Market brief 11/07/2023

VIETNAM STOCK MARKET

1,151.77

1D 0.24%

YTD 14.37%

1,146.67

1D 0.31%

YTD 14.07%

229.22

1D 0.37%

YTD 11.65%

85.82

1D 0.69%

YTD 19.78%

-79.15

1D 0.00%

YTD 0.00%

25,073.22

1D 14.41%

YTD 191.01%

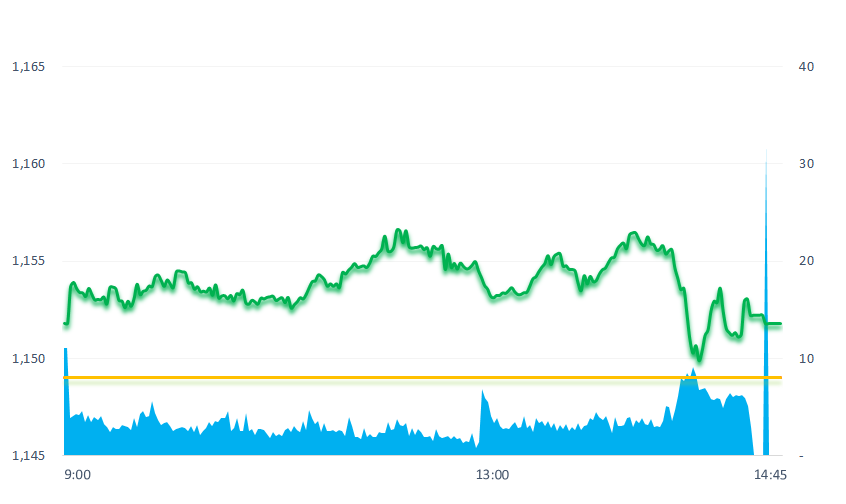

The stock market was in the green right from the beginning of the session. However, near the end of the session, there was a time when VNIndex was pulled to near reference but the buying power quickly returned to help the market maintain its gaining momentum.

ETF & DERIVATIVES

19,600

1D 0.31%

YTD 13.10%

13,580

1D 0.37%

YTD 13.93%

14,050

1D 0.43%

YTD 12.58%

17,060

1D 1.79%

YTD 21.42%

18,110

1D 0.95%

YTD 26.20%

24,470

1D 0.74%

YTD 9.24%

14,840

1D 0.47%

YTD 14.59%

1,138

1D 0.13%

YTD 0.00%

1,136

1D 0.22%

YTD 0.00%

1,133

1D 0.27%

YTD 0.00%

1,123

1D 0.40%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

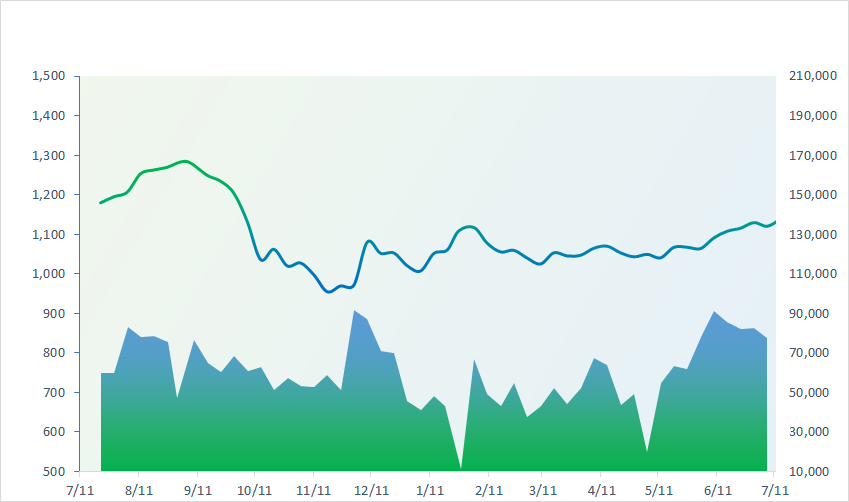

VNINDEX (12M)

GLOBAL MARKET

32,203.57

1D 0.04%

YTD 23.41%

3,221.37

1D 0.55%

YTD 4.28%

2,562.49

1D 1.66%

YTD 14.58%

18,659.83

1D 0.97%

YTD -5.67%

3,163.84

1D 0.46%

YTD -2.69%

1,496.96

1D 0.00%

YTD -10.38%

78.06

1D 0.15%

YTD -9.14%

1,940.65

1D 0.40%

YTD 6.27%

In the afternoon of July 11, Asian stock markets mostly gained, due to the news of China's measures to support the real estate sector and the government's commitment to further stimulate the economy.

VIETNAM ECONOMY

0.37%

1D (bps) -4

YTD (bps) -460

6.30%

YTD (bps) -110

2.15%

1D (bps) 1

YTD (bps) -264

2.68%

1D (bps) -5

YTD (bps) -222

23,910

1D (%) 0.20%

YTD (%) 0.63%

26,522

1D (%) 0.61%

YTD (%) 3.36%

3,361

1D (%) 0.69%

YTD (%) -3.56%

The Government also requested the State Bank to continue implementing synchronous and drastic solutions to reduce interest rates, especially lending rates (striving to reduce at least by 1.5 - 2%).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Government required to continue reducing lending interest rates by at least 1.5-2%;

- Focus on disbursing public investment;

- SBV loosens credit room, it is expected that more than VND1 million billion will be pumped into the economy until the end of the year;

- Japanese investors bought more than USD100 billion of foreign bonds;

- American companies pay 'huge' taxes to Russia;

- China launched new measures to boost the stock market.

VN30

BANK

103,000

1D 0.29%

5D 3.00%

Buy Vol. 1,855,481

Sell Vol. 1,435,550

46,550

1D -0.85%

5D 5.80%

Buy Vol. 4,169,576

Sell Vol. 5,151,659

30,300

1D 2.02%

5D 2.89%

Buy Vol. 27,460,088

Sell Vol. 24,565,297

31,950

1D -0.16%

5D -0.16%

Buy Vol. 10,419,640

Sell Vol. 9,310,524

19,900

1D -0.75%

5D 0.25%

Buy Vol. 30,910,746

Sell Vol. 42,722,607

21,200

1D 2.17%

5D 4.18%

Buy Vol. 32,185,419

Sell Vol. 28,243,637

18,600

1D 1.36%

5D 0.27%

Buy Vol. 5,688,523

Sell Vol. 5,559,056

18,300

1D 0.55%

5D 0.83%

Buy Vol. 16,918,542

Sell Vol. 18,979,061

30,000

1D 0.50%

5D 0.50%

Buy Vol. 36,557,214

Sell Vol. 38,638,175

20,300

1D 0.00%

5D 3.31%

Buy Vol. 8,450,622

Sell Vol. 12,088,562

22,000

1D 0.23%

5D 0.00%

Buy Vol. 14,036,448

Sell Vol. 22,452,927

Statistics on the listed interest rates show that only 14 banks have the highest deposit interest rates of 7.5%/year or more. Thus, most banks in the system have brought the highest deposit rates below this level. In particular, the highest interest rates at large private banks mainly fluctuated in the range of 7-7.3%/year, such as SHB (7.2%), MB (7.1%), Techcombank (7. 1%), VPBank (7.1%). Notably, some private banks put the highest deposit interest rates below 7%/year such as SCB (6.95%), ACB (6.9%), TPBank (6.7%).

REAL ESTATE

14,700

1D -1.34%

5D -1.01%

Buy Vol. 35,874,639

Sell Vol. 57,108,520

81,000

1D 0.62%

5D 0.25%

Buy Vol. 609,196

Sell Vol. 571,074

18,400

1D -0.54%

5D 8.24%

Buy Vol. 28,267,970

Sell Vol. 27,838,103

NVL: Novaland reached an agreement to extend 3 bond lots (total value of VND2,750 billion; extension from 12-24 months)

OIL & GAS

97,200

1D -0.31%

5D 2.21%

Buy Vol. 1,129,339

Sell Vol. 1,503,150

13,250

1D 0.38%

5D -1.12%

Buy Vol. 20,318,410

Sell Vol. 18,050,327

41,250

1D -1.32%

5D 3.51%

Buy Vol. 2,281,999

Sell Vol. 3,038,054

From 3pm on July 11, gasoline RON 95-III increased by VND70, while E5 RON 92 decreased by VND60. Oil products (diesel, kerosene and mazut) increased by VND400 - VND600 per liter, kg.

VINGROUP

50,800

1D -0.20%

5D -0.97%

Buy Vol. 3,586,503

Sell Vol. 4,115,222

53,900

1D 0.19%

5D -4.60%

Buy Vol. 3,887,028

Sell Vol. 3,411,561

27,300

1D 1.30%

5D 0.37%

Buy Vol. 14,720,664

Sell Vol. 15,622,932

VHM: The Government Office sent a quick document requesting that 4 ministries join the meeting to remove obstacles for the great project Vinhomes Dan Phuong

FOOD & BEVERAGE

72,800

1D 0.97%

5D 3.12%

Buy Vol. 10,220,058

Sell Vol. 10,741,488

79,200

1D 1.67%

5D 4.76%

Buy Vol. 5,354,778

Sell Vol. 4,529,416

150,000

1D -0.20%

5D -2.34%

Buy Vol. 435,062

Sell Vol. 336,613

VNM: Ong Tho condensed milk of Vinamilk with more than 1 million products produced every day, is now present in 35 countries.

OTHERS

45,500

1D -0.22%

5D 1.00%

Buy Vol. 2,486,541

Sell Vol. 2,526,970

94,200

1D 0.00%

5D 0.11%

Buy Vol. 1,133,769

Sell Vol. 1,282,266

75,000

1D -0.40%

5D 0.29%

Buy Vol. 1,837,349

Sell Vol. 1,729,456

48,800

1D 2.20%

5D 12.83%

Buy Vol. 12,892,010

Sell Vol. 12,188,666

21,500

1D 1.18%

5D 5.91%

Buy Vol. 5,759,724

Sell Vol. 6,002,263

28,050

1D 2.00%

5D 5.85%

Buy Vol. 51,666,221

Sell Vol. 42,661,685

27,300

1D -1.44%

5D 4.00%

Buy Vol. 37,778,654

Sell Vol. 43,402,859

HPG: Through the first half of the year, HPG's construction steel sales volume reached more than 1.6 million tons, down 30%. In addition to finished steel, HPG has also supplied 36,000 tons of billet to other steel mills in Vietnam.

Market by numbers

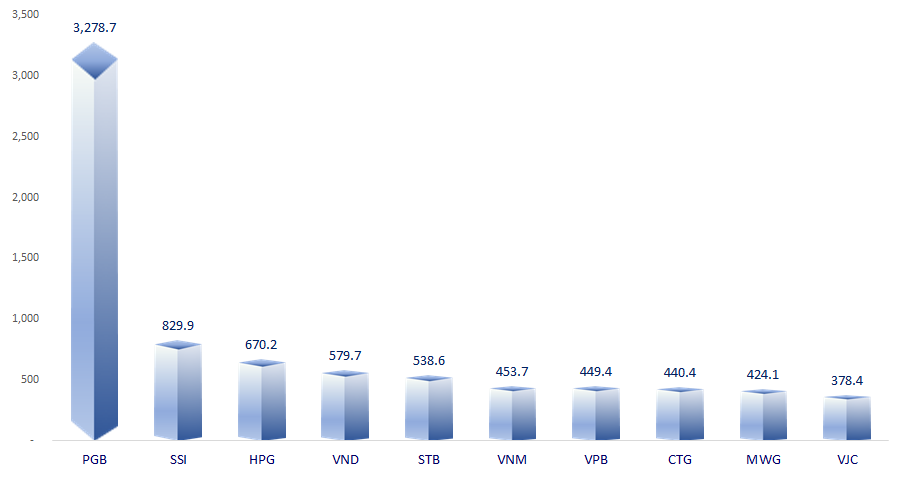

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

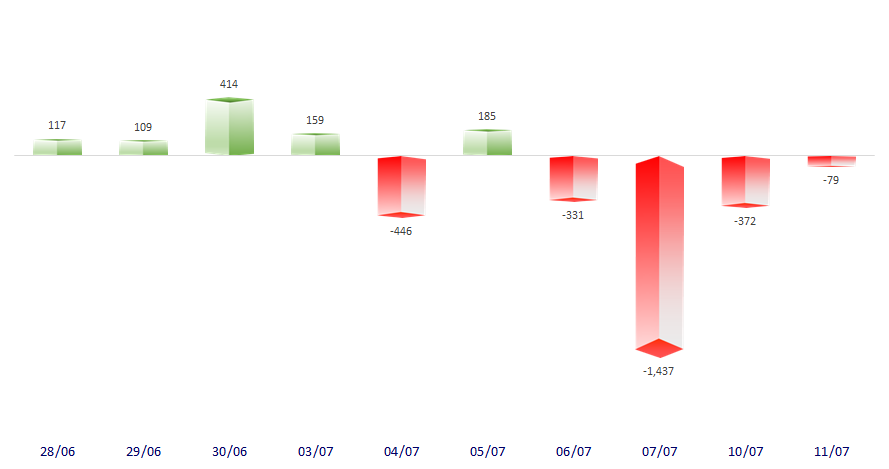

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

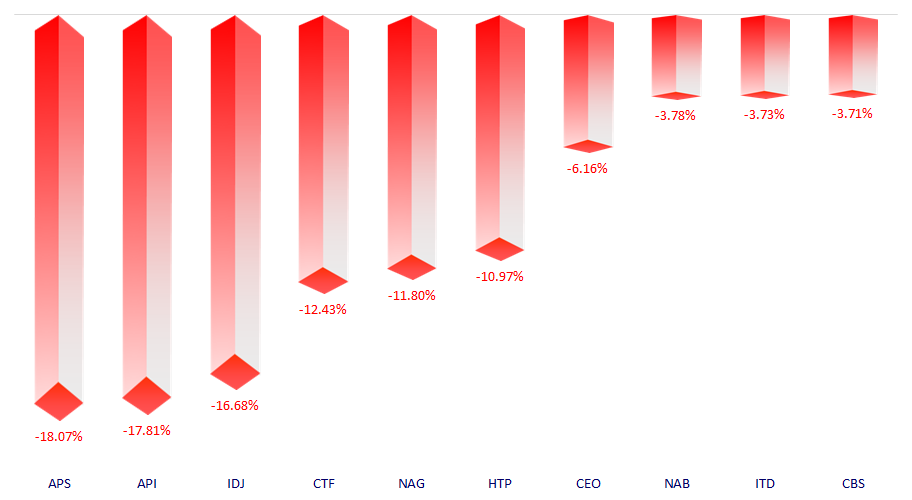

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.