Market Brief 28/06/2023

VIETNAM STOCK MARKET

1,138.35

1D 0.35%

YTD 13.03%

1,141.12

1D 0.59%

YTD 13.52%

230.25

1D -0.25%

YTD 12.15%

85.99

1D 0.40%

YTD 20.01%

117.27

1D 0.00%

YTD 0.00%

20,576.75

1D 23.40%

YTD 138.82%

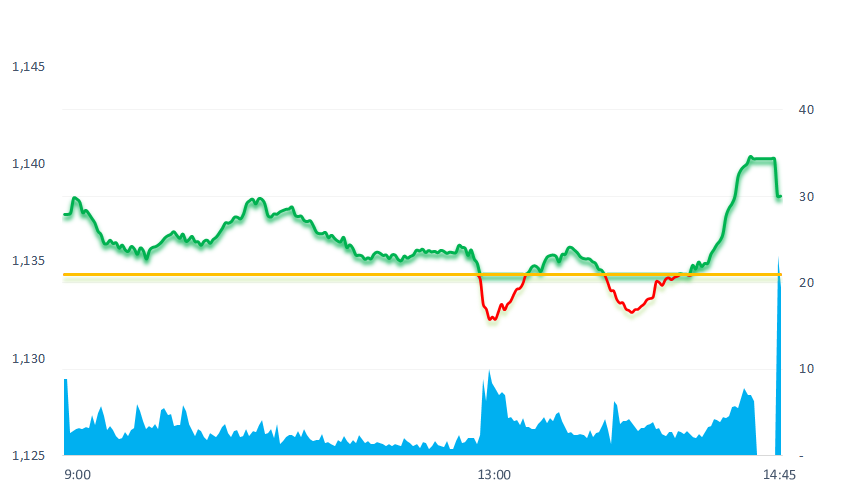

Contrary to the gloomy morning session, since 2:15pm, 3 bluechips (VCB, CTG, BID) were suddenly pulled strongly, pushing the VNIndex to the highest level before the end of the session. At the end of the session, BID was the gainer that had the strongest impact on the VNIndex, HPG moved closer to the highest price of the session and also the peak price area of this year.

ETF & DERIVATIVES

19,590

1D 1.08%

YTD 13.04%

13,490

1D 0.37%

YTD 13.17%

13,970

1D 0.43%

YTD 11.94%

16,690

1D 0.48%

YTD 18.79%

17,990

1D 0.50%

YTD 25.37%

24,200

1D 0.46%

YTD 8.04%

14,690

1D -0.34%

YTD 13.44%

1,132

1D 0.64%

YTD 0.00%

1,125

1D 0.29%

YTD 0.00%

1,125

1D 0.71%

YTD 0.00%

1,119

1D 1.10%

YTD 0.00%

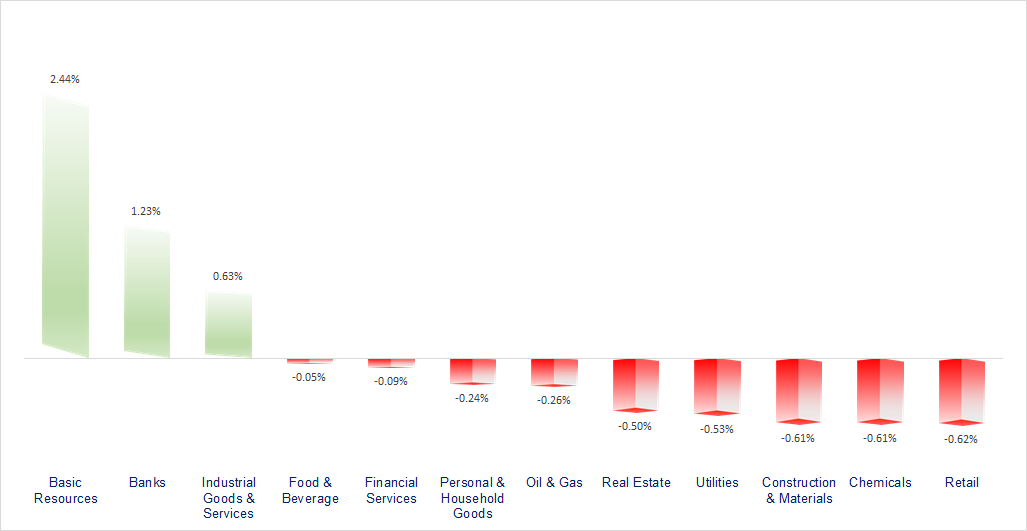

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

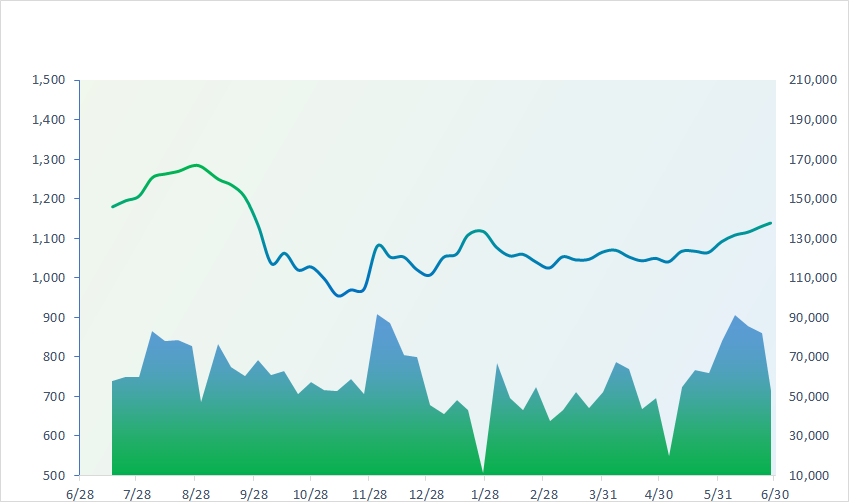

VNINDEX (12M)

GLOBAL MARKET

33,193.99

1D 2.02%

YTD 27.21%

3,189.38

1D 0.00%

YTD 3.24%

2,564.19

1D -0.67%

YTD 14.66%

19,172.05

1D 0.12%

YTD -3.08%

3,207.28

1D 0.06%

YTD -1.35%

1,466.93

1D -0.76%

YTD -12.18%

72.97

1D 0.43%

YTD -15.06%

1,917.25

1D -0.36%

YTD 4.99%

Oil rallied on Wednesday after an industry report of a larger-than-expected drop in U.S. crude inventories suggested robust demand and helped offset worries over further interest rate hikes. Crude stocks fell by about 2.4 million barrels, market sources said, citing data from industry group American Petroleum Institute (API) ahead of official data from the Energy Information Administration.

VIETNAM ECONOMY

0.82%

1D (bps) -16

YTD (bps) -415

6.30%

YTD (bps) -110

2.14%

YTD (bps) -265

2.55%

1D (bps) 3

YTD (bps) -235

23,737

1D (%) 0.13%

YTD (%) -0.10%

26,528

1D (%) 0.07%

YTD (%) 3.39%

3,323

1D (%) -0.21%

YTD (%) -4.65%

Many banks simultaneously reduced lending interest rates. Since June 1, BIDV has reduced lending rates by up to 0.5%/year compared to the current interest rates for medium and long-term loans. MSB announced that from now until December 31, MSB will continue to reduce the lending interest rate by 1%/year compared to the current interest rate. In addition, LPBank has just announced to increase the size of the loan incentive package from VND8,000 billion to 10,000 billion.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Durian exports in 5 months increased to a record, nearly 20 times higher than the same period in 2022;

- Binh Dinh: Proposing to remove difficulties for 10 large-scale real estate projects;

- Philippines's corp spent USD165 million to buy 9 solar power plants in Vietnam;

- China lures billionaires into race to catch US in AI;

- WB: Indonesia's FDI can reach 1.4% of GDP by 2025;

- Morgan Stanley sees Fed hiking rates in July after Powell speech.

VN30

BANK

101,100

1D 1.10%

5D 1.10%

Buy Vol. 1,388,003

Sell Vol. 1,306,559

45,350

1D 2.37%

5D 4.49%

Buy Vol. 3,695,408

Sell Vol. 4,200,276

30,000

1D 2.21%

5D 2.92%

Buy Vol. 17,227,639

Sell Vol. 14,230,434

33,300

1D 1.06%

5D 2.46%

Buy Vol. 8,425,928

Sell Vol. 6,721,663

20,250

1D 0.75%

5D 3.05%

Buy Vol. 31,161,553

Sell Vol. 39,427,953

20,700

1D 2.99%

5D 4.28%

Buy Vol. 47,854,198

Sell Vol. 35,349,212

18,750

1D 0.27%

5D 0.54%

Buy Vol. 3,761,675

Sell Vol. 4,744,749

18,450

1D 0.27%

5D 0.27%

Buy Vol. 7,080,842

Sell Vol. 6,899,309

29,900

1D 1.01%

5D 1.70%

Buy Vol. 39,631,244

Sell Vol. 30,045,857

19,850

1D 0.25%

5D 2.24%

Buy Vol. 11,814,405

Sell Vol. 8,692,764

22,300

1D 0.45%

5D 2.76%

Buy Vol. 14,809,713

Sell Vol. 15,104,492

BID: BIDV officially launched a commercial housing loan with a scale of VND20,000 billion, the interest rate applied from 8.5%/year for real estate investors and from 7.8%/year for home buyers. The promotion is valid until December 31, 2024 or until the size of the credit package is exhausted, whichever comes first.

REAL ESTATE

15,600

1D 4.00%

5D 7.59%

Buy Vol. 146,738,062

Sell Vol. 150,946,089

80,000

1D -1.23%

5D -2.56%

Buy Vol. 484,944

Sell Vol. 555,903

17,000

1D 0.00%

5D -1.73%

Buy Vol. 37,204,839

Sell Vol. 35,939,412

NVL: NVL has extended maturity of VND7,000 billion bonds by one year.

OIL & GAS

95,400

1D -0.93%

5D -0.42%

Buy Vol. 1,123,352

Sell Vol. 1,734,269

13,800

1D 1.47%

5D 1.10%

Buy Vol. 46,150,936

Sell Vol. 26,161,486

38,100

1D -0.13%

5D 1.60%

Buy Vol. 853,944

Sell Vol. 1,474,172

Petrolimex's management forecasts that the pressure on petroleum supply has eased, the demand for gasoline will peak in 2030 - 2035.

VINGROUP

52,200

1D -0.38%

5D -0.38%

Buy Vol. 3,080,829

Sell Vol. 4,184,700

55,400

1D -0.89%

5D 1.47%

Buy Vol. 1,941,849

Sell Vol. 2,423,693

27,300

1D -0.55%

5D 1.87%

Buy Vol. 7,111,063

Sell Vol. 10,252,097

VRE, VHM and VIC are all among the top 10 declining stocks that have the most impact on the VNIndex today, led by VHM.

FOOD & BEVERAGE

70,600

1D 0.14%

5D 6.49%

Buy Vol. 11,903,956

Sell Vol. 10,886,567

77,000

1D -0.90%

5D 1.18%

Buy Vol. 1,449,452

Sell Vol. 1,842,381

154,700

1D 0.19%

5D -0.19%

Buy Vol. 211,095

Sell Vol. 371,212

VNM: Vanguard Group - a large US asset management fund (managing USD7.7 trillion as of April 2023) bought 131,000 shares of VNM from October 31, 2022 to April 30, 2023.

OTHERS

45,150

1D -0.33%

5D 2.27%

Buy Vol. 1,534,525

Sell Vol. 1,909,805

94,900

1D -0.32%

5D 0.96%

Buy Vol. 845,757

Sell Vol. 1,111,532

87,000

1D -0.34%

5D 1.40%

Buy Vol. 1,402,309

Sell Vol. 2,116,839

43,900

1D -0.68%

5D 2.81%

Buy Vol. 6,856,611

Sell Vol. 7,633,527

19,300

1D -1.53%

5D -1.03%

Buy Vol. 5,412,005

Sell Vol. 6,049,835

26,550

1D -0.19%

5D 2.12%

Buy Vol. 30,492,118

Sell Vol. 34,656,797

26,600

1D 3.10%

5D 8.13%

Buy Vol. 51,794,467

Sell Vol. 52,724,812

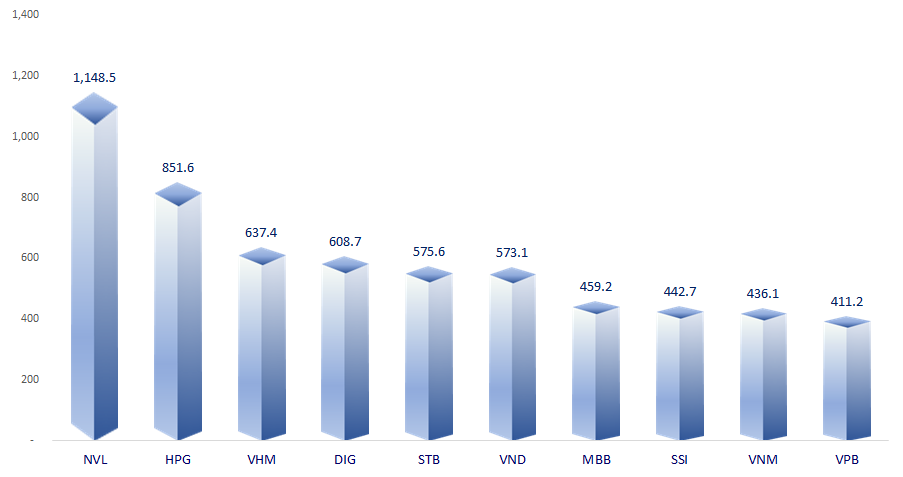

HPG: HPG capitalization hits 52-week all time high, when the stock closed at VND26,600 on June 28.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

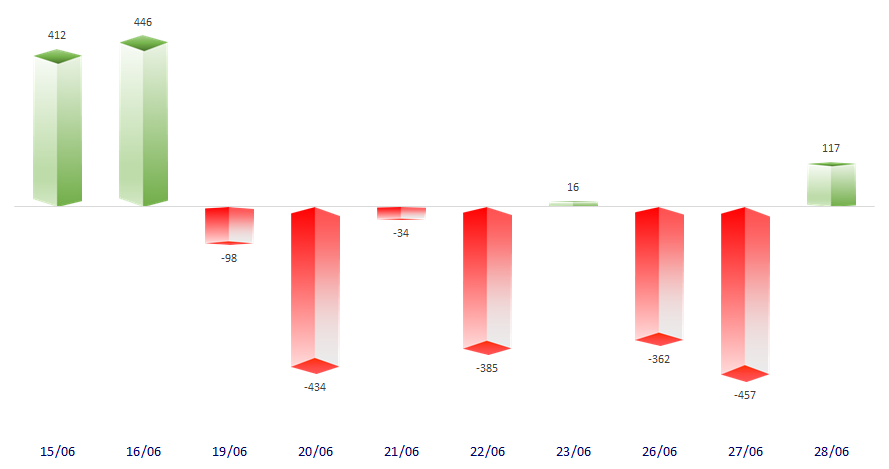

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

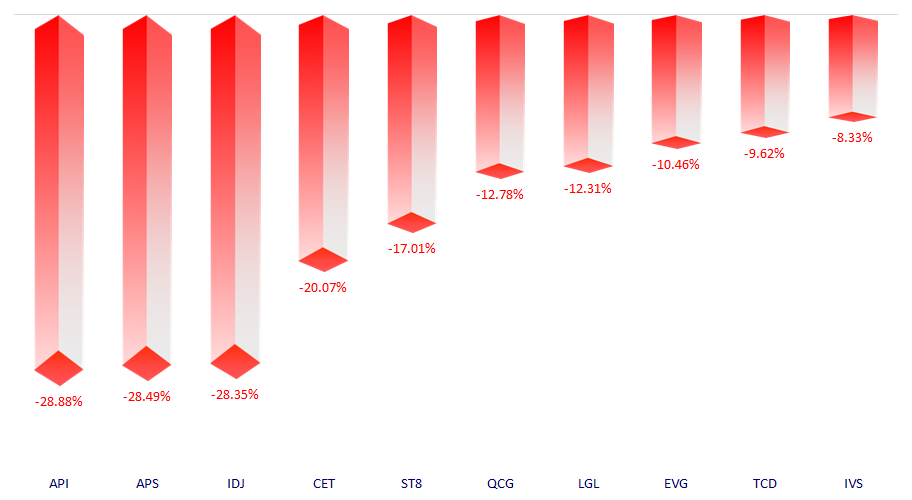

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.