Market brief 12/10/2023

VIETNAM STOCK MARKET

1,150.81

1D 0.62%

YTD 14.27%

1,167.29

1D 0.60%

YTD 16.13%

237.00

1D 1.21%

YTD 15.44%

87.75

1D 0.34%

YTD 22.47%

-647.35

1D 0.00%

YTD 0.00%

14,694.01

1D -17.66%

YTD 70.54%

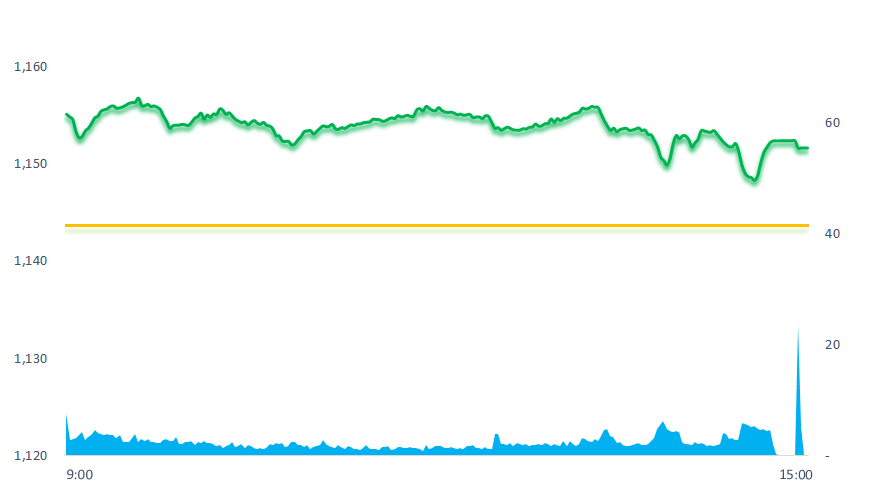

The stock market opened higher and the green color was maintained for most of the trading time. Gradually towards the end of the session, VNIndex showed signs of reversal when at several times the index traded below the reference level. At the ATC session, the market gradually recovered, helping VNIndex close slightly higher.

ETF & DERIVATIVES

20,000

1D 0.25%

YTD 15.41%

13,760

1D -0.22%

YTD 15.44%

14,300

1D -0.21%

YTD 14.58%

19,000

1D -2.06%

YTD 35.23%

18,650

1D -0.53%

YTD 29.97%

26,400

1D 0.19%

YTD 17.86%

15,480

1D 1.24%

YTD 19.54%

1,162

1D -0.39%

YTD 0.00%

1,159

1D -0.34%

YTD 0.00%

1,156

1D -0.49%

YTD 0.00%

1,154

1D -0.63%

YTD 0.00%

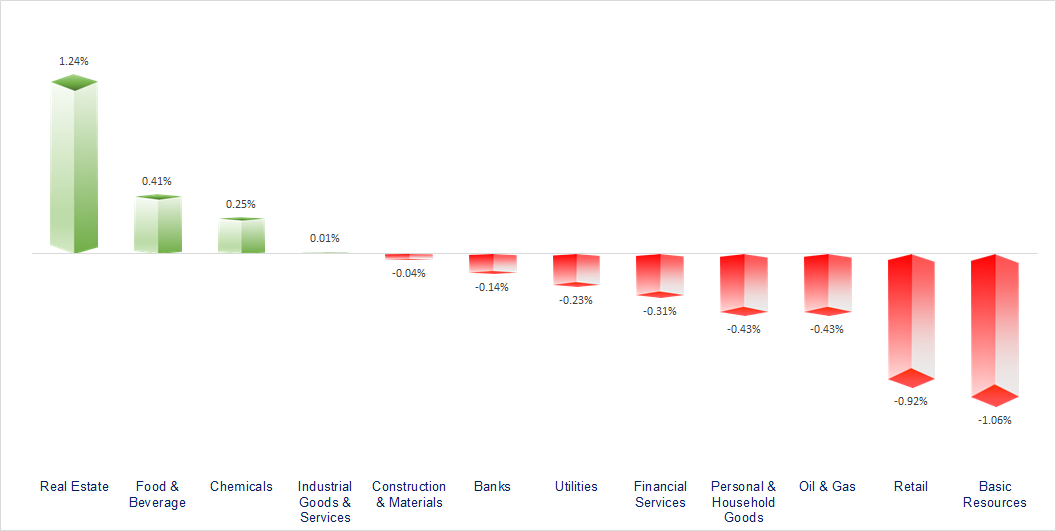

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

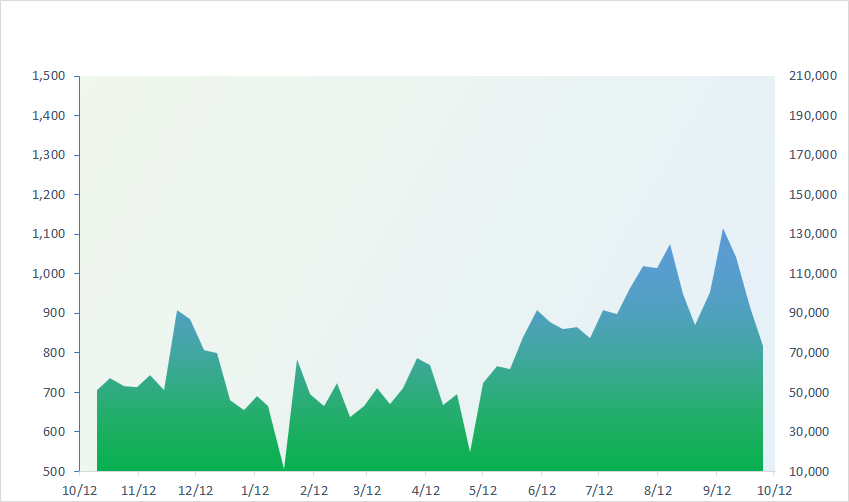

VNINDEX (12M)

GLOBAL MARKET

32,494.66

1D 1.75%

YTD 24.53%

3,107.90

1D 0.94%

YTD 0.60%

10,168.49

1D 0.83%

YTD -7.69%

18,238.21

1D 1.93%

YTD -7.80%

2,479.82

1D 1.21%

YTD 10.88%

66,445.23

1D 0.03%

YTD 9.21%

3,191.07

1D 0.00%

YTD -1.85%

1,450.75

1D -0.16%

YTD -13.15%

86.67

1D 1.51%

YTD 0.88%

1,881.96

1D 0.28%

YTD 3.05%

Asian stock markets were mostly higher on Thursday, thanks to strong activity on Wall Street as oil prices and bond yields fell. The Nikkei 225, Hang Seng, and Kospi indexes all recorded good increases of over 1%.

VIETNAM ECONOMY

0.37%

1D (bps) -4

YTD (bps) -460

5.30%

YTD (bps) -210

2.31%

1D (bps) 11

YTD (bps) -248

2.76%

1D (bps) -9

YTD (bps) -214

24,652

1D (%) 0.16%

YTD (%) 3.75%

26,394

1D (%) -1.15%

YTD (%) 2.86%

3,418

1D (%) 0.00%

YTD (%) -1.92%

Both interbank interest rates and deposit interest rates have tended to decrease in recent days. On the foreign exchange market, USD prices listed at banks simultaneously exceeded the VND24,600 VND, returning to the highest level since the beginning of the year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Deputy Governor Dao Minh Tu: The State Bank will continue to operate interest rates in a gradually decreasing direction;

- HSBC maintains its forecast for 2023 GDP growth of 5%, raising average inflation to 3.4%;

- Primary apartment prices in Hanoi increased for 19 consecutive quarters;

- There is disagreement within the Fed about the possibility of raising interest rates;

- China plans to inject USD137 billion to revive the economy;

- USA witnessed the largest strike in the auto industry.

VN30

BANK

86,000

1D -0.58%

5D 1.78%

Buy Vol. 1,156,619

Sell Vol. 1,562,212

42,150

1D 0.36%

5D 1.32%

Buy Vol. 1,724,595

Sell Vol. 1,810,123

29,600

1D 0.34%

5D 5.34%

Buy Vol. 4,753,734

Sell Vol. 5,437,135

32,500

1D -0.31%

5D 2.20%

Buy Vol. 4,191,998

Sell Vol. 5,436,433

21,850

1D 0.23%

5D 5.05%

Buy Vol. 18,959,452

Sell Vol. 23,142,572

18,350

1D -0.81%

5D 1.66%

Buy Vol. 12,247,511

Sell Vol. 12,581,073

17,500

1D -0.57%

5D 3.24%

Buy Vol. 7,702,912

Sell Vol. 10,276,309

17,200

1D 2.69%

5D 3.93%

Buy Vol. 13,658,485

Sell Vol. 8,319,983

31,600

1D -0.47%

5D 5.69%

Buy Vol. 18,777,350

Sell Vol. 21,302,549

19,650

1D 0.26%

5D 6.22%

Buy Vol. 5,218,233

Sell Vol. 5,104,991

22,700

1D 0.00%

5D 5.09%

Buy Vol. 10,113,920

Sell Vol. 13,775,016

10,850

1D -0.46%

5D 3.33%

Buy Vol. 22,622,490

Sell Vol. 24,862,449

24,750

1D 0.00%

5D 1.02%

Buy Vol. 1,313,104

Sell Vol. 1,562,897

ACB: After completing the first private bond issuance in 2023 with a maximum total par value of VND20,000 billion, ACB plans to continue to issue bonds for the second time in 2023 with a maximum par value of VND20,000 billion. The maximum is VND5,000 billion. The par value of each bond is VND100 million, corresponding to the maximum number of bonds issued is 50,000 bonds.

OIL & GAS

11,450

1D 0.00%

5D 5.05%

Buy Vol. 1,316,449

Sell Vol. 1,055,228

36,700

1D -0.43%

5D 6.69%

Buy Vol. 11,556,729

Sell Vol. 10,670,933

46,500

1D -0.54%

5D 1.97%

Buy Vol. 1,887,133

Sell Vol. 2,686,772

Oil prices plummeted more than 2% on Wednesday as Saudi Arabia's commitment to help stabilize the market.

VINGROUP

47,550

1D 2.31%

5D 6.73%

Buy Vol. 15,539,921

Sell Vol. 17,284,452

27,200

1D 0.32%

5D 1.49%

Buy Vol. 4,383,234

Sell Vol. 5,634,392

75,500

1D 0.74%

5D 3.85%

Buy Vol. 3,137,554

Sell Vol. 3,959,552

VIC: VinFast is negotiating to buy a Ford factory in Chennai (Tamil Nadu state, India). VinFast has made an initial request and negotiations may be at a preliminary stage.

FOOD & BEVERAGE

73,100

1D 1.48%

5D 0.41%

Buy Vol. 3,719,813

Sell Vol. 3,881,222

68,900

1D -0.95%

5D -0.86%

Buy Vol. 2,112,900

Sell Vol. 1,955,137

67,600

1D 1.32%

5D -1.89%

Buy Vol. 1,084,441

Sell Vol. 831,731

VNM: Since 2003, Ong Tho condensed milk products have become a strong export product of Vinamilk with a total accumulated export turnover of about USD243 million.

OTHERS

42,650

1D -1.02%

5D 1.79%

Buy Vol. 550,052

Sell Vol. 701,661

42,650

1D 0.12%

5D 1.79%

Buy Vol. 550,052

Sell Vol. 701,661

97,700

1D 0.10%

5D 2.30%

Buy Vol. 1,117,217

Sell Vol. 1,026,736

96,400

1D -0.62%

5D 5.24%

Buy Vol. 3,259,469

Sell Vol. 5,581,182

48,400

1D -1.83%

5D 2.98%

Buy Vol. 20,744,606

Sell Vol. 19,850,648

20,850

1D 0.72%

5D 5.30%

Buy Vol. 6,228,317

Sell Vol. 7,169,032

33,600

1D -1.18%

5D 6.16%

Buy Vol. 34,721,795

Sell Vol. 40,199,931

25,800

1D -1.53%

5D 3.61%

Buy Vol. 38,232,027

Sell Vol. 40,195,602

PNJ: Phu Nhuan Jewelry Joint Stock Company will finalize the list of shareholders on October 23 to pay cash dividends at a rate of 8%. Ex-rights trading date is October 20, expected dividend payment time is October 27. Thus, with more than 328 million shares listed and circulating, the company is expected to spend about VND262.4 billion to pay dividends to existing shareholders.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

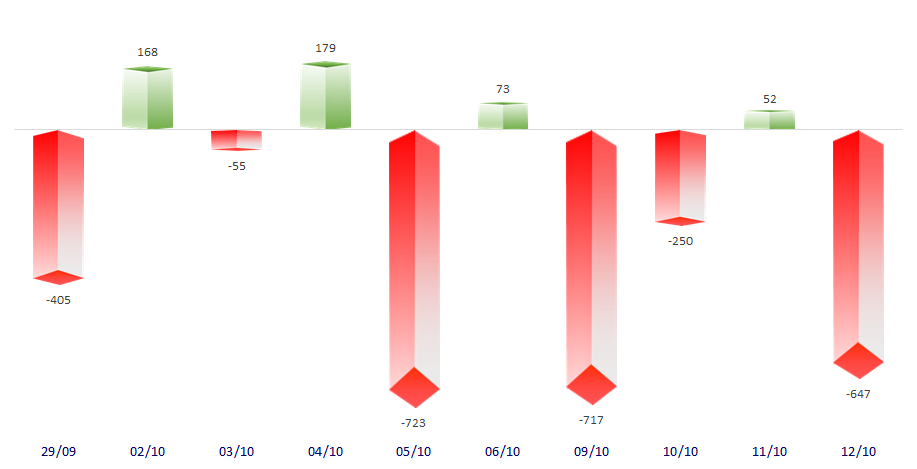

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

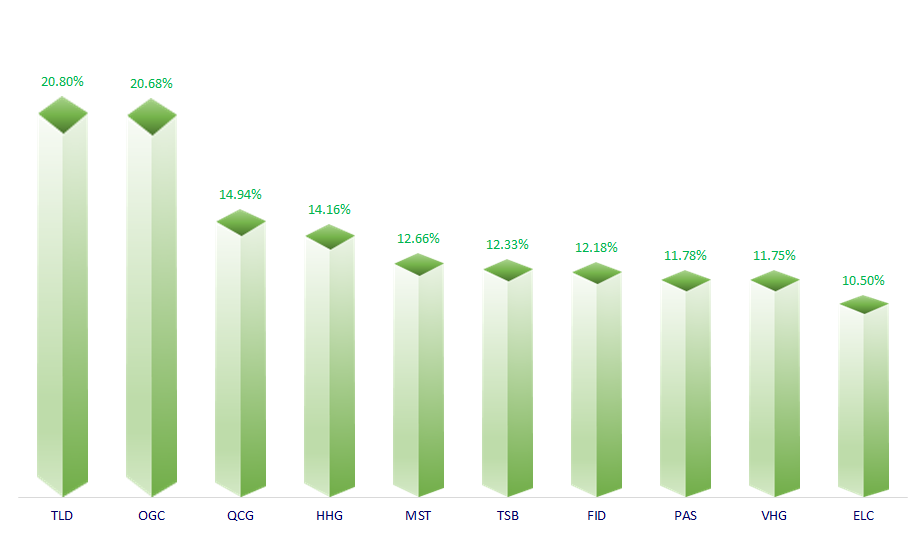

TOP INCREASES 3 CONSECUTIVE SESSIONS

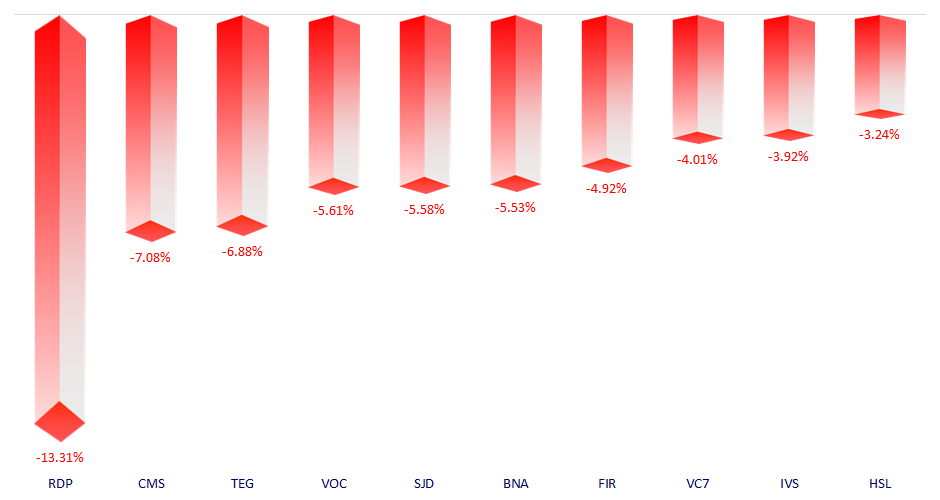

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.