Market brief 29/08/2023

VIETNAM STOCK MARKET

1,204.43

1D 0.23%

YTD 19.60%

1,215.47

1D 0.17%

YTD 20.92%

246.48

1D 0.65%

YTD 20.05%

92.36

1D 0.69%

YTD 28.90%

-151.08

1D 0.00%

YTD 0.00%

25,160.11

1D 10.70%

YTD 192.02%

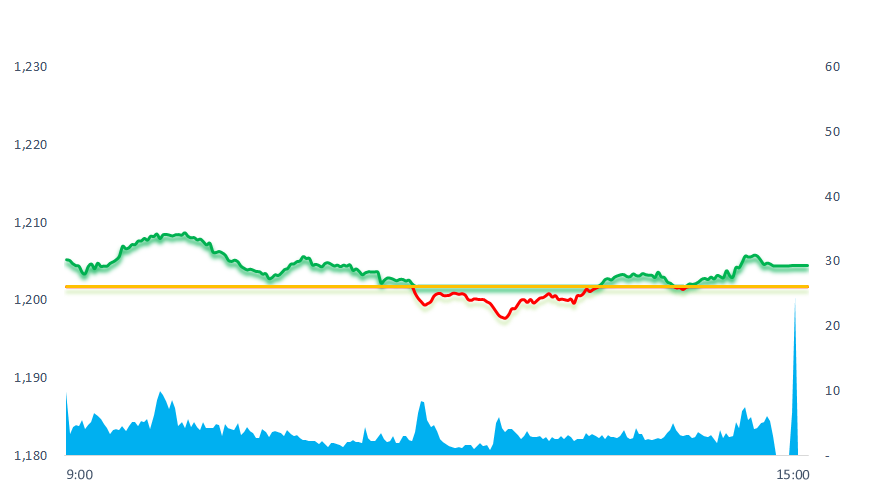

Today, the stock market opened with positive gains. However, since 11am, selling pressure increased and pulled the index down below reference level. Only after 13:00, the green color of the market gradually returned and towards the end of the session, the market's gaining momentum was strengthened thanks to the significant increase in liquidity compared to yesterday.

ETF & DERIVATIVES

20,900

1D 0.48%

YTD 20.60%

14,360

1D 0.00%

YTD 20.47%

14,920

1D 1.15%

YTD 19.55%

18,800

1D 1.68%

YTD 33.81%

19,080

1D 0.79%

YTD 32.96%

26,400

1D 1.07%

YTD 17.86%

16,030

1D 0.82%

YTD 23.78%

1,212

1D 0.07%

YTD 0.00%

1,211

1D 0.12%

YTD 0.00%

1,208

1D -0.04%

YTD 0.00%

1,204

1D 0.24%

YTD 0.00%

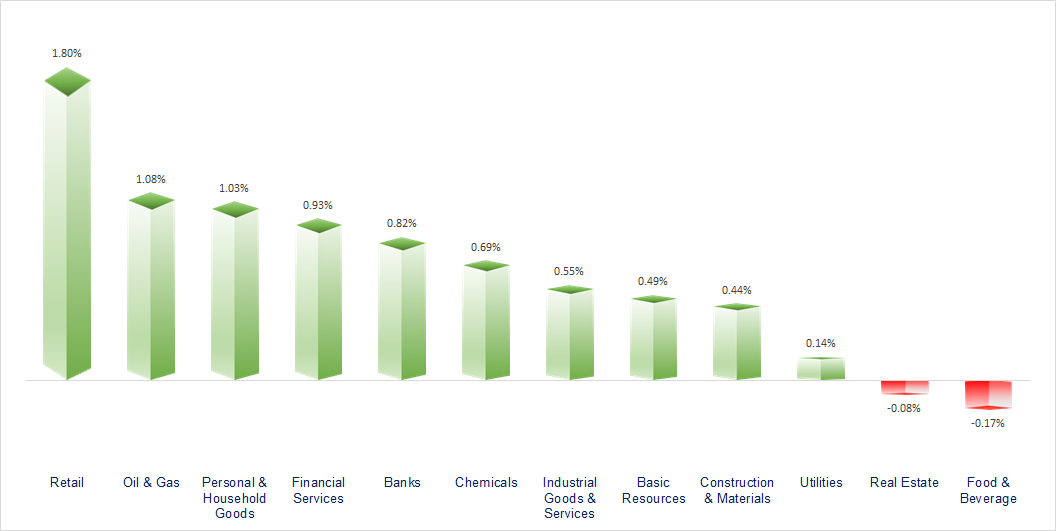

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

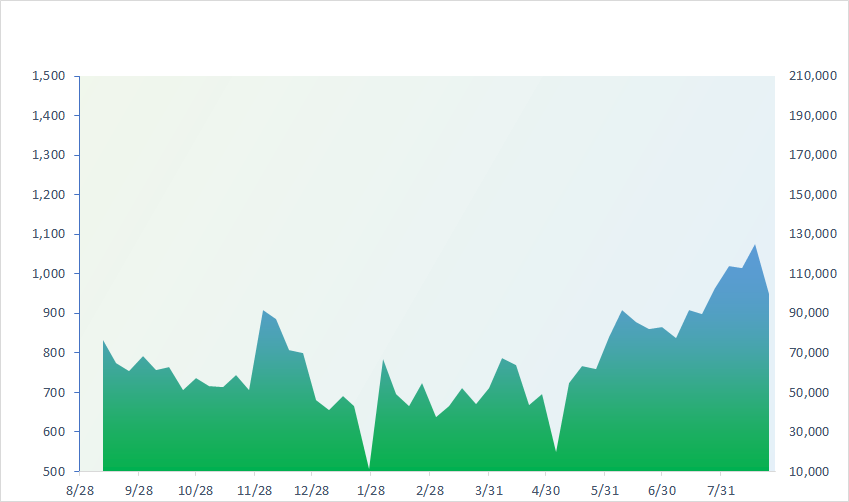

VNINDEX (12M)

GLOBAL MARKET

0

1D 32226.97

YTD 0.000915288

0

1D 3135.89

YTD 0.012021403

0

1D 10454.98

YTD 0.021677587

0

1D 18484.03

YTD 0.020061808

0

1D 2552.16

YTD 0.003440263

0

1D 65075.82

YTD 0.001218833

0

1D 3223.09

YTD 0.002928107

0

1D 1568.81

YTD 0.003736476

0

1D 84.42

YTD 0.008843212

0

1D 1924.17

YTD 0.00077496

Most Asian stocks rallied on Tuesday as markets awaited a slew of key economic data this week, along with China's stock market stimulus measures. China's Shenzhen and Shanghai indexes continue to rebound from their 2023 lows.

VIETNAM ECONOMY

0.20%

YTD (bps) -477

5.80%

YTD (bps) -160

1.78%

YTD (bps) -301

2.55%

YTD (bps) -235

24,393

1D (%) 0.42%

YTD (%) 2.66%

26,584

1D (%) -0.98%

YTD (%) 3.60%

3,386

1D (%) 0.24%

YTD (%) -2.84%

In 8M2023, the total import and export turnover of goods reached USD435.23 billion, down 13.1% over the same period last year, of which exports decreased by 10%; imports decreased by 16.2%. The balance of trade in goods in the first eight months of 2023 is estimated to have a trade surplus of USD20.19 billion.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- CPI in August 2023 increased by 0.88%, core inflation increased by 0.32% compared to the previous month;

- Vietnam has a trade surplus of USD20.19 billion in the first 8 months of 2023;

- US President Joe Biden will visit Vietnam;

- Eurozone money supply falls for first time in 13 years;

- Pakistan banned sugar exports due to sharp increase in domestic prices;

- China approved the establishment of 37 investment funds to revive the stock market.

VN30

BANK

88,400

1D 1.61%

5D 0.00%

Buy Vol. 2,095,744

Sell Vol. 2,529,945

45,800

1D 0.88%

5D 0.00%

Buy Vol. 2,078,759

Sell Vol. 2,820,902

31,250

1D 0.32%

5D -0.95%

Buy Vol. 7,059,366

Sell Vol. 9,619,999

33,900

1D -0.29%

5D 2.42%

Buy Vol. 6,687,219

Sell Vol. 7,446,908

20,850

1D 2.71%

5D 1.21%

Buy Vol. 34,619,133

Sell Vol. 30,873,680

18,250

1D 0.27%

5D 0.27%

Buy Vol. 23,191,611

Sell Vol. 17,513,846

16,200

1D -0.61%

5D -1.22%

Buy Vol. 6,360,000

Sell Vol. 6,070,129

19,000

1D 0.00%

5D 2.43%

Buy Vol. 9,765,793

Sell Vol. 15,849,360

31,750

1D 0.32%

5D -1.24%

Buy Vol. 40,277,610

Sell Vol. 38,584,294

19,800

1D 0.00%

5D -0.25%

Buy Vol. 7,679,256

Sell Vol. 7,079,872

22,050

1D 0.00%

5D 0.00%

Buy Vol. 10,873,297

Sell Vol. 11,772,981

12,250

1D 1.24%

5D 1.24%

Buy Vol. 39,265,516

Sell Vol. 44,485,021

28,350

1D 0.18%

5D 0.53%

Buy Vol. 2,716,625

Sell Vol. 2,656,383

MBB: MBB forecasts no bad debt from Trung Nam Group and Novaland this year. As of the second quarter of 2023, the credit levels of Trung Nam Group and Novaland Group at this bank reached VND9,000 billion (accounting for 1.6% of the credit balance) and VND7,000 billion (accounting for 1.2% of the credit balance). MBB assesses that both organizations have sufficient cash flow to pay their financial obligations to the bank in 2023.

OIL & GAS

99,900

1D 0.30%

5D 3.20%

Buy Vol. 1,190,341

Sell Vol. 1,196,219

12,600

1D -0.79%

5D -1.56%

Buy Vol. 15,835,617

Sell Vol. 18,968,938

38,050

1D -0.26%

5D 0.93%

Buy Vol. 1,417,363

Sell Vol. 1,874,040

Oil prices were mostly flat on Monday (August 28), although pressured by concerns that further US interest rate hikes could dampen demand.

VINGROUP

63,400

1D -2.01%

5D -1.71%

Buy Vol. 33,858,791

Sell Vol. 34,710,027

54,600

1D -0.18%

5D -1.62%

Buy Vol. 7,684,235

Sell Vol. 8,044,526

29,250

1D -1.68%

5D -0.17%

Buy Vol. 5,671,610

Sell Vol. 5,910,332

VIC: Currently, VinFast's market capitalization is at USD190 billion, higher than both Goldman Sachs'USD111 billion and Boeing's USD137 billion.

FOOD & BEVERAGE

77,400

1D -0.64%

5D 6.46%

Buy Vol. 6,177,172

Sell Vol. 7,273,246

80,000

1D -0.87%

5D 2.96%

Buy Vol. 2,458,913

Sell Vol. 3,405,647

158,100

1D 1.15%

5D 5.40%

Buy Vol. 588,480

Sell Vol. 535,284

VNM: Currently, the market share of Liquid Milk is over 60%, Yogurt is about 80%, Condensed milk is more than 80% and Powdered milk is around 20%.

OTHERS

44,800

1D -0.22%

5D -1.32%

Buy Vol. 1,279,486

Sell Vol. 1,579,963

44,800

1D -0.22%

5D -1.32%

Buy Vol. 1,279,486

Sell Vol. 1,579,963

97,500

1D -0.51%

5D 0.21%

Buy Vol. 1,227,230

Sell Vol. 1,075,760

93,600

1D -0.43%

5D 9.48%

Buy Vol. 3,209,885

Sell Vol. 3,106,612

52,900

1D 2.32%

5D 5.80%

Buy Vol. 12,747,365

Sell Vol. 14,242,794

20,650

1D 2.23%

5D 8.40%

Buy Vol. 4,648,774

Sell Vol. 5,283,525

32,350

1D -0.31%

5D 5.37%

Buy Vol. 69,301,272

Sell Vol. 58,947,810

27,000

1D 0.56%

5D 3.25%

Buy Vol. 30,224,769

Sell Vol. 37,560,054

FPT: FPT Deputy General Director Nguyen The Phuong said that FPT has no plans to issue or raise capital from foreign investors for both FPT and Fsoft.

Market by numbers

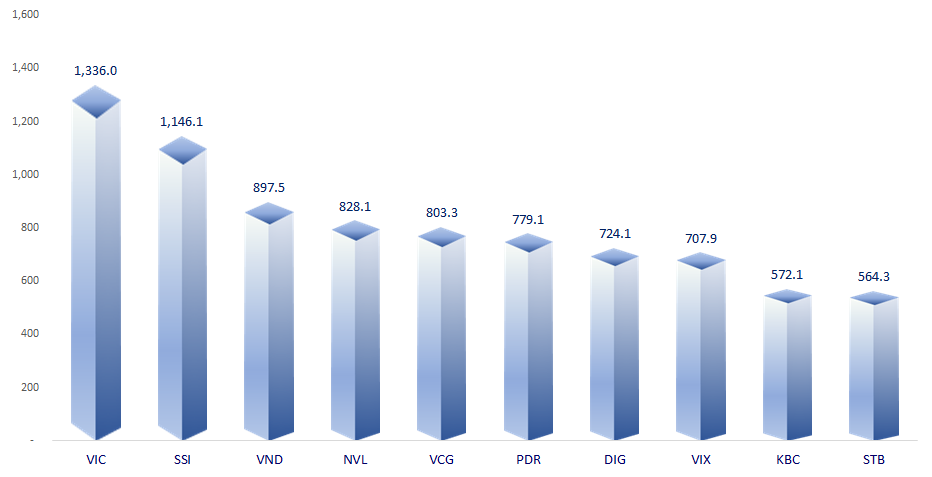

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

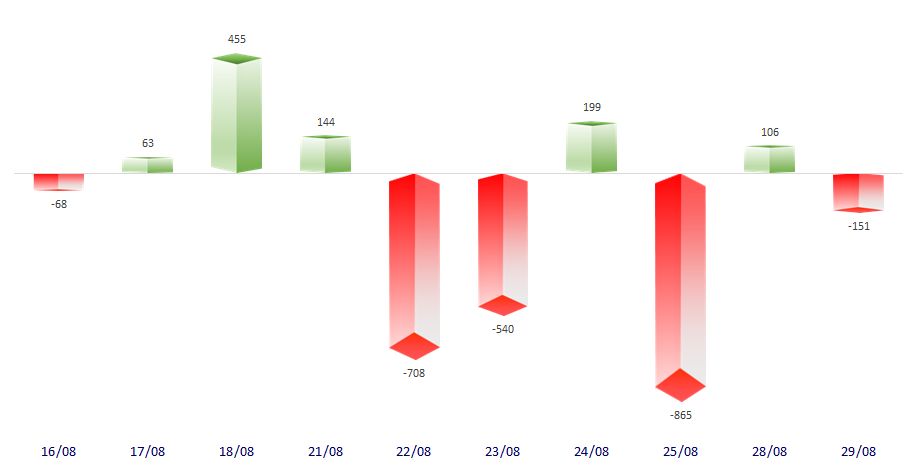

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

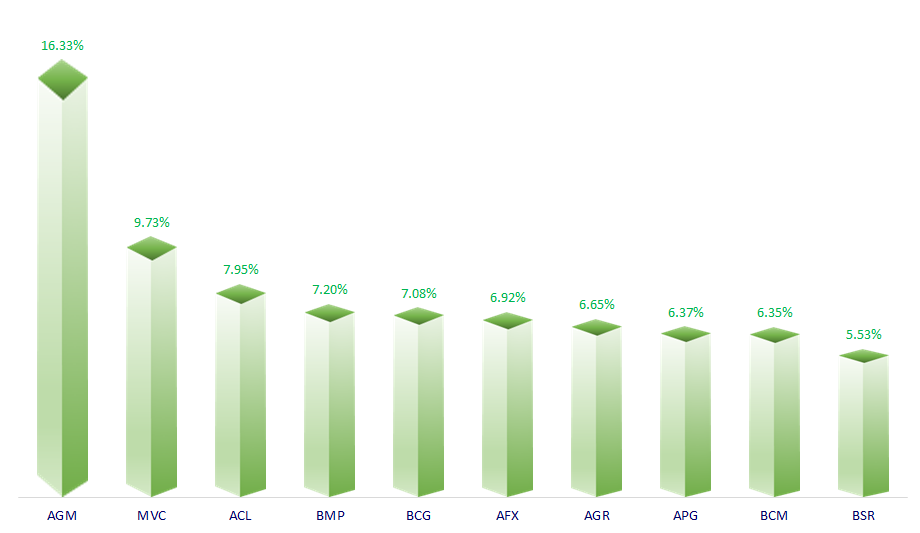

TOP INCREASES 3 CONSECUTIVE SESSIONS

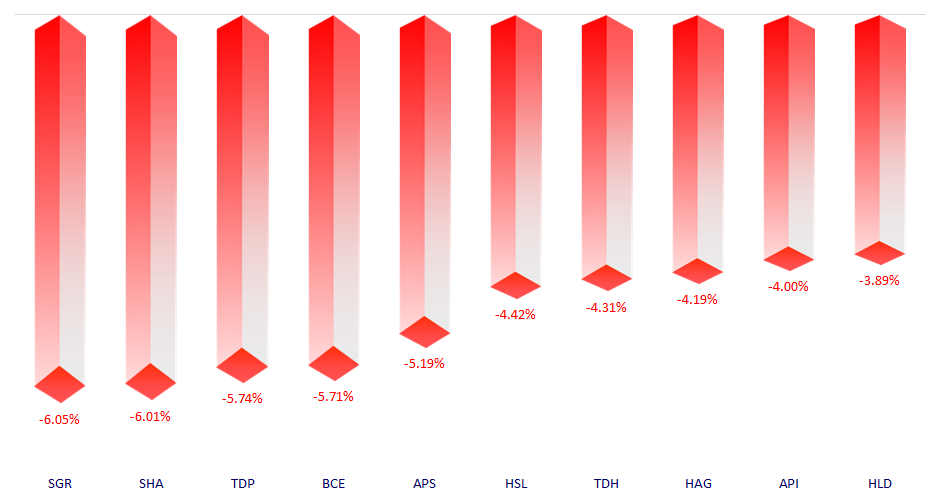

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.