Market Brief 24/07/2023

VIETNAM STOCK MARKET

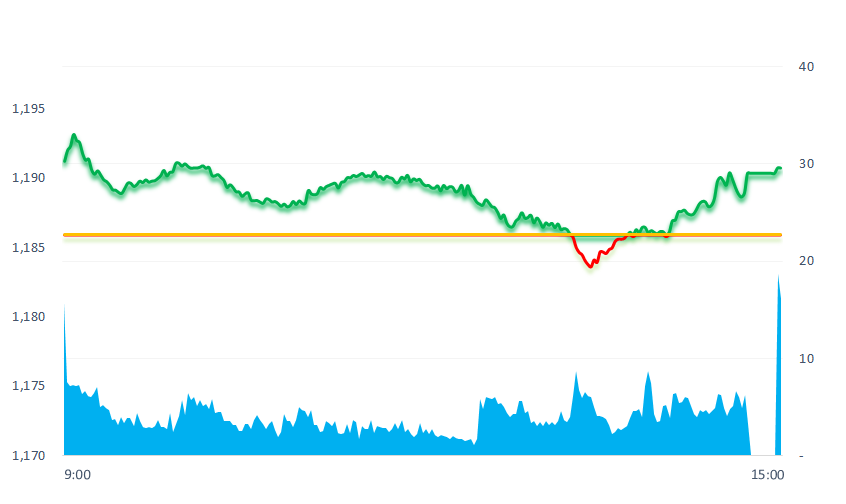

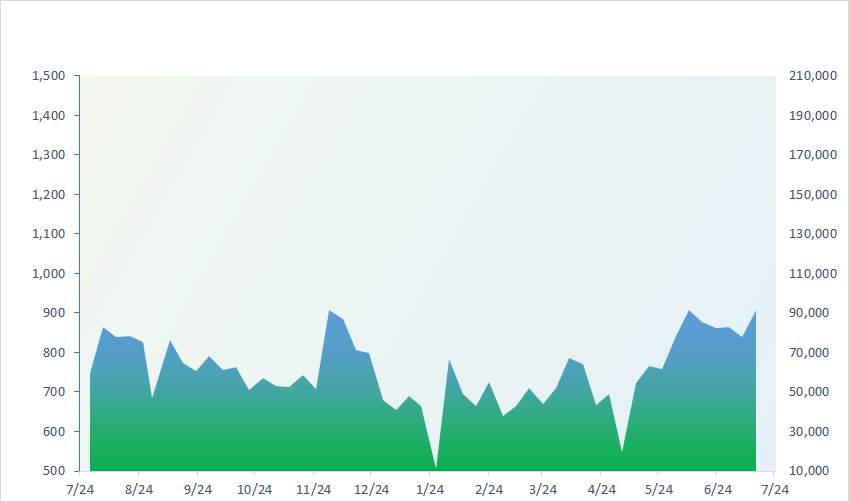

1,190.72

1D 0.41%

YTD 18.23%

1,193.14

1D 0.55%

YTD 18.70%

236.53

1D 0.66%

YTD 15.21%

88.69

1D 0.61%

YTD 23.78%

82.03

1D 0.00%

YTD 0.00%

23,116.76

1D 2.65%

YTD 168.30%

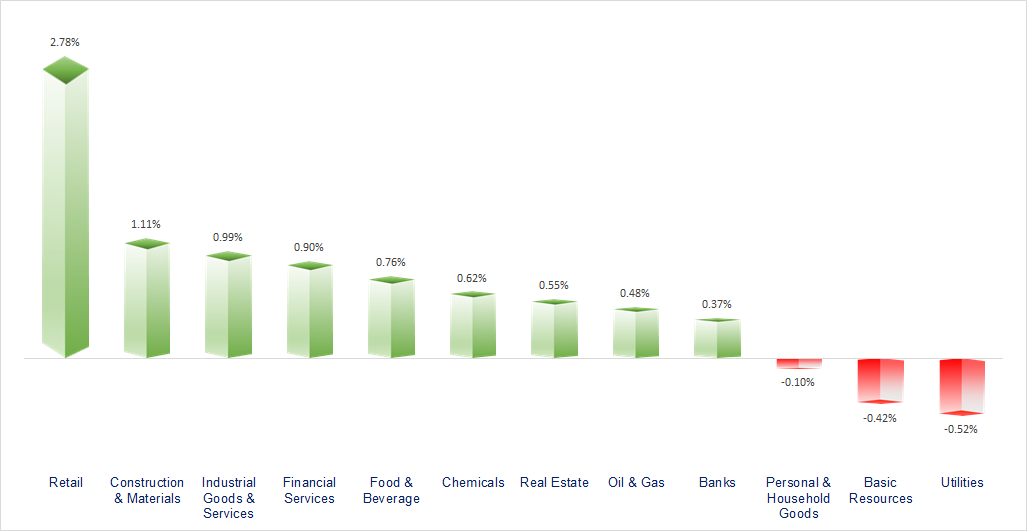

VN-Index had the 12th consecutive gaining session. Retail was the most active sector today, mainly driven by MWG stock with a gain of 3.8%. Rice stocks rebounded strongly at the beginning of the session, including TAR (ceiling price), LTG (+8.2%), PAN (+6.5%). Construction and oil and gas stocks also traded actively with some representative codes such as: VCG, TCD, FCN, HTN, PLC, PVB, BSR.

ETF & DERIVATIVES

20,390

1D 0.69%

YTD 17.66%

14,100

1D 0.28%

YTD 18.29%

14,680

1D 1.17%

YTD 17.63%

18,200

1D 1.11%

YTD 29.54%

18,350

1D 1.33%

YTD 27.87%

25,900

1D 1.53%

YTD 15.63%

15,510

1D 1.77%

YTD 19.77%

1,191

1D 0.55%

YTD 0.00%

1,189

1D 0.50%

YTD 0.00%

1,178

1D 0.68%

YTD 0.00%

1,177

1D 0.78%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

0

1D 32692.5

YTD 0.011697535

0

1D 3164.16

YTD -0.001133297

0

1D 10747.79

YTD -0.005771412

0

1D 18646

YTD -0.022503494

0

1D 2628.53

YTD 0.007192232

0

1D 66384.78

YTD -0.004491015

0

1D 3265.14

YTD -0.004014276

0

1D 1523.81

YTD -0.003557299

0

1D 80.38

0

1D 1962.65

Stocks and bonds in China's real estate industry fell to around eight-month lows on Monday as repayment concerns at two of the country's biggest developers deepened a crisis of confidence in the sector. The country’s two largest developers, Country Garden and Dalian Wanda, are grappling with cash crunches, leading to a loss of confidence in the industry. This decline comes as a result of the ongoing government crackdown on debts and waning public trust, leaving developers unable to sell properties or refinance their dues. As doubts grow regarding official support and with investors losing hope for any aid to shareholders, the future of the real estate sector remains uncertain.

VIETNAM ECONOMY

0.20%

1D (bps) -2

YTD (bps) -477

6.30%

YTD (bps) -110

2.18%

1D (bps) 28

YTD (bps) -261

2.44%

1D (bps) -1

YTD (bps) -246

23,890

1D (%) 0.23%

YTD (%) 0.55%

26,682

1D (%) -1.38%

YTD (%) 3.99%

3,362

1D (%) -0.03%

YTD (%) -3.53%

The euro slid on Monday after activity data in key economies came in much softer than expected, giving markets a jolt at the start of a week packed with central bank meetings at which investors expect rate hikes in Europe and the United States. The European common currency fell sharply, skidding after a quiet Asian session after PMI data showed business activity contracted in France and Germany.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- EVN and Binh Thuan Provincial People's Committee discuss to remove obstacles for power transmission projects;

- Fifteen transitional renewable energy projects reach commercial operations;

- Domestic rice prices increased sharply after news of India's export restriction;

- The Yen faces strong volatility as BoJ and Fed prepare to meet on interest rates;

- The US considers options to avoid the risk of default;

- Goldman Sachs: Stronger oil demand will boost oil prices.

VN30

BANK

104,600

1D -0.38%

5D -0.19%

Buy Vol. 1,524,678

Sell Vol. 1,294,099

46,800

1D 0.11%

5D 1.30%

Buy Vol. 3,134,513

Sell Vol. 4,386,858

29,850

1D 0.51%

5D 0.51%

Buy Vol. 8,855,716

Sell Vol. 11,028,811

32,450

1D 0.46%

5D 1.72%

Buy Vol. 10,596,759

Sell Vol. 8,444,537

21,850

1D 2.10%

5D 6.85%

Buy Vol. 41,512,797

Sell Vol. 42,201,978

18,750

1D 0.54%

5D 0.81%

Buy Vol. 17,692,699

Sell Vol. 17,840,141

17,250

1D 0.29%

5D 4.96%

Buy Vol. 4,229,192

Sell Vol. 4,516,451

18,650

1D -0.53%

5D 2.19%

Buy Vol. 13,983,809

Sell Vol. 13,630,218

28,700

1D -0.17%

5D 2.50%

Buy Vol. 27,560,339

Sell Vol. 42,113,833

21,000

1D 2.19%

5D 2.94%

Buy Vol. 12,644,723

Sell Vol. 11,886,857

22,050

1D -0.23%

5D 0.23%

Buy Vol. 11,066,065

Sell Vol. 14,695,209

ACB: ACB's Board of Directors has just approved the plan to issue VND20,000 billion of bonds in 2023. The issue price is equal to par value. This is a non-convertible bond, without warrants, without assets and is not a secondary debt of ACB. The bond has a term of up to 5 years and has a fixed interest rate throughout the term.

REAL ESTATE

16,200

1D 6.93%

5D 5.54%

Buy Vol. 189,897,464

Sell Vol. 150,842,775

79,200

1D -0.50%

5D -1.00%

Buy Vol. 268,290

Sell Vol. 359,652

21,350

1D 2.64%

5D 9.49%

Buy Vol. 30,740,127

Sell Vol. 26,410,164

NVL: Lam Dong Provincial People's Committee has just issued a written notice to assign the Department of Construction to receive Novaland's planning ideas and hand them over to localities.

OIL & GAS

98,500

1D -0.91%

5D -0.51%

Buy Vol. 953,699

Sell Vol. 1,044,513

13,300

1D 0.38%

5D -0.37%

Buy Vol. 23,543,111

Sell Vol. 28,142,936

40,300

1D -0.49%

5D -1.59%

Buy Vol. 2,475,483

Sell Vol. 3,106,317

PLX: In the first half of 2023, PLX's term deposits at PGBank decreased by VND600 billion; at the same time, payment deposits also decreased by more than VND158 billion.

VINGROUP

52,000

1D -0.19%

5D -1.70%

Buy Vol. 3,970,234

Sell Vol. 5,109,995

59,100

1D 0.17%

5D 0.17%

Buy Vol. 2,823,304

Sell Vol. 3,620,374

28,400

1D 0.00%

5D -0.87%

Buy Vol. 9,315,985

Sell Vol. 10,473,064

VHM: VHM was one of the top stocks that were strongly bought by foreign investors today with a value of VND25.4 billion.

FOOD & BEVERAGE

73,600

1D 0.14%

5D 1.80%

Buy Vol. 3,884,025

Sell Vol. 5,249,520

84,000

1D 1.20%

5D 4.09%

Buy Vol. 4,305,488

Sell Vol. 4,854,336

155,000

1D 1.24%

5D 0.98%

Buy Vol. 422,251

Sell Vol. 416,054

MSN: JPMorgan Chase has just set a target valuation for Masan's stock in 2024 December at VND102,000.

OTHERS

47,250

1D -0.53%

5D -0.11%

Buy Vol. 1,510,293

Sell Vol. 2,149,318

96,800

1D -1.22%

5D -0.51%

Buy Vol. 1,135,513

Sell Vol. 1,649,453

81,000

1D 0.00%

5D 2.53%

Buy Vol. 1,649,737

Sell Vol. 2,242,992

54,500

1D 3.81%

5D 12.02%

Buy Vol. 7,098,524

Sell Vol. 6,961,947

22,200

1D 0.91%

5D 0.91%

Buy Vol. 3,735,624

Sell Vol. 4,410,266

28,700

1D -0.17%

5D -0.35%

Buy Vol. 26,054,035

Sell Vol. 30,075,266

28,250

1D -0.53%

5D 3.48%

Buy Vol. 30,316,802

Sell Vol. 35,093,096

FPT: By the end of the second quarter, FPT's total assets reached VND60,556 billion, up 17.3% compared to the beginning of the year. In which, the amount of cash and bank deposits of FPT Corp was VND26,688 billion, an increase of 37.5% compared to the beginning of the year and an increase of nearly 54% compared to the end of the first quarter. This amount currently accounts for about 44% of the total assets of the corporation.

Market by numbers

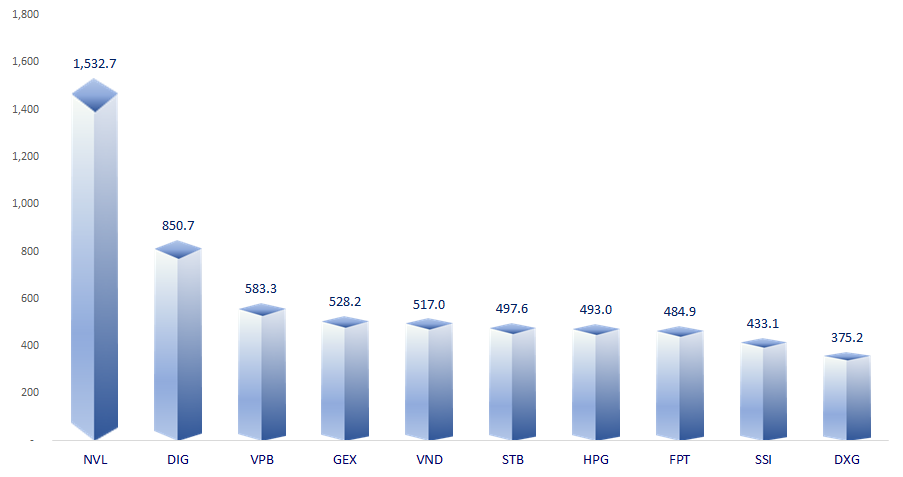

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

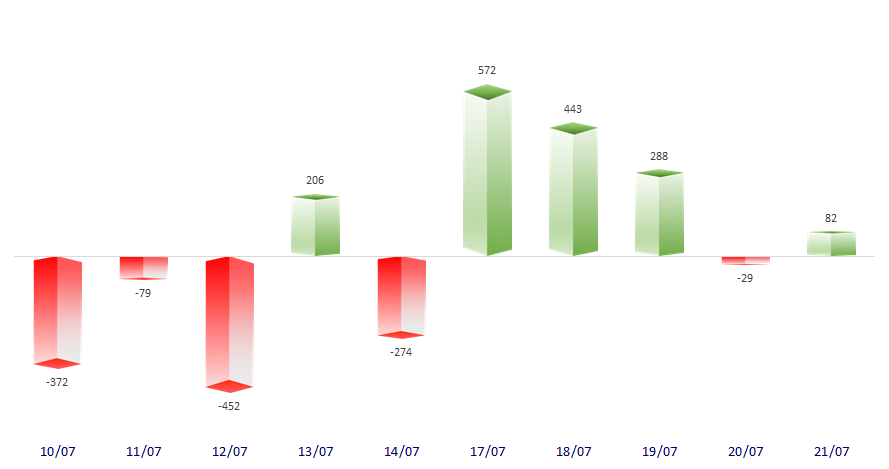

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

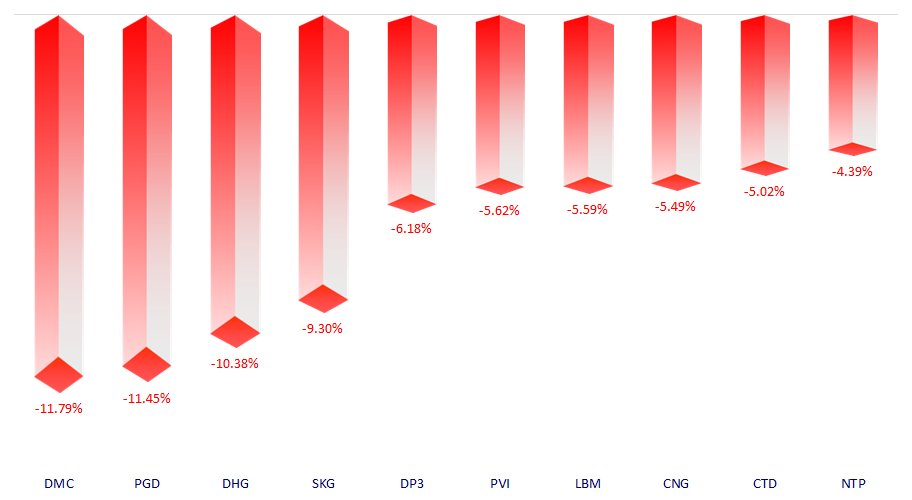

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.