Market brief 30/06/2023

VIETNAM STOCK MARKET

1,120.18

1D -0.46%

YTD 11.23%

1,123.13

1D -0.19%

YTD 11.73%

227.32

1D -0.07%

YTD 10.72%

86.00

1D 0.43%

YTD 20.03%

414.11

1D 0.00%

YTD 0.00%

14,421.95

1D -27.31%

YTD 67.39%

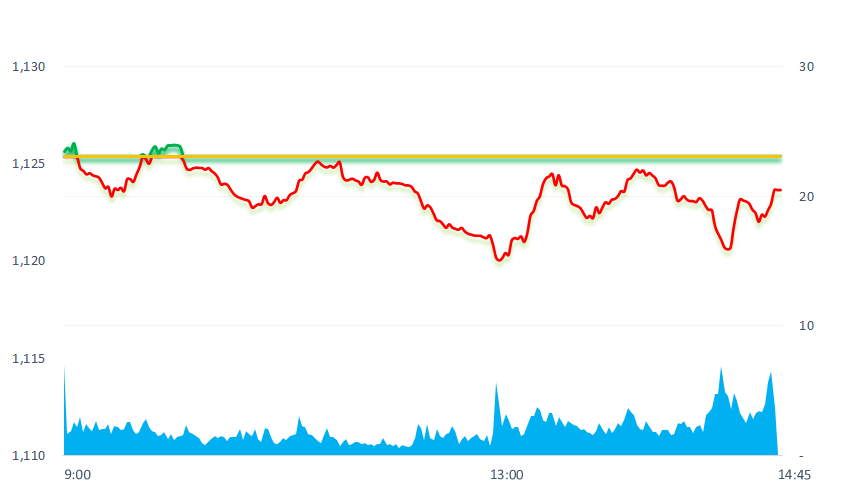

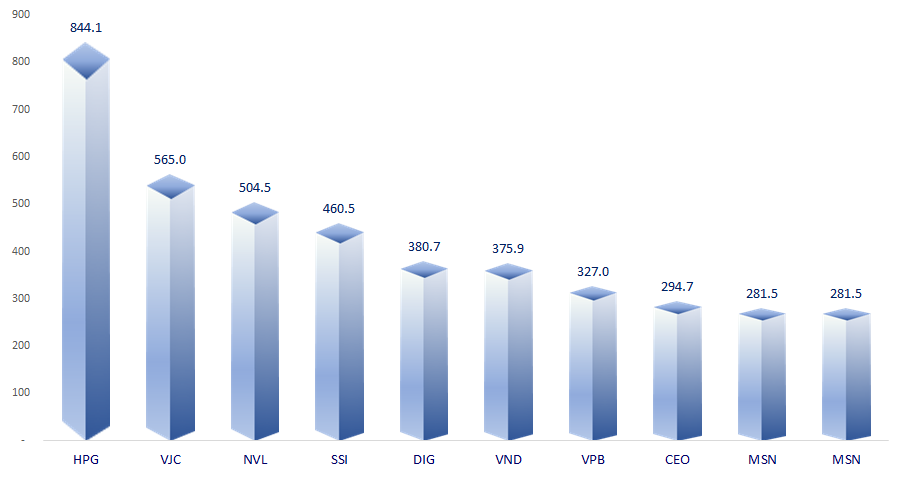

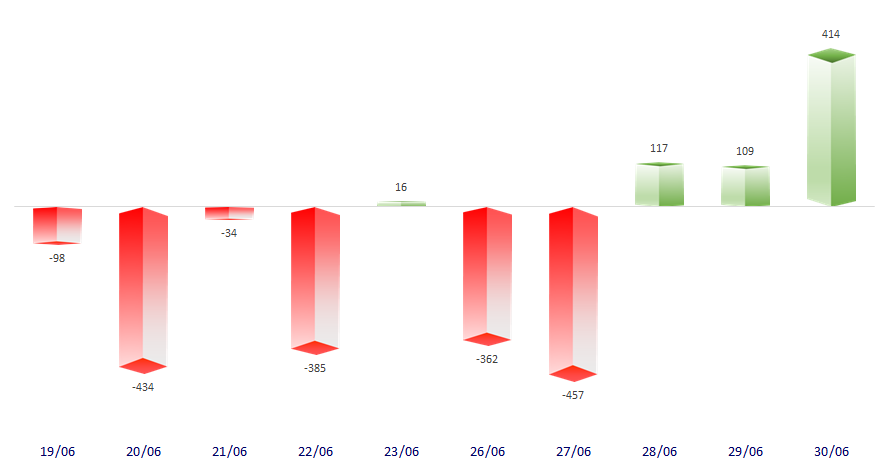

Today, VNIndex only had a few moments of gaining, most of trading time were in the red and closed at the lowest level of the session. Foreign investors had the 3rd net buying session in a row with VND414 billion, continuing to focus mainly on HPG with nearly VND164 billion.

ETF & DERIVATIVES

19,350

1D 0.26%

YTD 11.66%

13,330

1D 0.00%

YTD 11.83%

13,910

1D 0.80%

YTD 11.46%

16,800

1D 0.12%

YTD 19.57%

17,540

1D -0.96%

YTD 22.23%

24,090

1D -0.04%

YTD 7.54%

14,580

1D -0.14%

YTD 12.59%

1,117

1D 0.21%

YTD 0.00%

1,114

1D 0.07%

YTD 0.00%

1,111

1D 0.22%

YTD 0.00%

1,102

1D -0.01%

YTD 0.00%

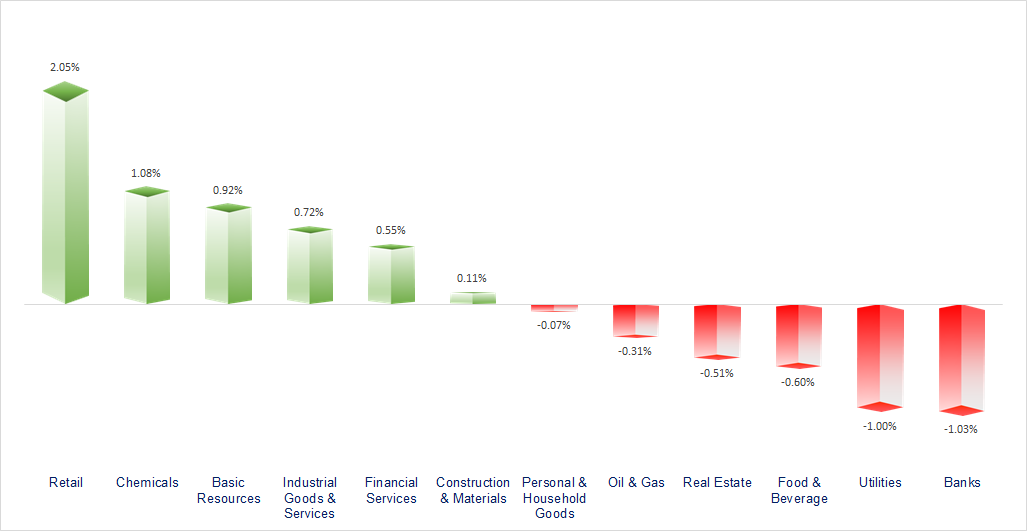

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

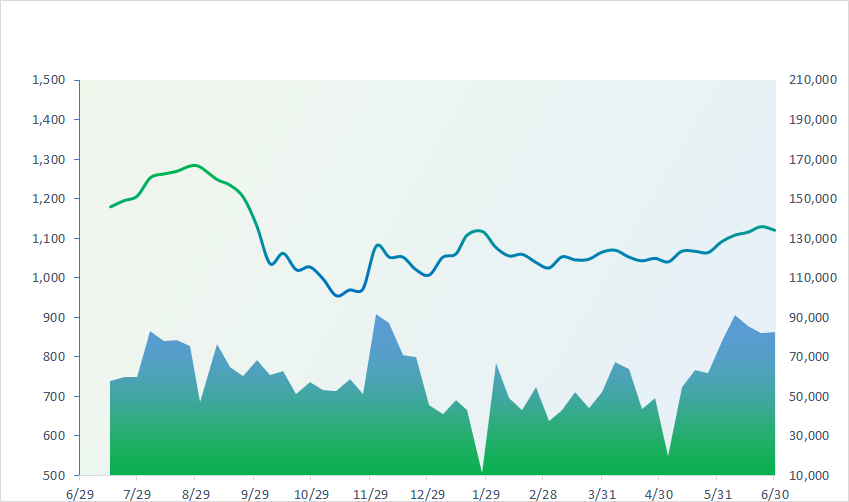

VNINDEX (12M)

GLOBAL MARKET

33,189.04

1D -0.14%

YTD 27.19%

3,202.06

1D 0.62%

YTD 3.65%

2,564.28

1D 0.56%

YTD 14.66%

18,916.43

1D -0.09%

YTD -4.37%

3,205.91

1D -0.04%

YTD -1.40%

1,503.10

1D 1.59%

YTD -10.01%

74.50

1D 0.12%

YTD -13.28%

1,913.70

1D -0.12%

YTD 4.79%

Asian stock markets were mixed on June 29, as central banks warned that they would continue to raise interest rates to control inflation.

VIETNAM ECONOMY

0.48%

YTD (bps) -449

6.30%

YTD (bps) -110

2.14%

1D (bps) -1

YTD (bps) -265

2.59%

1D (bps) 7

YTD (bps) -231

23,800

1D (%) 0.23%

YTD (%) 0.17%

26,019

1D (%) -1.30%

YTD (%) 1.40%

3,317

1D (%) -0.12%

YTD (%) -4.82%

According to the General Statistics Office report, as of June 20, 2023, the total means of payment increased by 2.53% compared to the end of 2022 (the same period last year up 3.3%); capital mobilization of credit institutions increased by 3.26% (the same period increased by 3.97%); credit growth reached 3.13% (the same period increased by 8.51%).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- As of June 20, credit growth reached 3.13%;

- Total state budget revenue in the first 6 months of 2023 reached VND875.8 trillion, equaling 54% of the year estimate;

- Total FDI into Vietnam in 6 months reached USD13.43 billion, down 4.3% over the same period last year;

- EU amends the application of safeguard measures to some imported steels;

- ECB: Profits in the Eurozone continue to put pressure on inflation;

- Japan's yen fell, heading for a more than 8% drop.

VN30

BANK

100,000

1D -1.86%

5D 0.10%

Buy Vol. 889,252

Sell Vol. 1,076,999

43,350

1D -2.58%

5D -2.14%

Buy Vol. 1,649,854

Sell Vol. 1,979,364

29,500

1D -1.34%

5D 0.85%

Buy Vol. 11,300,030

Sell Vol. 11,271,975

32,350

1D -0.92%

5D -1.67%

Buy Vol. 4,534,919

Sell Vol. 4,741,654

19,850

1D -0.25%

5D -1.73%

Buy Vol. 24,655,572

Sell Vol. 27,050,840

20,200

1D -0.49%

5D 0.00%

Buy Vol. 19,154,562

Sell Vol. 14,520,217

18,600

1D 1.36%

5D -0.27%

Buy Vol. 5,384,650

Sell Vol. 5,832,096

18,000

1D -0.55%

5D -2.70%

Buy Vol. 4,602,437

Sell Vol. 5,791,368

29,800

1D 0.85%

5D -1.65%

Buy Vol. 25,535,898

Sell Vol. 18,274,598

19,650

1D -0.51%

5D -1.50%

Buy Vol. 6,008,288

Sell Vol. 6,412,523

22,050

1D 0.68%

5D 0.68%

Buy Vol. 10,163,307

Sell Vol. 11,617,597

HDB: HDBank announced that the last registration date to close the list of shareholders to receive the share dividend in 2022 at the rate of 15% is July 20, 2023, shortly after completing the payment of cash dividend at the rate of 10 %. Charter capital of HDBank will increase from VND25,303 billion to over VND29,076 billion. The bank plans to spend most of the additional capital to supplement capital for medium and long-term loans.

REAL ESTATE

14,850

1D -1.00%

5D 2.41%

Buy Vol. 55,333,384

Sell Vol. 65,041,084

79,200

1D 0.00%

5D -1.74%

Buy Vol. 577,665

Sell Vol. 686,478

16,800

1D 1.82%

5D -2.04%

Buy Vol. 27,899,779

Sell Vol. 35,148,469

BCM: In 2023, BCM sets a total revenue of VND9,460 billion, up 19%, Profit after tax reached VND2,263 billion, up 32% compared to 2022. Expected dividend payment in 2023 is 9%.

OIL & GAS

93,000

1D -1.69%

5D -2.31%

Buy Vol. 1,115,860

Sell Vol. 1,516,864

13,400

1D -1.11%

5D -2.19%

Buy Vol. 15,206,735

Sell Vol. 16,250,528

37,350

1D -0.40%

5D -0.40%

Buy Vol. 918,964

Sell Vol. 1,101,548

Oil prices rose slightly on Thursday (June 29) thanks to a sharper-than-expected drop in US crude inventories. Ending Thursday's session, the Brent oil contract rose 0.4% to USD74.34 per barrel

VINGROUP

51,000

1D -1.54%

5D -1.92%

Buy Vol. 2,639,310

Sell Vol. 4,089,463

55,000

1D 0.00%

5D -1.79%

Buy Vol. 2,342,619

Sell Vol. 2,224,140

26,800

1D -0.74%

5D -0.19%

Buy Vol. 4,624,404

Sell Vol. 7,472,156

VHM: Vinhomes consortium won the bid for an urban area project along Cam Ranh Bay with a scale of 1,254ha, total investment cost is VND85,293 billion.

FOOD & BEVERAGE

71,000

1D -1.25%

5D 2.75%

Buy Vol. 5,955,218

Sell Vol. 8,819,907

75,200

1D -0.27%

5D -2.72%

Buy Vol. 1,486,739

Sell Vol. 1,827,689

153,600

1D -0.26%

5D -1.85%

Buy Vol. 265,603

Sell Vol. 391,535

MSN: MSN continues to be honored in the TOP 50 Corporate Sustainability Awards in 2023 in both categories: Sustainable Resource Management, Outstanding Risk Management Platform.

OTHERS

44,100

1D -0.45%

5D -2.22%

Buy Vol. 1,559,880

Sell Vol. 1,296,541

94,300

1D 0.21%

5D -0.42%

Buy Vol. 916,834

Sell Vol. 1,121,190

86,000

1D -0.58%

5D 1.06%

Buy Vol. 1,165,722

Sell Vol. 1,363,284

43,300

1D 1.41%

5D 0.93%

Buy Vol. 6,828,745

Sell Vol. 7,866,958

19,400

1D 1.84%

5D 2.11%

Buy Vol. 7,477,275

Sell Vol. 6,004,739

25,800

1D 1.38%

5D -0.77%

Buy Vol. 30,056,476

Sell Vol. 29,089,308

26,150

1D 1.36%

5D 2.95%

Buy Vol. 44,886,473

Sell Vol. 37,356,164

VJC: On June 28, Vietjet successfully raised VND300 billion after issuing 3,000 bonds code VJCH2328003. The bond lot has a term of 5 years, the par value of each bond is VND100 million/bond. The interest rate of VJCH2328003 is 12%/year.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

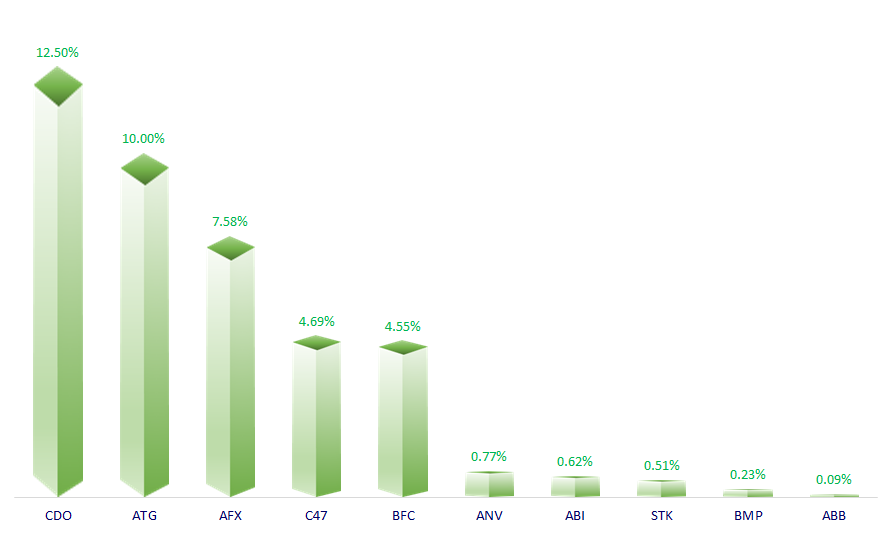

TOP INCREASES 3 CONSECUTIVE SESSIONS

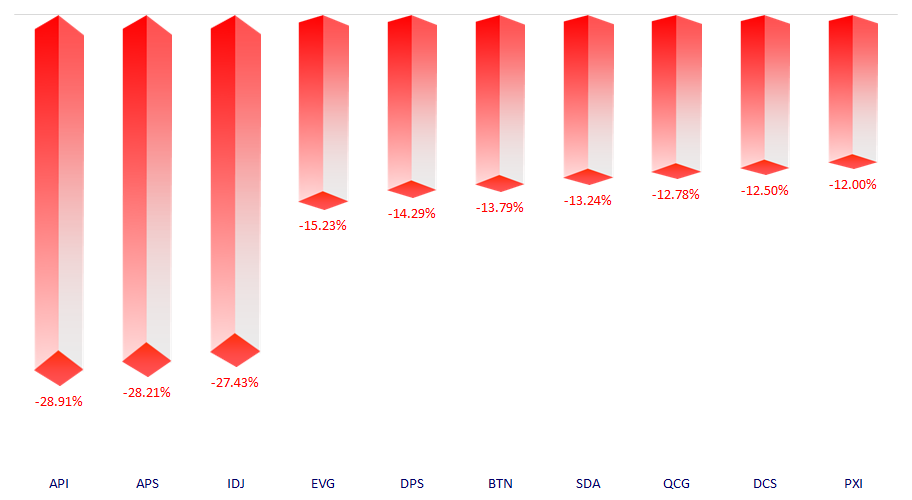

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.