Market brief 21/07/2023

VIETNAM STOCK MARKET

1,185.90

1D 1.12%

YTD 17.76%

1,186.60

1D 1.57%

YTD 18.05%

234.98

1D 0.82%

YTD 14.45%

88.15

1D 0.57%

YTD 23.03%

82.03

1D 0.00%

YTD 0.00%

22,519.55

1D 21.24%

YTD 161.37%

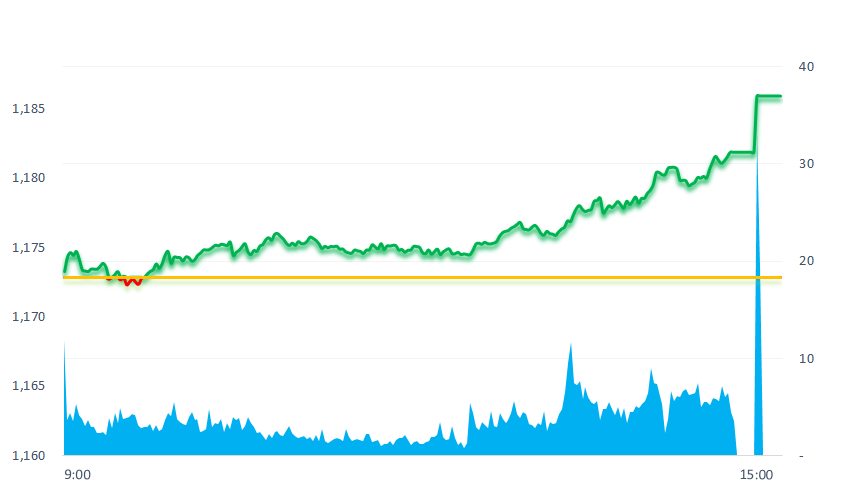

Today, the stock market maintained a slight uptrend throughout the morning session. Only in the afternoon session, large cash inflow poured into the market so the index gained strongly and closed at the highest level of the session. Market liquidity has increased significantly with trading volume of over 988 million shares and trading value of over VND20,000 billion.

ETF & DERIVATIVES

20,250

1D 1.20%

YTD 16.85%

14,060

1D 1.59%

YTD 17.95%

14,510

1D 0.83%

YTD 16.27%

18,000

1D 1.98%

YTD 28.11%

18,110

1D 0.89%

YTD 26.20%

25,510

1D 1.15%

YTD 13.88%

15,240

1D 0.66%

YTD 17.68%

1,185

1D 1.79%

YTD 0.00%

1,183

1D 1.84%

YTD 0.00%

1,170

1D 0.96%

YTD 0.00%

1,168

1D 1.45%

YTD 0.00%

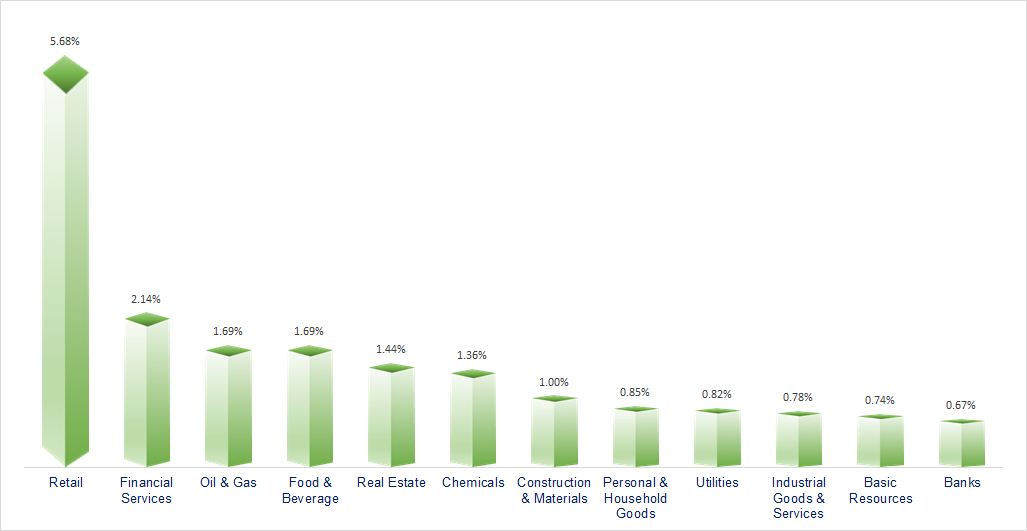

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

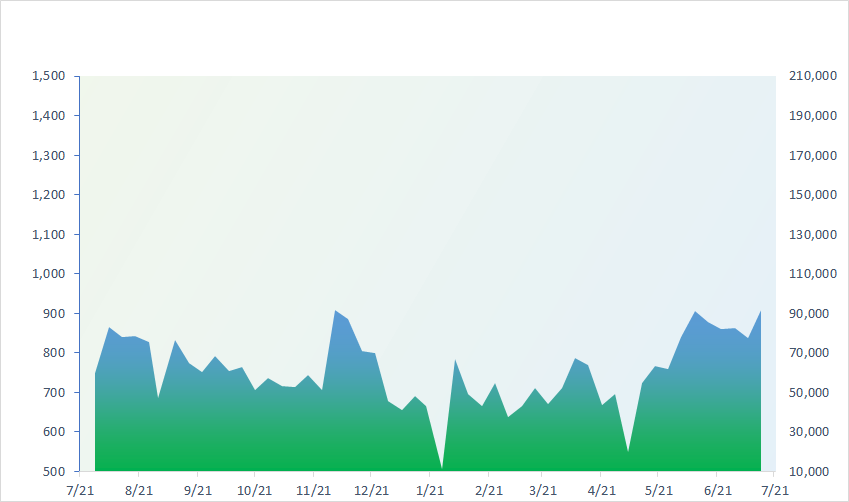

VNINDEX (12M)

GLOBAL MARKET

0

1D 32314.5

YTD -0.004635762

0

1D 3167.75

YTD -0.000558444

0

1D 10810.18

YTD -0.000563041

0

1D 19075.26

YTD 0.007989829

0

1D 2609.76

YTD 0.00366506

0

1D 66684.26

YTD -0.01313623

0

1D 3278.3

YTD 0.001197173

0

1D 1529.25

YTD 0.005305092

0

1D 80.56

YTD 0.009397319

0

1D 1965.55

YTD -0.009324362

Most Asian stock markets traded in a tight range on Friday as investors weighed more Chinese stimulus measures. In China, the National Development and Reform Commission announced new measures to boost spending in the automotive and consumer electronics sectors. The move comes as Beijing promises more policy support

VIETNAM ECONOMY

0.22%

1D (bps) -17

YTD (bps) -475

6.30%

YTD (bps) -110

1.90%

1D (bps) -2

YTD (bps) -289

2.45%

1D (bps) -6

YTD (bps) -245

23,873

1D (%) 0.01%

YTD (%) 0.48%

26,766

1D (%) -0.68%

YTD (%) 4.31%

3,366

1D (%) -0.18%

YTD (%) -3.41%

In OMO, yesterday, the State Bank offered a bid of VND3,000 billion with a term of 07 days, the interest rate was kept at 4.0%. This offering has no winning volume and no circulating volume on the pledge channel. The State Bank continued to not bid for bills.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Government proposes to reduce the union fee to 1%;

- Recommended to buyers of state-guaranteed bank bonds such as savings;

- The US wants to support Vietnam in the production of semiconductor chips;

- Bloomberg: Fed is about to raise interest rates to a 22-year high;

- India bans rice exports;

- The US Senate supported a ban on the sale of oil from the stockpile.

VN30

BANK

105,000

1D 0.00%

5D 0.00%

Buy Vol. 1,596,601

Sell Vol. 1,161,063

46,750

1D 1.08%

5D 0.00%

Buy Vol. 2,672,174

Sell Vol. 2,879,101

29,700

1D 0.17%

5D -0.67%

Buy Vol. 10,254,649

Sell Vol. 9,366,235

32,300

1D 1.25%

5D 1.10%

Buy Vol. 9,616,277

Sell Vol. 7,695,833

21,400

1D 1.90%

5D 7.54%

Buy Vol. 51,029,118

Sell Vol. 51,705,386

18,650

1D 1.08%

5D 0.00%

Buy Vol. 17,344,258

Sell Vol. 14,310,036

17,200

1D 1.18%

5D 4.65%

Buy Vol. 6,172,324

Sell Vol. 5,992,714

18,750

1D -0.27%

5D 3.31%

Buy Vol. 16,592,651

Sell Vol. 22,669,273

28,750

1D 3.23%

5D -0.86%

Buy Vol. 54,184,366

Sell Vol. 57,790,632

20,550

1D 0.24%

5D 1.48%

Buy Vol. 6,231,205

Sell Vol. 6,251,470

22,100

1D 0.45%

5D 0.45%

Buy Vol. 13,479,865

Sell Vol. 13,167,956

BID: On July 21, BIDV applied a new deposit interest rate table, at the counter, the bank reduced 0.1 percentage points for 1-month and 2-month deposit terms to 3.3%/year. The bank kept the deposit interest rate unchanged for the remaining terms, the highest was still 6.3%/year for terms of 12 months or more. For online savings, the interest rate for 1-month term decreased from 4% to 3.6%/year, 6-month term decreased from 5.6 to 5.3%/year.

REAL ESTATE

15,150

1D 2.36%

5D 0.00%

Buy Vol. 68,981,575

Sell Vol. 84,387,189

79,600

1D -0.87%

5D -1.61%

Buy Vol. 681,531

Sell Vol. 716,354

20,800

1D 6.94%

5D 10.05%

Buy Vol. 47,514,092

Sell Vol. 35,302,984

PDR: In Q2/2023 PDR's net revenue dropped to VND5 billion from VND853 billion in the same period due to no longer recording land transfer revenue.

OIL & GAS

99,400

1D 0.71%

5D 0.40%

Buy Vol. 988,129

Sell Vol. 1,020,346

13,250

1D -0.38%

5D -0.38%

Buy Vol. 30,624,812

Sell Vol. 22,278,659

40,500

1D 2.02%

5D -0.98%

Buy Vol. 3,611,641

Sell Vol. 2,879,375

GAS: 6M2023, GAS maintains a stable gas supply to produce nearly 11% of electricity output, about 70% of nitrogen fertilizer output, meeting nearly 70% of the national LPG market share.

VINGROUP

52,100

1D 0.19%

5D 1.36%

Buy Vol. 3,947,769

Sell Vol. 4,293,892

59,000

1D 2.25%

5D 4.61%

Buy Vol. 5,558,554

Sell Vol. 4,276,293

28,400

1D 1.25%

5D 1.43%

Buy Vol. 11,445,560

Sell Vol. 8,946,194

VIC: VEF (a subsidiary of Vingroup) reported a net profit of VND228 billion, up 57% YoY; undistributed after-tax profit by the end of the second quarter increased to VND1,200 billion.

FOOD & BEVERAGE

73,500

1D 1.24%

5D 0.27%

Buy Vol. 5,541,526

Sell Vol. 6,453,776

83,000

1D 4.40%

5D 1.47%

Buy Vol. 3,714,128

Sell Vol. 2,637,686

153,100

1D -0.07%

5D -0.46%

Buy Vol. 261,080

Sell Vol. 311,117

VNM: According to VNM's CEO, in the short term, Vinamilk will prioritize growth in market share and sales in a sustainable and profitable manner.

OTHERS

47,500

1D 1.50%

5D 1.50%

Buy Vol. 2,447,880

Sell Vol. 2,799,039

98,000

1D 0.20%

5D 0.10%

Buy Vol. 1,209,581

Sell Vol. 1,391,691

81,000

1D 0.87%

5D 3.45%

Buy Vol. 2,120,733

Sell Vol. 1,784,549

52,500

1D 6.92%

5D 6.17%

Buy Vol. 21,871,345

Sell Vol. 15,396,131

22,000

1D 2.33%

5D 1.85%

Buy Vol. 4,771,810

Sell Vol. 4,559,027

28,750

1D 2.68%

5D 0.88%

Buy Vol. 31,242,687

Sell Vol. 25,769,363

28,400

1D 0.71%

5D 3.27%

Buy Vol. 33,762,845

Sell Vol. 32,079,063

SSI: In the second quarter of 2023, SSI achieved operating revenue of more than VND1.57 trillion, approximately the same period. Key business segments such as brokerage and margin lending all recorded a decline in revenue. Specifically, interest from loans and receivables decreased by 25% to VND360 billion. Brokerage revenue decreased 25% to nearly VND336 billion.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

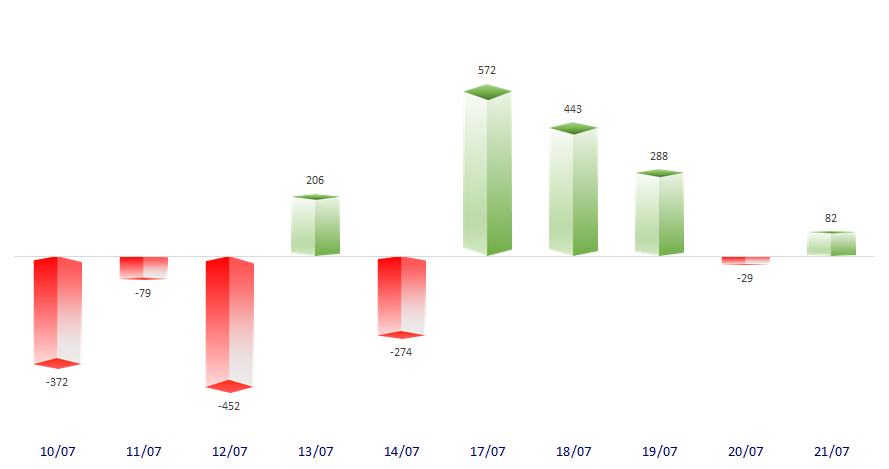

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

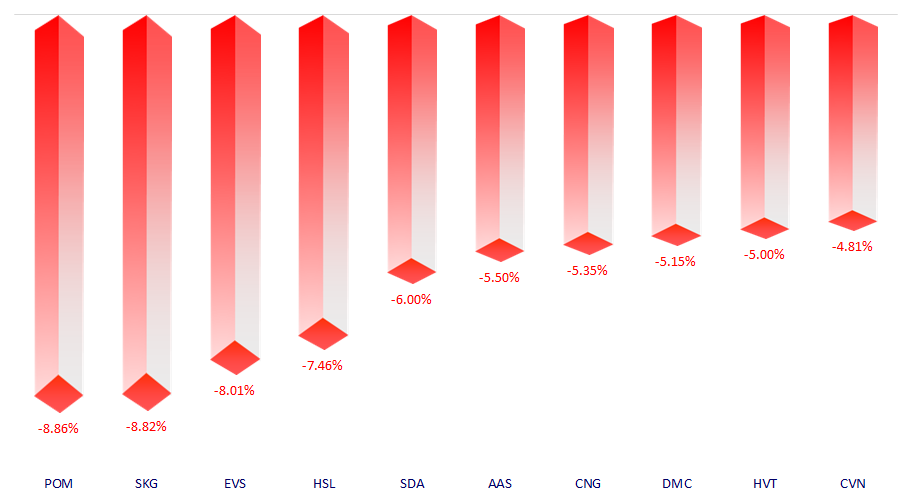

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.