Market brief 10/10/2023

VIETNAM STOCK MARKET

1,143.69

1D 0.56%

YTD 13.56%

1,160.28

1D 0.86%

YTD 15.43%

243.17

1D 4.12%

YTD 18.44%

87.45

1D 0.64%

YTD 22.05%

-250.32

1D 0.00%

YTD 0.00%

17,845.22

1D 12.07%

YTD 107.12%

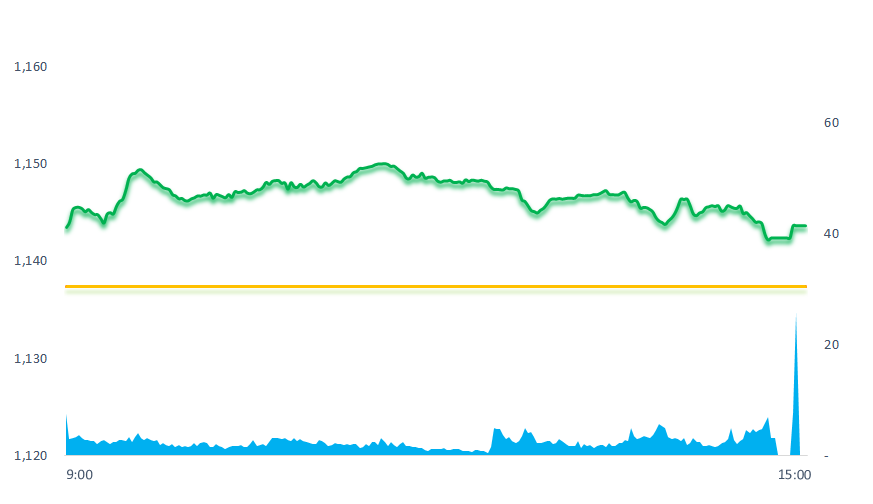

The stock market opened in green right from the beginning of the session, and this color was maintained until the market closed. Although the increase in scores is still quite limited, the improvement in trading volume and value compared to the last few sessions can also make investor sentiment somewhat better.

ETF & DERIVATIVES

19,930

1D 0.91%

YTD 15.00%

13,730

1D 0.96%

YTD 15.18%

14,300

1D 1.35%

YTD 14.58%

19,500

1D -1.56%

YTD 38.79%

18,730

1D 2.63%

YTD 30.52%

26,350

1D 1.07%

YTD 17.63%

15,370

1D 1.45%

YTD 18.69%

1,157

1D 1.05%

YTD 0.00%

1,155

1D 1.14%

YTD 0.00%

1,152

1D 1.14%

YTD 0.00%

1,150

1D 1.13%

YTD 0.00%

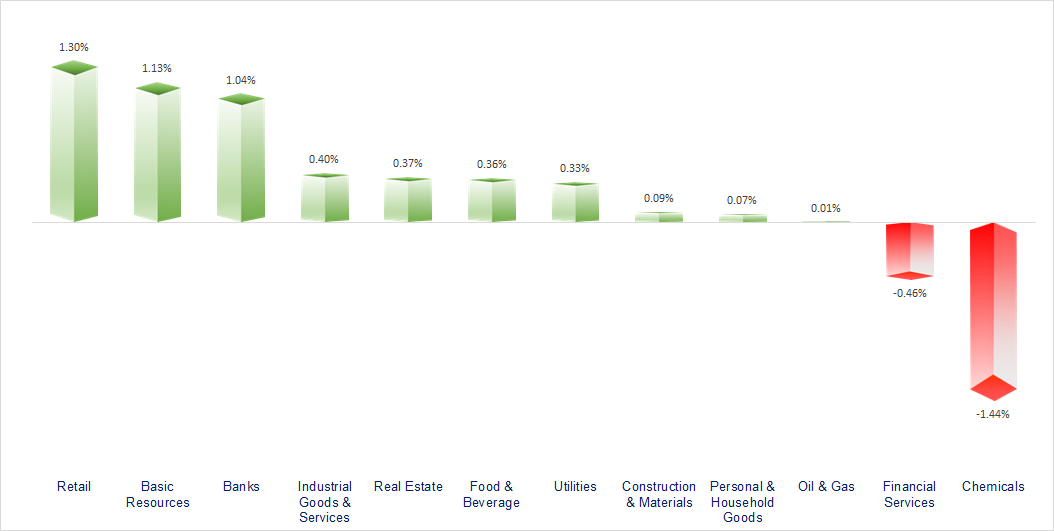

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

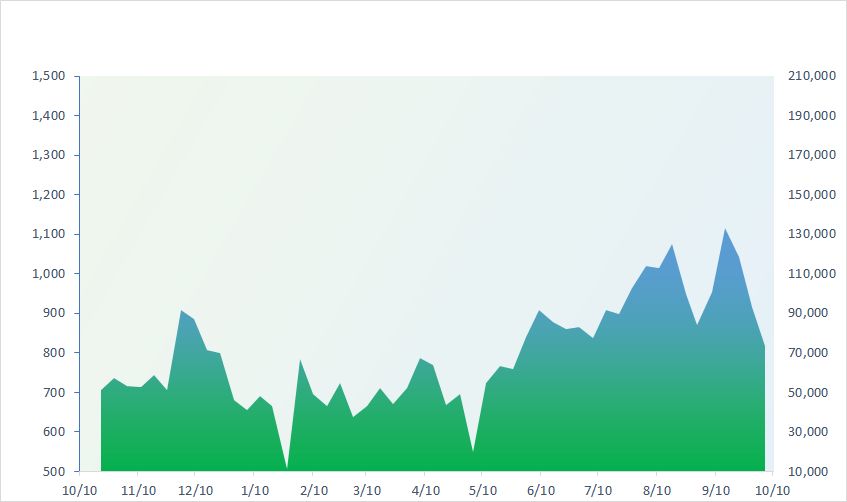

VNINDEX (12M)

GLOBAL MARKET

31,746.53

1D 2.43%

YTD 21.66%

3,075.24

1D -0.70%

YTD -0.45%

10,050.04

1D -0.56%

YTD -8.77%

17,664.73

1D 0.84%

YTD -10.70%

2,402.58

1D -0.26%

YTD 7.43%

66,136.24

1D 0.98%

YTD 8.70%

3,165.01

1D 0.00%

YTD -2.65%

1,434.45

1D 0.19%

YTD -14.12%

87.83

1D -0.09%

YTD 2.23%

1,858.35

1D -0.33%

YTD 1.76%

Asian stocks had mixed movements during the trading session on October 10, although Wall Street had a good trading session last night. The Nikkei 225 index increased the most in the region by 2.43% while the Chinese market dropped with the Shanghai Composite index -0.7%, Shenzhen -0.56%.

VIETNAM ECONOMY

1.14%

YTD (bps) -383

5.30%

YTD (bps) -210

2.21%

1D (bps) -11

YTD (bps) -258

2.86%

1D (bps) 7

YTD (bps) -204

24,620

1D (%) 0.27%

YTD (%) 3.62%

26,293

1D (%) -0.83%

YTD (%) 2.47%

3,415

1D (%) 0.03%

YTD (%) -2.01%

According to the State Bank's Report, in the first 7 months of 2023, the whole system handled VND128.8 trillion of bad debt, an increase of 46.3% over the same period last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister: Promote digitization of real estate transactions, clean up securities trader data;

- The State Bank is strong in dealing with cross-ownership;

- In the first 7 months of 2023, the entire banking system has handled more than VND128 trillion of bad debt;

- The Israel-Hamas crisis makes all of Asia uneasy;

- France prevents the US from acquiring a company providing nuclear components;

- Russia criticized the US approach to the Israeli-Palestinian conflict.

VN30

BANK

86,100

1D 1.77%

5D -0.23%

Buy Vol. 1,294,017

Sell Vol. 1,276,836

42,050

1D 0.24%

5D 1.20%

Buy Vol. 1,395,712

Sell Vol. 1,710,739

29,300

1D 0.51%

5D 0.69%

Buy Vol. 6,157,535

Sell Vol. 6,981,111

32,500

1D 1.25%

5D 0.00%

Buy Vol. 5,315,562

Sell Vol. 4,793,539

21,600

1D 0.93%

5D 2.86%

Buy Vol. 17,242,039

Sell Vol. 20,055,155

18,450

1D 0.82%

5D 2.22%

Buy Vol. 13,859,548

Sell Vol. 14,287,844

17,400

1D 2.05%

5D 1.75%

Buy Vol. 12,909,283

Sell Vol. 10,513,757

16,750

1D -0.59%

5D 0.30%

Buy Vol. 6,862,807

Sell Vol. 7,921,007

31,250

1D 0.16%

5D 7.02%

Buy Vol. 23,801,974

Sell Vol. 25,134,604

19,400

1D 2.37%

5D 3.19%

Buy Vol. 8,313,501

Sell Vol. 6,830,180

22,800

1D 1.33%

5D 5.56%

Buy Vol. 12,251,331

Sell Vol. 14,049,962

10,850

1D 0.93%

5D 2.84%

Buy Vol. 23,443,911

Sell Vol. 21,653,285

24,600

1D 0.20%

5D -1.20%

Buy Vol. 1,246,393

Sell Vol. 1,323,203

By the end of 2022, state-owned commercial banks have paid into the state budget VND22,516.4 billion, of which: Vietinbank: VND6,520 billion; BIDV: VND4,891 billion; Vietcombank: VND6,046.3 billion and Agribank: VND13,062.27 billion.

OIL & GAS

11,450

1D -0.23%

5D 2.23%

Buy Vol. 1,419,772

Sell Vol. 1,494,816

36,000

1D 2.23%

5D 0.00%

Buy Vol. 19,858,873

Sell Vol. 12,777,838

44,900

1D 0.84%

5D 0.90%

Buy Vol. 3,089,140

Sell Vol. 2,315,581

OPEC forecasts that global oil demand will reach 116 million barrels/day in 2045, an increase by 16.5% compared to demand at 99.4 million barrels/day in 2022.

VINGROUP

48,000

1D -0.66%

5D 8.97%

Buy Vol. 10,963,139

Sell Vol. 12,480,958

27,000

1D 2.13%

5D 2.66%

Buy Vol. 6,493,519

Sell Vol. 8,154,587

74,400

1D -0.18%

5D 0.54%

Buy Vol. 4,127,731

Sell Vol. 5,102,358

VHM: VHM affirms that it has enough capacity to carry out the company's projects independently, even without support from parent corporation Vingroup.

FOOD & BEVERAGE

73,200

1D 0.95%

5D -1.08%

Buy Vol. 2,594,434

Sell Vol. 1,903,251

68,800

1D -0.41%

5D -2.13%

Buy Vol. 1,613,614

Sell Vol. 1,875,120

68,900

1D 0.00%

5D 0.58%

Buy Vol. 988,938

Sell Vol. 952,482

VNM: VNM has just signed a MOU with two Chinese companies to bring Vinamilk yogurt products into this market.

OTHERS

42,550

1D 0.00%

5D 1.67%

Buy Vol. 692,707

Sell Vol. 646,355

42,550

1D 0.83%

5D 1.67%

Buy Vol. 692,707

Sell Vol. 646,355

97,300

1D 0.21%

5D -0.61%

Buy Vol. 1,082,215

Sell Vol. 1,176,273

96,300

1D 0.73%

5D 4.45%

Buy Vol. 6,117,053

Sell Vol. 6,422,992

48,850

1D 1.88%

5D -0.31%

Buy Vol. 8,855,929

Sell Vol. 9,204,580

20,050

1D -1.72%

5D 5.53%

Buy Vol. 5,912,192

Sell Vol. 7,276,639

32,700

1D -1.51%

5D 8.28%

Buy Vol. 47,044,429

Sell Vol. 58,896,376

26,000

1D 1.96%

5D 4.84%

Buy Vol. 43,308,888

Sell Vol. 38,090,020

FPT: According to Mr. Truong Gia Binh, the story of developing the semiconductor chip industry in Da Nang this time also needs strong desire. FPT initially plans to set a target of 10,000 employee and then possibly 20-30,000 employee per year to serve the semiconductor chip industry.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

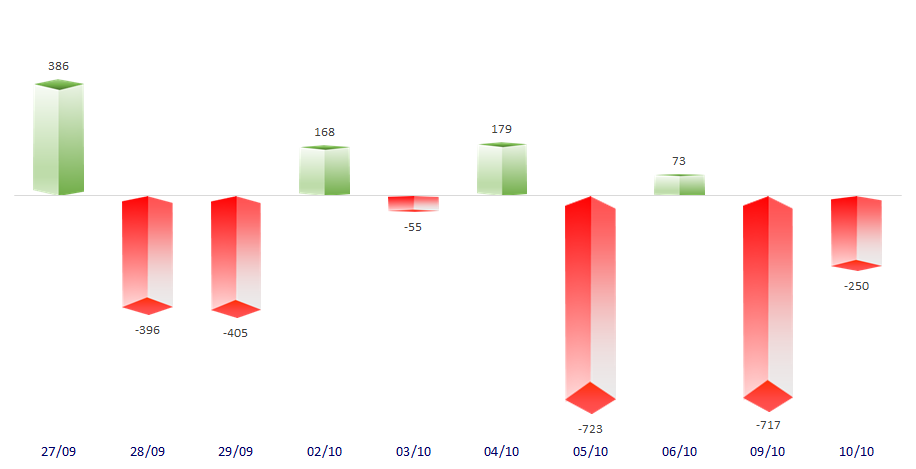

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

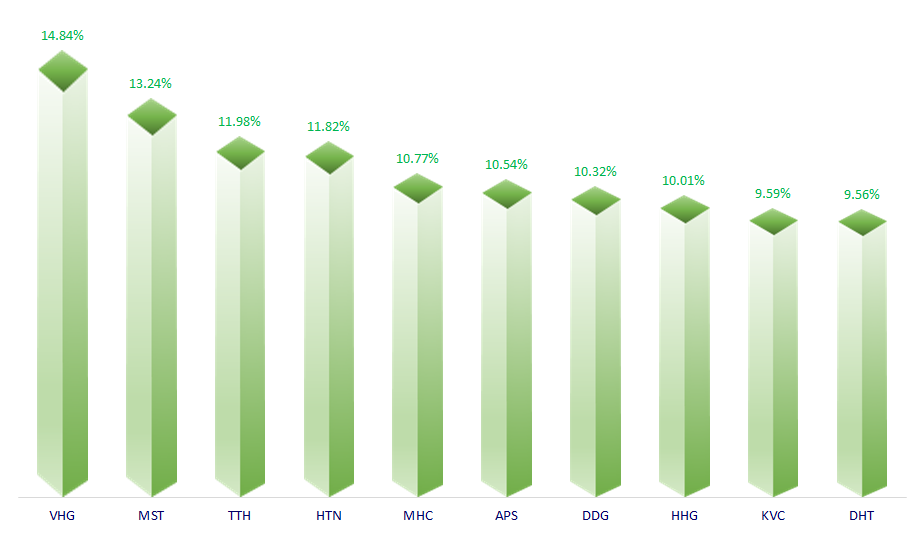

TOP INCREASES 3 CONSECUTIVE SESSIONS

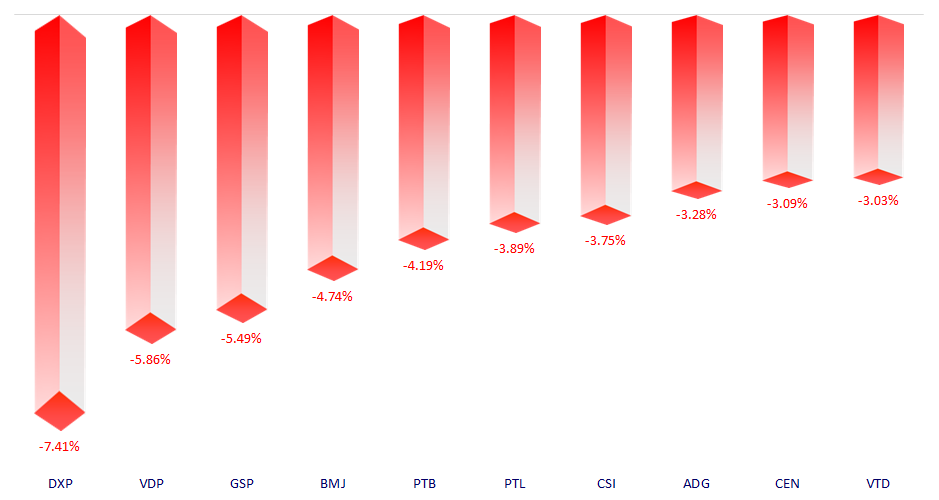

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.