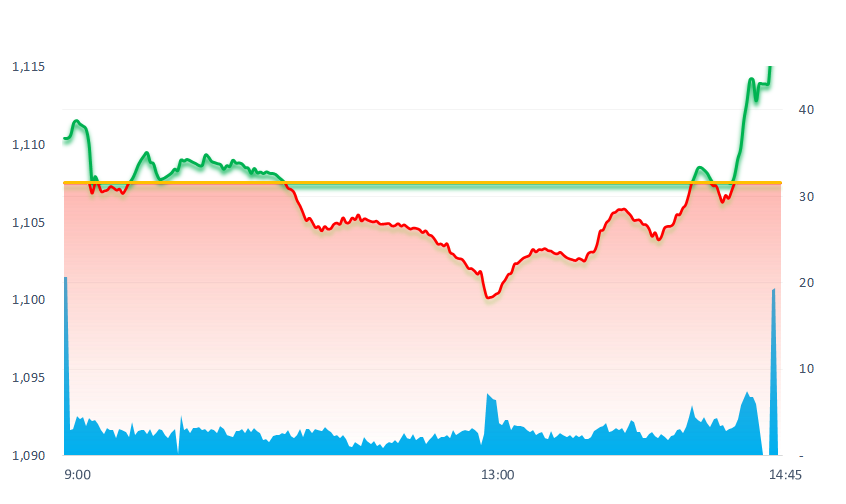

The stock market dropped from mid-morning as selling pressure spread across all industries. Only near the end of the afternoon session, the improved cash inflow pulled VNIndex to close at the highest level of the session. Volume and trading value continued to decline in recent sessions after reaching a record level of USD1 billion on June 8.

ETF & DERIVATIVES

18,880

1D 0.75%

YTD 8.94%

13,100

1D 0.46%

YTD 9.90%

13,500

1D 0.37%

YTD 8.17%

16,310

1D -0.67%

YTD 16.09%

17,100

1D 0.23%

YTD 19.16%

23,500

1D 0.86%

YTD 4.91%

14,130

1D 0.07%

YTD 9.11%

1,086

1D 1.00%

YTD 0.00%

1,092

1D 0.97%

YTD 0.00%

1,106

1D 1.40%

YTD 0.00%

1,108

1D 1.19%

YTD 0.00%

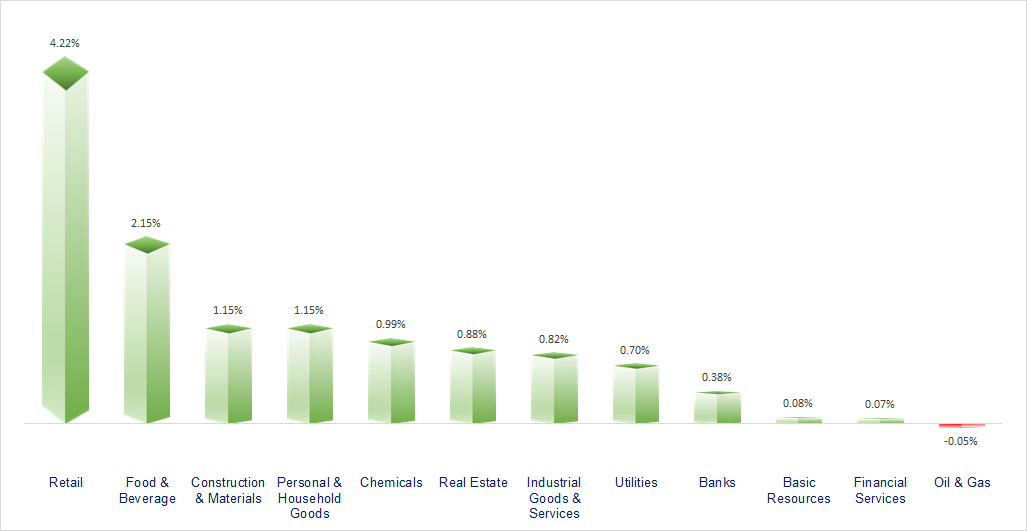

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

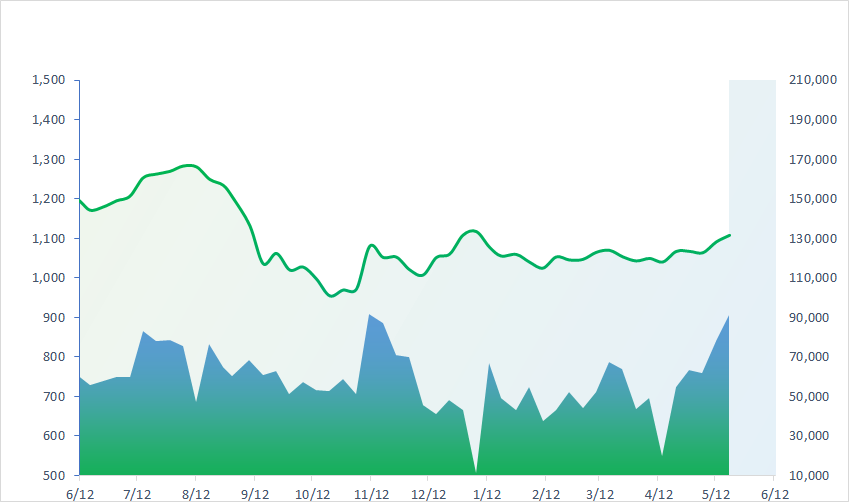

VNINDEX (12M)

GLOBAL MARKET

32,434.00

1D 0.52%

YTD 24.29%

3,228.83

1D -0.08%

YTD 4.52%

2,629.35

1D -0.45%

YTD 17.57%

19,404.31

1D 0.07%

YTD -1.91%

3,196.07

1D 0.29%

YTD -1.70%

1,551.41

1D -0.24%

YTD -7.12%

73.33

1D -1.35%

YTD -14.64%

1,980.05

1D 0.36%

YTD 8.42%

On the afternoon of June 12, most Asian stock exchanges gained, but investors were still cautious while waiting for inflation data in the US and interest rate decision of the US Fed.

VIETNAM ECONOMY

2.67%

1D (bps) -42

YTD (bps) -230

6.80%

YTD (bps) -60

2.74%

1D (bps) 6

YTD (bps) -205

2.99%

1D (bps) 5

YTD (bps) -191

23,700

1D (%) 0.23%

YTD (%) -0.25%

25,761

1D (%) -0.74%

YTD (%) 0.40%

3,359

1D (%) -0.12%

YTD (%) -3.62%

According to the General Department of Customs, in the face of gloomy consumption, in May, imports of CBU cars tended to decrease sharply, leading to a decrease in budget revenue of nearly VND1,300 billion.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Automobiles import plummeted, budget revenue decreased by nearly VND1,300 billion;

- EU relaxes food safety regulations for Vietnamese instant noodles;

- Officially propose to increase the ceiling of domestic airfares;

- UBS completed acquisition of Credit Suisse;

- American banks fled the commercial real estate sector;

- Inflation in Japan will exceed initial forecasts.

VN30

BANK

101,000

1D 0.50%

5D 3.06%

Buy Vol. 870,816

Sell Vol. 779,312

43,650

1D 0.46%

5D -2.35%

Buy Vol. 2,069,582

Sell Vol. 1,827,905

28,400

1D 0.18%

5D -1.22%

Buy Vol. 9,312,050

Sell Vol. 8,802,203

32,700

1D 0.93%

5D 2.51%

Buy Vol. 8,124,054

Sell Vol. 6,659,801

19,600

1D 0.51%

5D -0.76%

Buy Vol. 16,374,573

Sell Vol. 17,597,006

20,350

1D 0.49%

5D 2.78%

Buy Vol. 20,097,616

Sell Vol. 18,585,564

18,400

1D -0.54%

5D -3.41%

Buy Vol. 4,730,105

Sell Vol. 4,929,765

18,400

1D -1.34%

5D -1.87%

Buy Vol. 4,767,391

Sell Vol. 5,188,177

28,200

1D 0.36%

5D 0.53%

Buy Vol. 37,150,753

Sell Vol. 24,192,036

23,500

1D 0.43%

5D 1.29%

Buy Vol. 12,653,547

Sell Vol. 11,180,609

21,450

1D -0.46%

5D -1.38%

Buy Vol. 8,942,784

Sell Vol. 12,433,799

Today (June 12), two banks have adjusted their deposit rates, namely HDBank and Sacombank, with an adjustment of 0.2-0.35 percentage points. Accordingly, the highest interest rate at HDBank is only 7.7%/year, applied for 6-month, 12-month, and 13-month terms. The highest interest rate at Sacombank is 7.45%/year, applied for a 36-month deposit term in the online form.

REAL ESTATE

14,600

1D 0.00%

5D 8.15%

Buy Vol. 52,866,970

Sell Vol. 75,931,527

82,000

1D 2.50%

5D 5.40%

Buy Vol. 550,094

Sell Vol. 461,030

17,700

1D 4.73%

5D 20.41%

Buy Vol. 36,914,292

Sell Vol. 31,891,724

BCM: Regarding the dividend plan, in 2022, BCM plans to pay a cash dividend at the rate of 8%, equivalent to VND828 billion. In 2023, the dividend rate is expected to 9% in cash

OIL & GAS

93,900

1D 0.21%

5D -0.11%

Buy Vol. 930,065

Sell Vol. 1,005,964

13,900

1D 1.09%

5D -0.36%

Buy Vol. 19,778,894

Sell Vol. 22,350,687

37,950

1D -0.13%

5D -2.94%

Buy Vol. 1,064,883

Sell Vol. 1,335,781

GAS: Siam Cement Group Chemicals (SCGC) of Thailand has just had a meeting with PV GAS to discuss the preparation of supplying gas as raw materials for Long Sơn Petrochemicals –LSP.

VINGROUP

53,400

1D 2.10%

5D 2.50%

Buy Vol. 3,124,521

Sell Vol. 3,192,104

55,400

1D -0.18%

5D 3.17%

Buy Vol. 1,764,070

Sell Vol. 2,076,593

26,700

1D 0.00%

5D -1.48%

Buy Vol. 5,541,740

Sell Vol. 5,662,877

VIC: In Hai Phong, VinFast in the past 5 months has reduced up to VND859 billion in contractor tax, special consumption tax and VND273 billion in environmental protection tax.

FOOD & BEVERAGE

67,900

1D 3.19%

5D 2.11%

Buy Vol. 9,628,978

Sell Vol. 9,126,444

78,400

1D 2.48%

5D 5.80%

Buy Vol. 3,776,637

Sell Vol. 4,319,461

162,000

1D 2.53%

5D 2.60%

Buy Vol. 286,019

Sell Vol. 215,687

VNM: VNM is planning to expand the factory area at Angkormilk factory, Cambodia, increasing production capacity to 90 million liters of all kinds per year.

OTHERS

44,500

1D 1.60%

5D 0.00%

Buy Vol. 1,582,735

Sell Vol. 1,785,624

96,400

1D 0.42%

5D -0.41%

Buy Vol. 942,747

Sell Vol. 1,014,847

84,900

1D 0.35%

5D -0.12%

Buy Vol. 1,007,377

Sell Vol. 1,047,039

43,000

1D 3.86%

5D 4.37%

Buy Vol. 14,164,304

Sell Vol. 11,065,077

18,150

1D 0.55%

5D -1.09%

Buy Vol. 7,564,562

Sell Vol. 6,626,027

25,350

1D 0.40%

5D 5.19%

Buy Vol. 33,410,251

Sell Vol. 32,461,672

22,950

1D 0.22%

5D 6.00%

Buy Vol. 34,959,920

Sell Vol. 47,582,180

HPG: Hoa Phat Group reduced the selling price of HRC by USD40/ton while domestic demand was still weak. This is the second discount in the past 1 month. Specifically, Hoa Phat fixed the selling price of HRC steel grade SAE1006/SS400 at USD 570/ton, down USD 40/ton from last month. And Formosa Ha Tinh is offering HRC at 580 USD/ton (CIF price).

Market by numbers

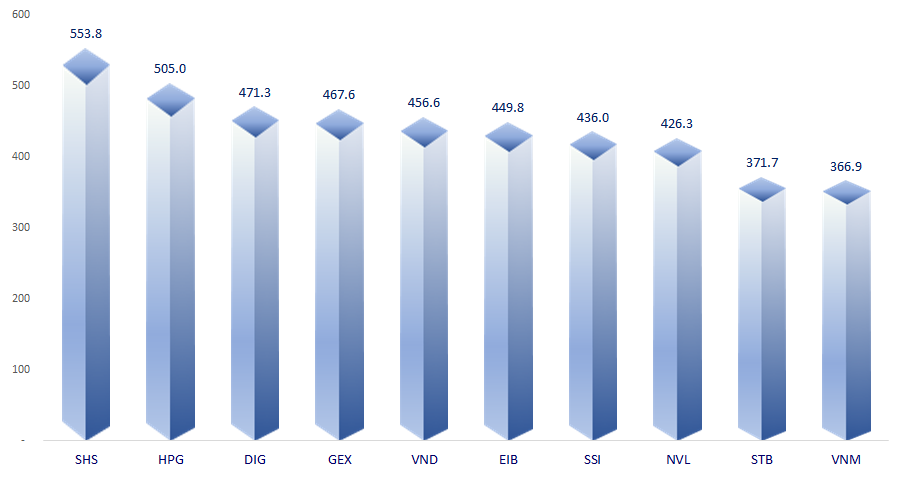

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

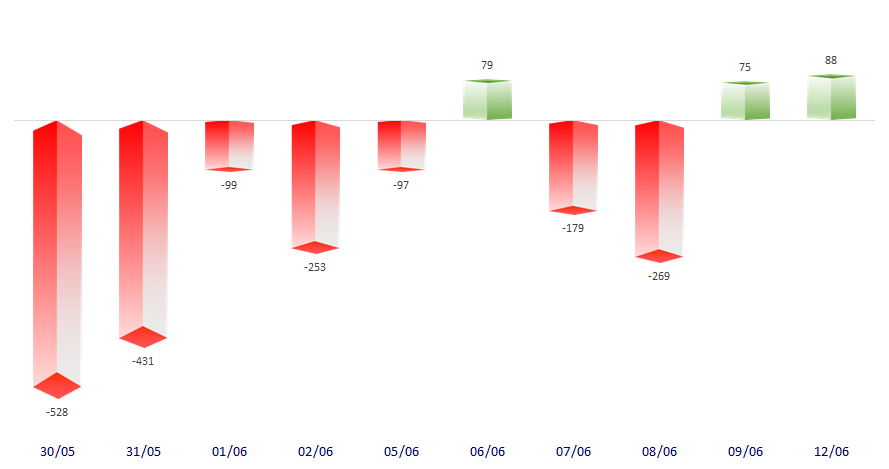

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

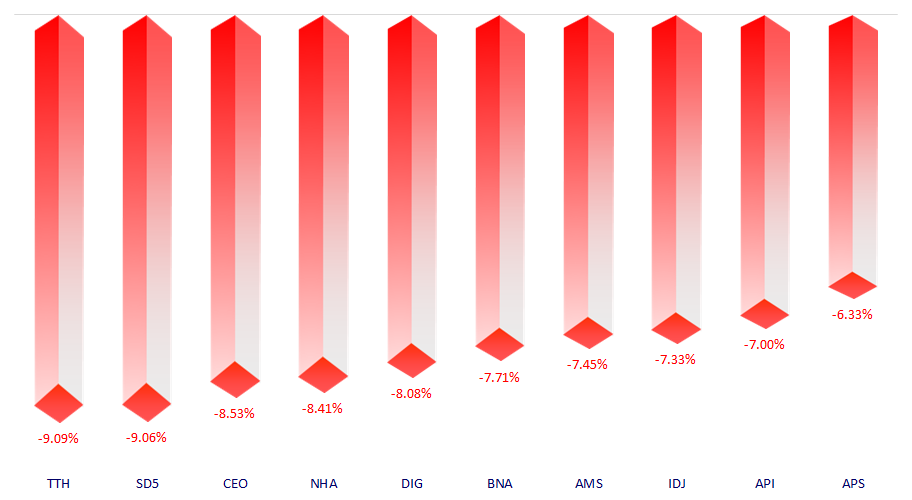

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.