Market brief 29/06/2023

VIETNAM STOCK MARKET

1,125.39

1D -1.14%

YTD 11.75%

1,125.29

1D -1.39%

YTD 11.95%

227.48

1D -1.20%

YTD 10.80%

85.63

1D -0.42%

YTD 19.51%

109.21

1D 0.00%

YTD 0.00%

19,840.32

1D -3.58%

YTD 130.27%

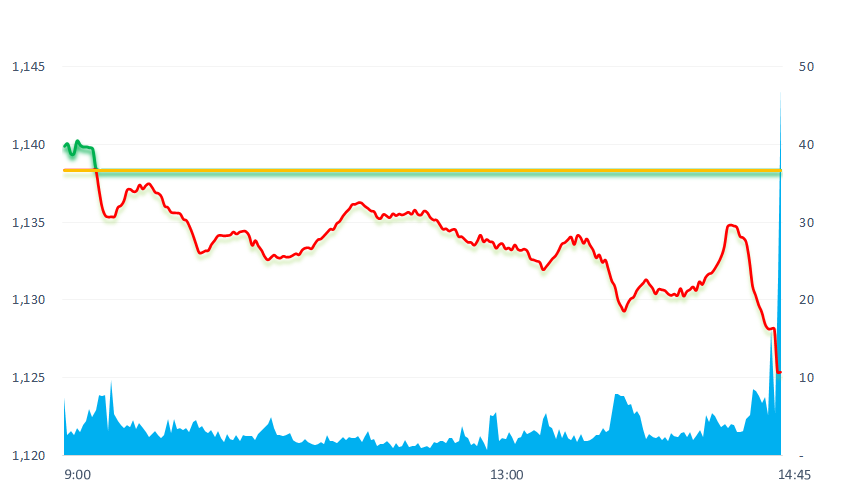

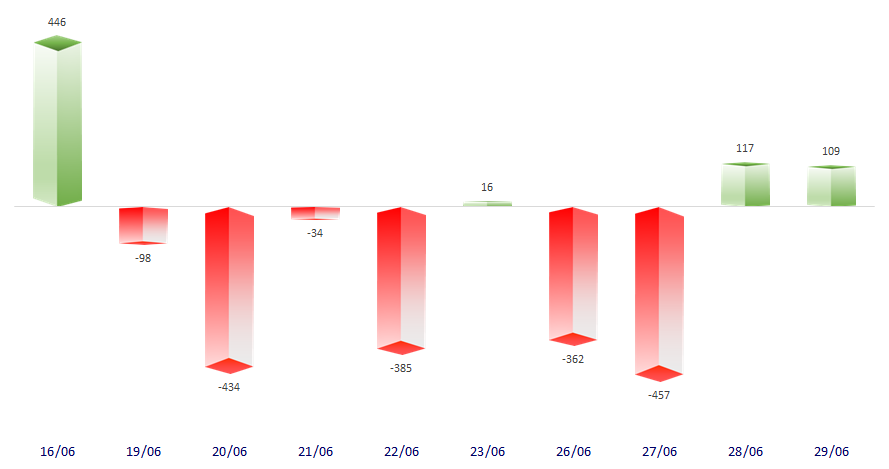

Today, the green only flickered in the early morning, then VNIndex turned down and closed at the lowest level of the session. Foreign investors had the second net buying session with VND109 billion, focusing mainly on HPG with nearly VND182 billion.

ETF & DERIVATIVES

19,300

1D -1.48%

YTD 11.37%

13,330

1D -1.19%

YTD 11.83%

13,800

1D -1.22%

YTD 10.58%

16,780

1D 0.54%

YTD 19.43%

17,710

1D -1.56%

YTD 23.41%

24,100

1D -0.41%

YTD 7.59%

14,600

1D -0.61%

YTD 12.74%

1,115

1D -1.54%

YTD 0.00%

1,113

1D -1.06%

YTD 0.00%

1,109

1D -1.45%

YTD 0.00%

1,102

1D -1.52%

YTD 0.00%

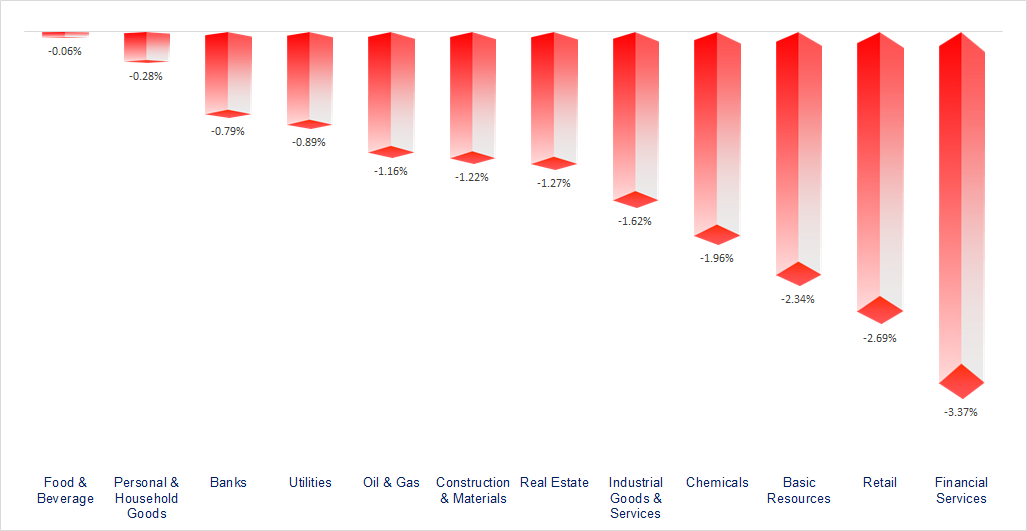

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

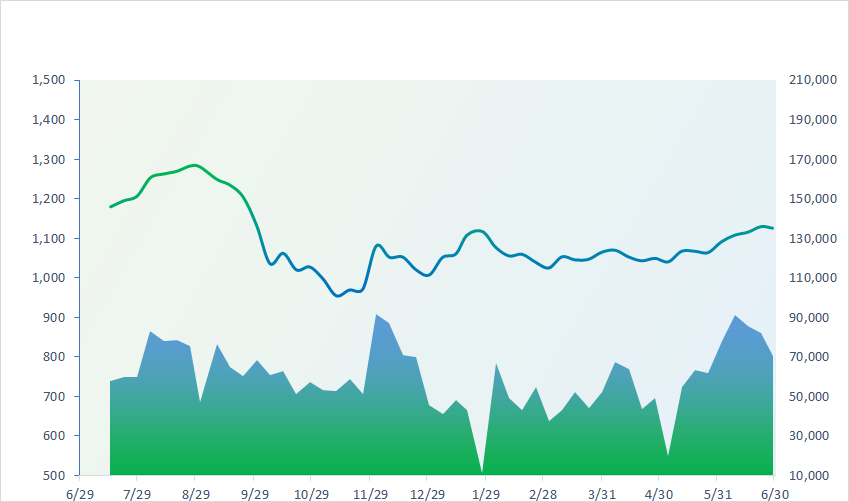

VNINDEX (12M)

GLOBAL MARKET

33,234.14

1D 0.12%

YTD 27.36%

3,182.38

1D -0.22%

YTD 3.01%

2,550.02

1D -0.55%

YTD 14.02%

18,934.36

1D -1.24%

YTD -4.28%

3,207.28

1D 0.00%

YTD -1.35%

1,479.57

1D 0.86%

YTD -11.42%

74.27

1D 0.22%

YTD -13.55%

1,916.80

1D -0.20%

YTD 4.96%

Asian stock markets were mixed on June 29, as central banks warned that they would continue to raise interest rates to control inflation.

VIETNAM ECONOMY

0.48%

1D (bps) -34

YTD (bps) -449

6.30%

YTD (bps) -110

2.15%

1D (bps) 1

YTD (bps) -264

2.52%

1D (bps) -3

YTD (bps) -238

23,785

1D (%) 0.20%

YTD (%) 0.11%

26,193

1D (%) -0.92%

YTD (%) 2.08%

3,327

1D (%) 0.12%

YTD (%) -4.53%

According to the latest report of the General Statistics Office, the GDP in the second quarter of 2023 was estimated to increase by 4.14% over the same period last year, only higher than the growth rate of 0.34% in the second quarter 2020.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- GDP in the second quarter of 2023 grew by 4.14%;

- Average CPI in the second quarter of 2023 increased by 2.41%;

- The added value of the whole industry in the first 6 months of 2023 is estimated to increase by 0.44%;

- The Fed and other central banks are more committed to inflation;

- Fed Chairman: Interest rates may raise in July and September;

- Asia's leading economies are closely following currency market developments.

VN30

BANK

101,900

1D 0.79%

5D 1.49%

Buy Vol. 1,053,482

Sell Vol. 1,183,622

44,500

1D -1.87%

5D 1.25%

Buy Vol. 2,387,874

Sell Vol. 3,698,055

29,900

1D -0.33%

5D 1.53%

Buy Vol. 9,061,481

Sell Vol. 10,028,029

32,650

1D -1.95%

5D 0.15%

Buy Vol. 6,635,738

Sell Vol. 6,915,725

19,900

1D -1.73%

5D 1.53%

Buy Vol. 31,436,654

Sell Vol. 42,496,511

20,300

1D -1.93%

5D 2.01%

Buy Vol. 23,502,822

Sell Vol. 24,731,138

18,350

1D -2.13%

5D -1.87%

Buy Vol. 4,209,439

Sell Vol. 5,619,231

18,100

1D -1.90%

5D -1.63%

Buy Vol. 6,443,601

Sell Vol. 8,781,681

29,550

1D -1.17%

5D -1.50%

Buy Vol. 37,350,744

Sell Vol. 32,796,379

19,750

1D -0.50%

5D 0.00%

Buy Vol. 9,482,557

Sell Vol. 10,852,176

21,900

1D -1.79%

5D 1.15%

Buy Vol. 11,417,940

Sell Vol. 16,674,642

GPBank simultaneously reduced 0.25 percentage points deposit interest rates for terms of 6 months or more for online deposit. Previously, GPBank was the bank with the highest deposit interest rate in the system; and is one of two rare banks that still apply interest rates of 8% or more along with Saigonbank. After this adjustment of GPBank, there is only Saigonbank that lists the interest rate of 8%.

REAL ESTATE

15,000

1D -3.85%

5D 2.39%

Buy Vol. 77,233,359

Sell Vol. 89,105,613

79,200

1D -1.00%

5D -2.58%

Buy Vol. 451,592

Sell Vol. 574,679

16,500

1D -2.94%

5D -4.90%

Buy Vol. 18,770,876

Sell Vol. 20,794,882

PDR: PDR has bought back VND38.1 billion of PDRH213002 bonds before maturity. Accordingly, the remaining volume of bonds after redemption is VND 71.9 billion.

OIL & GAS

94,600

1D -0.84%

5D -1.05%

Buy Vol. 1,201,983

Sell Vol. 1,330,927

13,550

1D -1.81%

5D -1.45%

Buy Vol. 27,832,746

Sell Vol. 18,212,682

37,500

1D -1.57%

5D -0.40%

Buy Vol. 1,166,833

Sell Vol. 1,614,657

PLX: At the last AGM, PLX set a plan to reduce the 2022 dividend rate to 7%, compared with the plan of 12%. The dividend rate in 2023 is expected to be 10%.

VINGROUP

51,800

1D -0.77%

5D -1.15%

Buy Vol. 2,510,441

Sell Vol. 3,282,761

55,000

1D -0.72%

5D -1.26%

Buy Vol. 1,641,523

Sell Vol. 1,935,511

27,000

1D -1.10%

5D 0.00%

Buy Vol. 8,993,073

Sell Vol. 12,229,120

VRE: VRE focuses on optimizing the operation of 83 shopping centers instead of opening new shopping centers in 2023, so it has adjusted the plan for the number new opening from 6 to 2.

FOOD & BEVERAGE

71,900

1D 1.84%

5D 7.47%

Buy Vol. 18,365,431

Sell Vol. 13,245,452

75,400

1D -2.08%

5D -1.18%

Buy Vol. 1,888,339

Sell Vol. 2,126,219

154,000

1D -0.45%

5D -0.52%

Buy Vol. 265,288

Sell Vol. 397,008

VNM: If only for order matching, Vinamilk is the most net sold stock with the accumulated value since the beginning of the year up to more than VND2,500 billion.

OTHERS

44,300

1D -1.88%

5D 0.34%

Buy Vol. 1,707,473

Sell Vol. 2,087,626

94,100

1D -0.84%

5D -0.11%

Buy Vol. 1,009,759

Sell Vol. 1,135,715

86,500

1D -0.57%

5D 1.17%

Buy Vol. 1,080,480

Sell Vol. 1,211,896

42,700

1D -2.73%

5D -0.81%

Buy Vol. 5,130,381

Sell Vol. 6,718,669

19,050

1D -1.30%

5D -1.55%

Buy Vol. 6,523,425

Sell Vol. 5,320,958

25,450

1D -4.14%

5D -2.49%

Buy Vol. 30,941,847

Sell Vol. 37,042,566

25,800

1D -3.01%

5D 3.82%

Buy Vol. 60,228,330

Sell Vol. 68,417,070

FPT: Most of the markets recorded good growth, like the US (in the first quarter, it increased by 18% compared to the same period last year and increased by 14% in the first 5 months of the year). In Asia-Pacific, in the first quarter, FPT grew by 65.7% and by 50.4% in the first 5 months of the year compared to last year. The European market grew 10% in Q1 and up 14% in 5 months.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

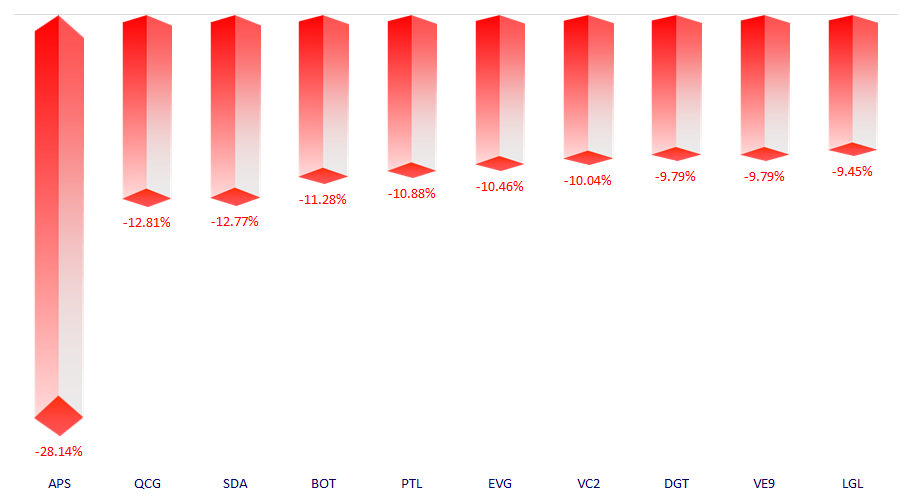

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.