Market brief 22/08/2023

VIETNAM STOCK MARKET

1,180.49

1D 0.06%

YTD 17.22%

1,193.51

1D 0.27%

YTD 18.73%

239.65

1D 0.71%

YTD 16.73%

89.51

1D 0.01%

YTD 24.93%

-709.21

1D 0.00%

YTD 0.00%

25,536.30

1D 1.66%

YTD 196.38%

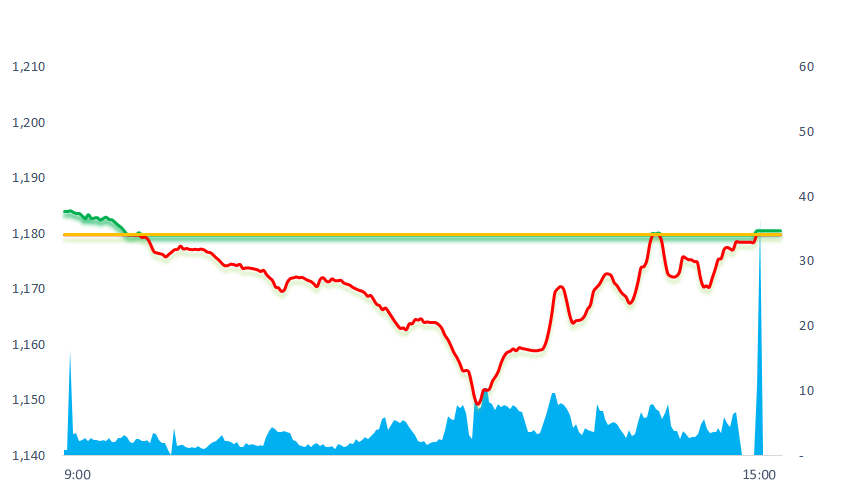

The stock market opened in the green but quickly corrected. There was a time VNIndex lost nearly 30 points with the focus on banking and real estate stocks. But close to the end, the index gradually recovered and closed slightly up.

ETF & DERIVATIVES

20,550

1D 0.49%

YTD 18.58%

14,080

1D 0.07%

YTD 18.12%

14,550

1D -1.02%

YTD 16.59%

18,600

1D 2.71%

YTD 32.38%

18,430

1D -0.70%

YTD 28.43%

25,300

1D 0.00%

YTD 12.95%

15,690

1D 0.84%

YTD 21.16%

1,196

1D 0.43%

YTD 0.00%

1,193

1D -0.55%

YTD 0.00%

1,192

1D 1.35%

YTD 0.00%

1,187

1D -0.08%

YTD 0.00%

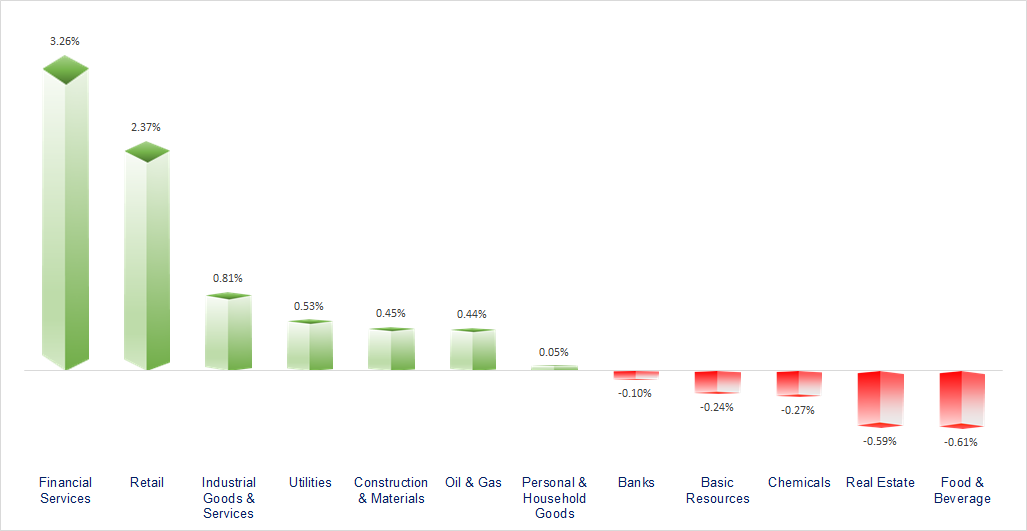

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

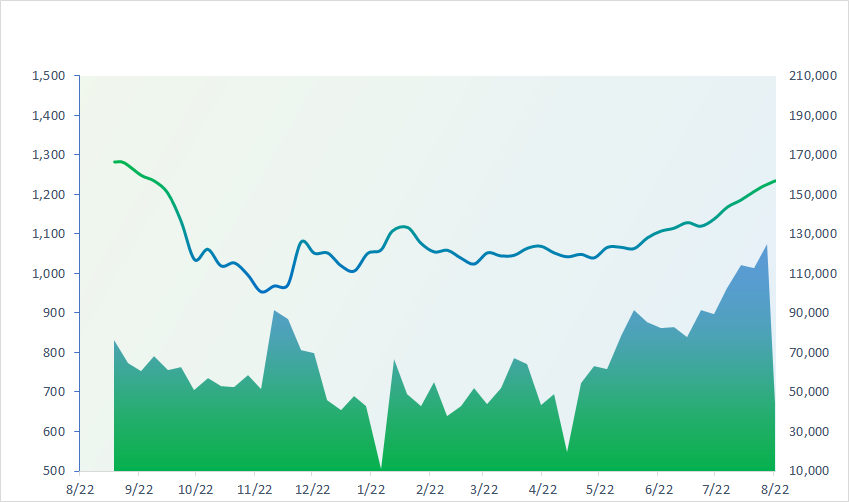

VNINDEX (12M)

GLOBAL MARKET

0

1D 31856.71

YTD 0.009221102

0

1D 3120.33

YTD 0.008842605

0

1D 10374.73

YTD 0.005265305

0

1D 17791.01

YTD 0.009516952

0

1D 2515.74

YTD 0.002766263

0

1D 65220.03

YTD 6.04145E-05

0

1D 3159.88

YTD 0.00185477

0

1D 1545.6

YTD 0.012943605

0

1D 84.31

YTD -0.002484619

0

1D 1901.82

YTD 0.002958533

Most Asian stock markets rose on Tuesday, helped by a rebound in technology shares. Japan's Nikkei 225 was the best performer in Asia on the day, up 0.92%.

VIETNAM ECONOMY

0.20%

1D (bps) -1

YTD (bps) -477

6.30%

YTD (bps) -110

1.78%

YTD (bps) -301

2.53%

1D (bps) 4

YTD (bps) -237

24,135

1D (%) 0.60%

YTD (%) 1.58%

26,497

1D (%) -0.82%

YTD (%) 3.27%

3,350

1D (%) 0.30%

YTD (%) -3.87%

Credit growth in the first 7 months of this year is much lower than the same period in 2022 (about 9.54%), not even reaching half of last year's growth. Meanwhile, credit growth orientation this year is up to 14-15%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Bad debt in the real estate sector increased sharply;

- The bank bought back nearly VND77,000 billion of bonds before maturity;

- Credit growth in the first 7 months of the year was negative, reaching only 4.56%;

- US bond yields hit a 16-year high;

- The risk of food price inflation when rice prices increase sharply;

- Following Moody's, S&P downgraded the credit rating of five US banks.

VN30

BANK

88,400

1D -1.56%

5D -0.56%

Buy Vol. 2,452,972

Sell Vol. 2,740,530

45,800

1D 0.44%

5D -2.55%

Buy Vol. 2,142,549

Sell Vol. 2,537,648

31,550

1D -1.41%

5D -2.62%

Buy Vol. 11,131,790

Sell Vol. 11,362,804

33,100

1D 1.07%

5D -2.79%

Buy Vol. 12,913,013

Sell Vol. 10,099,763

20,600

1D -0.96%

5D -6.36%

Buy Vol. 39,109,602

Sell Vol. 33,347,923

18,200

1D 0.28%

5D -3.96%

Buy Vol. 19,791,887

Sell Vol. 15,684,363

16,400

1D 1.23%

5D -3.81%

Buy Vol. 5,075,315

Sell Vol. 5,546,713

18,550

1D 0.27%

5D -2.37%

Buy Vol. 7,792,868

Sell Vol. 8,725,030

32,150

1D 1.10%

5D 2.06%

Buy Vol. 73,917,768

Sell Vol. 52,337,232

19,850

1D 0.00%

5D -3.64%

Buy Vol. 10,096,135

Sell Vol. 10,868,659

22,050

1D 0.23%

5D -3.50%

Buy Vol. 18,837,609

Sell Vol. 14,757,293

12,100

1D -0.41%

5D -6.56%

Buy Vol. 39,476,526

Sell Vol. 43,532,173

28,200

1D 6.02%

5D -4.41%

Buy Vol. 2,003,375

Sell Vol. 1,677,987

STB: Sacombank has launched a credit package of VND11,000 billion, in which a package of VND10,000 billion loans to businesses for short-term production and business with interest rates from 6.2%/year, for medium and long-term production enterprises. If customers need a car loan, they can access a loan package of VND1,000 billion with an interest rate of 9.5%/year.

OIL & GAS

100,300

1D 1.21%

5D -0.10%

Buy Vol. 1,507,034

Sell Vol. 1,123,572

12,800

1D -1.54%

5D -7.91%

Buy Vol. 32,328,802

Sell Vol. 27,507,786

37,700

1D 0.53%

5D -6.57%

Buy Vol. 2,645,689

Sell Vol. 2,894,843

POW: In August, PV Power targets mobilized electricity output of 1,054 million kWh, down 17% compared to July. Revenue is also expected to decrease by 18% to VND1,895 billion.

VINGROUP

64,500

1D -1.98%

5D -8.77%

Buy Vol. 22,023,962

Sell Vol. 22,657,196

55,500

1D -0.89%

5D -10.05%

Buy Vol. 7,088,347

Sell Vol. 6,605,431

29,300

1D -0.68%

5D -6.39%

Buy Vol. 8,538,706

Sell Vol. 10,597,078

VIC: Closing the session on August 21, VinFast shares increased 14% to 17.58 USD/share. At this price, the company's market capitalization is nearly USD41 billion.

FOOD & BEVERAGE

72,700

1D -0.27%

5D -0.14%

Buy Vol. 5,670,700

Sell Vol. 5,535,983

77,700

1D -0.89%

5D -5.70%

Buy Vol. 3,982,825

Sell Vol. 3,023,206

150,000

1D -1.77%

5D -4.64%

Buy Vol. 662,839

Sell Vol. 668,515

VNM: On August 18, Vinamilk, Gaia Nature Conservation Center and Ca Mau National Park, launched a program of zoning and reforestation to help regenerate 25ha of mangroves.

OTHERS

45,400

1D 1.79%

5D -3.81%

Buy Vol. 2,033,355

Sell Vol. 1,845,182

45,400

1D 1.79%

5D -3.81%

Buy Vol. 2,033,355

Sell Vol. 1,845,182

97,300

1D 1.35%

5D -4.51%

Buy Vol. 1,482,161

Sell Vol. 1,290,340

86,500

1D 0.70%

5D 2.98%

Buy Vol. 4,717,954

Sell Vol. 4,672,066

50,000

1D 2.04%

5D -7.41%

Buy Vol. 15,629,374

Sell Vol. 13,665,856

19,050

1D -1.30%

5D -11.19%

Buy Vol. 7,730,663

Sell Vol. 5,396,979

30,700

1D 6.41%

5D 6.97%

Buy Vol. 112,509,638

Sell Vol. 77,495,394

26,150

1D -0.19%

5D -6.44%

Buy Vol. 67,937,816

Sell Vol. 55,709,965

PNJ: In July, PNJ's net revenue reached VND2,364 billion, down nearly 6% over the same period; but profit after tax increased by 7% to VND85 billion. However, this is the lowest profit month of PNJ since September 2022.

Market by numbers

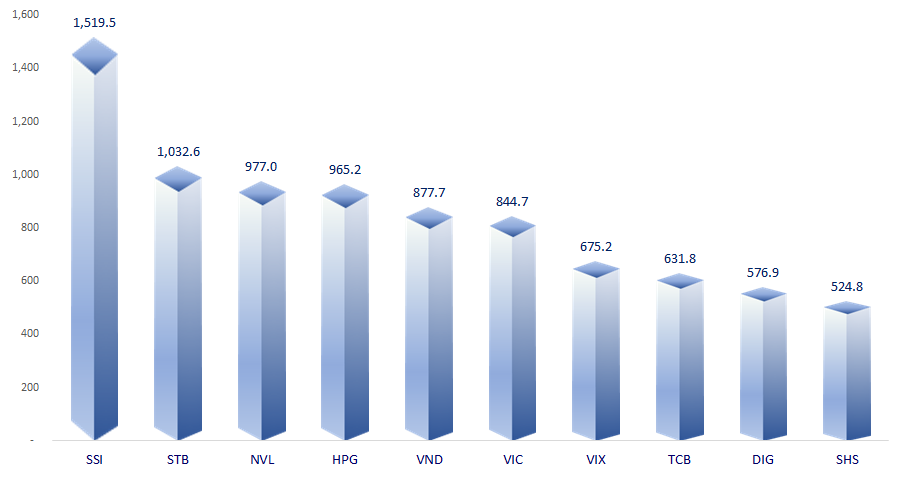

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

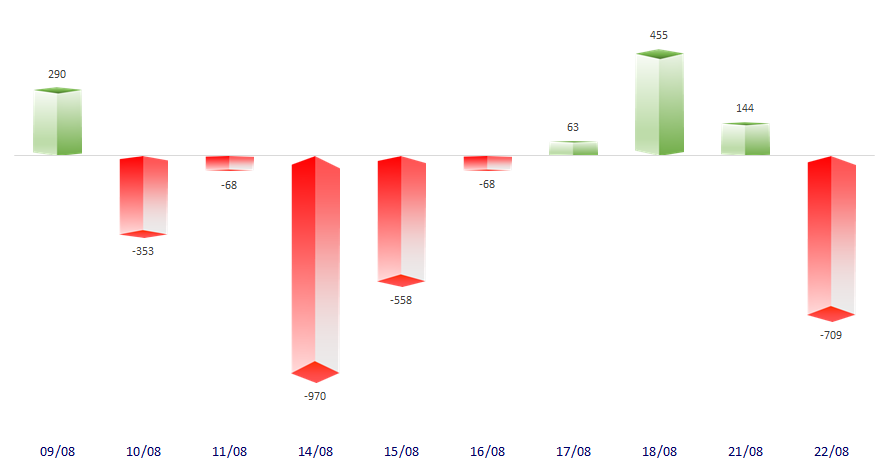

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

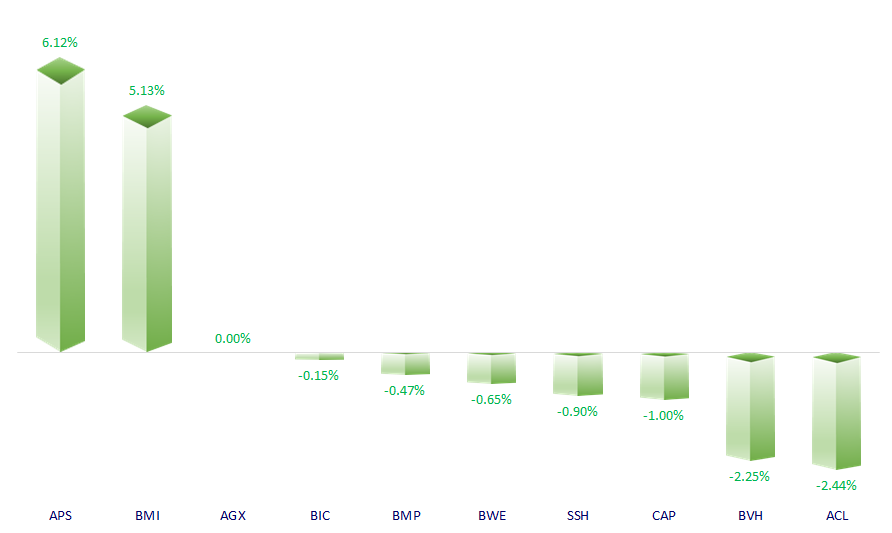

TOP INCREASES 3 CONSECUTIVE SESSIONS

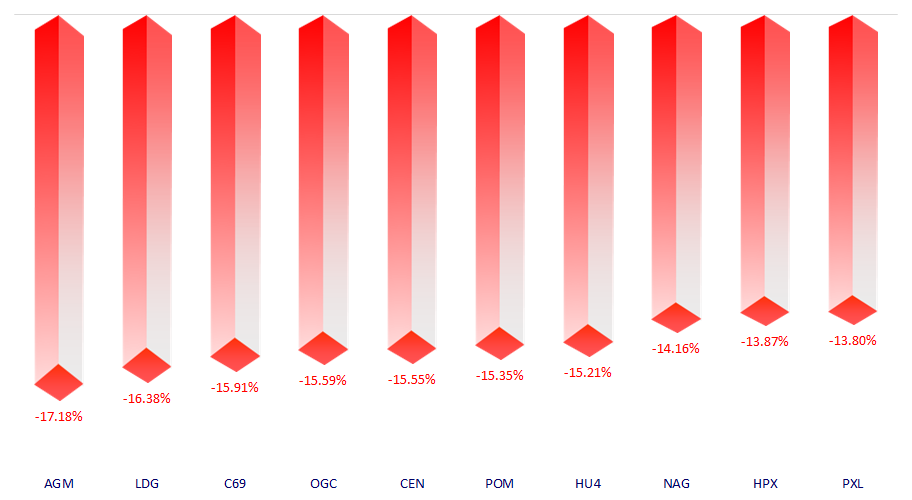

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.