Market brief 13/06/2023

VIETNAM STOCK MARKET

1,122.46

1D 0.58%

YTD 11.46%

1,115.39

1D 0.52%

YTD 10.96%

230.25

1D 0.38%

YTD 12.15%

85.00

1D 0.56%

YTD 18.63%

251.44

1D 0.00%

YTD 0.00%

20,265.88

1D 11.97%

YTD 135.21%

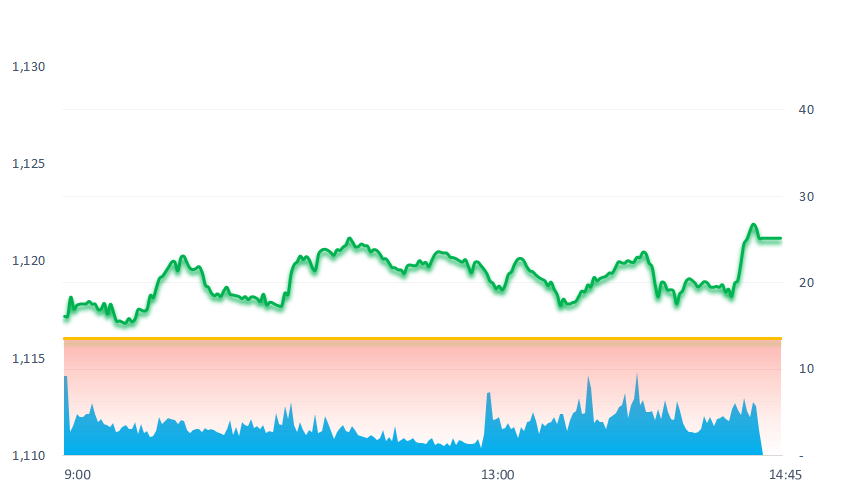

The stock market maintained a slight uptrend in most of today's trading session. Gradually towards the end of the session, the cash inflow poured into the market so that VNIndex closed at the highest level of the session. Volume and value increased slightly by 20.4% and 14.2% respectively compared to yesterday.

ETF & DERIVATIVES

19,030

1D 0.79%

YTD 9.81%

13,210

1D 0.84%

YTD 10.82%

13,550

1D 0.37%

YTD 8.57%

16,890

1D 3.56%

YTD 20.21%

17,200

1D 0.58%

YTD 19.86%

23,500

1D 0.00%

YTD 4.91%

14,340

1D 1.49%

YTD 10.73%

1,092

1D 0.60%

YTD 0.00%

1,102

1D 0.92%

YTD 0.00%

1,111

1D 0.47%

YTD 0.00%

1,116

1D 0.65%

YTD 0.00%

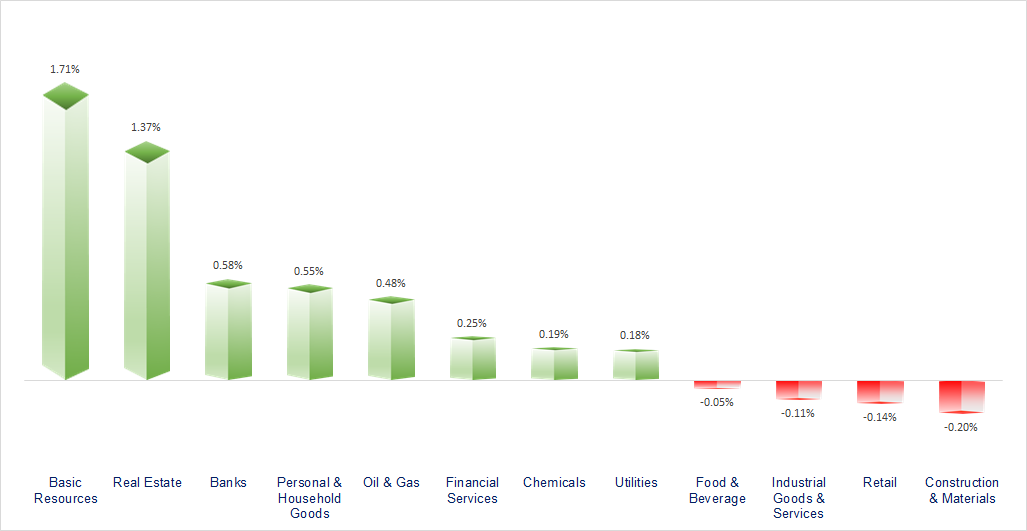

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

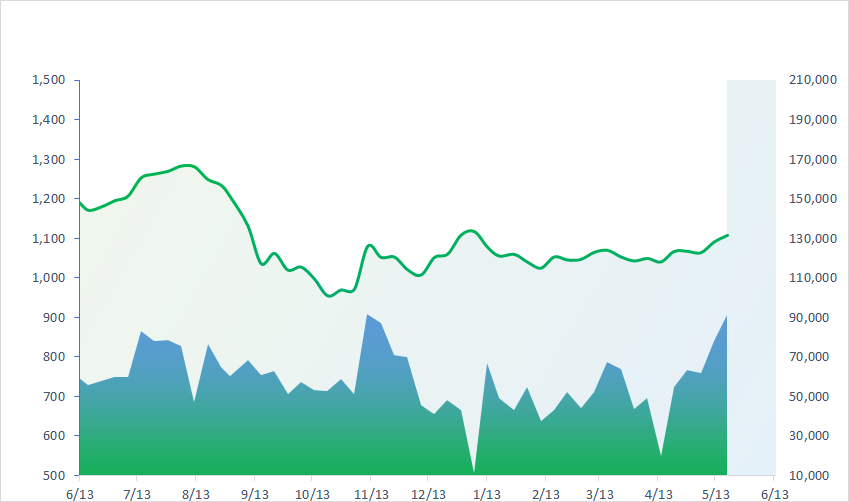

VNINDEX (12M)

GLOBAL MARKET

33,018.65

1D 1.80%

YTD 26.53%

3,233.67

1D 0.15%

YTD 4.67%

2,637.95

1D 0.33%

YTD 17.96%

19,521.42

1D 0.60%

YTD -1.31%

3,189.40

1D -0.21%

YTD -1.90%

1,562.40

1D 0.71%

YTD -6.46%

68.44

1D -5.21%

YTD -20.34%

1,978.55

1D 0.27%

YTD 8.34%

Asian stocks all rose in the afternoon session of June 13, continuing Wall Street's rally, amid investors' focus on US inflation data and the Federal Reserve's interest rate decision. The US Federal Reserve (Fed), is expected to be announced this week.

VIETNAM ECONOMY

2.41%

1D (bps) -26

YTD (bps) -256

6.80%

YTD (bps) -60

2.68%

1D (bps) -6

YTD (bps) -211

2.93%

1D (bps) -6

YTD (bps) -197

23,715

1D (%) 0.23%

YTD (%) -0.19%

25,825

1D (%) -0.72%

YTD (%) 0.65%

3,357

1D (%) 0.00%

YTD (%) -3.67%

The abundance of liquidity in VND is clearly shown in recent weeks when almost no banks need capital support from the State Bank through the OMO, although the OMO interest rate has dropped to 4.5% to 6% not too long ago.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Water volume to hydropower reservoirs increased by 28%;

- VAFI proposes tax exemption for corporate bond investors;

- Vietnam attracts many semiconductor manufacturers;

- China unexpectedly cut short-term policy interest rates;

- Eurozone economy falling into recession did not prevent the ECB from raising interest rates;

- The Bank of Korea (BOK) warns of financial risks as the risk of real estate loans increases.

VN30

BANK

102,500

1D 1.49%

5D 3.54%

Buy Vol. 1,286,119

Sell Vol. 1,354,037

44,350

1D 1.60%

5D -1.00%

Buy Vol. 2,566,144

Sell Vol. 2,241,558

28,300

1D -0.35%

5D -1.39%

Buy Vol. 6,628,599

Sell Vol. 7,611,060

32,800

1D 0.31%

5D 0.31%

Buy Vol. 5,947,364

Sell Vol. 7,102,609

19,500

1D -0.51%

5D -1.76%

Buy Vol. 17,928,539

Sell Vol. 23,340,841

20,300

1D -0.25%

5D -0.73%

Buy Vol. 18,251,771

Sell Vol. 22,761,844

18,600

1D 1.09%

5D -3.13%

Buy Vol. 2,603,881

Sell Vol. 2,785,625

18,150

1D -1.36%

5D -2.08%

Buy Vol. 5,799,815

Sell Vol. 5,627,358

28,200

1D 0.00%

5D -0.35%

Buy Vol. 27,268,040

Sell Vol. 24,746,531

23,400

1D -0.43%

5D -0.85%

Buy Vol. 11,233,216

Sell Vol. 11,318,815

21,600

1D 0.70%

5D -0.92%

Buy Vol. 14,030,851

Sell Vol. 14,588,357

MBB: Today, MBB reduced interest rates by 0.2 percentage points for terms of 13 months or more. Currently, the highest interest rate listed by this bank is only 7.2%/year.

REAL ESTATE

15,600

1D 6.85%

5D 14.71%

Buy Vol. 140,633,460

Sell Vol. 108,591,996

81,400

1D -0.73%

5D 4.49%

Buy Vol. 489,888

Sell Vol. 624,292

17,700

1D 0.00%

5D 18.39%

Buy Vol. 31,760,198

Sell Vol. 34,647,297

PDR: In 2023, PDR plans to deploy more than 13,000 products with great demand such as Binh Duong, Ba Ria - Vung Tau, Binh Dinh, etc., expecting to bring in more than VND30,000 billion in revenue.

OIL & GAS

94,000

1D 0.11%

5D -1.16%

Buy Vol. 1,042,881

Sell Vol. 1,031,686

13,850

1D -0.36%

5D 0.36%

Buy Vol. 19,933,492

Sell Vol. 22,437,077

38,050

1D 0.26%

5D -2.19%

Buy Vol. 1,006,327

Sell Vol. 911,532

GAS: PV GAS will participate in the supply of raw materials for the Long Son Petrochemicals –LSP, with the following products: Ethane, propane and condensate/naphtha.

VINGROUP

54,100

1D 1.31%

5D 1.69%

Buy Vol. 3,474,590

Sell Vol. 3,629,670

56,700

1D 2.35%

5D 3.09%

Buy Vol. 3,236,212

Sell Vol. 3,220,593

27,100

1D 1.50%

5D -0.91%

Buy Vol. 6,191,627

Sell Vol. 6,022,401

VIC: VinFast has just issued a notice to adjust the cost of charging electric vehicles at public charging stations from VND3,117.4/kWh to VND3,210.9/kWh (VAT included), effective from June 10 2023.

FOOD & BEVERAGE

67,600

1D -0.44%

5D 1.81%

Buy Vol. 7,931,415

Sell Vol. 9,822,483

78,800

1D 0.51%

5D 7.07%

Buy Vol. 2,252,456

Sell Vol. 3,205,670

161,800

1D -0.12%

5D 2.08%

Buy Vol. 157,720

Sell Vol. 223,454

VNM: Up to now, Vinamilk's products have set in 58 countries and territories, with total accumulated export turnover so far has exceeded USD3 billion.

OTHERS

45,000

1D 1.12%

5D 0.11%

Buy Vol. 2,999,172

Sell Vol. 3,661,053

96,500

1D 0.10%

5D -1.23%

Buy Vol. 1,174,754

Sell Vol. 1,342,982

84,400

1D -0.59%

5D -1.06%

Buy Vol. 855,096

Sell Vol. 1,867,892

43,000

1D 0.00%

5D 2.87%

Buy Vol. 6,454,148

Sell Vol. 7,733,704

18,400

1D 1.38%

5D -1.87%

Buy Vol. 6,609,681

Sell Vol. 5,450,852

25,350

1D 0.00%

5D 0.80%

Buy Vol. 31,290,503

Sell Vol. 35,099,317

23,400

1D 1.96%

5D 7.59%

Buy Vol. 56,790,478

Sell Vol. 67,963,866

MWG: After buying back 366 thousand treasury shares in May 2023, Mobile World has just announced that it will buy back more than 450 thousand treasury shares in June and July. This volume has far exceeded the figures of previous years.

Market by numbers

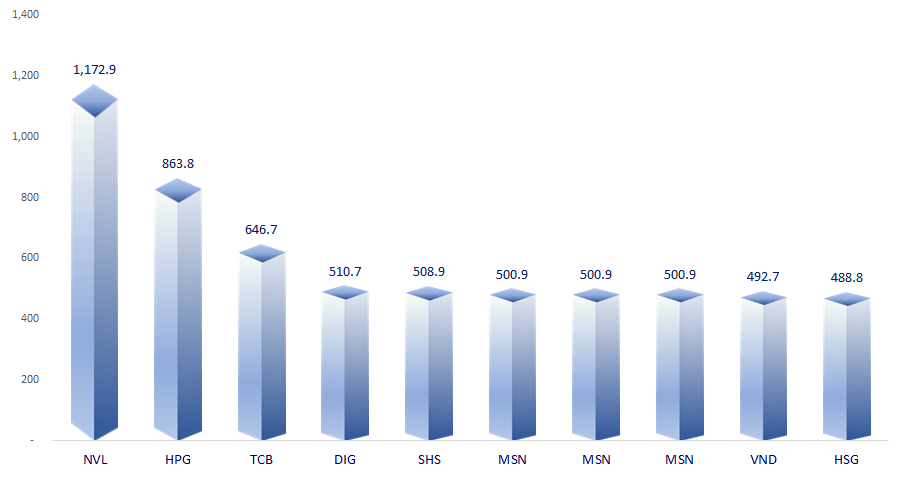

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

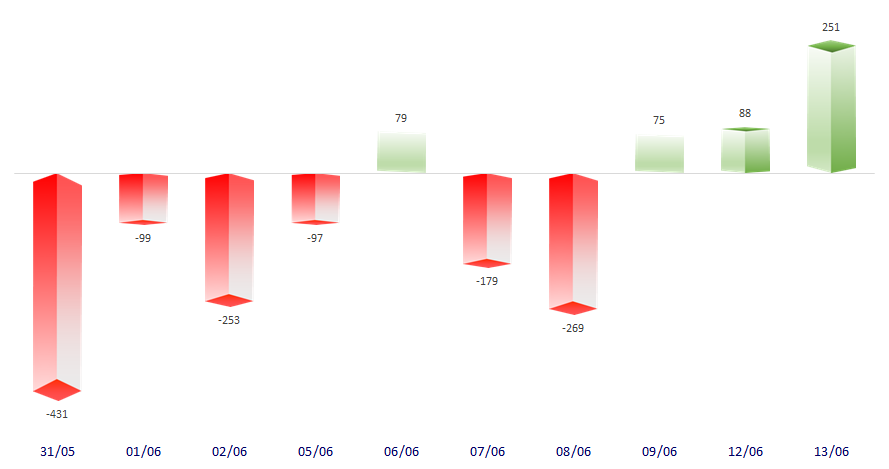

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.