Market brief 07/07/2023

VIETNAM STOCK MARKET

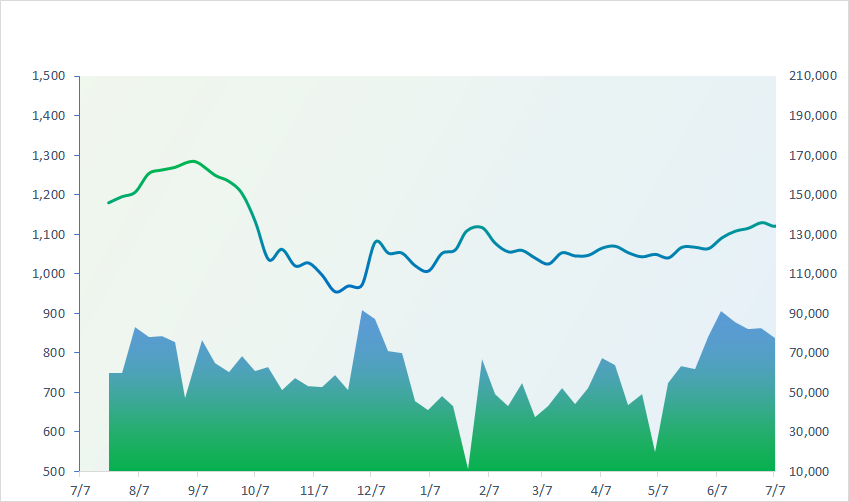

1,138.07

1D 1.05%

YTD 13.01%

1,129.43

1D 0.89%

YTD 12.36%

225.82

1D 0.33%

YTD 9.99%

84.66

1D -0.51%

YTD 18.16%

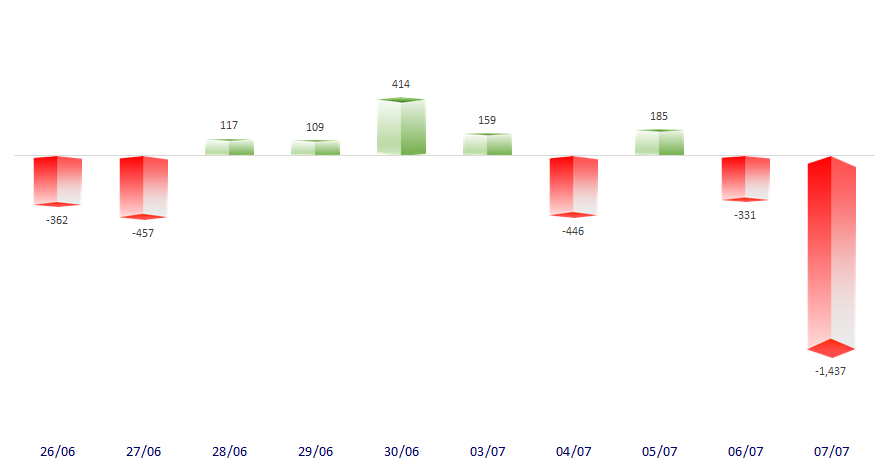

-1,436.67

1D 0.00%

YTD 0.00%

18,708.98

1D -11.70%

YTD 117.14%

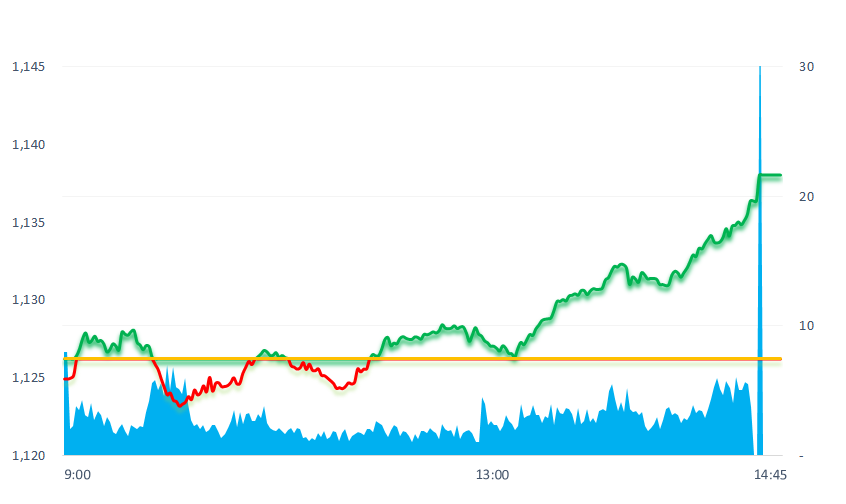

Today, the market struggled during the morning session and the situation only really improved in the afternoon session. The buying force returned and surpassed the selling force at the beginning of the session, helping VNIndex to close at the highest price.

ETF & DERIVATIVES

19,410

1D 0.05%

YTD 12.00%

13,390

1D 0.90%

YTD 12.33%

13,880

1D 0.80%

YTD 11.22%

16,880

1D 1.44%

YTD 20.14%

17,610

1D 0.40%

YTD 22.72%

23,950

1D 1.27%

YTD 6.92%

14,570

1D 0.21%

YTD 12.51%

1,125

1D 0.81%

YTD 0.00%

1,122

1D 0.81%

YTD 0.00%

1,116

1D 0.50%

YTD 0.00%

1,108

1D 0.52%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

32,388.42

1D -1.17%

YTD 24.12%

3,196.61

1D -0.28%

YTD 3.47%

2,526.71

1D -1.16%

YTD 12.98%

18,365.70

1D -0.90%

YTD -7.16%

3,139.47

1D -0.35%

YTD -3.44%

1,490.51

1D 0.00%

YTD -10.77%

76.87

1D 0.42%

YTD -10.52%

1,922.45

1D 0.31%

YTD 5.27%

Asian stock markets fell in the afternoon session of 7/7 after a series of data reinforced expectations that the US Federal Reserve (Fed) will continue to raise interest rates to curb inflation. Investors are also closely following US Treasury Secretary Janet Yellen's four-day visit to China to ease strained relations between the economic powers.

VIETNAM ECONOMY

0.48%

1D (bps) -13

YTD (bps) -449

6.30%

YTD (bps) -110

2.12%

1D (bps) -27

YTD (bps) -267

2.69%

1D (bps) 10

YTD (bps) -221

23,850

1D (%) -0.31%

YTD (%) 0.38%

26,189

1D (%) -0.27%

YTD (%) 2.07%

3,337

1D (%) -0.27%

YTD (%) -4.25%

In the first 6 months of the year, total state budget revenue was estimated at VND875,800 billion, total state budget expenditure was estimated at VND804,600 billion; estimated state budget surplus VND71,200 billion.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Prime Minister requested the State Bank and banks to continue researching to lower lending rates;

- In the first 6 months of 2023, the state budget has a surplus of VND71,200 billion;

- 48 localities have increased industrial production index;

- Riots threaten the French economy;

- China leads the way in signing long-term LNG deals;

- More efforts to stabilize US-China relations.

VN30

BANK

105,000

1D 4.27%

5D 5.00%

Buy Vol. 1,829,621

Sell Vol. 1,412,616

44,300

1D 0.80%

5D 2.19%

Buy Vol. 1,871,359

Sell Vol. 1,878,434

29,600

1D 0.85%

5D 0.34%

Buy Vol. 7,461,181

Sell Vol. 6,356,454

31,550

1D 0.00%

5D -2.47%

Buy Vol. 6,598,865

Sell Vol. 5,617,291

19,850

1D 1.53%

5D 0.00%

Buy Vol. 20,327,100

Sell Vol. 17,439,318

20,450

1D 1.24%

5D 1.24%

Buy Vol. 23,580,792

Sell Vol. 17,564,396

18,350

1D 0.82%

5D -1.34%

Buy Vol. 4,291,888

Sell Vol. 3,468,747

18,050

1D -0.82%

5D 0.28%

Buy Vol. 10,664,626

Sell Vol. 10,667,388

29,600

1D 1.72%

5D -0.67%

Buy Vol. 25,431,394

Sell Vol. 21,881,168

19,800

1D 1.02%

5D 0.76%

Buy Vol. 5,074,130

Sell Vol. 5,706,975

21,700

1D 0.00%

5D -1.59%

Buy Vol. 13,624,591

Sell Vol. 11,938,551

Capital mobilization of the whole credit institution system is expected to increase by an average of 3.2% in the third quarter of 2023 and 10.6% in 2023, slightly revised up from the expectation of 9.2% in the previous survey period. Credit balance of the banking system is expected to increase by 4.4% in the third quarter of 2023 and increase by 12.5% in 2023, revised down by 0.6 percentage points compared to the forecast of 13.7% in the previous survey.

REAL ESTATE

14,500

1D 0.69%

5D -2.36%

Buy Vol. 40,264,713

Sell Vol. 39,190,937

80,100

1D 0.38%

5D 1.14%

Buy Vol. 408,064

Sell Vol. 413,396

17,300

1D 2.37%

5D 2.98%

Buy Vol. 19,368,028

Sell Vol. 18,160,303

NVL: proposed Lam Dong province to allow research, survey, detailed planning and investment in the construction of an international multi-functional resort with a total area of 396ha

OIL & GAS

96,000

1D 0.84%

5D 3.23%

Buy Vol. 1,128,959

Sell Vol. 1,485,156

13,100

1D -1.13%

5D -2.24%

Buy Vol. 37,445,373

Sell Vol. 22,332,139

40,300

1D 0.00%

5D 7.90%

Buy Vol. 2,423,898

Sell Vol. 3,023,177

GAS: 6M revenue is estimated at VND45,117 billion, ~ 117% of the plan. Profit before tax is estimated at VND7,542 billion and profit after tax is estimated at VND6,035 billion, ~ 183% of the plan.

VINGROUP

50,100

1D -0.60%

5D -1.76%

Buy Vol. 4,594,603

Sell Vol. 4,724,289

54,000

1D -0.92%

5D -1.82%

Buy Vol. 1,666,830

Sell Vol. 2,080,401

27,000

1D 0.19%

5D 0.75%

Buy Vol. 7,348,132

Sell Vol. 6,522,671

VIC: On July 7, held the exhibition event "VinFast - For a green future". VinFast introduces the VF6, VF7 and VF3 models and also introduced a shop selling souvenirs and accessories.

FOOD & BEVERAGE

70,900

1D 0.57%

5D -0.14%

Buy Vol. 13,270,084

Sell Vol. 10,427,421

75,200

1D -1.05%

5D 0.00%

Buy Vol. 2,046,689

Sell Vol. 2,189,063

151,000

1D -1.56%

5D -1.69%

Buy Vol. 304,685

Sell Vol. 488,434

VNM: Q2 revenue is expected to reach VND15.2 trillion, up 1.6% QoQ. Profit after tax was estimated at VND2.22 trillion, up 5.6% QoQ and up 16.5% compared to the previous quarter.

OTHERS

45,250

1D 0.56%

5D 2.61%

Buy Vol. 1,430,143

Sell Vol. 1,480,530

93,800

1D -0.53%

5D -0.53%

Buy Vol. 1,063,640

Sell Vol. 1,124,420

75,300

1D 0.94%

5D 1.86%

Buy Vol. 1,445,104

Sell Vol. 1,485,813

45,500

1D 5.32%

5D 5.08%

Buy Vol. 11,232,724

Sell Vol. 10,651,537

21,250

1D 2.66%

5D 9.54%

Buy Vol. 7,235,658

Sell Vol. 7,140,736

26,450

1D 0.57%

5D 2.52%

Buy Vol. 32,315,109

Sell Vol. 28,121,734

27,450

1D 1.67%

5D 4.97%

Buy Vol. 39,881,088

Sell Vol. 38,622,275

MWG: MWG is starting to suffer the consequences of a war of its own making. The company has not announced profit for 3 months, while analysts believe that MWG's profit will definitely be "corrosted" significantly by the price war when the first time sales of meat, fish, vegetables... are higher than selling phones.

Market by numbers

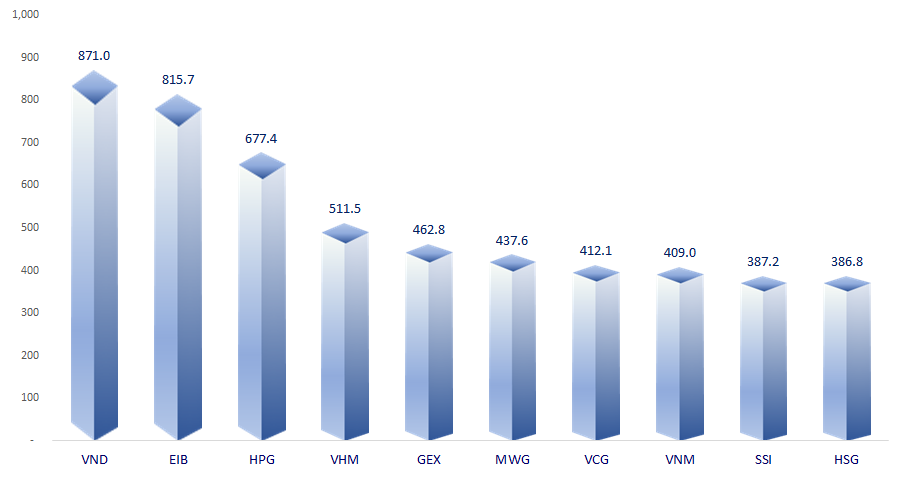

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

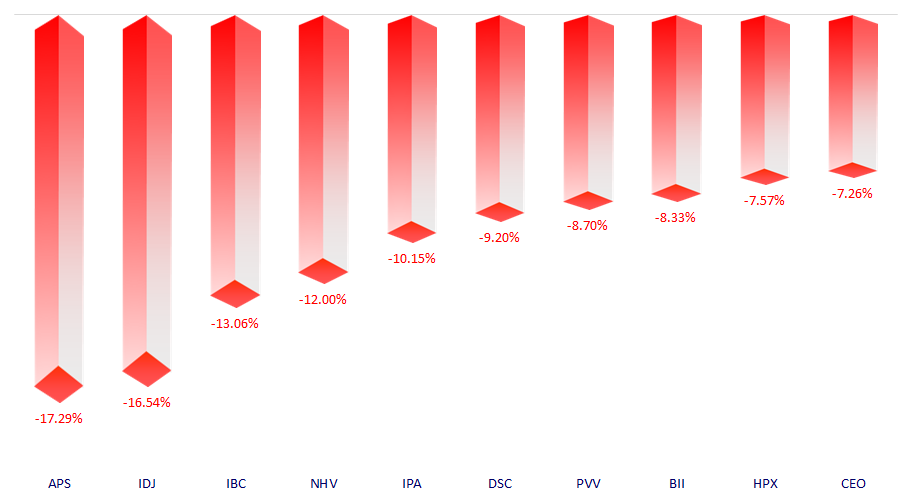

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.