Market brief 25/08/2023

VIETNAM STOCK MARKET

1,183.37

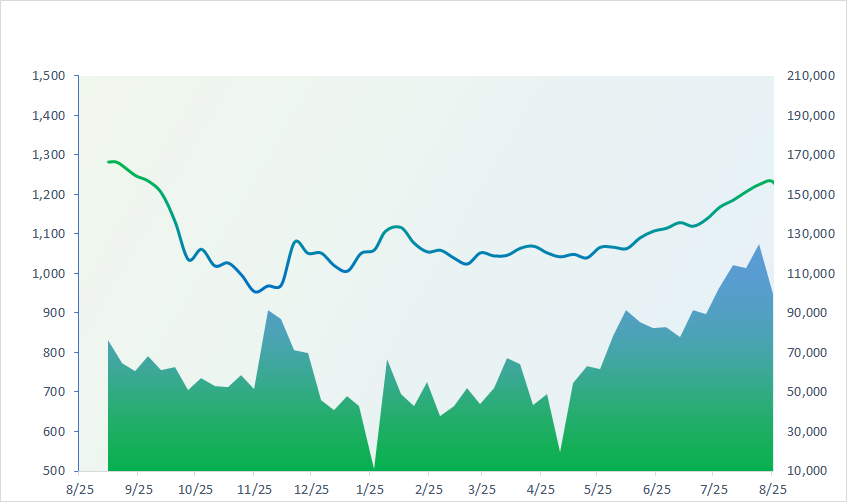

1D -0.51%

YTD 17.50%

1,193.93

1D -0.66%

YTD 18.78%

242.90

1D -0.14%

YTD 18.31%

91.01

1D 0.18%

YTD 27.02%

-869.83

1D 0.00%

YTD 0.00%

22,868.32

1D 7.09%

YTD 165.42%

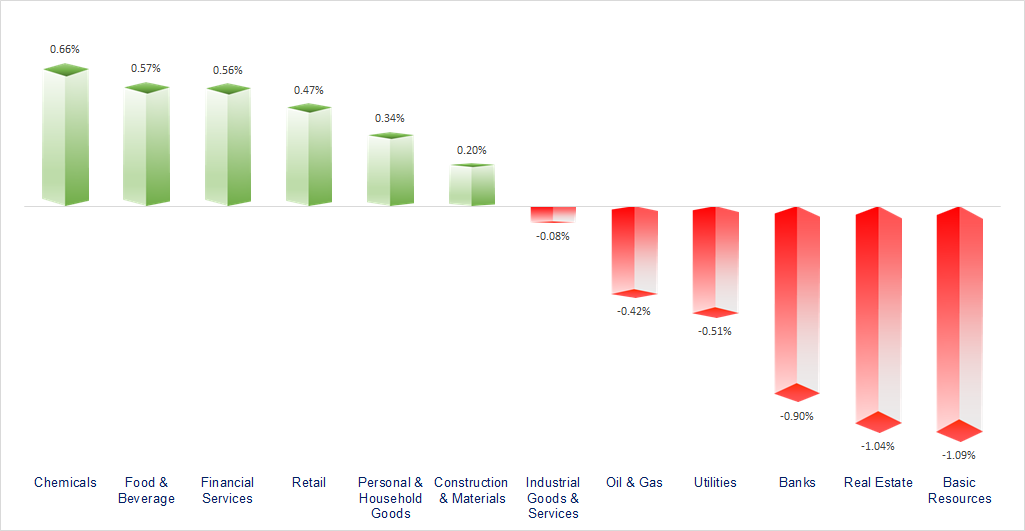

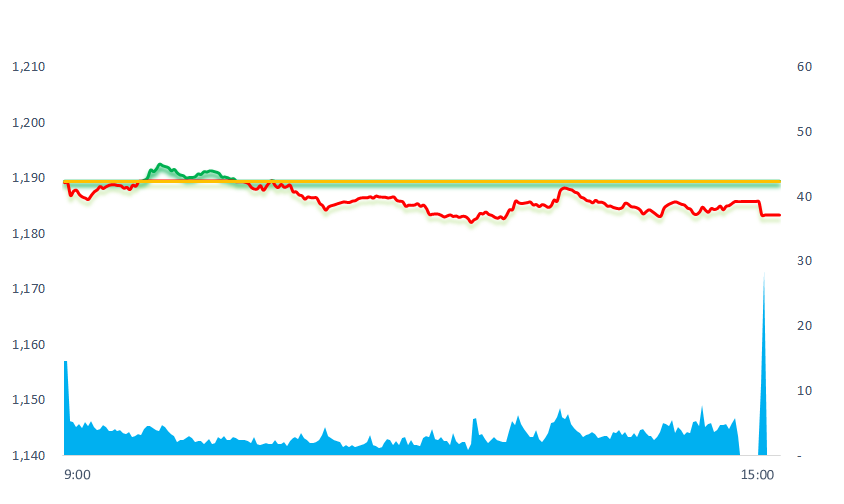

The stock market opened in the red, then recovered above the reference level, but it did not last long and then turned down for the rest of the time. Chemical, Food, Beverage and Securities group led the market's gain. In contrast, Steel, Real Estate, and Banking sectors were the groups that took away the most points from the VNIndex.

ETF & DERIVATIVES

20,560

1D -0.39%

YTD 18.64%

14,140

1D -0.56%

YTD 18.62%

14,730

1D -0.87%

YTD 18.03%

18,760

1D 1.41%

YTD 33.52%

18,740

1D -0.27%

YTD 30.59%

25,600

1D -0.39%

YTD 14.29%

15,700

1D 0.00%

YTD 21.24%

1,195

1D -0.29%

YTD 0.00%

1,193

1D -0.48%

YTD 0.00%

1,191

1D -0.53%

YTD 0.00%

1,184

1D -0.55%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

0

1D 31624.28

YTD -0.020532279

0

1D 3064.07

YTD -0.005895063

0

1D 10130.47

YTD -0.012257963

0

1D 17956.38

YTD -0.014045004

0

1D 2519.14

YTD -0.007305886

0

1D 64886.51

YTD -0.007531633

0

1D 3189.88

YTD 0.001673706

0

1D 1560.2

YTD -0.000173025

0

1D 84.53

YTD 0.012699173

0

1D 1916.07

YTD -9.91515E-05

Most Asian stocks fell sharply on Friday, with technology stocks witnessing a sharp reversal as the overall market turned to concern over more monetary policy signals from the Jackson Hole Symposium.

VIETNAM ECONOMY

0.20%

YTD (bps) -477

5.80%

YTD (bps) -160

1.76%

1D (bps) -2

YTD (bps) -303

2.55%

1D (bps) -2

YTD (bps) -235

24,245

1D (%) 0.21%

YTD (%) 2.04%

26,405

1D (%) -0.93%

YTD (%) 2.91%

3,367

1D (%) -0.06%

YTD (%) -3.39%

The government requires not to increase prices rapidly at the end of the year, strictly handle cases of speculation, hoarding and unreasonable price increases.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The government asked not to increase prices sharply at the end of the year;

- Real estate transactions are not required to go through the exchange;

- China massively buys Vietnamese agricultural products, detecting violations can stop the import;

- BRICS officially invited 6 countries to join the bloc;

- China calls on pension funds, banks and insurance companies to support the stock market;

- Two Fed officials forecast the cycle of rate hikes is coming to an end.

VN30

BANK

86,200

1D -0.92%

5D -3.69%

Buy Vol. 2,508,977

Sell Vol. 2,422,051

45,200

1D -1.31%

5D 2.26%

Buy Vol. 2,031,948

Sell Vol. 2,285,037

31,150

1D -1.89%

5D 1.47%

Buy Vol. 13,951,602

Sell Vol. 12,669,299

33,650

1D -0.44%

5D 3.54%

Buy Vol. 8,721,769

Sell Vol. 7,062,549

20,200

1D -1.46%

5D -1.94%

Buy Vol. 27,217,095

Sell Vol. 25,841,387

18,100

1D -0.82%

5D 0.00%

Buy Vol. 12,925,538

Sell Vol. 9,452,696

16,250

1D 0.31%

5D 0.31%

Buy Vol. 3,947,530

Sell Vol. 3,775,837

18,850

1D 0.27%

5D 4.14%

Buy Vol. 6,458,017

Sell Vol. 9,094,962

31,100

1D -1.43%

5D -0.64%

Buy Vol. 33,961,888

Sell Vol. 34,475,932

19,600

1D -0.76%

5D 0.26%

Buy Vol. 7,892,033

Sell Vol. 5,961,162

21,950

1D -0.45%

5D 0.23%

Buy Vol. 11,899,409

Sell Vol. 10,173,886

11,950

1D -1.24%

5D -0.42%

Buy Vol. 28,759,152

Sell Vol. 35,526,649

28,200

1D -0.88%

5D 2.73%

Buy Vol. 1,830,755

Sell Vol. 1,594,066

At the end of June 2023, banks with a high proportion of outstanding loans to the real estate and construction sectors include Techcombank (35.5%), LPBank (31.6%), SHB (27, 3%), VPBank (22.5%), HDBank (19.0%) and MSB (17.9%).

OIL & GAS

101,400

1D -0.98%

5D 3.89%

Buy Vol. 1,012,090

Sell Vol. 1,163,748

12,500

1D -0.79%

5D -4.21%

Buy Vol. 17,134,158

Sell Vol. 14,920,299

37,550

1D -0.66%

5D 0.54%

Buy Vol. 1,506,411

Sell Vol. 2,230,169

Ending Thursday's session, the Brent oil contract dropped 18 cents, or 0.2%, to 83.03 USD/barrel. WTI oil contract lost 16 cents (0.2%) to 78.73 USD/barrel

VINGROUP

63,500

1D -1.09%

5D -5.08%

Buy Vol. 27,997,624

Sell Vol. 29,637,728

54,100

1D -2.35%

5D -4.75%

Buy Vol. 7,579,344

Sell Vol. 7,819,480

28,700

1D -1.20%

5D -1.37%

Buy Vol. 6,277,082

Sell Vol. 7,624,793

VIC: 24/8 session, on Nasdaq, VinFast's VFS closed up more than 32% to 49 USD/share. VinFast's market capitalization increased to USD113 billion USD.

FOOD & BEVERAGE

74,900

1D 0.27%

5D 2.18%

Buy Vol. 4,714,658

Sell Vol. 6,029,844

79,700

1D -0.38%

5D 0.89%

Buy Vol. 2,107,126

Sell Vol. 2,513,388

156,200

1D 1.76%

5D 1.69%

Buy Vol. 855,664

Sell Vol. 856,265

SAB: Q2/2023, inventory increased by 10% to VND2,430 billion, total liabilities of the company decreased by 18% compared to the beginning of the year, recorded at VN 8,123 billion.

OTHERS

44,900

1D -1.10%

5D 1.58%

Buy Vol. 1,258,875

Sell Vol. 1,341,588

44,900

1D -1.10%

5D 1.58%

Buy Vol. 1,258,875

Sell Vol. 1,341,588

97,000

1D -0.51%

5D -0.92%

Buy Vol. 1,548,322

Sell Vol. 1,138,747

90,600

1D 0.67%

5D 7.21%

Buy Vol. 5,289,200

Sell Vol. 5,608,295

50,500

1D 0.40%

5D 0.60%

Buy Vol. 10,884,223

Sell Vol. 11,673,288

19,650

1D -0.76%

5D -1.01%

Buy Vol. 3,430,126

Sell Vol. 3,634,383

32,200

1D 0.63%

5D 13.78%

Buy Vol. 72,746,119

Sell Vol. 57,407,700

25,950

1D -1.33%

5D -2.08%

Buy Vol. 44,262,764

Sell Vol. 38,543,416

MWG: Bach Hoa Xanh achieved revenue of more than VND2,800 billion, continuing to increase by 20% over the same period and 10% compared to the previous June. This is the fourth consecutive month in 2023 that Bach Hoa Xanh's monthly revenue surpassed Mobile World and is also the largest revenue recorded since August 2021.

Market by numbers

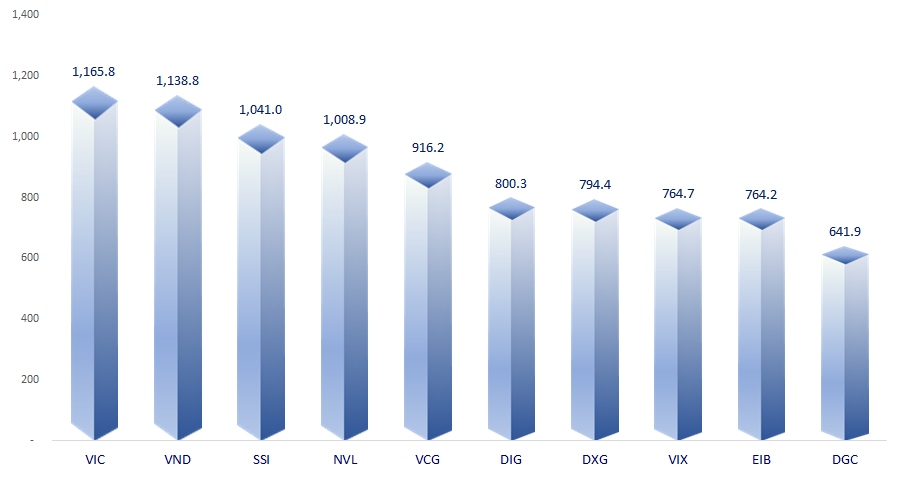

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

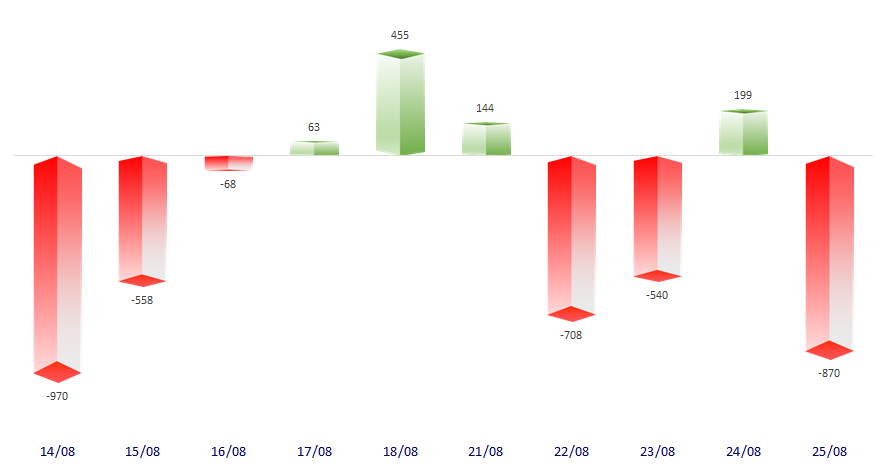

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

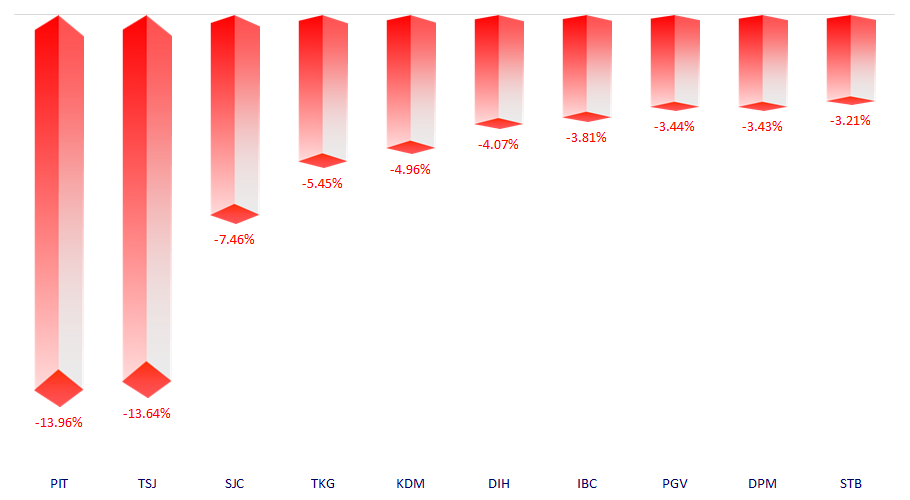

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.