Market brief 15/09/2023

VIETNAM STOCK MARKET

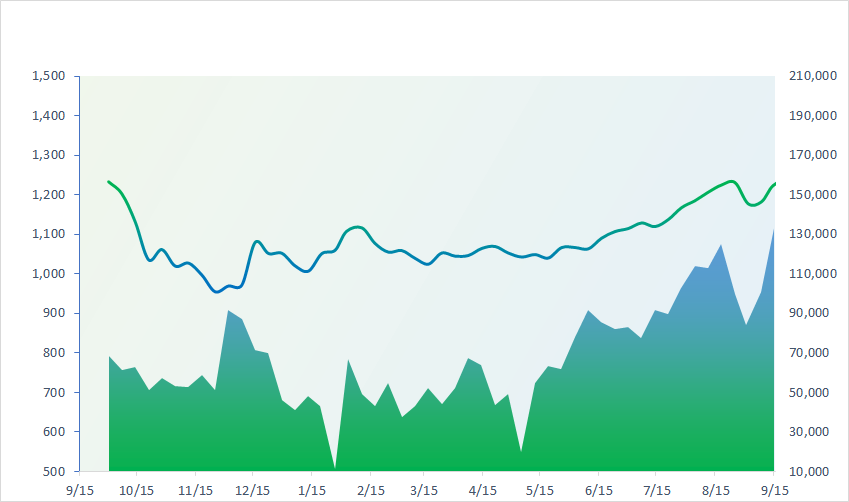

1,227.36

1D 0.29%

YTD 21.87%

1,238.81

1D 0.38%

YTD 23.24%

252.76

1D 0.36%

YTD 23.11%

93.76

1D 0.12%

YTD 30.86%

98.65

1D 0.00%

YTD 0.00%

24,447.10

1D -20.54%

YTD 183.74%

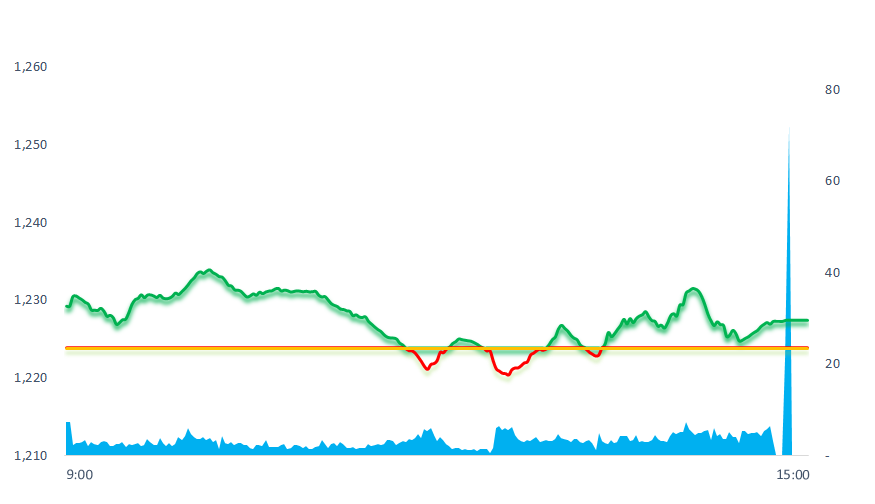

The stock market continued green scenario at the beginning of the session, then gradually decreased to below reference level. However, in contrast to previous sessions when VNIndex closed in the red, today the index has returned to green.

ETF & DERIVATIVES

21,340

1D 0.52%

YTD 23.14%

14,740

1D 0.89%

YTD 23.66%

15,230

1D -0.46%

YTD 22.04%

19,120

1D 0.63%

YTD 36.09%

19,900

1D 0.25%

YTD 38.68%

27,590

1D -0.40%

YTD 23.17%

16,490

1D 0.24%

YTD 27.34%

1,241

1D 0.45%

YTD 0.00%

1,238

1D 0.02%

YTD 0.00%

1,236

1D 0.36%

YTD 0.00%

1,229

1D 0.41%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

0

1D 33533.09

YTD 0.011004248

0

1D 3117.74

YTD -0.002817802

0

1D 10144.59

YTD -0.005197306

0

1D 18182.89

YTD 0.007478424

0

1D 2601.28

YTD 0.011034284

0

1D 67781.9

YTD 0.003893719

0

1D 3280.69

YTD 0.009595293

0

1D 1546.76

YTD 0.001048449

0

1D 93.94

YTD -0.002124495

0

1D 1918.09

YTD 0.002833735

Asian stock markets had mixed movements on September 15. Technology-oriented exchanges all increased points, such as Korea's KOSPI index increased by 1.1%, Hong Kong's Hang Seng index increased by 0.75%. Although China launched many measures to support economic growth when the PBOC cut the mandatory reserve ratio requirement for local lending institutions by 25 basis points but Chinese markets lagged other markets in the region, with the Shanghai Shenzhen CSI 300 and Shanghai Composite indexes both falling 0.52% and 0.28% respectively.

VIETNAM ECONOMY

0.16%

YTD (bps) -481

5.50%

YTD (bps) -190

2.10%

1D (bps) -1

YTD (bps) -269

2.55%

1D (bps) 10

YTD (bps) -235

24,433

1D (%) 0.14%

YTD (%) 2.83%

26,608

1D (%) 0.37%

YTD (%) 3.70%

3,404

1D (%) 0.15%

YTD (%) -2.32%

USD prices simultaneously exceeded VND24,400. At Vietcombank, the USD exchange rate at 10:15 a.m. was listed at VND24,070-24,410, up VND25 compared to the end of yesterday.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Tax debt tends to increase;

- HSBC: Vietnam continues to take the lead in attracting quality FDI;

- Many Philippine delegations went to Vietnam to negotiate rice purchases;

- The ECB raised interest rates to a record level, signaling that interest rates may have peaked;

- China plans to refinance bonds;

- PBOC cuts mandatory reserve ratio requirements by 25 basis points.

VN30

BANK

89,800

1D 0.79%

5D 0.34%

Buy Vol. 2,904,429

Sell Vol. 3,625,969

46,800

1D 0.11%

5D -0.43%

Buy Vol. 2,140,687

Sell Vol. 2,642,407

32,750

1D -1.36%

5D 1.39%

Buy Vol. 9,895,433

Sell Vol. 14,886,433

34,900

1D 0.00%

5D -1.27%

Buy Vol. 8,613,684

Sell Vol. 8,451,633

22,550

1D 0.67%

5D 3.44%

Buy Vol. 40,086,250

Sell Vol. 40,909,921

19,400

1D 1.31%

5D 1.57%

Buy Vol. 50,343,799

Sell Vol. 49,916,274

18,000

1D 2.86%

5D 3.75%

Buy Vol. 16,312,535

Sell Vol. 13,992,225

19,200

1D 1.05%

5D -1.03%

Buy Vol. 10,614,780

Sell Vol. 9,857,555

32,500

1D 2.20%

5D 0.00%

Buy Vol. 65,643,929

Sell Vol. 62,466,558

21,550

1D -0.69%

5D 4.61%

Buy Vol. 22,157,524

Sell Vol. 21,512,022

22,650

1D 0.89%

5D -0.44%

Buy Vol. 11,080,210

Sell Vol. 12,044,889

12,200

1D -0.81%

5D -3.94%

Buy Vol. 46,986,863

Sell Vol. 51,740,820

27,000

1D 2.66%

5D -1.82%

Buy Vol. 1,742,092

Sell Vol. 2,058,015

VPB: VPB launches three preferential loan packages with a total scale of VND13,000 billion for individual customers who need car loans, production and business loans, home loans, and consumer loans with interest rates from 5%/year, maximum loan rate 85%, maximum loan term up to 35 years. In particular, VPBank's loan package for production and business is designed with a fixed interest rate of 5%/year for the first 6 months. The preferential interest rate package for VPBank home loan customers has interest rates from 5.9%/year. As for the car loan package, VPBank currently applies an interest rate of 7%/year.

OIL & GAS

109,600

1D 3.40%

5D 7.24%

Buy Vol. 1,758,079

Sell Vol. 1,325,091

12,750

1D 0.00%

5D -0.78%

Buy Vol. 16,114,500

Sell Vol. 18,657,703

40,150

1D 0.38%

5D 1.90%

Buy Vol. 3,171,113

Sell Vol. 4,946,192

Oil prices increased sharply on Thursday (September 14), with WTI oil surpassing the USD90/barrel, due to increasing expectations of tight supply.

VINGROUP

53,600

1D -3.42%

5D -9.31%

Buy Vol. 33,501,516

Sell Vol. 34,802,801

50,500

1D 3.06%

5D -6.48%

Buy Vol. 15,980,424

Sell Vol. 18,638,568

28,400

1D -1.73%

5D -4.05%

Buy Vol. 9,394,836

Sell Vol. 7,711,140

VHM: The investor of Vinhomes Central Park residential area proposed to hand over to HCMC to manage roads D1-D19, including the part of the road along the Saigon River.

FOOD & BEVERAGE

79,500

1D 0.13%

5D -0.63%

Buy Vol. 8,259,927

Sell Vol. 8,997,919

79,700

1D 1.40%

5D -2.57%

Buy Vol. 3,576,215

Sell Vol. 3,694,309

83,100

1D -2.46%

5D 3.49%

Buy Vol. 1,272,684

Sell Vol. 1,213,615

VNM: In New Zealand, VNM provides "green and sustainable" products such as no plastic straws or plastic lids under an agreement to reduce plastic waste into the environment.

OTHERS

44,900

1D -0.66%

5D -1.64%

Buy Vol. 921,935

Sell Vol. 1,440,180

44,900

1D -0.66%

5D -1.64%

Buy Vol. 921,935

Sell Vol. 1,440,180

99,700

1D 0.71%

5D -1.68%

Buy Vol. 1,278,932

Sell Vol. 1,185,716

97,500

1D 1.67%

5D -0.10%

Buy Vol. 5,014,825

Sell Vol. 3,868,682

55,900

1D -2.44%

5D 0.72%

Buy Vol. 14,597,970

Sell Vol. 14,412,492

22,600

1D 2.73%

5D -0.44%

Buy Vol. 6,266,861

Sell Vol. 6,052,876

35,500

1D -0.42%

5D 5.19%

Buy Vol. 47,039,045

Sell Vol. 45,517,233

27,600

1D -0.72%

5D -4.00%

Buy Vol. 43,566,624

Sell Vol. 40,868,772

FPT: Revenue and pre-tax profit in 8 months reached VND32,827 billion and VND5,902 billion, respectively, up 21% and 19% over the same period. PAT reached VND4,994 billion, of which profit after tax for parent company shareholders recorded VND4,086 billion, an increase of 20%. EPS increased more than 19% to VND3,227.

Market by numbers

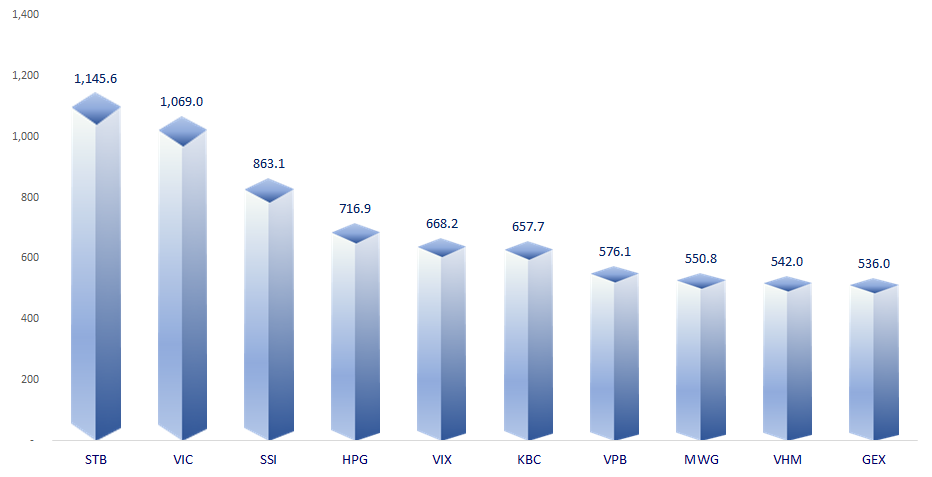

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

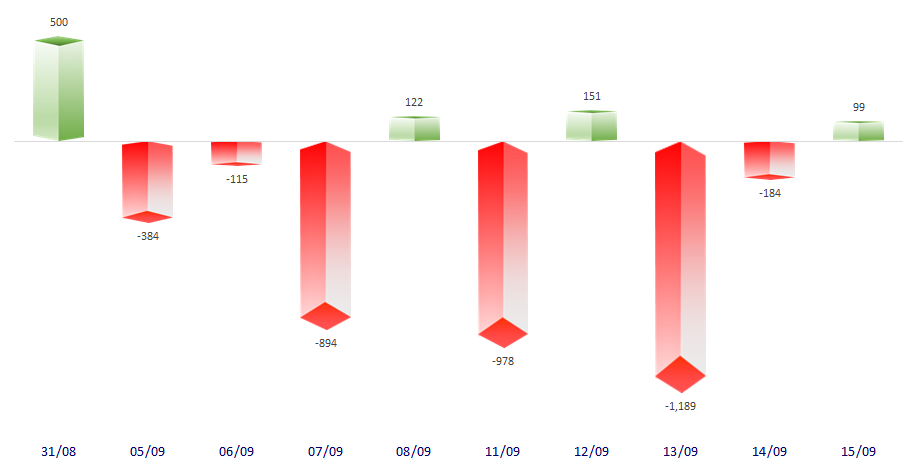

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

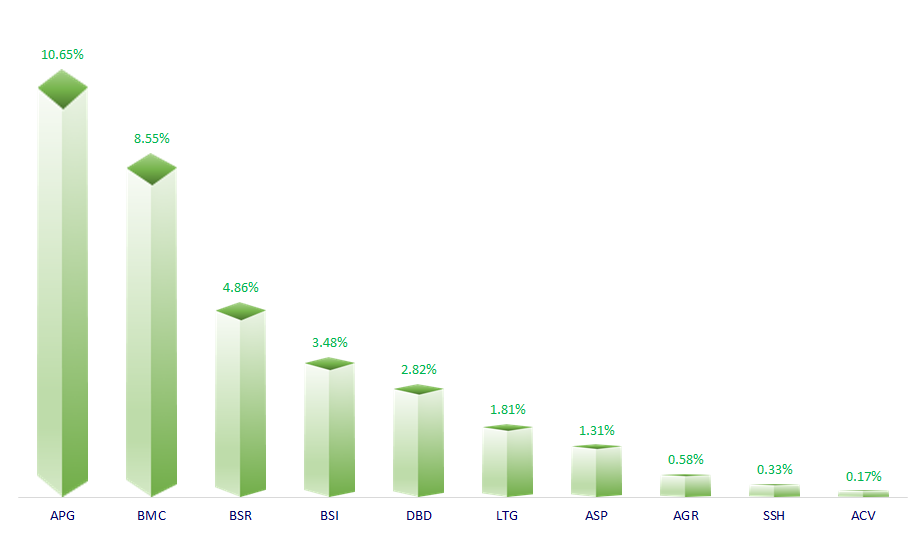

TOP INCREASES 3 CONSECUTIVE SESSIONS

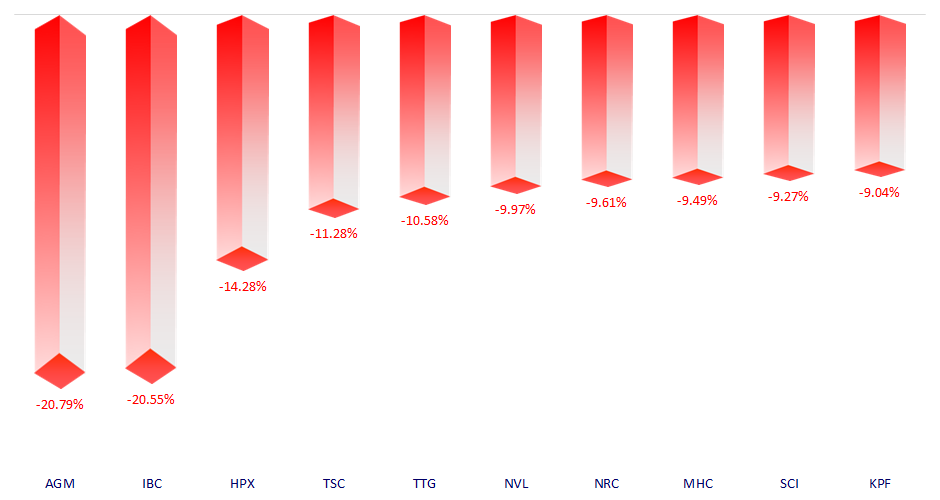

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.