Market brief 14/07/2023

VIETNAM STOCK MARKET

1,168.40

1D 0.26%

YTD 16.02%

1,160.59

1D 0.39%

YTD 15.46%

230.19

1D 0.10%

YTD 12.12%

86.29

1D 0.09%

YTD 20.43%

-273.87

1D 0.00%

YTD 0.00%

23,430.18

1D 21.52%

YTD 171.94%

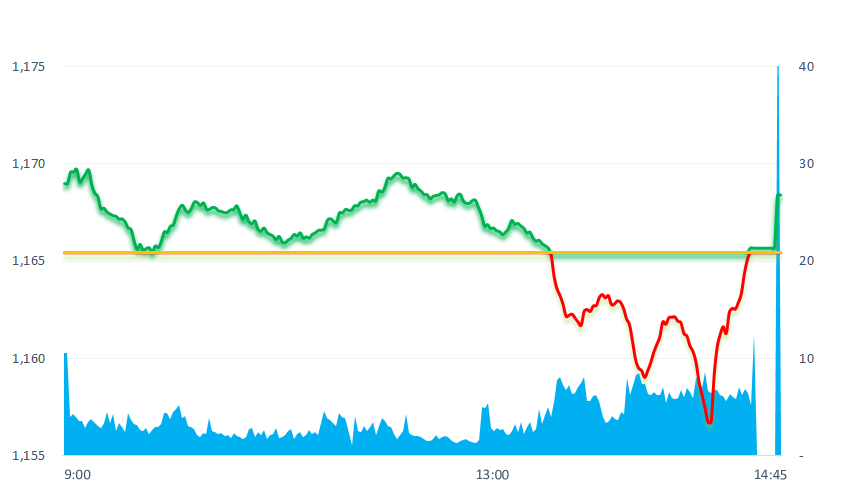

This morning, VNIndex continues positive trend. However, the uptrend gradually narrowed and then dropped again from 13:30. At ATC session, the buying force quickly poured into the market to help VNIndex close above the reference level. Liquidity increased sharply when the volume and trading value reached more than 1 billion shares and VND20,878 billion, respectively (the highest since June 19).

ETF & DERIVATIVES

19,860

1D 0.30%

YTD 14.60%

13,780

1D 0.73%

YTD 15.60%

14,110

1D -0.63%

YTD 13.06%

17,400

1D -2.41%

YTD 23.84%

17,980

1D 0.62%

YTD 25.30%

25,000

1D 0.20%

YTD 11.61%

15,000

1D 0.00%

YTD 15.83%

1,162

1D 0.61%

YTD 0.00%

1,155

1D 0.26%

YTD 0.00%

1,154

1D 0.65%

YTD 0.00%

1,140

1D 0.39%

YTD 0.00%

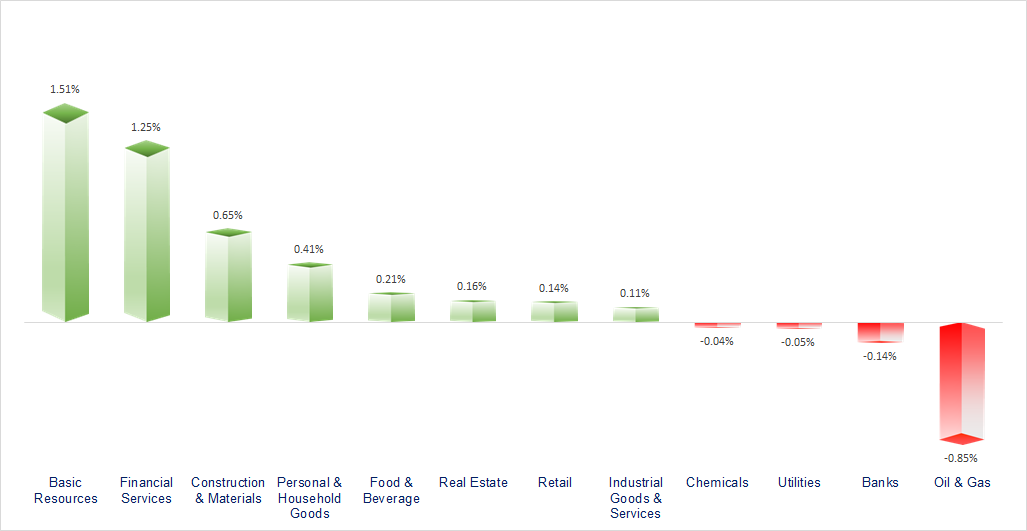

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

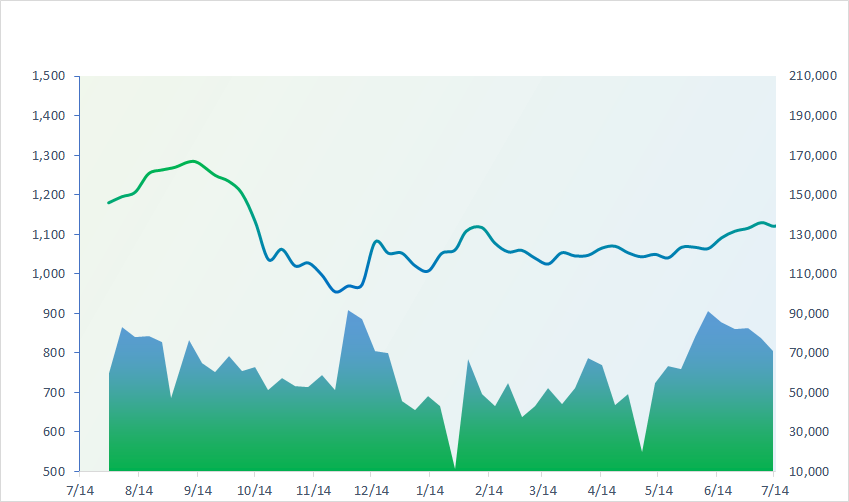

VNINDEX (12M)

GLOBAL MARKET

32,391.26

1D -0.09%

YTD 24.13%

3,237.70

1D 0.04%

YTD 4.81%

2,628.30

1D 1.43%

YTD 17.52%

19,413.78

1D 0.33%

YTD -1.86%

3,248.63

1D 0.31%

YTD -0.08%

1,517.92

1D 1.60%

YTD -9.13%

81.22

1D -0.34%

YTD -5.46%

1,960.10

1D -0.17%

YTD 7.33%

On July 14, except for Japan's Nikkei, which dropped slightly today, other Asian stock indexes such as Shanghai, Kospi, Hang Seng, ... increased for the fifth consecutive day and was the best week. This year, as US inflation cools, raising the possibility that the Federal Reserve may pause interest rate hikes after this month.

VIETNAM ECONOMY

0.20%

1D (bps) -1

YTD (bps) -477

6.30%

YTD (bps) -110

1.95%

1D (bps) -5

YTD (bps) -284

2.61%

1D (bps) -3

YTD (bps) -229

23,846

1D (%) -0.12%

YTD (%) 0.36%

26,955

1D (%) 0.29%

YTD (%) 5.05%

3,381

1D (%) 0.21%

YTD (%) -2.98%

Deputy Prime Minister Le Minh Khai asked ministries to seriously implement of a credit package of VND10,000 billion to support forestry and fishery businesses. At the same time, ministries need to study to reduce unemployment insurance contributions and extend policies on exemption and reduction of land rents and other fees and charges for businesses until the end of the year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- IMF: Vietnam's economic growth will recover in the second half of the year;

- Deputy Prime Minister requested extension, tax exemption for forestry - fishery enterprises;

- US Treasury Secretary Janet Yellen is coming to Vietnam;

- Global government debt to exceed USD92 trillion by 2022;

- US markets bet the Fed rate peaks in July;

- The decade of cheap money ended, the wave of defaults and bankruptcies surged from Asia to Europe.

VN30

BANK

105,000

1D 0.10%

5D 0.00%

Buy Vol. 1,242,932

Sell Vol. 1,230,734

46,750

1D -0.32%

5D 5.53%

Buy Vol. 6,279,303

Sell Vol. 4,742,132

29,900

1D -0.33%

5D 1.01%

Buy Vol. 13,599,141

Sell Vol. 16,257,171

31,950

1D 0.00%

5D 1.27%

Buy Vol. 9,065,870

Sell Vol. 9,006,901

19,900

1D -0.25%

5D 0.25%

Buy Vol. 29,337,632

Sell Vol. 35,880,143

18,650

1D 1.64%

5D 4.87%

Buy Vol. 34,251,690

Sell Vol. 31,485,563

18,900

1D 1.61%

5D 3.00%

Buy Vol. 7,894,995

Sell Vol. 7,493,582

18,150

1D -0.55%

5D 0.55%

Buy Vol. 6,807,401

Sell Vol. 8,793,363

29,000

1D -3.33%

5D -2.03%

Buy Vol. 109,676,772

Sell Vol. 129,577,880

20,250

1D 0.25%

5D 2.27%

Buy Vol. 7,631,245

Sell Vol. 9,084,792

22,000

1D 0.00%

5D 1.38%

Buy Vol. 13,111,099

Sell Vol. 16,529,338

Credit institutions have reduced lending interest rates for existing and new outstanding loans to support the economy, after the State Bank of Vietnam loosened the credit room and provided liquidity support solutions. Many banks have announced their commitment to reduce lending interest rates with the interest rate reduced from 0.5% to 1.5%/year.

REAL ESTATE

15,150

1D 1.34%

5D 4.48%

Buy Vol. 90,023,757

Sell Vol. 103,309,802

80,900

1D -0.12%

5D 1.00%

Buy Vol. 463,437

Sell Vol. 496,573

18,900

1D -1.56%

5D 9.25%

Buy Vol. 34,618,306

Sell Vol. 34,378,273

NVL: NovaGroup has been forcesell by a securities company for 433,364 shares of NVL from July 6 to July 10. After the transaction, NovaGroup reduced its ownership in NVL to 27.56%.

OIL & GAS

99,000

1D -0.30%

5D 3.13%

Buy Vol. 1,234,701

Sell Vol. 1,591,563

13,300

1D -0.37%

5D 1.53%

Buy Vol. 20,471,132

Sell Vol. 22,552,577

40,900

1D -1.21%

5D 1.49%

Buy Vol. 2,743,743

Sell Vol. 3,304,279

GAS: AES and PV Gas Group have been awarded the decision to approve the investment policy of Son My LNG terminal by Binh Thuan, with a total investment of about USD1.34 billion.

VINGROUP

51,400

1D -0.19%

5D 2.59%

Buy Vol. 3,402,772

Sell Vol. 5,055,861

56,400

1D 0.18%

5D 4.44%

Buy Vol. 2,832,071

Sell Vol. 3,637,458

28,000

1D -0.53%

5D 3.70%

Buy Vol. 16,254,739

Sell Vol. 16,391,910

VHM: Vinhomes will be the investor of an urban project in Duong Kinh and Kien Thuy districts, Hai Phong province, worth more than VND23,200 billion.

FOOD & BEVERAGE

73,300

1D 0.27%

5D 3.39%

Buy Vol. 8,364,240

Sell Vol. 8,847,898

81,800

1D 0.00%

5D 8.78%

Buy Vol. 2,693,387

Sell Vol. 3,571,988

153,800

1D 0.20%

5D 1.85%

Buy Vol. 226,437

Sell Vol. 310,344

VNM: Q2/2023, profit after tax is estimated at VND2,220 billion, up 5.6% QoQ and up 16.5% compared to Q1/2023. This is the first quarter to record positive profit growth since the beginning of 2021.

OTHERS

46,800

1D -0.43%

5D 3.43%

Buy Vol. 2,567,031

Sell Vol. 2,917,242

97,900

1D 3.16%

5D 4.37%

Buy Vol. 2,544,514

Sell Vol. 2,184,722

78,300

1D 3.30%

5D 3.98%

Buy Vol. 4,568,191

Sell Vol. 4,570,665

49,450

1D 0.20%

5D 8.68%

Buy Vol. 10,712,019

Sell Vol. 9,003,997

21,600

1D -0.23%

5D 1.65%

Buy Vol. 4,617,797

Sell Vol. 4,438,648

28,500

1D 0.35%

5D 7.75%

Buy Vol. 31,110,338

Sell Vol. 28,234,218

27,500

1D 1.66%

5D 0.18%

Buy Vol. 30,520,411

Sell Vol. 31,223,690

BVH: BVH's BODs said that from 2026, it might consider reducing the State's ownership rate to 51% by increasing the capital contribution ratio of other shareholders and/or by private placement. However, the Ministry of Finance will still be the largest shareholder of the Group. Currently, the Ministry of Finance and the State Capital Investment Corporation (SCIC) currently own 65% and 3% shares in Bao Viet Group, respectively.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

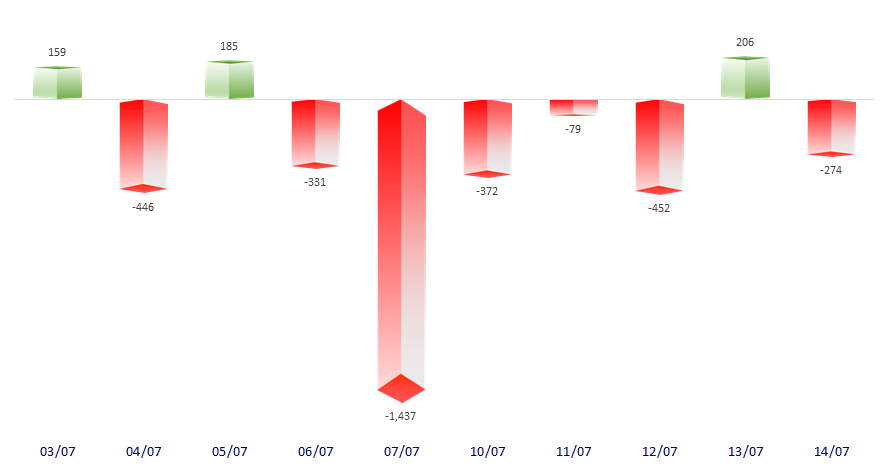

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

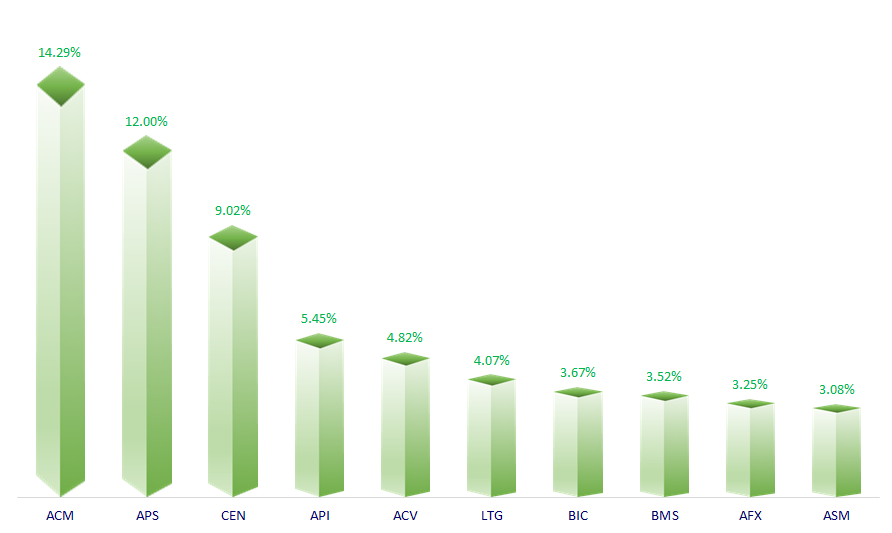

TOP INCREASES 3 CONSECUTIVE SESSIONS

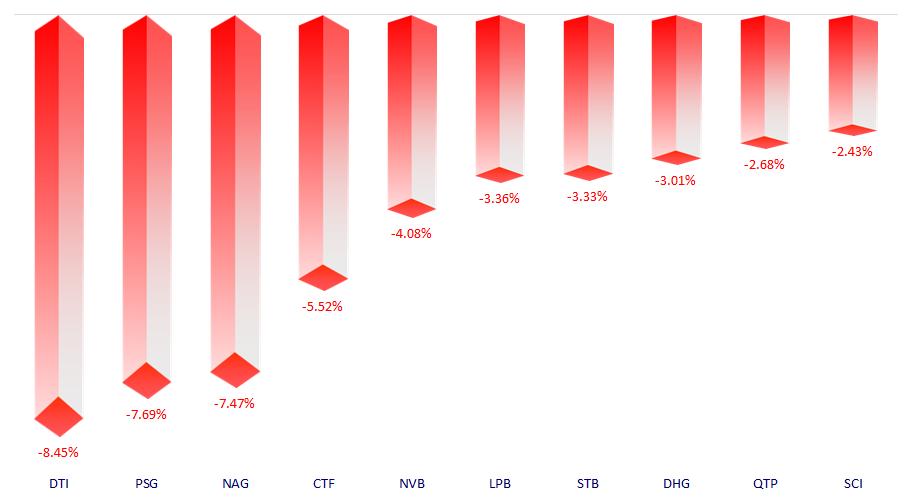

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.