Market brief 30/08/2023

VIETNAM STOCK MARKET

1,213.16

1D 0.72%

YTD 20.46%

1,225.56

1D 0.83%

YTD 21.92%

247.96

1D 0.60%

YTD 20.77%

92.68

1D 0.35%

YTD 29.35%

545.59

1D 0.00%

YTD 0.00%

23,481.97

1D -6.67%

YTD 172.54%

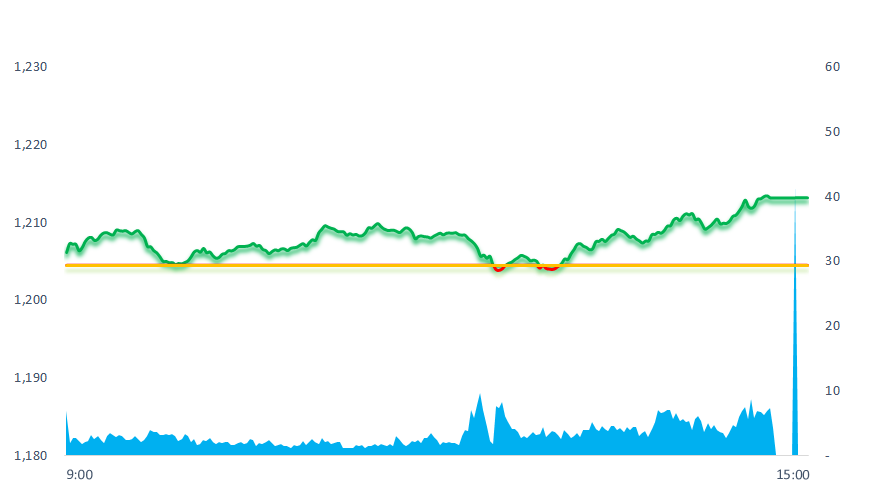

VNIndex opened with green spreading across most sectors, helping the index to approach the 1.210. However, the continuous selling pressure that appeared afterward caused the market to lose steam, significantly narrowing its upward momentum and VNIndex fell below the reference level. Close to the holiday liquidity was still good as strong cash inflow in the afternoon session pulled VNIndex up again.

ETF & DERIVATIVES

21,080

1D 0.86%

YTD 21.64%

14,490

1D 0.91%

YTD 21.56%

14,960

1D 0.27%

YTD 19.87%

18,900

1D 0.53%

YTD 34.52%

19,240

1D 0.84%

YTD 34.08%

26,700

1D 1.14%

YTD 19.20%

16,210

1D 1.12%

YTD 25.17%

1,224

1D 1.02%

YTD 0.00%

1,223

1D 1.03%

YTD 0.00%

1,220

1D 1.01%

YTD 0.00%

1,211

1D 0.59%

YTD 0.00%

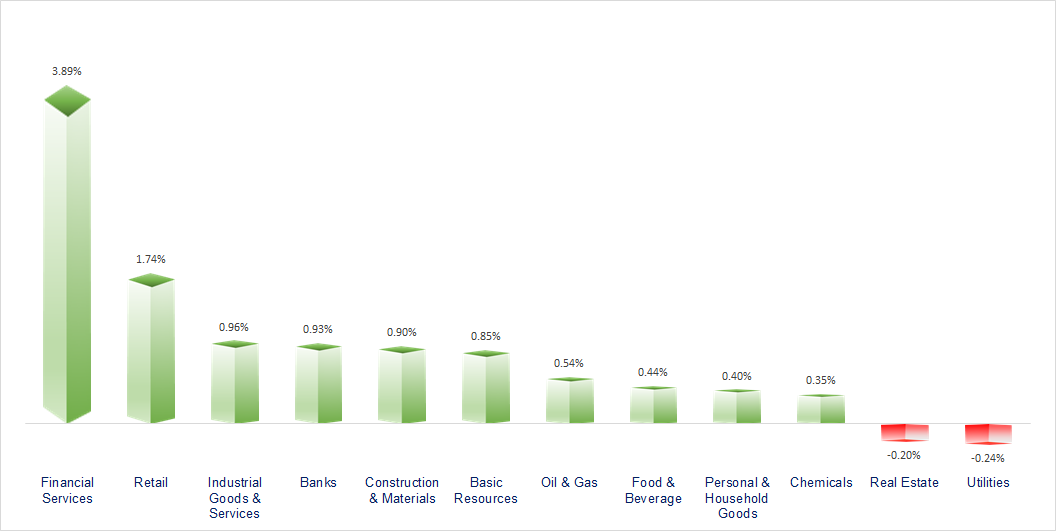

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

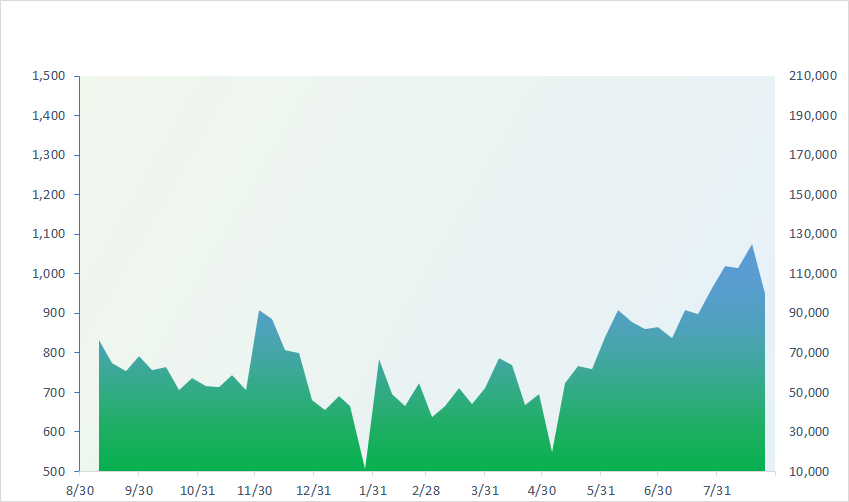

VNINDEX (12M)

GLOBAL MARKET

0

1D 32333.46

YTD 0.003304375

0

1D 3137.14

YTD 0.000398611

0

1D 10482.5

YTD 0.002632238

0

1D 18482.86

YTD -6.32979E-05

0

1D 2561.22

YTD 0.003549934

0

1D 65087.25

YTD 0.000175641

0

1D 3220.22

YTD -0.00089045

0

1D 1576.67

YTD 0.005010167

0

1D 85.42

YTD 0.003642345

0

1D 1937.62

YTD 0.000547362

Most Asian stocks rose on Wednesday. Technology stocks were the main beneficiaries of last night's trading session on Wall Street. Technology stocks helped KOSPI index increase by 0.35%, Nikkei 225 increased by 0.33%. However, Hong Kong's Hang Seng index decreased slightly by 0.01% due to concerns about the real estate sector.

VIETNAM ECONOMY

0.20%

YTD (bps) -477

5.80%

YTD (bps) -160

1.81%

1D (bps) 3

YTD (bps) -298

2.58%

1D (bps) 1

YTD (bps) -232

24,350

1D (%) -0.01%

YTD (%) 2.48%

26,714

1D (%) -1.11%

YTD (%) 4.11%

3,382

1D (%) -0.27%

YTD (%) -2.96%

From the beginning of the year until now, the total newly and adjusted foreign investment capital of Vietnam has reached more than USD416 million (up 5.2% over the same period). In which, wholesale and retail take the lead.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Total investment capital of Vietnam abroad reached more than USD416 million in 8 months;

- Agricultural, forestry and fishery exports in the first 8 months of 2023 decreased by 9.5%;

- Total retail sales of goods and consumer service revenue in the first 8 months of 2023 will reach more than VND4 million billion;

- Bloomberg: Chinese banks are about to lower mortgage interest rates;

- Foreign investors fled Chinese stocks, net selling nearly USD10 billion;

- India allows rice exports to Singapore.

VN30

BANK

89,100

1D 0.79%

5D 3.24%

Buy Vol. 1,819,689

Sell Vol. 2,518,319

46,200

1D 0.87%

5D 1.09%

Buy Vol. 1,907,768

Sell Vol. 2,423,694

32,100

1D 2.72%

5D 2.56%

Buy Vol. 11,884,270

Sell Vol. 12,778,311

34,000

1D 0.29%

5D 2.41%

Buy Vol. 7,858,318

Sell Vol. 9,224,735

20,800

1D -0.24%

5D 2.72%

Buy Vol. 18,555,302

Sell Vol. 19,688,480

18,400

1D 0.82%

5D 2.22%

Buy Vol. 18,046,011

Sell Vol. 14,854,519

16,350

1D 0.93%

5D 1.55%

Buy Vol. 5,396,731

Sell Vol. 4,019,859

19,550

1D 2.89%

5D 5.68%

Buy Vol. 37,570,609

Sell Vol. 30,383,979

32,500

1D 2.36%

5D 5.18%

Buy Vol. 64,421,402

Sell Vol. 52,137,852

20,000

1D 1.01%

5D 1.27%

Buy Vol. 6,591,348

Sell Vol. 6,495,006

22,450

1D 1.81%

5D 2.75%

Buy Vol. 20,504,512

Sell Vol. 13,457,566

12,250

1D 0.00%

5D 2.08%

Buy Vol. 29,693,146

Sell Vol. 40,644,245

28,100

1D -0.88%

5D -0.35%

Buy Vol. 2,395,603

Sell Vol. 2,580,533

VPB: VPBank's net interest income (NIM) ratio in the first half of 2023 decreased significantly due to a sharp increase in deposit costs, FE Credit is in the process of restructuring and a high rate of bad debt formation. Specifically, the second quarter's consolidated NIM reached 5.5%, down 230 basis points from 7.8% in the same period last year and down 200 basis points from 7.5% in the whole of 2022. Notably, this is the 4th consecutive quarter that VPB recorded a decline in NIM over the same period.

OIL & GAS

99,300

1D -0.60%

5D 0.97%

Buy Vol. 887,090

Sell Vol. 869,717

12,700

1D 0.79%

5D 2.83%

Buy Vol. 11,232,886

Sell Vol. 13,653,652

38,400

1D 0.92%

5D 2.67%

Buy Vol. 1,395,293

Sell Vol. 2,099,368

PLX: State Bank of Vietnam officially approved Petrolimex to hand over PGBank to 3 investors, expected to earn VND2,568 billion

VINGROUP

62,000

1D -2.21%

5D -4.62%

Buy Vol. 46,729,613

Sell Vol. 39,503,939

54,600

1D 0.00%

5D 0.18%

Buy Vol. 7,707,834

Sell Vol. 7,524,214

29,700

1D 1.54%

5D 3.30%

Buy Vol. 10,854,671

Sell Vol. 10,635,937

VIC: Closing August 29 session, VinFast decreased by more than 44% to 46.25USD/share, with a capitalization of USD106 billion, down USD84 billion compared to the previous session.

FOOD & BEVERAGE

77,800

1D 0.52%

5D 5.85%

Buy Vol. 5,638,073

Sell Vol. 5,467,250

79,600

1D -0.50%

5D 2.71%

Buy Vol. 2,642,556

Sell Vol. 2,568,212

159,800

1D 1.08%

5D 6.46%

Buy Vol. 601,834

Sell Vol. 772,364

VNM: A joint venture between Vilico and Japan's Sojitz Group JVL to implement the beef project is expected to be completed and the product launched in Q3/2024.

OTHERS

45,050

1D 0.56%

5D -0.99%

Buy Vol. 833,892

Sell Vol. 1,190,652

45,050

1D 0.56%

5D -0.99%

Buy Vol. 833,892

Sell Vol. 1,190,652

96,900

1D -0.62%

5D 0.41%

Buy Vol. 1,158,666

Sell Vol. 1,170,278

96,600

1D 3.21%

5D 12.99%

Buy Vol. 5,450,443

Sell Vol. 4,109,403

53,800

1D 1.70%

5D 8.25%

Buy Vol. 12,274,474

Sell Vol. 15,167,746

20,700

1D 0.24%

5D 7.81%

Buy Vol. 4,613,583

Sell Vol. 4,429,997

33,500

1D 3.55%

5D 10.20%

Buy Vol. 52,070,050

Sell Vol. 44,328,550

27,200

1D 0.74%

5D 6.04%

Buy Vol. 34,635,899

Sell Vol. 35,598,445

BCM: The Prime Minister has just approved the investment policy of the infrastructure construction and trading project of Son My Industrial Park phase 1, and at the same time approved the investor for East Saigon Industrial Development Joint Stock Company (affiliated company 30% owned by Becamex IDC (as of June 30, 2023).

Market by numbers

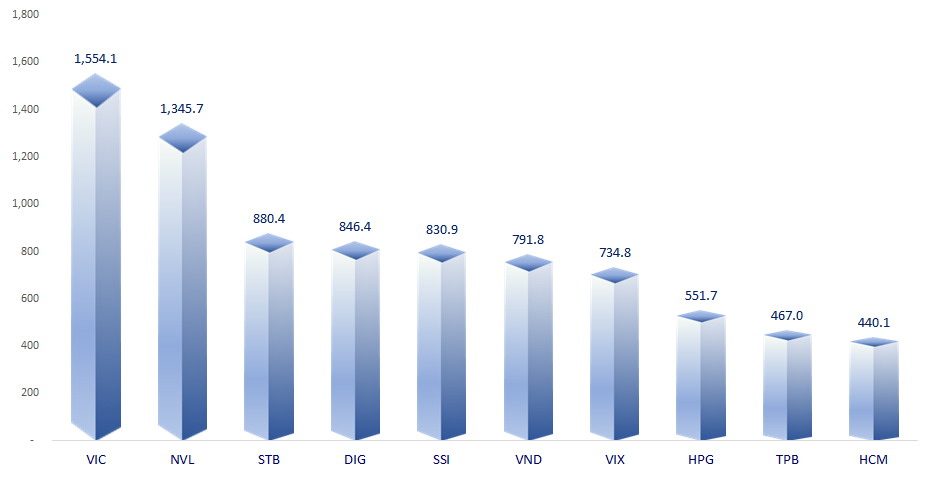

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

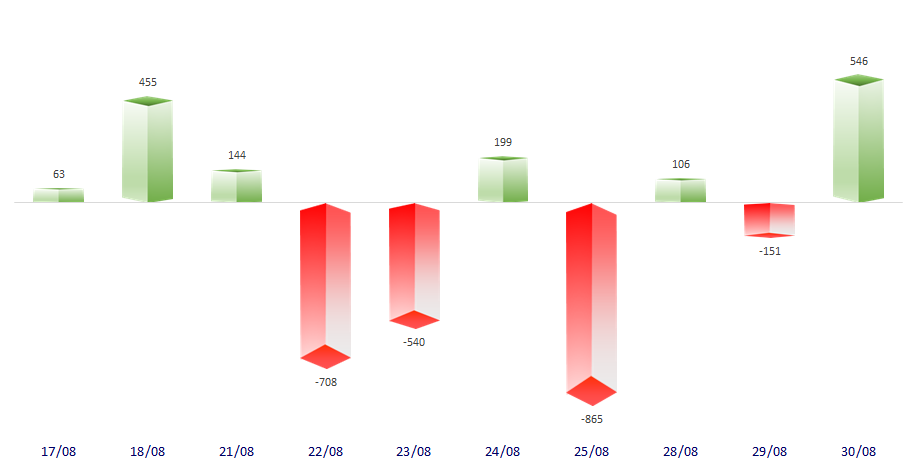

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

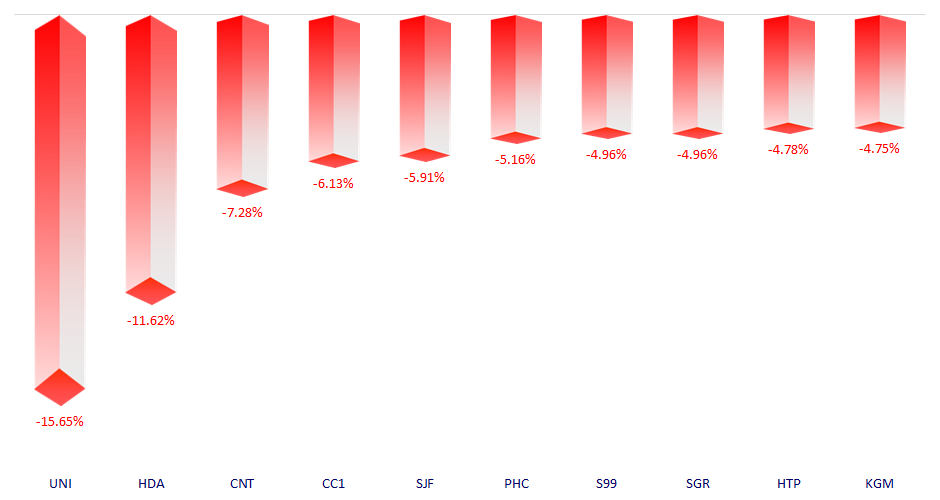

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.