Market brief 28/07/2023

VIETNAM STOCK MARKET

1,207.67

1D 0.86%

YTD 19.92%

1,212.45

1D 1.06%

YTD 20.62%

237.54

1D 0.81%

YTD 15.70%

88.91

1D 0.30%

YTD 24.09%

373.45

1D 0.00%

YTD 0.00%

24,791.95

1D -2.62%

YTD 187.75%

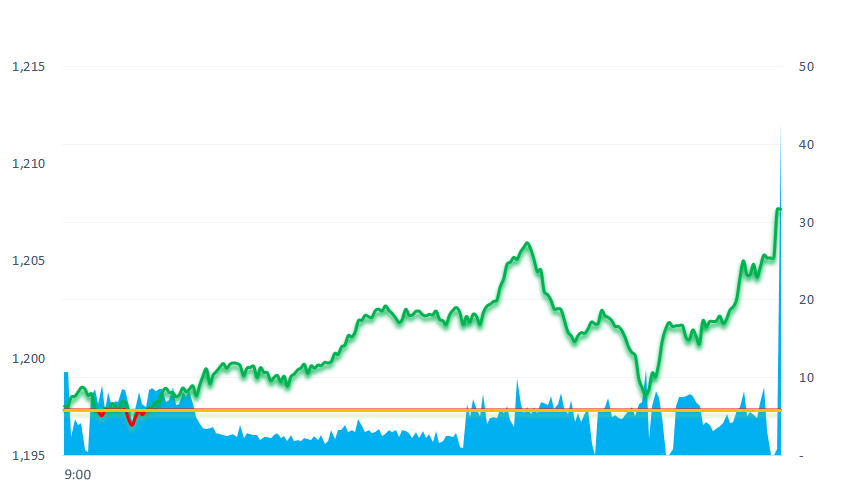

Today, the stock market struggled at the beginning of the session, but after 10a.m, the market's momentum soon returned, helping VNIndex to close at the highest price in the session. Liquidity remained at a high level with volume and trading value reaching over 1.1 billion shares and nearly VND22,000 billion on HSX, respectively.

ETF & DERIVATIVES

20,750

1D 1.07%

YTD 19.73%

14,350

1D 1.06%

YTD 20.39%

14,950

1D 1.56%

YTD 19.79%

18,770

1D 2.01%

YTD 33.59%

18,590

1D 0.81%

YTD 29.55%

26,500

1D 0.88%

YTD 18.30%

15,730

1D 0.64%

YTD 21.47%

1,210

1D 1.36%

YTD 0.00%

1,210

1D 1.44%

YTD 0.00%

1,204

1D 1.34%

YTD 0.00%

1,203

1D 1.66%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

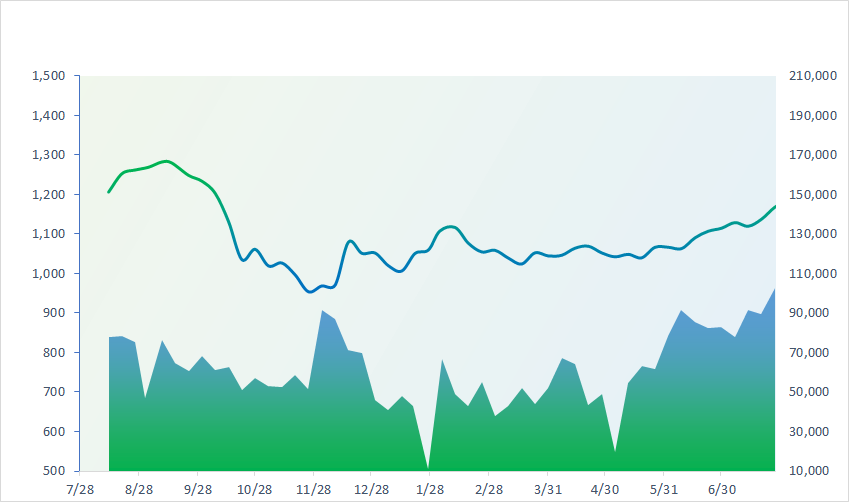

VNINDEX (12M)

GLOBAL MARKET

0

1D 32766.5

YTD -0.004662819

0

1D 3275.93

YTD 0.018422779

0

1D 11100.4

YTD 0.016169326

0

1D 19916.56

YTD 0.014127422

0

1D 2608.32

YTD 0.001732077

0

1D 66008.88

YTD -0.003892446

0

1D 3364.77

YTD 0.008194953

0

1D 1543.27

0

1D 83.42

YTD -0.004296968

0

1D 1950.49

YTD 0.001494162

Chinese stocks continued their previous gains as investors braced for possible policy easing from Beijing. The Shanghai, Shenzhen and Hang Seng indexes all recorded good gains of 1.84%, 1.62% and 1.41%, respectively. Automaker shares rallied after news Volkswagen poured $700 million into Chinese electric vehicle maker XPeng

VIETNAM ECONOMY

0.23%

1D (bps) 1

YTD (bps) -474

6.30%

YTD (bps) -110

1.85%

1D (bps) -2

YTD (bps) -294

2.41%

1D (bps) -3

YTD (bps) -249

23,863

1D (%) 0.09%

YTD (%) 0.43%

26,695

1D (%) -0.05%

YTD (%) 4.04%

3,380

1D (%) 0.33%

YTD (%) -3.01%

As of July 20, 2023, the total newly registered capital, adjusted and contributed capital to buy shares, buy capital contributions from foreign investors reached nearly USD16.24 billion, up 4.5% over the same period in 2022, an increase of 8.8 percentage points compared to the first 6 months of the year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Prime Minister directed the State Bank to implement synchronous solutions to reduce lending interest rates;

- Vietnamese rice prices increased by over 35%, Thai goods jumped to USD603/ton;

- Total FDI into Vietnam reached more than USD16 billion in the first 7 months of 2023;

- US GDP grew by 2.4% in Q2, showing no signs of recession;

- European Central Bank raised interest rates for the 9th time;

- Inflation and government debt are still the main challenges for the global economy.

VN30

BANK

93,000

1D 0.32%

5D 4.61%

Buy Vol. 2,163,840

Sell Vol. 1,508,918

46,700

1D 0.00%

5D -0.11%

Buy Vol. 2,820,317

Sell Vol. 4,036,413

29,500

1D 0.51%

5D -0.67%

Buy Vol. 9,248,129

Sell Vol. 9,567,833

33,800

1D 2.11%

5D 4.64%

Buy Vol. 10,668,028

Sell Vol. 8,855,722

22,100

1D 1.61%

5D 3.27%

Buy Vol. 32,314,994

Sell Vol. 29,818,100

18,700

1D 0.54%

5D 0.27%

Buy Vol. 15,000,836

Sell Vol. 14,316,155

17,250

1D 0.29%

5D 0.29%

Buy Vol. 6,042,322

Sell Vol. 5,217,220

18,700

1D 0.81%

5D -0.27%

Buy Vol. 12,460,084

Sell Vol. 14,943,277

28,650

1D 1.96%

5D -0.35%

Buy Vol. 45,067,069

Sell Vol. 40,805,944

20,750

1D 0.48%

5D 0.97%

Buy Vol. 6,237,150

Sell Vol. 5,467,391

22,200

1D 0.23%

5D 0.45%

Buy Vol. 21,126,214

Sell Vol. 18,494,944

TPB: TPBank has cut risk provision expenses by more than half in the last two quarters, from more than VND1,400 billion in the first 6 months of 2022 to VND683 billion. However, the bank's pre-tax profit still fell by nearly 11% due to the weakening of net interest income. Excluding the impact of risk provisions, TPBank's net profit even decreased by nearly 22% compared to the same period last year.

REAL ESTATE

18,350

1D 2.80%

5D 21.12%

Buy Vol. 122,179,285

Sell Vol. 129,446,732

78,000

1D -0.64%

5D -2.01%

Buy Vol. 262,420

Sell Vol. 182,343

21,850

1D -0.68%

5D 5.05%

Buy Vol. 26,066,817

Sell Vol. 24,637,129

NVL: Diamond Properties, the second largest shareholder of Novaland, has not sold any shares out of the total of more than 13.6 million registered NVL shares.

OIL & GAS

99,500

1D 1.32%

5D 0.10%

Buy Vol. 1,106,973

Sell Vol. 1,126,640

13,550

1D 1.88%

5D 2.26%

Buy Vol. 40,000,639

Sell Vol. 37,095,666

40,050

1D 0.38%

5D -1.11%

Buy Vol. 2,822,336

Sell Vol. 2,820,769

POW: Q2/2023 with net revenue of VND8,431 billion, up 13% QoQ. COGS increased by nearly 22% to VND7,961 billion, causing gross profit to decrease to VND469 billion.

VINGROUP

51,500

1D 0.78%

5D -1.15%

Buy Vol. 6,162,637

Sell Vol. 5,769,089

58,900

1D 2.43%

5D -0.17%

Buy Vol. 4,117,365

Sell Vol. 3,577,651

28,800

1D 1.05%

5D 1.41%

Buy Vol. 10,527,081

Sell Vol. 14,067,417

VRE: Total consolidated net revenue in Q2 reached VND2,173 billion, up 17% QoQ. In which, shopping mall business recorded a revenue of VND1,943 billion, up 7% over the same period

FOOD & BEVERAGE

77,400

1D 2.25%

5D 5.31%

Buy Vol. 9,714,343

Sell Vol. 8,655,789

86,100

1D 2.26%

5D 3.73%

Buy Vol. 4,081,372

Sell Vol. 3,418,501

157,000

1D -2.00%

5D 2.55%

Buy Vol. 444,395

Sell Vol. 673,011

SAB: In Q2/2023, Sabeco's gross profit margin decreased from 34.3% to 29.9% - the lowest level in many years and very low compared to over 50% of its main competitor - Heineken.

OTHERS

46,650

1D 0.21%

5D -1.79%

Buy Vol. 1,338,009

Sell Vol. 1,501,297

97,800

1D 0.93%

5D -0.20%

Buy Vol. 1,281,077

Sell Vol. 1,308,639

84,400

1D 0.84%

5D 4.20%

Buy Vol. 1,661,352

Sell Vol. 1,649,793

54,500

1D 0.74%

5D 4.81%

Buy Vol. 5,868,264

Sell Vol. 7,590,481

22,000

1D 1.38%

5D 0.00%

Buy Vol. 7,162,314

Sell Vol. 7,491,395

29,750

1D 1.02%

5D 3.48%

Buy Vol. 22,468,386

Sell Vol. 28,139,399

28,300

1D -0.35%

5D -0.35%

Buy Vol. 39,904,658

Sell Vol. 43,512,709

HPG: In Q2/2023, Hoa Phat Group achieved a revenue of VND29,800 billion, down 21% QoQ. Profit after tax was VND1,448 billion, down 64% YoY, but better than in recent quarters. Accumulated in the first 6 months, Hoa Phat recorded VND56,665 billion in revenue and more than VND1,830 billion in profit after tax, reaching 23% of the year plan.

Market by numbers

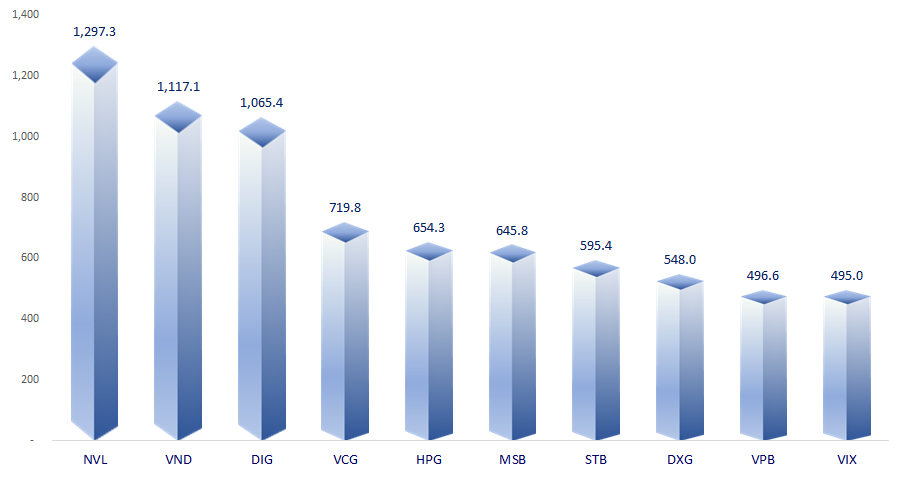

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

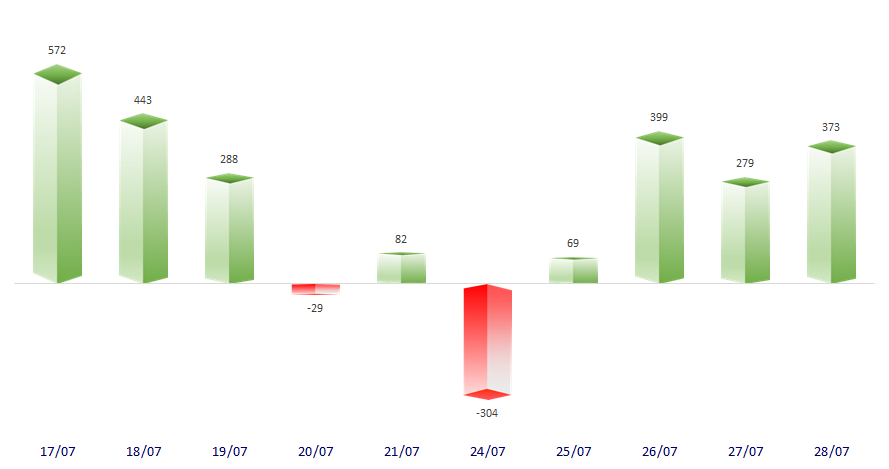

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

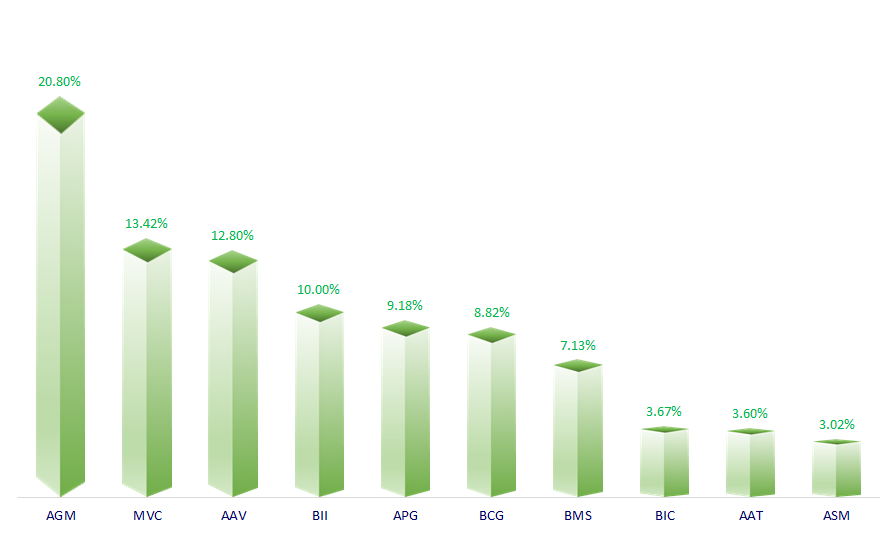

TOP INCREASES 3 CONSECUTIVE SESSIONS

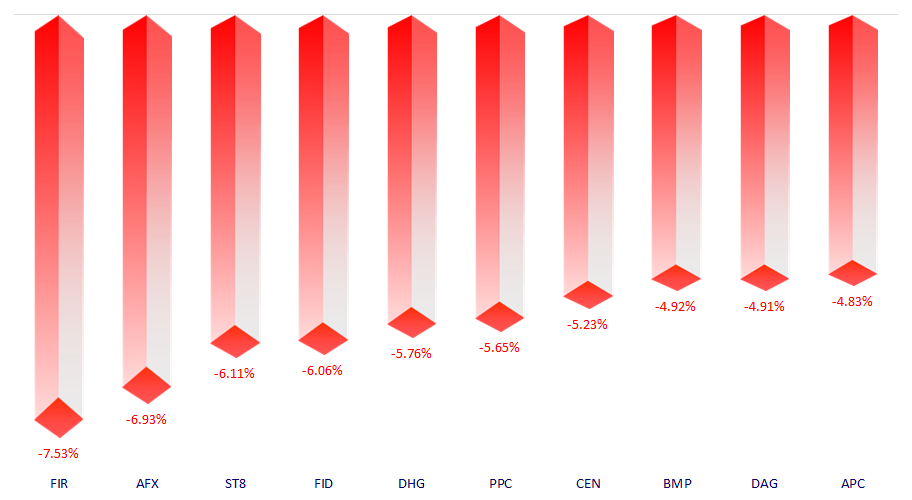

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.