Market brief 27/09/2023

VIETNAM STOCK MARKET

1,153.85

1D 1.40%

YTD 14.57%

1,168.60

1D 1.32%

YTD 16.26%

235.84

1D 2.65%

YTD 14.87%

88.73

1D 0.34%

YTD 23.84%

388.35

1D 0.00%

YTD 0.00%

21,186.55

1D -14.43%

YTD 145.90%

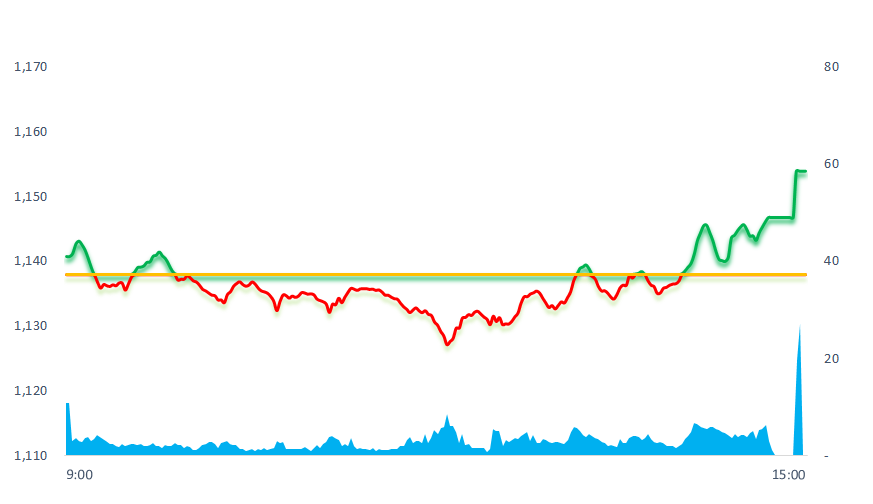

Most of the time the stock market fluctuates around the reference level. After 2:00 p.m., the market had a stronger recovery rhythm and accordingly helped VNIndex close at the highest level of the session.

ETF & DERIVATIVES

20,000

1D 0.05%

YTD 15.41%

13,810

1D 1.17%

YTD 15.86%

14,300

1D -0.14%

YTD 14.58%

18,500

1D -0.54%

YTD 31.67%

18,530

1D 0.54%

YTD 29.13%

26,500

1D 1.65%

YTD 18.30%

15,500

1D 1.31%

YTD 19.69%

1,164

1D 0.31%

YTD 0.00%

1,164

1D -0.26%

YTD 0.00%

1,162

1D 0.28%

YTD 0.00%

1,156

1D 0.34%

YTD 0.00%

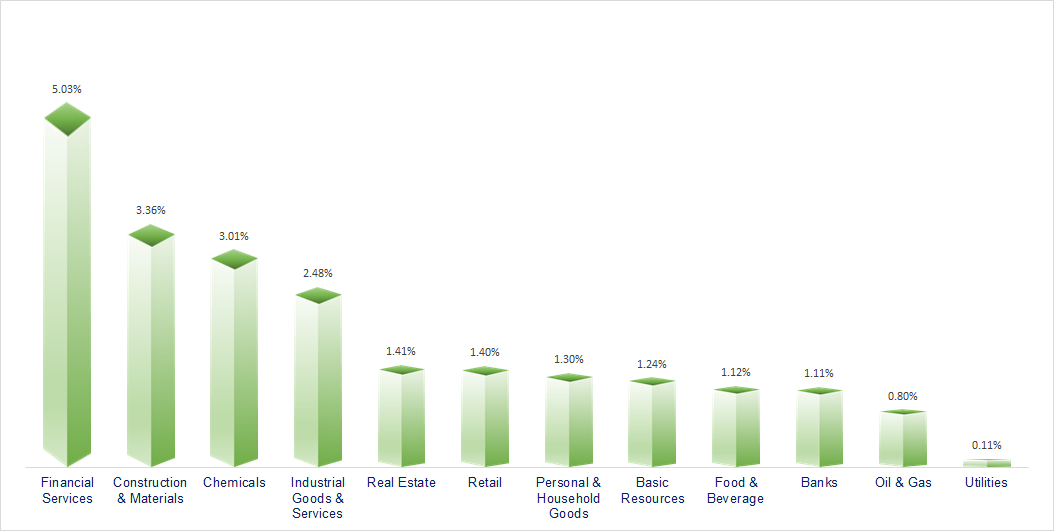

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

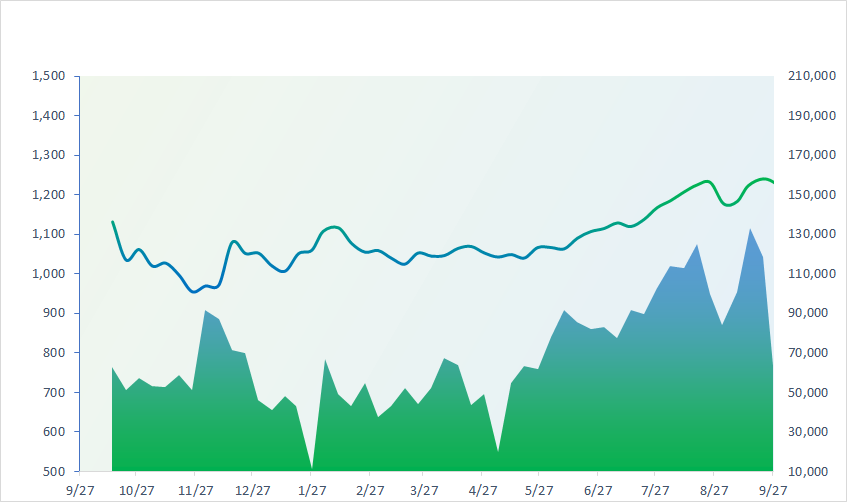

VNINDEX (12M)

GLOBAL MARKET

0

1D 32371.9

YTD 0.001759242

0

1D 3107.32

YTD 0.00162784

0

1D 10104.32

YTD 0.004390591

0

1D 17611.87

YTD 0.008299698

0

1D 2465.07

YTD 0.000852629

0

1D 66045.87

YTD 0.000993781

0

1D 3197.74

YTD -0.005411895

0

1D 1497.15

YTD -0.000133569

0

1D 93.09

YTD 0.022068511

0

1D 1895.78

YTD -0.008965305

Most Asian stocks rose on Wednesday, thank to positive industrial data and promises of more stimulus from Chinese markets. Data showed China's industrial rebounded strongly in August, helping to narrow a year-to-date decline.

VIETNAM ECONOMY

0.16%

1D (bps) -1

YTD (bps) -481

5.50%

YTD (bps) -190

2.18%

1D (bps) 2

YTD (bps) -261

2.54%

1D (bps) 3

YTD (bps) -236

24,605

1D (%) 0.20%

YTD (%) 3.56%

26,186

1D (%) -1.13%

YTD (%) 2.05%

3,407

1D (%) 0.06%

YTD (%) -2.24%

On September 27, the State Bank continued to offer 28-day T-bills according to the interest rate bidding mechanism. As a result, 9/12 participating members won the bid with a total volume of VND20,000 billion, interest rate 0.65% - higher than yesterday's session (0.58%) and the first session of the week (0.49%).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank continued to withdraw VND20,000 billion via T-bills on September 27, the winning interest rate increased;

- Apple officially brought 11 manufacturing factories to Vietnam;

- ADB forecasts that Vietnam's current account surplus in 2023 will be about 3% of GDP;

- USD hits 10-month peak;

- Mexico cancels lithium mining concession with China;

- Singapore reviews banks involved in USD1.8 billion money laundering scandal.

VN30

BANK

87,800

1D 0.92%

5D -0.23%

Buy Vol. 1,861,969

Sell Vol. 2,491,390

44,400

1D 0.11%

5D -2.84%

Buy Vol. 1,584,280

Sell Vol. 1,616,210

31,000

1D 2.31%

5D -3.28%

Buy Vol. 6,486,488

Sell Vol. 5,677,868

32,600

1D 0.62%

5D -5.09%

Buy Vol. 5,495,337

Sell Vol. 5,481,143

21,000

1D 2.69%

5D -4.11%

Buy Vol. 23,654,504

Sell Vol. 18,344,661

18,500

1D 1.37%

5D -3.65%

Buy Vol. 15,421,106

Sell Vol. 16,381,029

17,400

1D 0.00%

5D -2.52%

Buy Vol. 8,850,806

Sell Vol. 11,559,045

17,800

1D 0.56%

5D -8.72%

Buy Vol. 9,588,726

Sell Vol. 8,705,234

31,800

1D 1.44%

5D -4.36%

Buy Vol. 43,148,834

Sell Vol. 38,804,494

19,550

1D 1.56%

5D -6.90%

Buy Vol. 8,041,587

Sell Vol. 7,142,714

22,000

1D 0.46%

5D -2.00%

Buy Vol. 9,990,595

Sell Vol. 9,001,799

11,100

1D 2.78%

5D -9.02%

Buy Vol. 41,726,604

Sell Vol. 30,056,505

26,250

1D 0.19%

5D -0.94%

Buy Vol. 1,927,444

Sell Vol. 2,706,533

MBB: SCIC has registered to buy an additional 3 million shares (0.0575%) of Military Commercial Joint Stock Bank (MBB). Trading time is from September 26 - October 24. Thus, it is likely that SCIC will spend about VND55 billion to increase its ownership ratio in MBB from 9.4% to 9.5% after this transaction.

OIL & GAS

88,900

1D 0.11%

5D -2.12%

Buy Vol. 1,006,168

Sell Vol. 1,025,770

11,750

1D 0.86%

5D -8.20%

Buy Vol. 9,875,154

Sell Vol. 8,944,964

36,550

1D -1.48%

5D -7.94%

Buy Vol. 2,420,772

Sell Vol. 2,651,416

Oil prices rose on Tuesday (September 26) as expectations of tight supply outweighed concerns that an uncertain economic outlook would dampen demand.

VINGROUP

45,200

1D 0.44%

5D -15.51%

Buy Vol. 16,604,638

Sell Vol. 14,403,646

45,100

1D 0.22%

5D -11.05%

Buy Vol. 11,869,630

Sell Vol. 9,871,547

26,100

1D 1.16%

5D -7.12%

Buy Vol. 7,772,547

Sell Vol. 6,949,481

VHM: Vinhomes plans to open for sale 3 Happy Home social housing projects in Hai Phong, Thanh Hoa and Quang Tri.

FOOD & BEVERAGE

76,600

1D 0.66%

5D -2.17%

Buy Vol. 4,363,981

Sell Vol. 3,368,361

76,000

1D 4.11%

5D -4.64%

Buy Vol. 3,483,389

Sell Vol. 2,730,295

74,100

1D -1.59%

5D -7.95%

Buy Vol. 825,300

Sell Vol. 784,680

VNM: F&N Dairy Investments Pte.Ltd continues not to buy any shares among the nearly 21 million shares registered for trading from August 29, 2023 to September 27, 2023

OTHERS

42,400

1D 0.95%

5D -4.93%

Buy Vol. 1,143,660

Sell Vol. 815,090

42,400

1D 0.95%

5D -4.93%

Buy Vol. 1,143,660

Sell Vol. 815,090

99,700

1D 1.73%

5D 0.30%

Buy Vol. 1,283,099

Sell Vol. 1,314,881

94,300

1D 0.86%

5D -4.26%

Buy Vol. 7,981,088

Sell Vol. 7,238,097

52,000

1D 0.97%

5D -6.81%

Buy Vol. 9,611,940

Sell Vol. 8,148,418

19,850

1D 4.75%

5D -14.07%

Buy Vol. 9,755,898

Sell Vol. 7,780,277

33,000

1D 6.80%

5D -9.47%

Buy Vol. 65,611,437

Sell Vol. 55,512,360

26,500

1D 1.15%

5D -6.69%

Buy Vol. 35,738,864

Sell Vol. 34,972,907

HPG: Hot rolled steel coil (HRC) orders in the third quarter of 2023 reached 100% of the factory's capacity (250,000 tons/month). Demand mainly comes from export channels, as blast furnaces in Europe temporarily stop operating for maintenance from July 2023.

Market by numbers

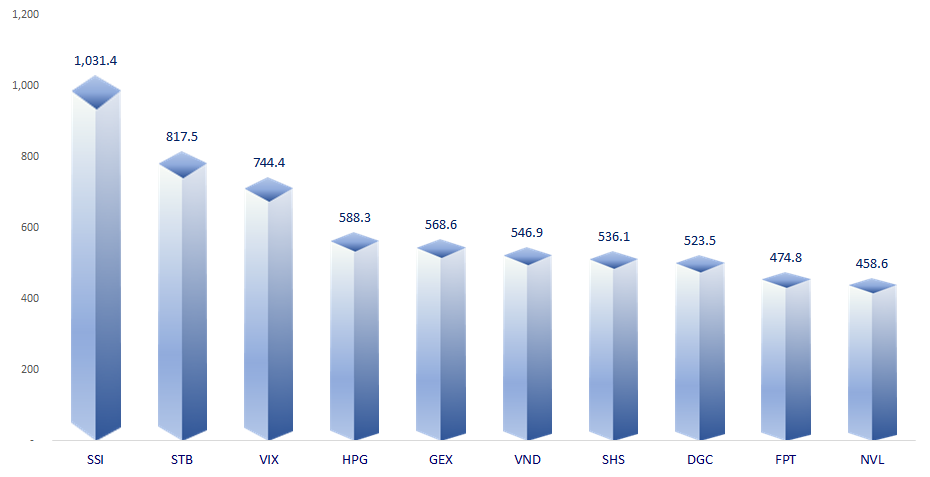

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

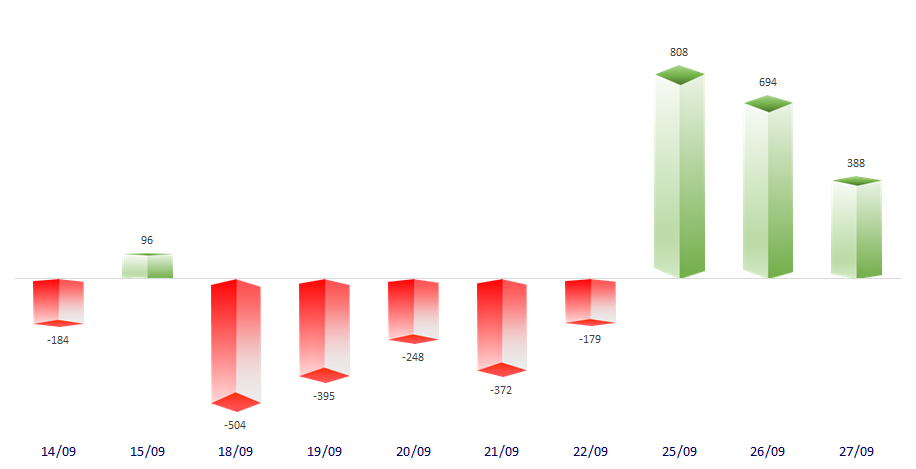

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

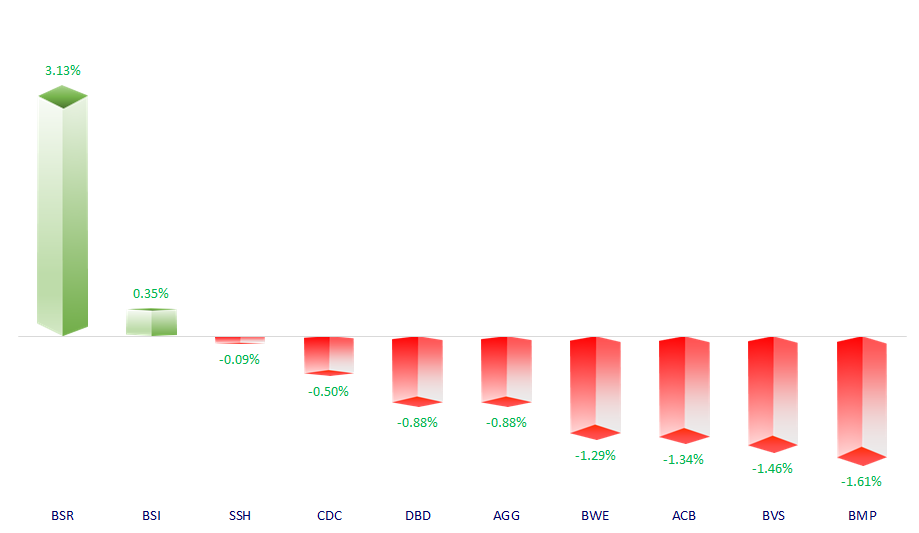

TOP INCREASES 3 CONSECUTIVE SESSIONS

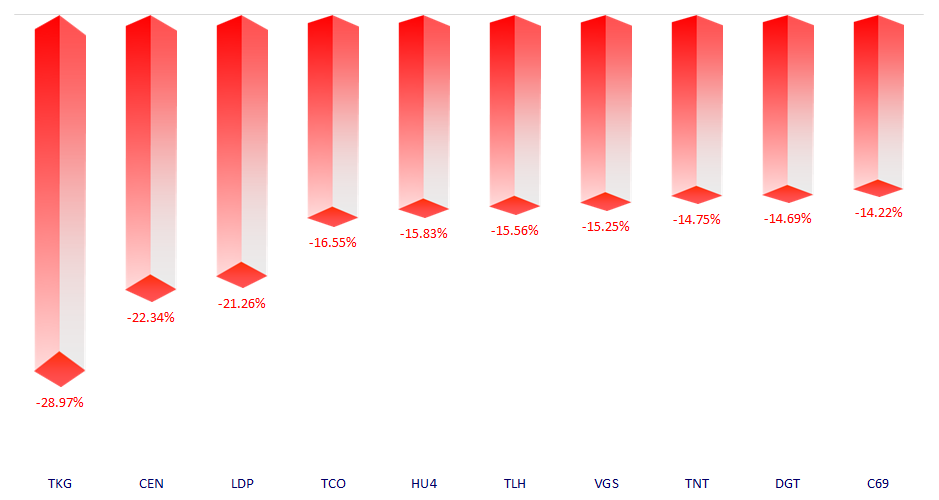

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.