Market Brief 11/10/2023

VIETNAM STOCK MARKET

1,150.81

1D 0.62%

YTD 14.27%

1,167.29

1D 0.60%

YTD 16.13%

237.00

1D 1.21%

YTD 15.44%

87.75

1D 0.34%

YTD 22.47%

52.12

1D 0.00%

YTD 0.00%

14,694.01

1D -17.66%

YTD 70.54%

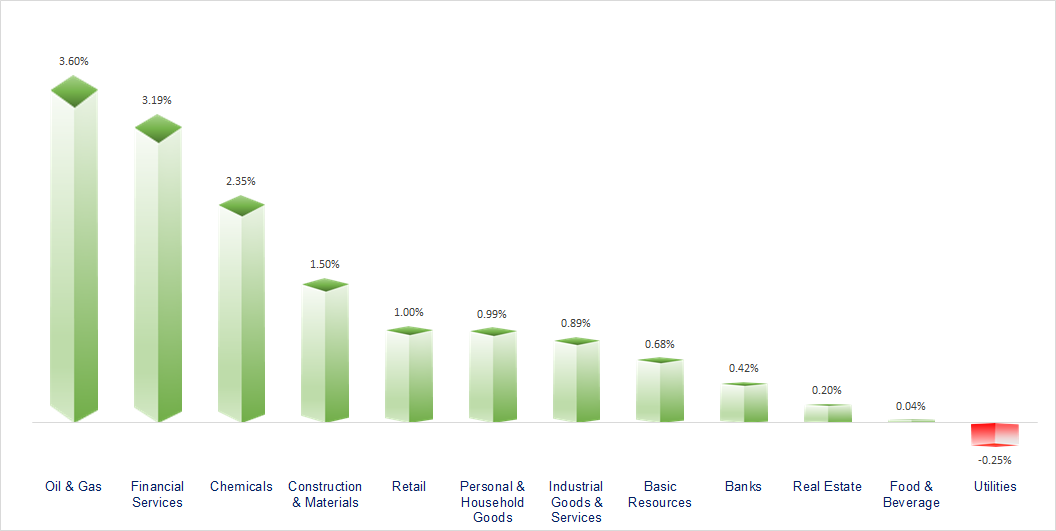

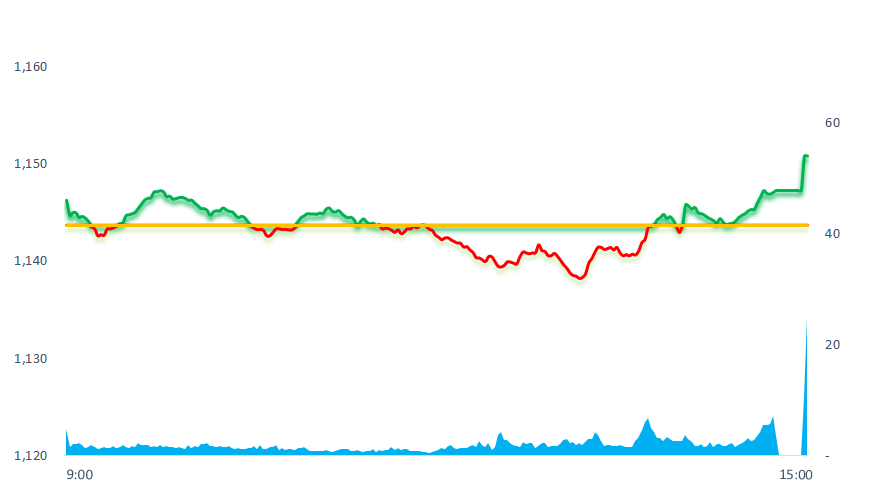

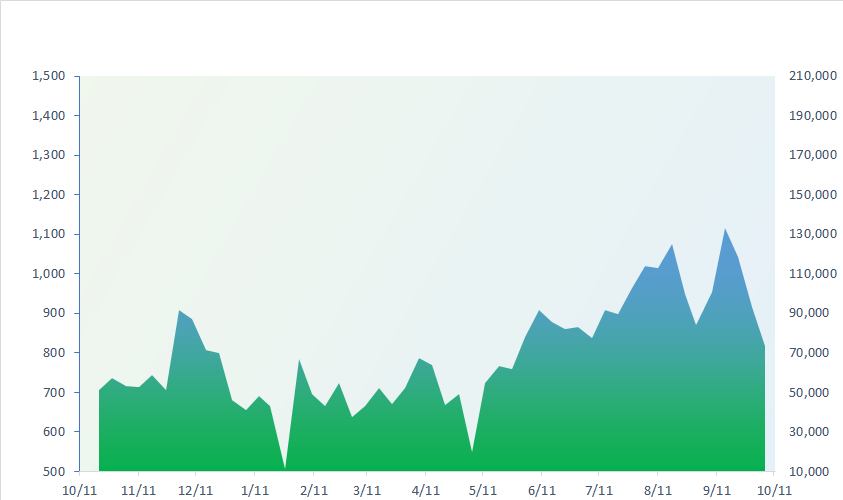

The market traded in a narrow range with low liquidity, showing the cautious psychology of investors, but the large cash flow entering the ATC session helped VN-Index rebound strongly. Financial services, oil and gas were the two most active sectors in today's session.

ETF & DERIVATIVES

19,950

1D 0.10%

YTD 15.12%

13,790

1D 0.44%

YTD 15.69%

14,330

1D 0.21%

YTD 14.82%

19,400

1D -0.51%

YTD 38.08%

18,750

1D 0.11%

YTD 30.66%

26,350

1D 0.00%

YTD 17.63%

15,290

1D -0.52%

YTD 18.07%

1,166

1D 0.78%

YTD 0.00%

1,163

1D 0.68%

YTD 0.00%

1,161

1D 0.82%

YTD 0.00%

1,161

1D 0.93%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

31,936.51

1D 0.60%

YTD 22.39%

3,078.96

1D 0.12%

YTD -0.33%

10,084.89

1D 0.35%

YTD -8.45%

17,893.10

1D 1.29%

YTD -9.55%

2,450.08

1D 1.98%

YTD 9.55%

66,422.68

1D 0.43%

YTD 9.17%

3,191.07

1D 0.82%

YTD -1.85%

1,453.07

1D 1.30%

YTD -13.01%

87.47

1D -0.30%

YTD 1.82%

1,870.70

1D 0.51%

YTD 2.44%

Asian stocks rallied today, while the dollar beat a retreat as a dovish shift in tone from Federal Reserve officials had traders paring U.S. interest rate expectations. However, all markets are focusing on US inflation data scheduled for release on Thursday.

VIETNAM ECONOMY

0.41%

1D (bps) -31

YTD (bps) -456

5.30%

YTD (bps) -210

2.20%

1D (bps) -1

YTD (bps) -259

2.85%

1D (bps) -1

YTD (bps) -205

24,611

1D (%) 0.13%

YTD (%) 3.58%

26,644

1D (%) 0.08%

YTD (%) 3.84%

3,419

1D (%) 0.09%

YTD (%) -1.89%

According to the latest data released by the State Bank of Vietnam, the average interbank interest rate at the overnight term (the main term accounting for about 90% of the transaction value) simultaneously decreased sharply, to below 1%. This is also the lowest winning interest rate for T-bills since early October until now.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ca Mau province supports airlines to compensate for losses;

- Proposal to add a project worth nearly VND3,500 billion to Power Planning VIII;

- Pangasius exports to CPTPP market to see positive growth this year;

- The Indian stock market attracts billions of dollars in investment capital;

- IMF hikes India's 2023 GDP growth forecast to 6.3%, downgrades China;

- Country Garden warns of missed foreign debt payments.

VN30

BANK

86,500

1D 0.46%

5D 0.23%

Buy Vol. 1,209,847

Sell Vol. 1,437,870

42,000

1D -0.12%

5D -1.18%

Buy Vol. 1,803,518

Sell Vol. 2,119,389

29,500

1D 0.68%

5D 2.08%

Buy Vol. 5,938,729

Sell Vol. 4,324,731

32,600

1D 0.31%

5D 1.09%

Buy Vol. 4,423,308

Sell Vol. 3,845,068

21,800

1D 0.93%

5D 3.81%

Buy Vol. 17,596,170

Sell Vol. 18,019,443

18,500

1D 0.27%

5D 1.93%

Buy Vol. 10,661,364

Sell Vol. 11,037,526

17,600

1D 1.15%

5D 2.92%

Buy Vol. 12,499,708

Sell Vol. 11,300,316

16,750

1D 0.00%

5D 0.90%

Buy Vol. 5,777,815

Sell Vol. 5,981,842

31,750

1D 1.60%

5D 5.13%

Buy Vol. 23,532,145

Sell Vol. 17,793,362

19,600

1D 1.03%

5D 3.70%

Buy Vol. 5,160,038

Sell Vol. 3,522,150

22,700

1D -0.44%

5D 5.09%

Buy Vol. 5,903,040

Sell Vol. 8,989,198

10,900

1D 0.46%

5D 2.35%

Buy Vol. 15,082,891

Sell Vol. 15,188,355

24,750

1D 0.61%

5D 1.23%

Buy Vol. 1,045,518

Sell Vol. 994,428

All four state-owned banks: CTG, VCB, BID and Agribank have reduced the highest deposit interest rate to a record low of 5.3%, lower than the Covid-19 period. Specifically, the Big4 group once listed the 12-month term interest rate at 5.5%/year during the period from July 2021 to July 2022.

OIL & GAS

11,500

1D -0.46%

5D 2.22%

Buy Vol. 1,186,973

Sell Vol. 1,121,986

36,900

1D 0.44%

5D 1.79%

Buy Vol. 13,925,724

Sell Vol. 11,679,619

45,450

1D 2.50%

5D -1.41%

Buy Vol. 2,541,149

Sell Vol. 2,670,862

Imported gasoline prices in September reached their highest level since the beginning of the year.

VINGROUP

47,400

1D 1.22%

5D 6.28%

Buy Vol. 7,102,218

Sell Vol. 7,952,404

27,000

1D -1.25%

5D 0.00%

Buy Vol. 5,274,542

Sell Vol. 7,501,343

74,400

1D 0.00%

5D 0.00%

Buy Vol. 2,403,716

Sell Vol. 2,614,401

VRE: Vincom Retail appoints new General Director.

FOOD & BEVERAGE

73,800

1D 0.00%

5D 0.41%

Buy Vol. 2,570,634

Sell Vol. 2,305,867

68,000

1D 0.82%

5D -2.86%

Buy Vol. 2,195,497

Sell Vol. 1,625,765

68,300

1D -1.16%

5D -1.01%

Buy Vol. 900,975

Sell Vol. 848,279

MSN: The session on October 11 was the 7th session that foreign investors net sold MSN with a value of more than VND9 billion.

OTHERS

42,600

1D -0.87%

5D 1.31%

Buy Vol. 506,018

Sell Vol. 673,834

42,600

1D 0.12%

5D 1.31%

Buy Vol. 506,018

Sell Vol. 673,834

97,600

1D 0.31%

5D 0.83%

Buy Vol. 1,022,992

Sell Vol. 1,060,189

97,000

1D 0.73%

5D 4.86%

Buy Vol. 4,858,775

Sell Vol. 5,923,378

49,300

1D 0.92%

5D 0.20%

Buy Vol. 6,079,169

Sell Vol. 6,486,499

20,700

1D 3.24%

5D 6.15%

Buy Vol. 4,791,513

Sell Vol. 4,837,236

34,000

1D 3.98%

5D 7.09%

Buy Vol. 66,337,721

Sell Vol. 44,019,500

26,200

1D 0.77%

5D 3.76%

Buy Vol. 25,137,702

Sell Vol. 28,006,671

FPT: FPT Digital Retail JSC (FRT - an associate of FPT Corporation Viet Nam) has launched a total of 4 Long Chau vaccination centers with 2 facilities in Ho Chi Minh City and 2 facilities in Hanoi.

Market by numbers

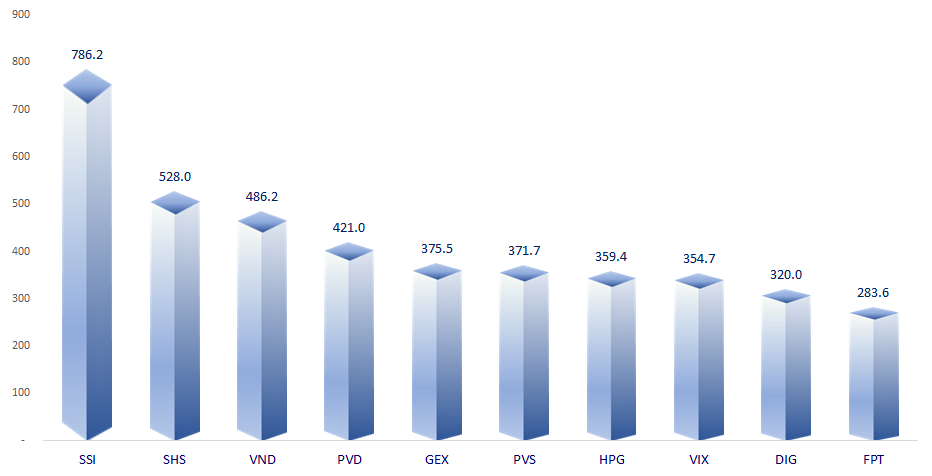

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

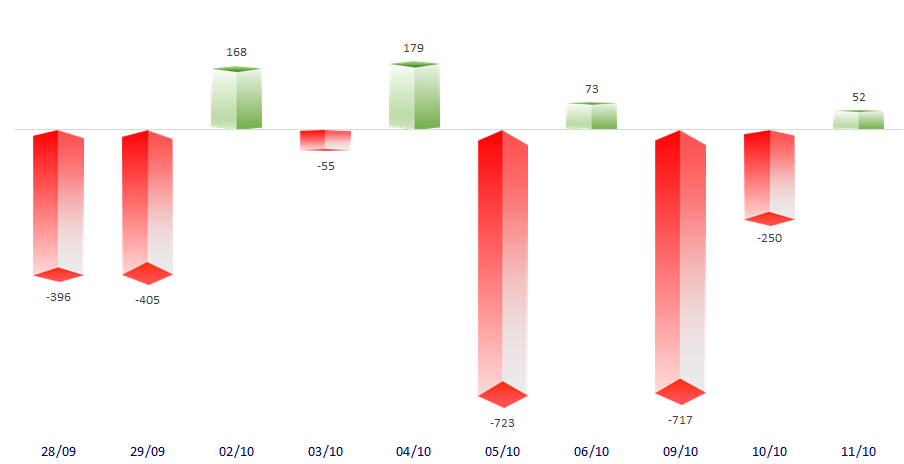

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

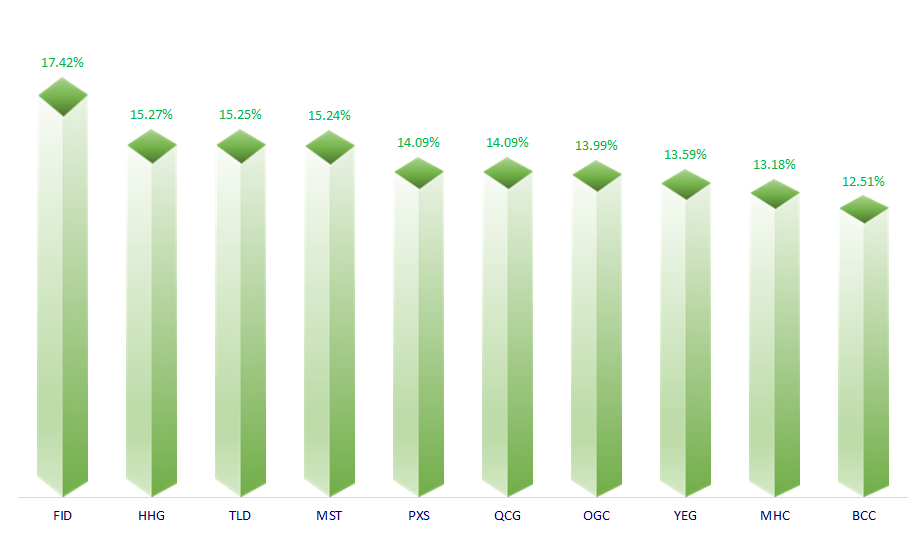

TOP INCREASES 3 CONSECUTIVE SESSIONS

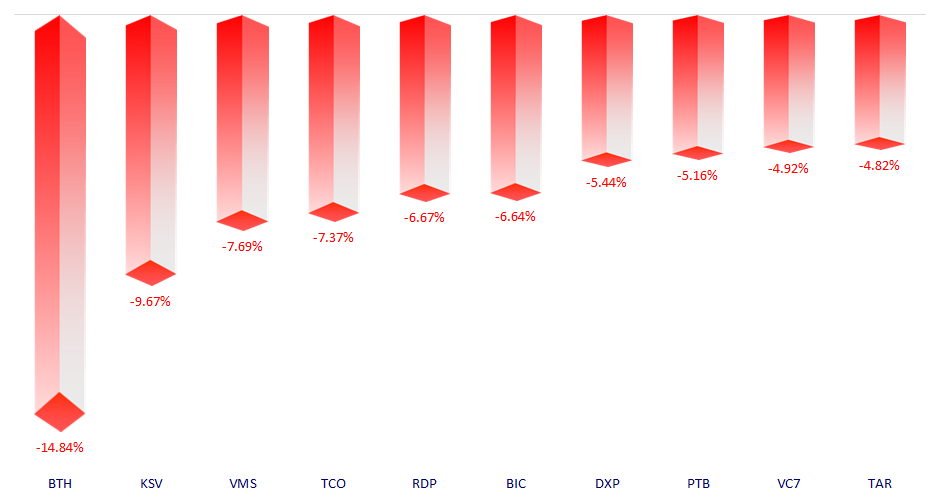

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.