Market brief 18/09/2023

VIETNAM STOCK MARKET

1,211.83

1D -1.27%

YTD 20.33%

1,223.69

1D -1.22%

YTD 21.74%

250.48

1D -0.90%

YTD 22.00%

93.17

1D -0.63%

YTD 30.03%

-487.25

1D 0.00%

YTD 0.00%

22,555.97

1D -7.74%

YTD 161.79%

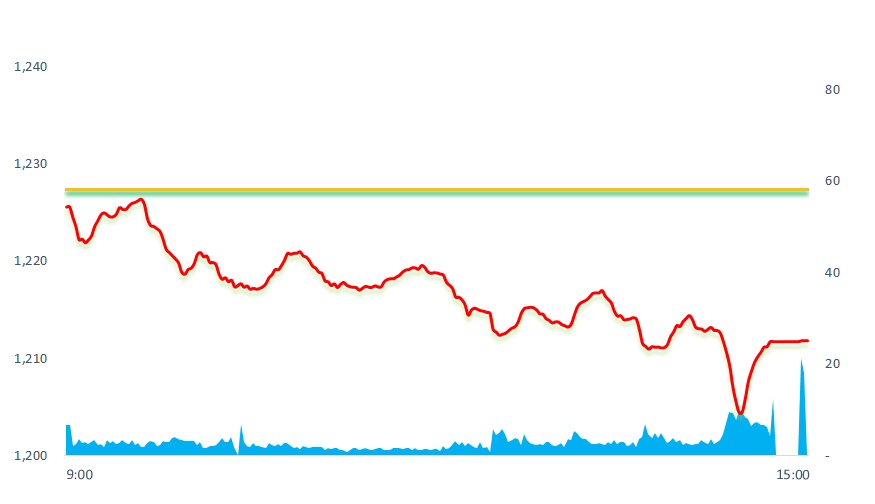

The stock market opened with overwhelming pessimism. VNIndex was red right from the beginning of the session and lasted until the end of the session. At one point, the index lost up to 24 points, but by the end, the downward momentum narrowed to only 15.55 points (equivalent to 1.27%) helping VNIndex close at 1,211.81 points.

ETF & DERIVATIVES

21,070

1D -1.27%

YTD 21.58%

14,430

1D -2.10%

YTD 21.06%

15,020

1D -1.38%

YTD 20.35%

18,800

1D -1.67%

YTD 33.81%

19,970

1D 0.35%

YTD 39.16%

27,130

1D -1.67%

YTD 21.12%

16,490

1D 0.00%

YTD 27.34%

1,222

1D -1.49%

YTD 0.00%

1,220

1D -1.43%

YTD 0.00%

1,219

1D -1.40%

YTD 0.00%

1,213

1D -1.31%

YTD 0.00%

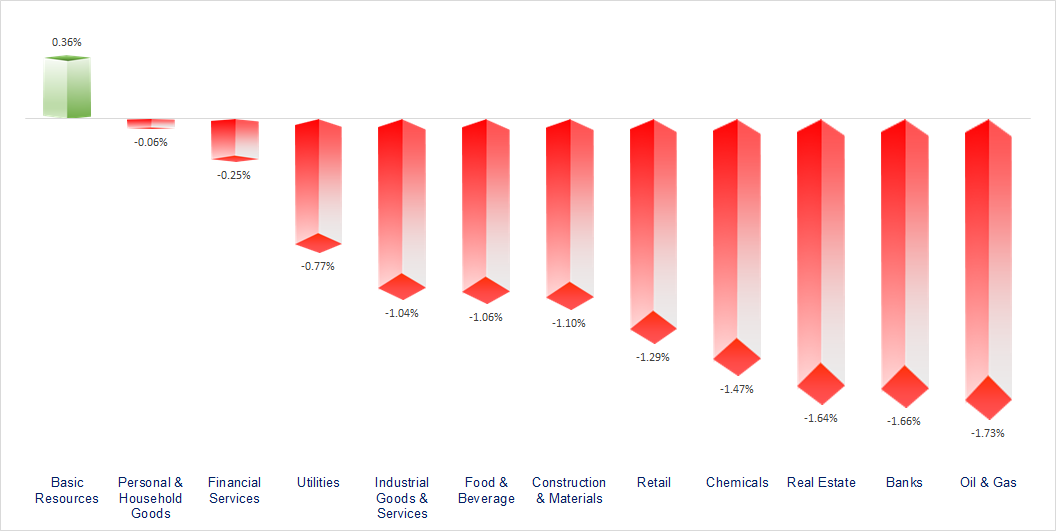

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

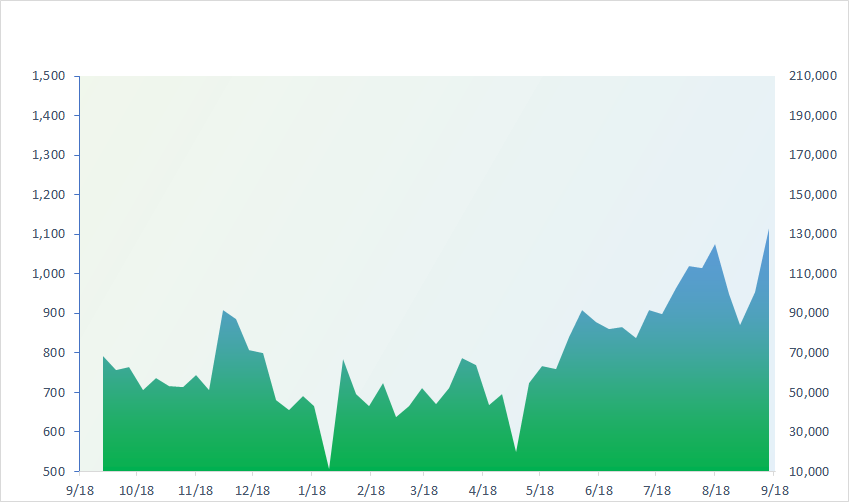

VNINDEX (12M)

GLOBAL MARKET

0

1D 33533.09

0

1D 3125.93

YTD 0.002626903

0

1D 10200.04

YTD 0.005465968

0

1D 17930.55

YTD -0.013877882

0

1D 2574.72

YTD -0.010210358

0

1D 67596.84

YTD -0.002730227

0

1D 3263.39

YTD -0.005273281

0

1D 1527.57

YTD -0.012406579

0

1D 94.3

YTD 0.000424358

0

1D 1926.44

YTD -0.010178548

Asian stock markets were mixed on Monday as investors generally consider a series of major central bank interest rate decisions this week, with the Federal Reserve being the main focus. Trading volume in the region decreased somewhat due to the Japanese market's holiday. Hong Kong's Hang Seng Index fell the most, down 1.39% and about to hit a 10-month low amid continued sell-off of real estate stocks.

VIETNAM ECONOMY

0.16%

YTD (bps) -481

5.50%

YTD (bps) -190

2.15%

1D (bps) 5

YTD (bps) -264

2.57%

1D (bps) 2

YTD (bps) -233

24,551

1D (%) 0.48%

YTD (%) 3.33%

26,751

1D (%) 0.54%

YTD (%) 4.26%

3,412

1D (%) 0.24%

YTD (%) -2.09%

In the remainder of 2023, the total bond value will mature at VND109,448 billion. 36.3% of the value of bonds will mature belongs to the Real Estate group, followed by the Banking group with 28%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister: Strive to bring China-ASEAN trade turnover to exceed USD1,000 billion;

- There have been no bond issuances in the first half of September;

- A series of banks reduced interest rates for existing borrowers;

- Fed signals interest rate hike again this year;

- EU agrees on financial regulation reform roadmap;

- Wave of flight from Chinese stocks: Foreign investors sell off USD188 billion.

VN30

BANK

88,800

1D -1.11%

5D 0.34%

Buy Vol. 1,155,956

Sell Vol. 1,593,601

45,750

1D -2.24%

5D -1.61%

Buy Vol. 2,139,357

Sell Vol. 2,464,136

32,050

1D -2.14%

5D 0.47%

Buy Vol. 14,203,702

Sell Vol. 14,232,065

34,100

1D -2.29%

5D -1.30%

Buy Vol. 12,822,553

Sell Vol. 12,120,678

22,150

1D -1.77%

5D 1.14%

Buy Vol. 25,783,229

Sell Vol. 33,304,035

19,150

1D -1.29%

5D 2.13%

Buy Vol. 20,223,467

Sell Vol. 24,244,711

17,600

1D -2.22%

5D 2.92%

Buy Vol. 14,424,970

Sell Vol. 17,826,984

18,950

1D -1.30%

5D 0.00%

Buy Vol. 9,810,803

Sell Vol. 8,606,553

32,600

1D 0.31%

5D 3.16%

Buy Vol. 35,199,978

Sell Vol. 30,958,475

20,950

1D -2.78%

5D 3.71%

Buy Vol. 17,532,284

Sell Vol. 19,032,609

22,450

1D -0.88%

5D 0.45%

Buy Vol. 9,610,425

Sell Vol. 9,516,930

12,100

1D -0.82%

5D -1.63%

Buy Vol. 34,632,789

Sell Vol. 43,123,650

26,800

1D -0.74%

5D -0.74%

Buy Vol. 1,566,920

Sell Vol. 1,815,538

BID: BIDV has just applied a new deposit interest rate schedule from today (September 18) and reduced it by 0.2-0.3 percentage points in a series of terms. For over-the-counter savings, deposit interest rates for terms of 12 months or more have decreased by 0.3 percentage points to 5.5%/year. Meanwhile, 6-month and 9-month term interest rates decreased by 0.2 percentage points to 4.5%/year.

OIL & GAS

109,000

1D -0.55%

5D 7.50%

Buy Vol. 1,037,872

Sell Vol. 1,103,538

12,650

1D -0.78%

5D -0.39%

Buy Vol. 10,580,850

Sell Vol. 12,836,709

39,600

1D -1.37%

5D -0.63%

Buy Vol. 2,440,608

Sell Vol. 3,540,807

GAS: From September 12, 2023, GAS will organize a block auction to transfer capital at PV Pipe owned by PV GAS

VINGROUP

53,000

1D -1.12%

5D -10.32%

Buy Vol. 24,329,161

Sell Vol. 18,221,612

48,950

1D -3.07%

5D -6.76%

Buy Vol. 7,752,158

Sell Vol. 8,502,606

27,700

1D -2.46%

5D -3.48%

Buy Vol. 9,007,492

Sell Vol. 9,834,849

VIC, VHM and VRE were all net sold by foreign investors today. Of which, VIC had the strongest net selling of VND136 billion, VHM and VRE VND42 billion and VND46 billion respectively.

FOOD & BEVERAGE

78,900

1D -0.75%

5D -0.75%

Buy Vol. 2,653,794

Sell Vol. 2,801,197

78,500

1D -1.51%

5D -1.38%

Buy Vol. 1,674,597

Sell Vol. 1,965,235

80,800

1D -2.77%

5D -3.52%

Buy Vol. 909,636

Sell Vol. 978,446

SAB: During the recent restructuring of the Fubon FTSE Vietnam ETF, this fund bought 2.2 million SAB shares and 1 million VNM shares

OTHERS

44,800

1D -0.22%

5D -1.54%

Buy Vol. 886,776

Sell Vol. 1,159,207

44,800

1D -0.22%

5D -1.54%

Buy Vol. 886,776

Sell Vol. 1,159,207

98,800

1D -0.90%

5D -0.20%

Buy Vol. 1,093,428

Sell Vol. 1,094,091

96,900

1D -0.62%

5D -0.51%

Buy Vol. 3,635,224

Sell Vol. 3,568,089

55,000

1D -1.61%

5D 0.92%

Buy Vol. 12,158,021

Sell Vol. 10,872,590

22,150

1D -1.99%

5D 1.84%

Buy Vol. 6,725,054

Sell Vol. 8,016,977

35,700

1D 0.56%

5D 6.57%

Buy Vol. 46,563,475

Sell Vol. 40,181,796

27,600

1D 0.00%

5D -1.43%

Buy Vol. 41,773,309

Sell Vol. 39,859,112

VJC: Vietjet and Vaeco submitted documents to implement the Project to build aircraft maintenance area No. 1 at Long Thanh International Airport. Through assessing preliminary requirements for capacity and experience, the Vietnam Aviation Administration determined that both investors who submitted registration documents to implement the project met the requirements.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

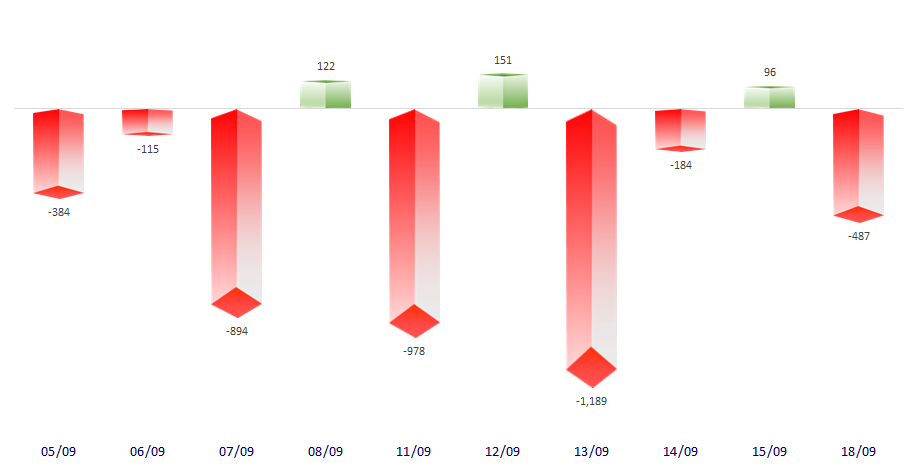

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

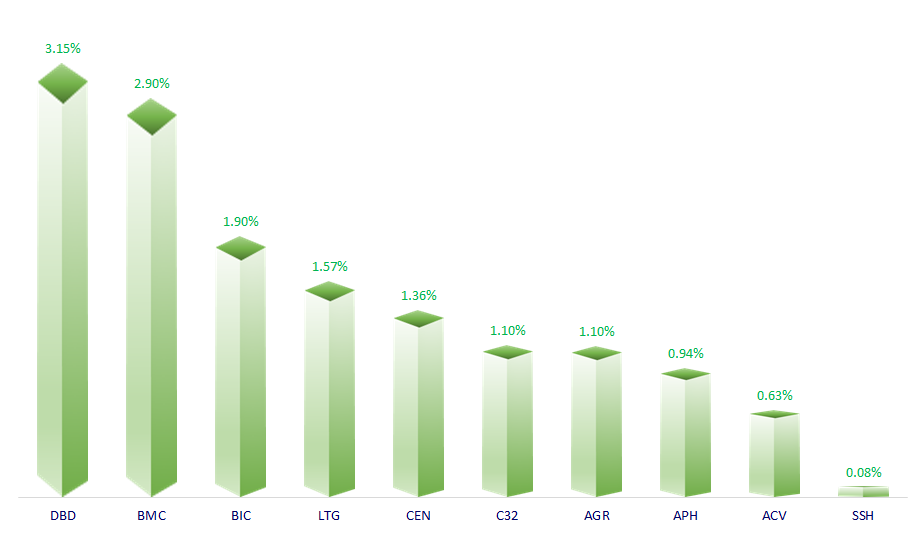

TOP INCREASES 3 CONSECUTIVE SESSIONS

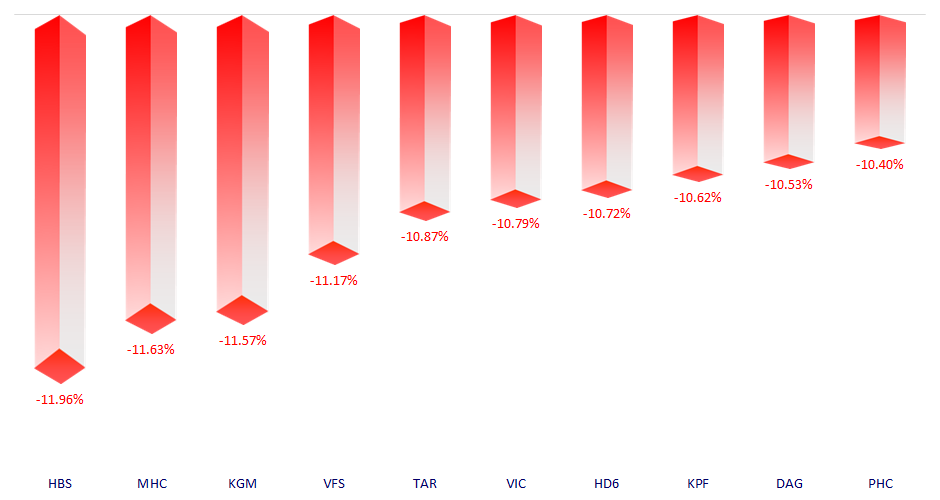

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.