Market brief 19/07/2023

VIETNAM STOCK MARKET

1,172.98

1D -0.09%

YTD 16.47%

1,165.19

1D -0.14%

YTD 15.92%

231.47

1D 0.22%

YTD 12.74%

87.13

1D 0.13%

YTD 21.61%

288.12

1D 0.00%

YTD 0.00%

20,108.79

1D 5.50%

YTD 133.39%

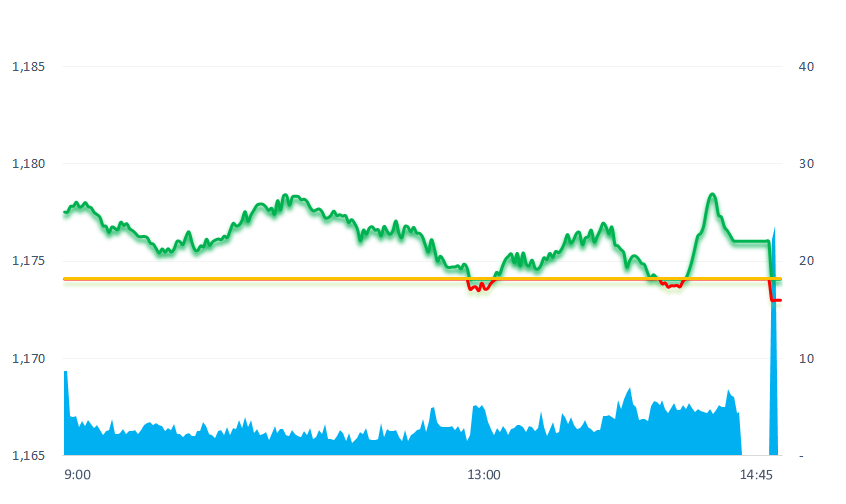

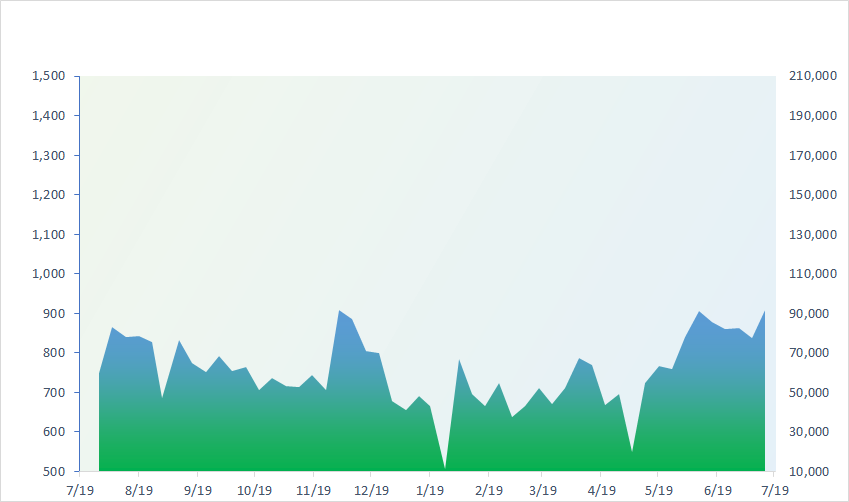

Today, the stock market recorded a decline after 8 consecutive gaining sessions. Although the market dropped slightly, 52% of stocks declined compared to 36% that gained.

ETF & DERIVATIVES

20,110

1D 0.40%

YTD 16.04%

13,840

1D 0.22%

YTD 16.11%

14,410

1D 0.63%

YTD 15.46%

17,650

1D 0.00%

YTD 25.62%

17,960

1D -0.17%

YTD 25.16%

25,100

1D 0.00%

YTD 12.05%

15,150

1D 0.33%

YTD 16.99%

1,164

1D -0.08%

YTD 0.00%

1,162

1D -0.03%

YTD 0.00%

1,159

1D 0.21%

YTD 0.00%

1,152

1D 0.24%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

32,896.03

1D 1.24%

YTD 26.06%

3,198.84

1D 0.03%

YTD 3.55%

2,608.24

1D 0.02%

YTD 16.63%

18,952.31

1D -0.27%

YTD -4.19%

3,275.24

1D 0.64%

YTD 0.74%

1,536.64

1D 0.22%

YTD -8.01%

79.86

1D 0.23%

YTD -7.04%

1,975.50

1D -0.28%

YTD 8.18%

Asian stock markets mostly rose in the session on July 19, following Wall Street's rally amid growing investor optimism that the US Federal Reserve (Fed) will soon end the cycle raise interest rates and the US economy will avoid a recession.

VIETNAM ECONOMY

0.39%

1D (bps) -17

YTD (bps) -458

6.30%

YTD (bps) -110

1.92%

1D (bps) -1

YTD (bps) -287

2.51%

1D (bps) -2

YTD (bps) -239

23,850

1D (%) 0.16%

YTD (%) 0.38%

26,957

1D (%) -1.18%

YTD (%) 5.06%

3,345

1D (%) -0.33%

YTD (%) -4.02%

In the first 6 months of 2023, the tax authority issued 8,510 decisions corresponding to the refunded tax amount of VND61,093 billion, equal to 33% of the VAT refund amount in 2023 approved by the National Assembly.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In the first 6 months of 2023, China is the largest buyer of Vietnamese agricultural products;

- General Department of Taxation: More than VND60,000 billion of tax has been refunded in the first 6 months of the year;

- HP plans to move part of its PC production line from China to Vietnam;

- The US economy received data not as expected in June;

- The luxury goods industry is concerned about demand in the US and China;

- Wheat prices spiked after Russia pulled out of Ukraine grain deal.

VN30

BANK

106,500

1D 2.11%

5D 2.40%

Buy Vol. 1,672,653

Sell Vol. 1,334,491

46,250

1D -0.96%

5D -0.96%

Buy Vol. 3,842,030

Sell Vol. 4,111,813

29,900

1D 0.17%

5D -0.33%

Buy Vol. 10,526,570

Sell Vol. 13,386,107

32,300

1D 0.00%

5D 2.05%

Buy Vol. 9,552,000

Sell Vol. 11,990,461

20,650

1D -1.43%

5D 5.09%

Buy Vol. 33,475,394

Sell Vol. 55,591,100

18,400

1D -1.08%

5D 0.76%

Buy Vol. 19,073,593

Sell Vol. 22,481,808

16,850

1D 2.52%

5D 4.46%

Buy Vol. 8,069,936

Sell Vol. 6,174,459

18,700

1D -1.32%

5D 3.03%

Buy Vol. 18,447,109

Sell Vol. 20,489,566

28,250

1D -0.70%

5D -5.20%

Buy Vol. 28,594,921

Sell Vol. 32,600,814

20,550

1D 0.00%

5D 2.24%

Buy Vol. 7,555,050

Sell Vol. 9,690,287

22,000

1D 0.00%

5D 0.69%

Buy Vol. 15,855,438

Sell Vol. 21,895,820

TPB: In the first 6 months of the year, TPBank continued to record a pre-tax profit of nearly VND3,400 billion. The bank's main source of income still comes from net interest income, but the proportion of non-interest income has improved positively when increasing to 28% of total income.

REAL ESTATE

14,700

1D -2.33%

5D 0.68%

Buy Vol. 68,964,214

Sell Vol. 85,489,724

80,100

1D 0.38%

5D -0.74%

Buy Vol. 424,049

Sell Vol. 473,485

18,800

1D -2.34%

5D -1.57%

Buy Vol. 31,347,163

Sell Vol. 28,827,442

NVL: Regarding the USD300 million convertible bond package, NVL said it is working with financial advisor Deloitte, legal counsel YKVN, Sidley Austin and Hogan Lovells on bond restructuring.

OIL & GAS

98,900

1D -0.90%

5D 2.49%

Buy Vol. 793,860

Sell Vol. 1,621,997

13,300

1D -1.48%

5D 0.38%

Buy Vol. 14,686,867

Sell Vol. 25,229,728

40,100

1D -1.11%

5D -3.37%

Buy Vol. 2,157,561

Sell Vol. 2,872,523

GAS: The Son My LNG Terminal Project, along with the Son My 2 Combined Cycle Gas Turbine Power Plant (CCGT) project with a total capacity of 2.2 GW of AES is an investment worth billions of USD.

VINGROUP

52,100

1D -1.14%

5D 1.36%

Buy Vol. 2,735,530

Sell Vol. 4,745,377

58,500

1D -0.51%

5D 6.17%

Buy Vol. 2,854,360

Sell Vol. 3,573,696

27,950

1D -1.24%

5D -0.53%

Buy Vol. 12,680,164

Sell Vol. 15,059,455

VIC: VinFast announced the groundbreaking of an electric vehicle factory in North Carolina on July 28. The project covers an area of about 733ha with an expected capacity of 150,000 vehicles/year

FOOD & BEVERAGE

72,600

1D 0.28%

5D -1.22%

Buy Vol. 4,274,483

Sell Vol. 5,578,577

80,800

1D 0.37%

5D 1.64%

Buy Vol. 2,421,782

Sell Vol. 2,705,454

152,800

1D -0.20%

5D 1.19%

Buy Vol. 233,839

Sell Vol. 357,149

VNM: According to VNM's General Director: Q2's profit growth increased partly thank to the strong downtrend of milk powder price recently.

OTHERS

46,900

1D -0.32%

5D 0.11%

Buy Vol. 1,556,595

Sell Vol. 1,691,484

96,700

1D 0.42%

5D 2.98%

Buy Vol. 1,037,872

Sell Vol. 1,352,170

78,500

1D -0.25%

5D 4.25%

Buy Vol. 1,100,646

Sell Vol. 1,577,278

48,500

1D 0.94%

5D -1.32%

Buy Vol. 6,361,618

Sell Vol. 5,999,966

21,700

1D -0.69%

5D 0.46%

Buy Vol. 5,067,534

Sell Vol. 6,147,254

28,500

1D -0.18%

5D 1.97%

Buy Vol. 18,861,454

Sell Vol. 21,126,544

27,400

1D 0.74%

5D 1.48%

Buy Vol. 30,493,906

Sell Vol. 37,620,479

VJC: From July 7 to July 13, VJC issued 3,000 bonds with par value of VND100 million/bond under code VJCH2328006, thereby successfully mobilizing VND300 billion. The bond batch has a term of 5 years, is issued in the domestic market and has an interest rate of 12%/year.

Market by numbers

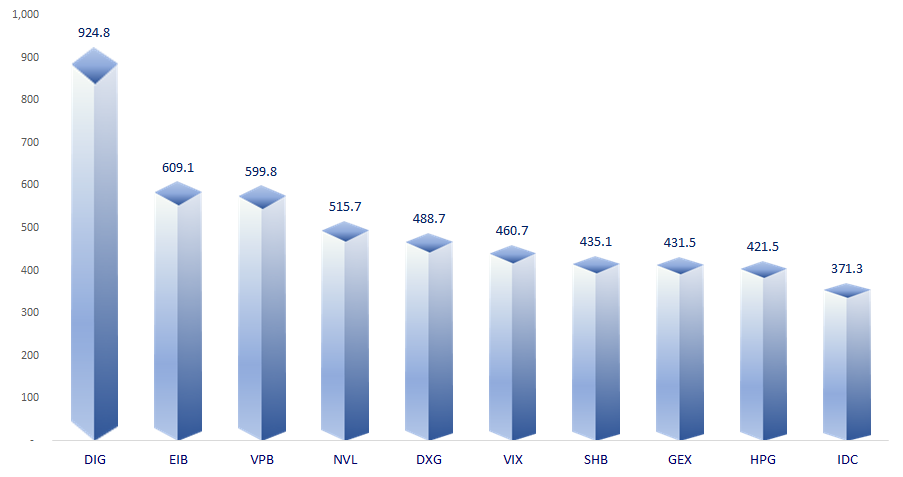

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

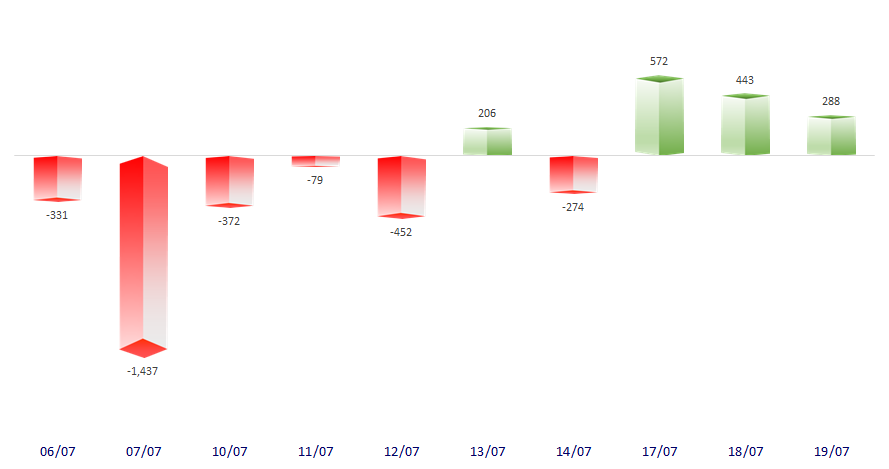

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

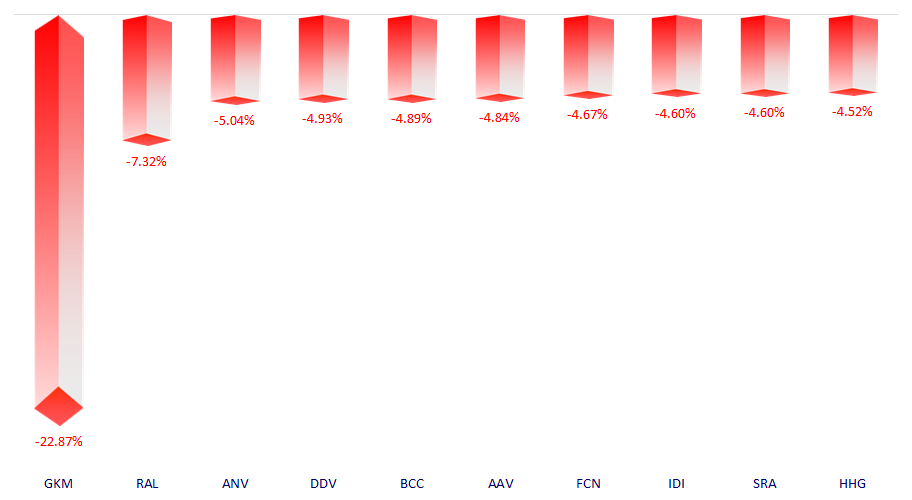

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.