Market brief 02/08/2023

VIETNAM STOCK MARKET

1,220.43

1D 0.24%

YTD 21.18%

1,221.32

1D -0.07%

YTD 21.50%

241.31

1D 0.82%

YTD 17.53%

90.88

1D 0.74%

YTD 26.84%

77.07

1D 0.00%

YTD 0.00%

21,952.10

1D -32.34%

YTD 154.78%

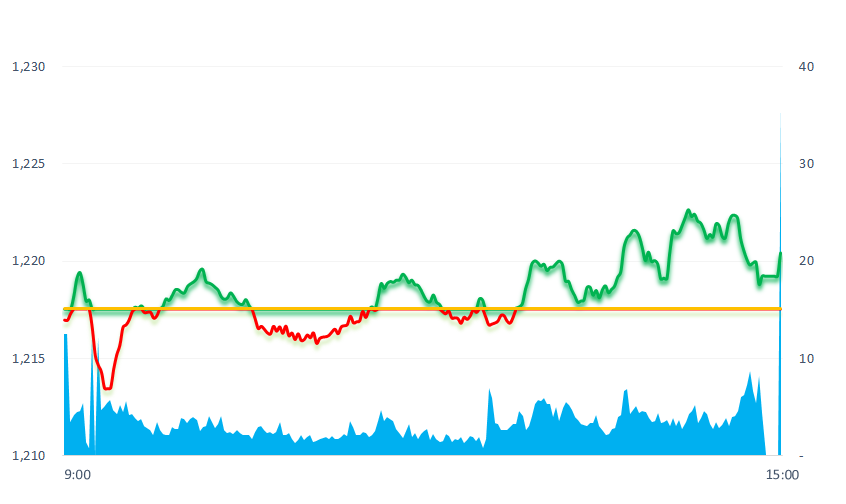

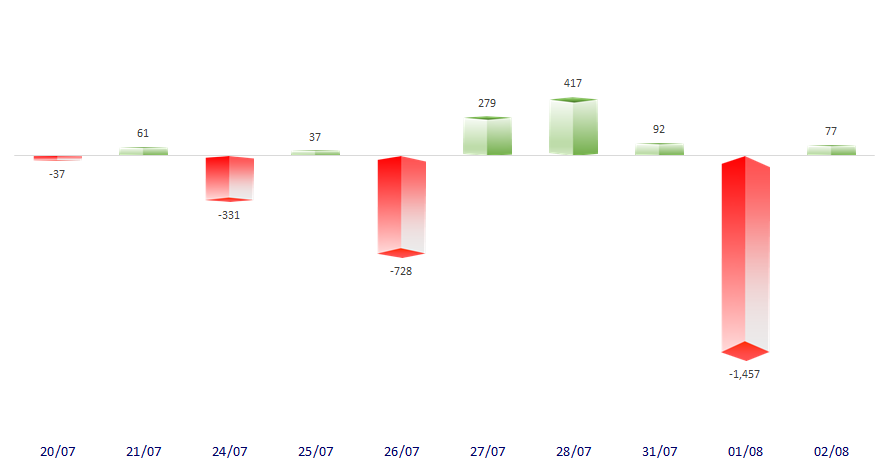

Today, most of time the stock market trades in a narrow range, just around the reference level. Gradually towards the end of the session, VNIndex gained slightly more than 2.87 points. Foreigners turned to be net buyers of less than VND77 billion in the whole market, focusing mainly on MSB (+VND246 billion), besides, CTG (+VND86.5 billion), NVL and DCM (+VND44 billion). …

ETF & DERIVATIVES

20,900

1D -0.57%

YTD 20.60%

14,440

1D -0.07%

YTD 21.14%

14,990

1D -0.79%

YTD 20.11%

18,900

1D -1.31%

YTD 34.52%

18,720

1D -0.37%

YTD 30.45%

26,150

1D -0.61%

YTD 16.74%

16,060

1D 0.44%

YTD 24.02%

1,218

1D -0.16%

YTD 0.00%

1,219

1D -0.45%

YTD 0.00%

1,218

1D -0.23%

YTD 0.00%

1,215

1D -0.03%

YTD 0.00%

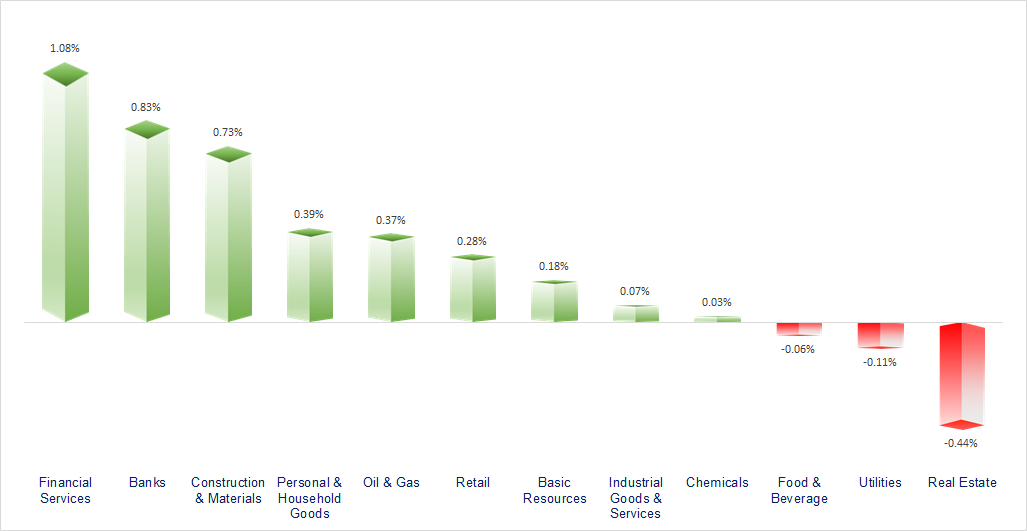

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

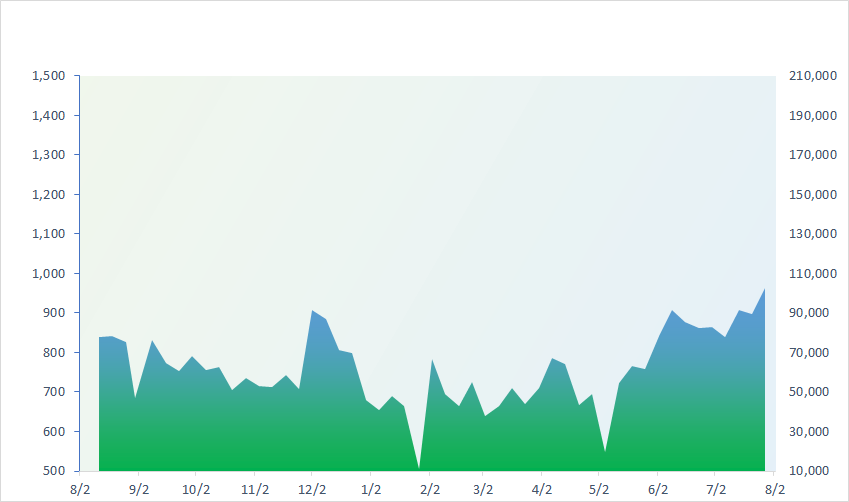

VNINDEX (12M)

GLOBAL MARKET

0

1D 32707.5

YTD -0.022679396

0

1D 3261.69

YTD -0.00889105

0

1D 11104.16

YTD -0.003506165

0

1D 19517.38

YTD -0.024673282

0

1D 2616.47

YTD -0.01897213

0

1D 65782.78

YTD -0.011238755

0

1D 3325.02

YTD -0.013736419

0

1D 1550.28

YTD -0.00371451

0

1D 85.5

YTD -0.004192872

0

1D 1950.64

YTD 0.000892811

Asian markets fell on news that US government bonds were downgraded, as recent concerns about the US public debt ceiling increased market concerns.

VIETNAM ECONOMY

0.26%

1D (bps) 4

YTD (bps) -471

6.30%

YTD (bps) -110

1.83%

1D (bps) -34

YTD (bps) -296

2.40%

1D (bps) -4

YTD (bps) -250

23,957

1D (%) 0.41%

YTD (%) 0.83%

26,495

1D (%) -1.08%

YTD (%) 3.26%

3,378

1D (%) 0.24%

YTD (%) -3.07%

By the end of July 2023, the disbursement of government investment capital of Ho Chi Minh City only reached VND19,135 billion (reaching 28%), out of a total of more than VND70,000 billion allocated by the Government in 2023.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- HSBC: SBV will cut interest rates for the last time in the easing cycle;

- Over half of 2023, disbursement of government investment capital in Ho Chi Minh City is less than 30%;

- Shipping enterprises face difficulties;

- The US credit rating downgraded;

- The yen fell to a three-week low;

- Manufacturing activity in Asia contracted in July on weak demand.

VN30

BANK

91,500

1D 0.33%

5D -2.03%

Buy Vol. 1,719,756

Sell Vol. 1,672,355

49,100

1D 1.87%

5D 3.70%

Buy Vol. 4,406,901

Sell Vol. 4,220,884

31,050

1D 2.14%

5D 4.19%

Buy Vol. 25,316,758

Sell Vol. 24,710,565

33,900

1D -0.29%

5D 1.35%

Buy Vol. 8,831,557

Sell Vol. 7,901,719

22,000

1D 0.23%

5D 0.69%

Buy Vol. 30,894,057

Sell Vol. 39,107,699

18,900

1D 0.27%

5D 0.80%

Buy Vol. 12,458,684

Sell Vol. 15,542,472

17,400

1D -0.85%

5D 1.16%

Buy Vol. 3,252,586

Sell Vol. 3,635,861

18,900

1D 0.53%

5D 0.53%

Buy Vol. 12,777,452

Sell Vol. 13,457,484

29,100

1D 0.52%

5D 2.83%

Buy Vol. 34,929,534

Sell Vol. 37,456,119

20,700

1D 0.24%

5D -0.48%

Buy Vol. 11,160,385

Sell Vol. 9,543,884

23,100

1D 1.09%

5D 3.59%

Buy Vol. 20,415,549

Sell Vol. 20,861,963

CTG: VietinBank's pre-tax profit is VND6,550 billion in the second quarter, up 13.2% over the same period in 2022. This is the fourth consecutive quarter of profit growth and also the largest quarterly profit since second quarter of 2021. In the first 6 months of the year, VietinBank's consolidated profit before tax reached VND12,530 billion, up 8% over the same period. Thereby, bringing VietinBank back to the 4th position in terms of profits among listed banks, after Vietcombank, BIDV and MB.

REAL ESTATE

18,350

1D 3.09%

5D 6.69%

Buy Vol. 108,842,450

Sell Vol. 85,702,386

77,900

1D -1.39%

5D -0.64%

Buy Vol. 311,674

Sell Vol. 469,571

21,400

1D 2.64%

5D -0.70%

Buy Vol. 19,116,674

Sell Vol. 15,756,648

NVL: Aqua City, a subsidiary of Novaland, has fully paid the principal and interest of the bonds in payments in the second half of 2023, nearly VND321 billion.

OIL & GAS

100,400

1D -0.30%

5D 2.24%

Buy Vol. 697,926

Sell Vol. 889,772

13,700

1D 1.86%

5D 1.11%

Buy Vol. 19,918,934

Sell Vol. 23,623,675

40,950

1D -0.12%

5D 1.11%

Buy Vol. 2,135,409

Sell Vol. 2,947,346

PLX: 6M2023, PLX's net revenue decreased 12% to VND133,184 billion. A sharp decrease in expenses and an increase in financial revenue helped pre-tax profit to VND1,868 billion( rise 6 times HoH)

VINGROUP

58,300

1D -1.02%

5D 14.31%

Buy Vol. 22,367,361

Sell Vol. 25,909,605

61,900

1D -1.43%

5D 4.92%

Buy Vol. 5,199,149

Sell Vol. 5,697,372

28,900

1D -0.69%

5D 0.00%

Buy Vol. 7,451,051

Sell Vol. 9,088,963

VIC: VIC will issue 5 lots of bonds to the public with a total value of VND10,000 billion for the purpose of lending VinFast to invest in an automobile manufacturing project in Cat Hai, Hai Phong.

FOOD & BEVERAGE

76,100

1D 0.13%

5D 1.47%

Buy Vol. 5,055,006

Sell Vol. 4,797,736

85,200

1D -1.73%

5D 0.71%

Buy Vol. 3,668,166

Sell Vol. 3,177,568

158,900

1D 0.32%

5D -1.67%

Buy Vol. 302,309

Sell Vol. 375,433

SAB: At the end of Q2/2023, SAB had nearly VND22.4 trillion (nearly 1 billion USD) in cash and short-term deposits (accounting for more than 67% of total assets). Inventory is more than VND2.5 trillion.

OTHERS

47,850

1D 1.27%

5D 2.57%

Buy Vol. 2,343,624

Sell Vol. 2,267,312

100,800

1D -0.40%

5D 4.46%

Buy Vol. 1,272,645

Sell Vol. 1,150,637

83,500

1D -1.18%

5D 0.97%

Buy Vol. 1,665,664

Sell Vol. 1,823,169

51,700

1D 0.00%

5D -0.77%

Buy Vol. 9,937,620

Sell Vol. 8,653,843

21,900

1D -0.45%

5D 1.39%

Buy Vol. 4,353,756

Sell Vol. 4,049,245

29,000

1D 0.69%

5D 0.00%

Buy Vol. 23,825,556

Sell Vol. 23,625,109

27,500

1D 0.00%

5D -3.17%

Buy Vol. 40,955,771

Sell Vol. 36,887,799

MWG: Bach Hoa Xanh continued to lose nearly VND659 billion in the first 6 months, of which the 2nd quarter lost more than VND300 billion. Up to now, Bach Hoa Xanh has accumulated losses of more than VND8,000 billion.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

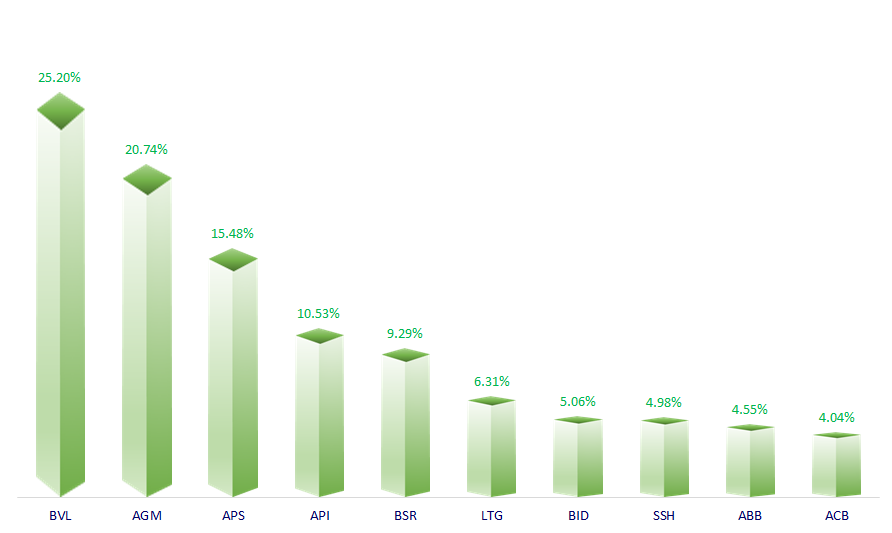

TOP INCREASES 3 CONSECUTIVE SESSIONS

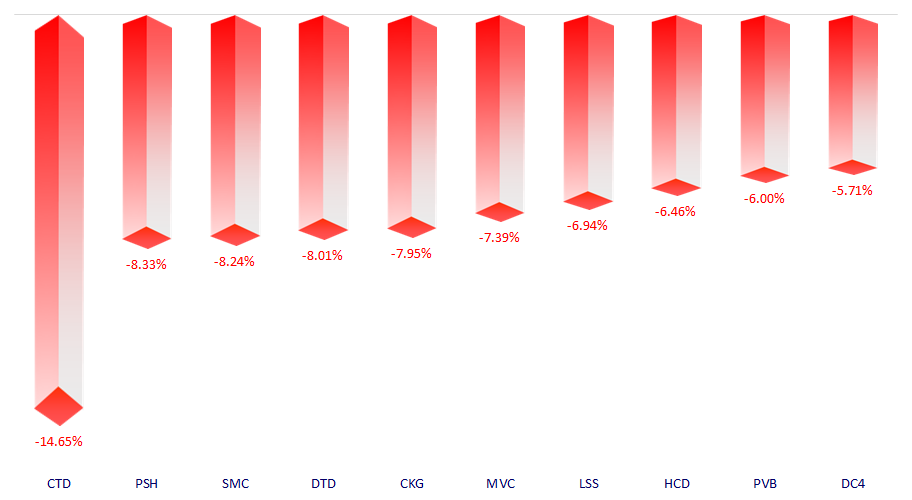

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.