Market brief 16/08/2023

VIETNAM STOCK MARKET

1,243.26

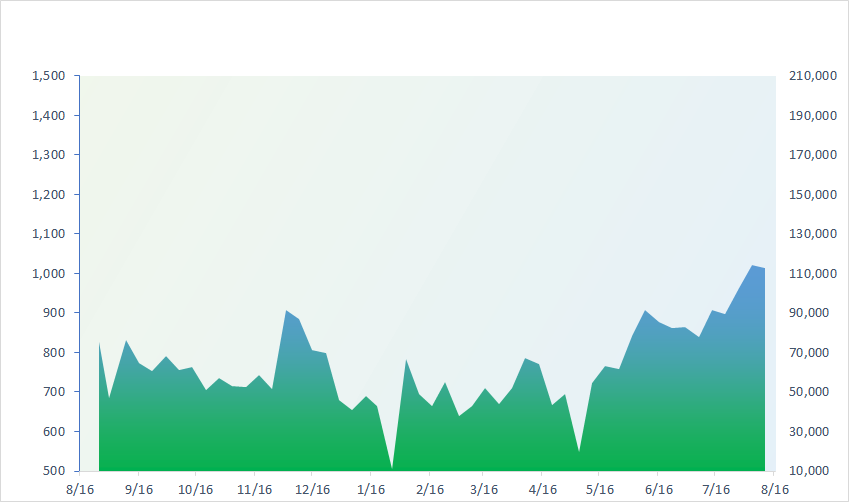

1D 0.75%

YTD 23.45%

1,256.95

1D 1.27%

YTD 25.05%

252.56

1D 0.44%

YTD 23.01%

93.67

1D 0.19%

YTD 30.73%

-67.79

1D 0.00%

YTD 0.00%

24,014.08

1D 6.80%

YTD 178.72%

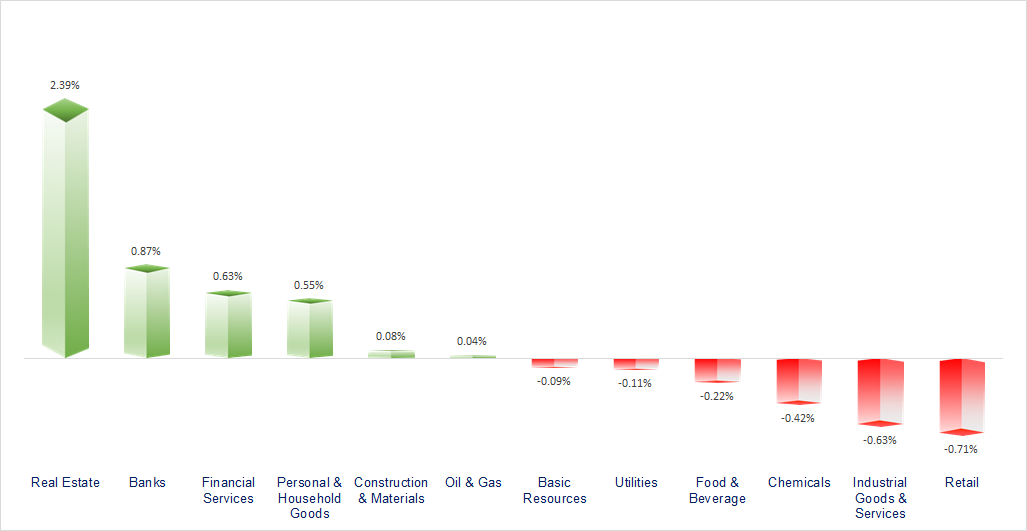

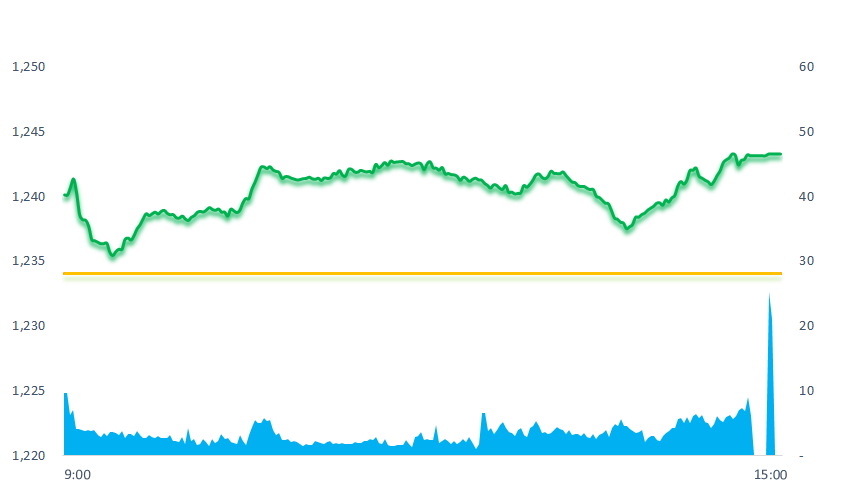

The stock market opened with a positive sentiment as green at the beginning of the session. Around 9:30, selling pressure gradually appeared and pulled the VNIndex down. However, real estate group prospered and pulled the market up again.

ETF & DERIVATIVES

21,420

1D 0.61%

YTD 23.60%

14,850

1D 1.16%

YTD 24.58%

15,440

1D 1.58%

YTD 23.72%

18,900

1D 0.00%

YTD 34.52%

19,380

1D 1.36%

YTD 35.05%

26,360

1D 0.42%

YTD 17.68%

16,420

1D 1.11%

YTD 26.80%

1,255

1D 1.15%

YTD 0.00%

1,253

1D 1.02%

YTD 0.00%

1,252

1D 1.27%

YTD 0.00%

1,249

1D 1.49%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

0

1D 31766.82

YTD -0.014642874

0

1D 3150.13

YTD -0.008201676

0

1D 10579.56

YTD -0.009379451

0

1D 18329.3

YTD -0.013551935

0

1D 2525.64

YTD -0.017593266

0

1D 65539.42

YTD 0.002102385

0

1D 3213.58

YTD -0.005926861

0

1D 1519.56

YTD -0.000769367

0

1D 84.8

YTD 0.001298855

0

1D 1905.68

YTD 0.002482956

Most Asian stock markets fell on Wednesday as there were signs of worsening economic conditions in China. China's home prices decreased further in July, when policy support measures failed to stimulate the sector.

VIETNAM ECONOMY

0.23%

1D (bps) 1

YTD (bps) -474

6.30%

YTD (bps) -110

1.78%

YTD (bps) -301

2.50%

1D (bps) 4

YTD (bps) -240

24,155

1D (%) 0.04%

YTD (%) 1.66%

26,588

1D (%) -1.05%

YTD (%) 3.62%

3,352

1D (%) -0.30%

YTD (%) -3.82%

The central exchange rate today (August 16) was announced by SBV at 23,918VND/USD, up VND38 compared to the listed level yesterday. This is the third consecutive increase of the central rate since the beginning of the week, with a total increase of VND81. With a margin of 5%, currently the USD exchange rate commercial banks are allowed to trade is from 22,722 to 25,114VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank has confirmed that it will amend Circular 06 on real estate lending;

- Vietnam may have an additional USD629 million in 2024 if the new tax is imposed;

- Good news for the real estate market: Projects that are not eligible for business can still get credit;

- Fitch warned to downgrade a series of banks, including giant JPMorgan;

- Global wealth will reach USD629 trillion within the next 5 years;

- Thousands of small hedge funds in China at risk of closing.

VN30

BANK

89,200

1D 0.34%

5D -1.11%

Buy Vol. 1,131,125

Sell Vol. 1,805,609

47,500

1D 1.06%

5D -1.45%

Buy Vol. 2,172,478

Sell Vol. 2,603,201

32,350

1D -0.15%

5D -0.46%

Buy Vol. 11,314,867

Sell Vol. 14,214,511

35,300

1D 3.67%

5D 3.82%

Buy Vol. 21,174,871

Sell Vol. 21,463,964

22,400

1D 1.82%

5D 1.59%

Buy Vol. 67,806,524

Sell Vol. 67,878,816

19,000

1D 0.26%

5D -0.78%

Buy Vol. 18,672,935

Sell Vol. 24,435,533

17,150

1D 0.59%

5D -0.87%

Buy Vol. 3,766,623

Sell Vol. 5,291,722

19,100

1D 0.53%

5D 1.33%

Buy Vol. 16,658,217

Sell Vol. 21,384,258

32,900

1D 4.44%

5D 5.45%

Buy Vol. 98,865,922

Sell Vol. 72,761,240

20,650

1D 0.24%

5D -1.43%

Buy Vol. 7,426,124

Sell Vol. 9,217,309

22,900

1D 0.22%

5D -1.29%

Buy Vol. 14,134,381

Sell Vol. 19,360,778

12,900

1D -0.39%

5D -1.90%

Buy Vol. 30,671,802

Sell Vol. 42,854,430

29,500

1D 0.00%

5D -1.67%

Buy Vol. 1,710,576

Sell Vol. 1,965,671

MBB: For terms of 6 months - 13 months - 24 months - 36 months, MB's interest rate is 6 - 6.1 - 6.4 - 6.6%/year respectively. The rate of 6.6%/year is also the highest deposit interest rate of MB currently. After adjustment, MB's 12-month term interest rate fell to the lowest level in the system, lower than the Big 4 group (Vietcombank, VietinBank, BIDV, Agribank).

OIL & GAS

100,200

1D -0.20%

5D -0.79%

Buy Vol. 1,314,343

Sell Vol. 879,510

13,900

1D 0.00%

5D 0.00%

Buy Vol. 16,693,099

Sell Vol. 24,475,781

40,250

1D -0.25%

5D -1.11%

Buy Vol. 2,087,413

Sell Vol. 3,116,185

Ending Tuesday's session, the Brent oil contract fell USD1.31 (equivalent to 1.5%) to 84.90 USD/barrel. WTI oil contract lost USD1.44 (equivalent to 1.8%) to 81.07USD/barrel.

VINGROUP

75,600

1D 6.93%

5D 14.89%

Buy Vol. 39,841,906

Sell Vol. 19,564,860

62,900

1D 1.94%

5D 3.80%

Buy Vol. 9,065,452

Sell Vol. 11,738,730

31,500

1D 0.64%

5D 1.94%

Buy Vol. 16,746,998

Sell Vol. 21,648,914

VIC: VinFast shares closed up 68.4% compared to the asking price (USD22) on Nasdaq. Currently, the market capitalization of VinFast in the US is up to 85.5 billion USD.

FOOD & BEVERAGE

73,100

1D 0.41%

5D 0.00%

Buy Vol. 3,946,628

Sell Vol. 4,267,655

81,800

1D -0.73%

5D -7.05%

Buy Vol. 3,289,943

Sell Vol. 3,219,438

157,300

1D 0.00%

5D -2.30%

Buy Vol. 364,654

Sell Vol. 543,831

VNM: As for foreign branches, AngkorMilk in Cambodia still maintained a growth rate of over 10% in Q2/2023.

OTHERS

46,900

1D -0.64%

5D -1.05%

Buy Vol. 1,095,117

Sell Vol. 1,254,526

46,900

1D -0.64%

5D -1.05%

Buy Vol. 1,095,117

Sell Vol. 1,254,526

100,800

1D -1.08%

5D -0.79%

Buy Vol. 1,230,277

Sell Vol. 1,118,860

85,100

1D 1.31%

5D 2.41%

Buy Vol. 4,879,885

Sell Vol. 4,379,924

53,800

1D -0.37%

5D 2.28%

Buy Vol. 10,032,024

Sell Vol. 8,708,917

21,350

1D -0.47%

5D -3.61%

Buy Vol. 3,948,502

Sell Vol. 3,660,987

28,850

1D 0.52%

5D 0.87%

Buy Vol. 25,760,831

Sell Vol. 30,477,248

27,950

1D 0.00%

5D 0.54%

Buy Vol. 27,130,307

Sell Vol. 28,791,460

SSI: SSI announced that it sold 2.35 million SGN shares on August 9 to restructure its portfolio. After the transaction, this organization reduced its ownership of SGN from more than 5.72 million shares (equivalent of 17.06%) to more than 3.37 million shares (10.06%).

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

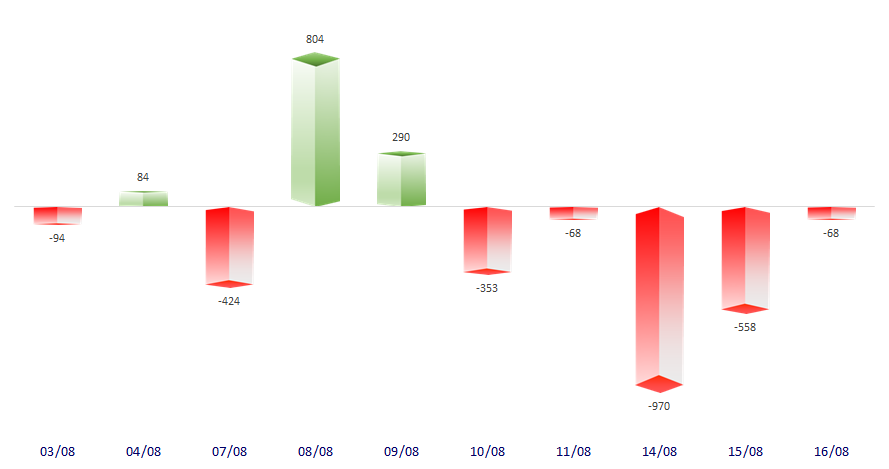

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

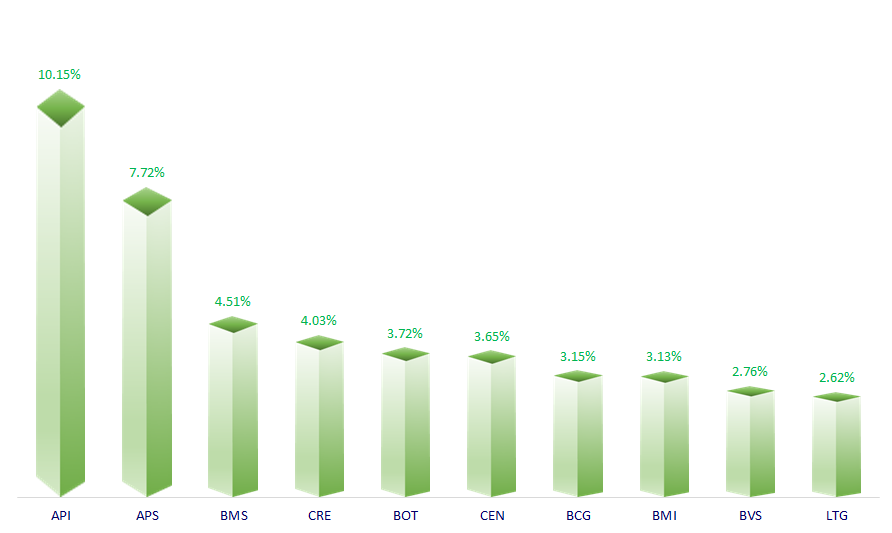

TOP INCREASES 3 CONSECUTIVE SESSIONS

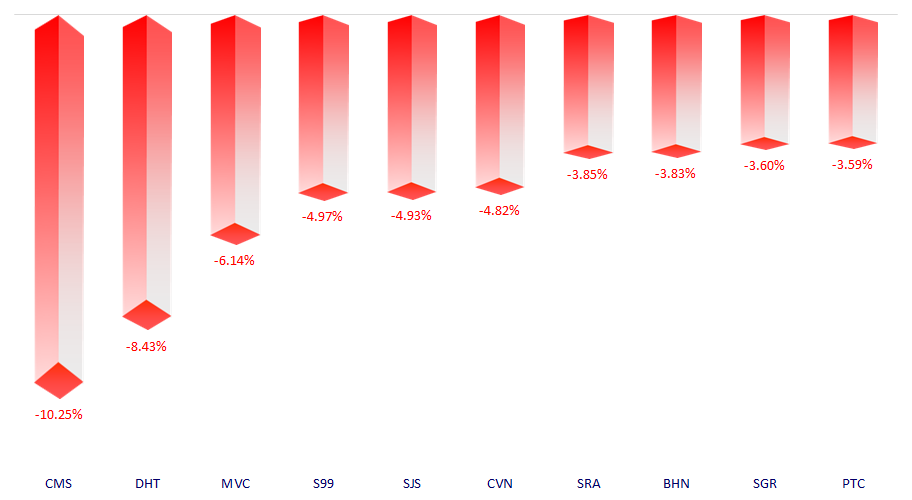

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.