Market brief 25/07/2023

VIETNAM STOCK MARKET

1,195.90

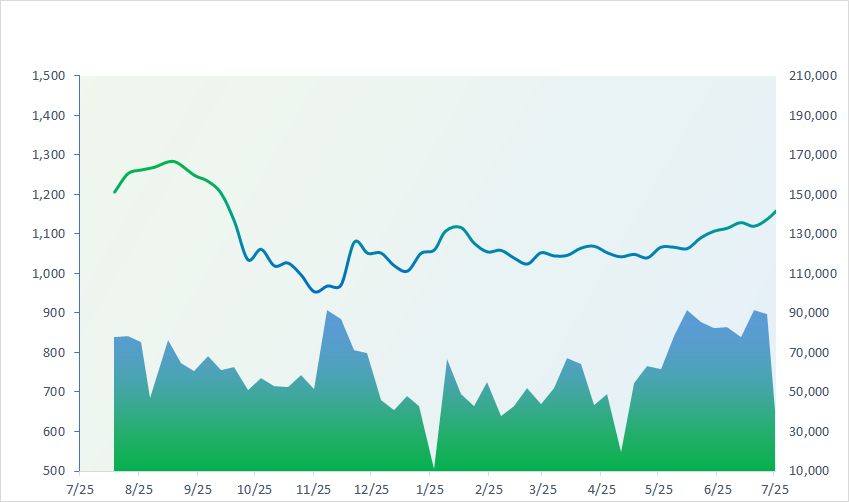

1D 0.44%

YTD 18.75%

1,198.01

1D 0.41%

YTD 19.18%

236.93

1D 0.17%

YTD 15.40%

88.58

1D -0.12%

YTD 23.63%

86.38

1D 0.00%

YTD 0.00%

22,879.70

1D -1.03%

YTD 165.55%

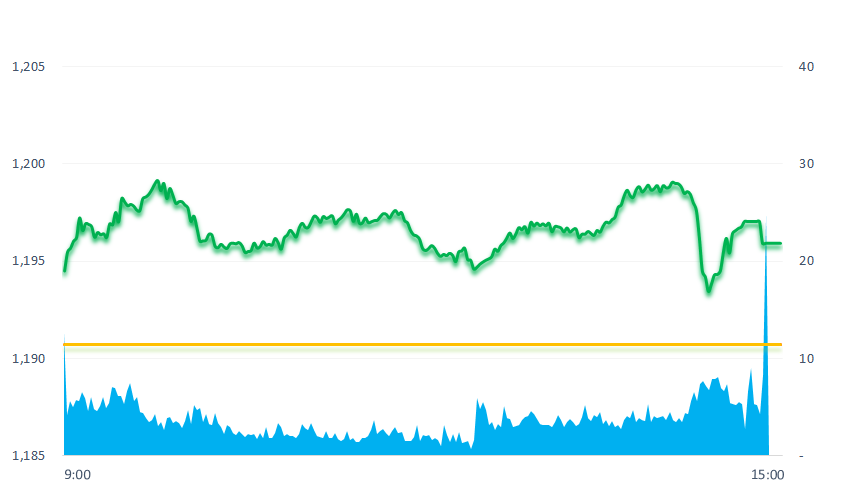

Today, the stock market has a good momentum right from the beginning of the session, showing the desire to conquer the milestone of 1,200 points. However, the gaining momentum only pulled the index to the highest level of 1,199.27. Market liquidity was high when the trading volume reached more than 1 million shares and the trading value recorded nearly VND20,150 billion.

ETF & DERIVATIVES

20,500

1D 0.54%

YTD 18.29%

14,190

1D 0.64%

YTD 19.04%

14,720

1D 0.27%

YTD 17.95%

18,200

1D 0.00%

YTD 29.54%

18,380

1D 0.16%

YTD 28.08%

26,090

1D 0.73%

YTD 16.47%

15,590

1D 0.52%

YTD 20.39%

1,194

1D 0.22%

YTD 0.00%

1,194

1D 0.41%

YTD 0.00%

1,185

1D 0.60%

YTD 0.00%

1,182

1D 0.42%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

0

1D 32649.5

YTD -0.001315286

0

1D 3231.52

YTD 0.02128843

0

1D 11021.29

YTD 0.025447092

0

1D 19430.01

YTD 0.042047088

0

1D 2636.46

YTD 0.003016895

0

1D 66355.71

YTD -0.000437902

0

1D 3286.16

YTD 0.006437703

0

1D 1526.3

YTD 0.001634062

0

1D 82.17

YTD -0.010238497

0

1D 1962.6

YTD 0.001132434

Asian stock markets traded mixed on July 25 as the market waited for more signals from the Federal Reserve meeting today. China's Hang Seng, Shenzhen and Shanghai indexes were among the day's best performers, up 4.2%, 2.54% and 2.13% respectively, after top Chinese officials promised more policies to support growth

VIETNAM ECONOMY

0.25%

1D (bps) 5

YTD (bps) -472

6.30%

YTD (bps) -110

1.90%

1D (bps) -28

YTD (bps) -289

2.46%

1D (bps) 2

YTD (bps) -244

23,871

1D (%) 0.08%

YTD (%) 0.47%

26,574

1D (%) -1.42%

YTD (%) 3.57%

3,381

1D (%) 0.48%

YTD (%) -2.98%

According to the latest report of the State Bank of Vietnam, by the end of May 2023, the total payment at credit institutions, including deposits of economic organizations, deposits of residents, and valuable paper issuances reached a balance of VND14,517 million billion, up 2.05% compared to the end of 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Residents deposited nearly VND6.35 million billion in banks, a record high;

- The State Bank has affirmed that it does not tighten conditions for loans;

- Credit package of VND120,000 billion: More than 1,000 billion VND has been committed to lend;

- Eurozone business activity dropped sharply in July;

- China acknowledged economic difficulties and signaled to support the soaring real estate and stock markets;

- Inflation surpasses the US, Japan's economy is at risk of stagnation.

VN30

BANK

91,700

1D 3.54%

5D 3.84%

Buy Vol. 3,898,713

Sell Vol. 3,323,582

47,150

1D 0.75%

5D 0.96%

Buy Vol. 2,572,091

Sell Vol. 3,608,455

29,900

1D 0.17%

5D 0.17%

Buy Vol. 11,500,727

Sell Vol. 14,375,061

33,500

1D 3.24%

5D 3.72%

Buy Vol. 23,372,038

Sell Vol. 23,104,686

21,850

1D 0.00%

5D 4.30%

Buy Vol. 45,161,083

Sell Vol. 49,944,349

18,800

1D 0.27%

5D 1.08%

Buy Vol. 18,977,691

Sell Vol. 24,280,784

17,200

1D -0.29%

5D 4.65%

Buy Vol. 6,955,499

Sell Vol. 6,949,314

19,000

1D 1.88%

5D 0.26%

Buy Vol. 25,446,743

Sell Vol. 27,738,701

28,500

1D -0.70%

5D 0.18%

Buy Vol. 33,975,319

Sell Vol. 47,264,669

20,950

1D -0.24%

5D 1.95%

Buy Vol. 8,532,093

Sell Vol. 11,676,136

22,300

1D 1.13%

5D 1.36%

Buy Vol. 23,807,894

Sell Vol. 30,221,572

TCB: In the first 6 months of the year, TCB's net interest income decreased by 19% yoy to VND12,822 billion, due to an increase in interest payments on deposits (2.8 times) and loan interests (4.2 times). Profit from service activities increased by 8% to nearly VND3,964 billion, thanks to payment service and cash collection of VND4,166 billion (+68%). Notably, profit from other activities was more than VND1,996 billion, up 62% over the same period, because of the recognition of VND1,775 billion in income from the sale of investment properties.

REAL ESTATE

16,200

1D 0.00%

5D 7.64%

Buy Vol. 78,558,361

Sell Vol. 94,750,629

78,000

1D -1.52%

5D -2.26%

Buy Vol. 249,953

Sell Vol. 287,247

21,350

1D 0.00%

5D 10.91%

Buy Vol. 31,294,457

Sell Vol. 28,470,098

PDR: In 1H2023, PDR's net revenue reached more than VND197 billion and net profit reached nearly VND300 billion, down 87% and 57% respectively compared to HoH.

OIL & GAS

98,800

1D 0.30%

5D -1.00%

Buy Vol. 898,612

Sell Vol. 958,643

13,250

1D -0.38%

5D -1.85%

Buy Vol. 21,948,338

Sell Vol. 32,348,261

40,300

1D 0.00%

5D -0.62%

Buy Vol. 3,195,737

Sell Vol. 4,508,827

From August 25, Nghi Son Refinery will suspend production for 55 days for the first time for maintenance after nearly 5 years. Nghi Son Refinery accounts for 35-40% of the domestic market's demand

VINGROUP

51,500

1D -0.96%

5D -2.28%

Buy Vol. 5,854,977

Sell Vol. 6,133,983

58,600

1D -0.85%

5D -0.34%

Buy Vol. 5,057,628

Sell Vol. 5,291,798

29,000

1D 2.11%

5D 2.47%

Buy Vol. 14,496,888

Sell Vol. 16,803,064

VIC: 6M2023, a subsidiary of Vingroup (VNB) recorded net revenue of more than VND16.8 billion, up nearly 14% HoH; profit after tax increased by 92% to VND32.7 billion, up 92% compared to 2022

FOOD & BEVERAGE

74,500

1D 1.22%

5D 2.90%

Buy Vol. 8,448,511

Sell Vol. 7,326,878

83,400

1D -0.71%

5D 3.60%

Buy Vol. 3,073,907

Sell Vol. 3,233,989

158,000

1D 1.94%

5D 3.20%

Buy Vol. 607,033

Sell Vol. 624,626

MSN: Q2/2023, NET Detergent (a subsidiary of Masan) after-tax profit of more than VND59 billion, up 149% compared to the second quarter of 2022, the highest in the history of operation.

OTHERS

46,900

1D -0.74%

5D -0.32%

Buy Vol. 2,019,712

Sell Vol. 2,391,608

97,100

1D 0.31%

5D 0.83%

Buy Vol. 1,522,748

Sell Vol. 1,573,158

81,300

1D 0.37%

5D 3.30%

Buy Vol. 1,679,046

Sell Vol. 2,061,142

53,600

1D -1.65%

5D 11.55%

Buy Vol. 8,568,785

Sell Vol. 9,160,650

21,800

1D -1.80%

5D -0.23%

Buy Vol. 4,128,403

Sell Vol. 4,449,941

28,800

1D 0.35%

5D 0.88%

Buy Vol. 31,110,419

Sell Vol. 31,840,111

28,250

1D 0.00%

5D 3.86%

Buy Vol. 37,191,607

Sell Vol. 36,607,966

SSI: Accumulated in the first half of the year, SSI achieved operating revenue of more than VND3 trillion, down 15% and pre-tax profit of more than VND1.2 trillion, down 9%. Consolidated revenue is estimated at VND3,184 billion and profit before tax is estimated at VND1,321 billion; fulfilled 46% of revenue plan and 52% of profit plan.

Market by numbers

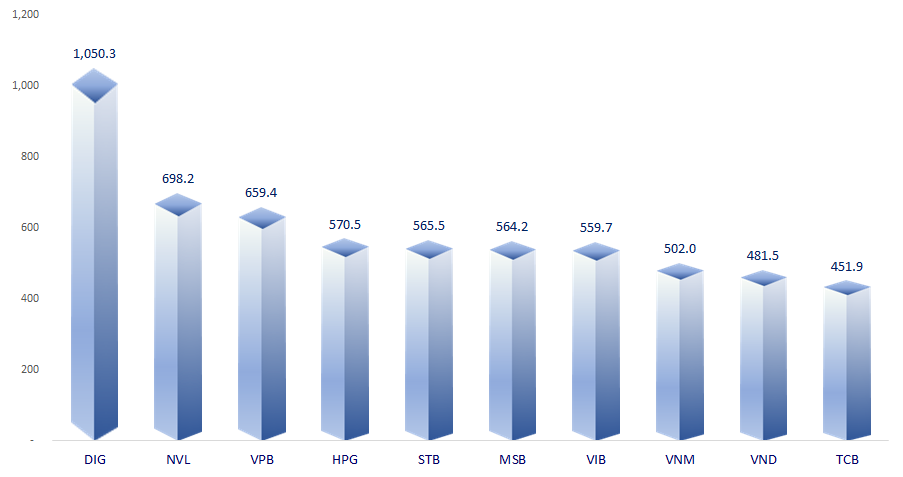

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

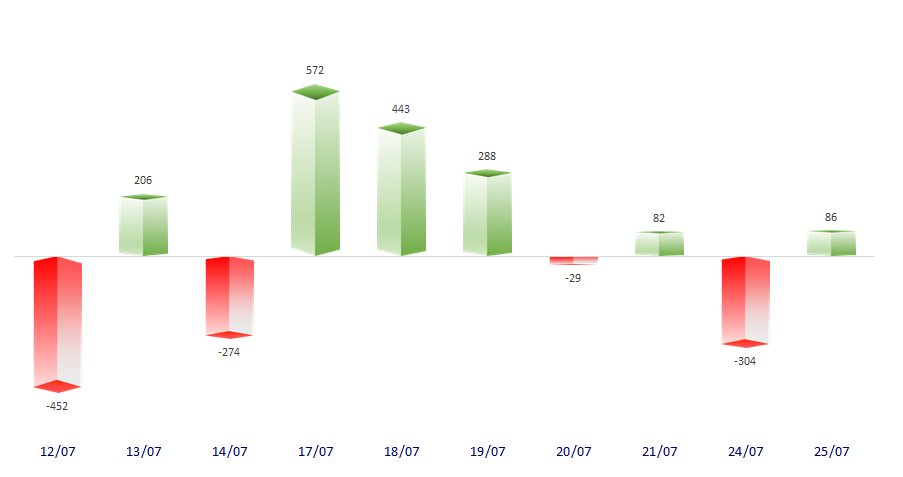

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

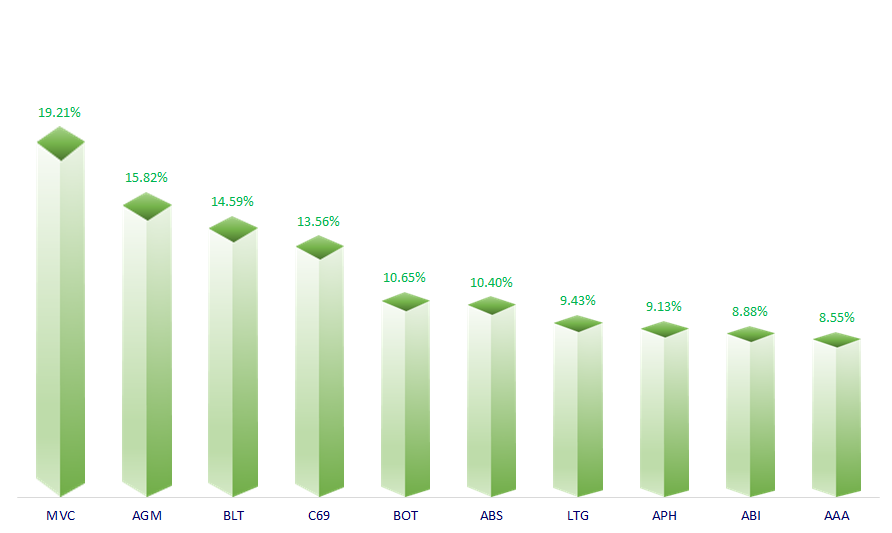

TOP INCREASES 3 CONSECUTIVE SESSIONS

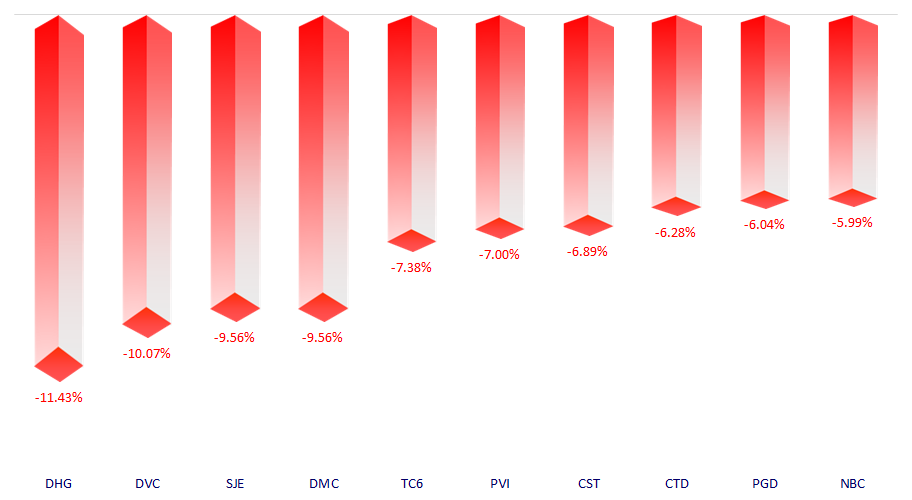

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.