Market brief 16/10/2023

VIETNAM STOCK MARKET

1,141.42

1D -1.15%

YTD 13.34%

1,153.21

1D -1.15%

YTD 14.73%

236.46

1D -1.08%

YTD 15.17%

87.35

1D -0.63%

YTD 21.91%

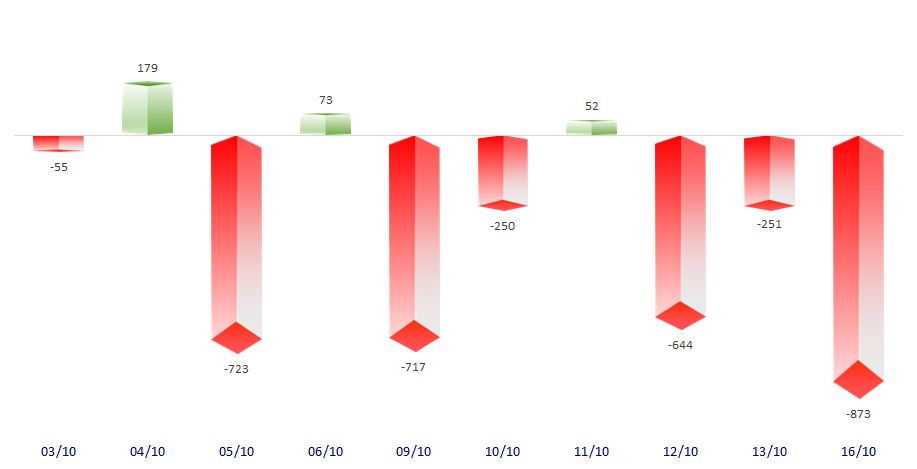

-872.93

1D 0.00%

YTD 0.00%

18,156.04

1D 9.87%

YTD 110.73%

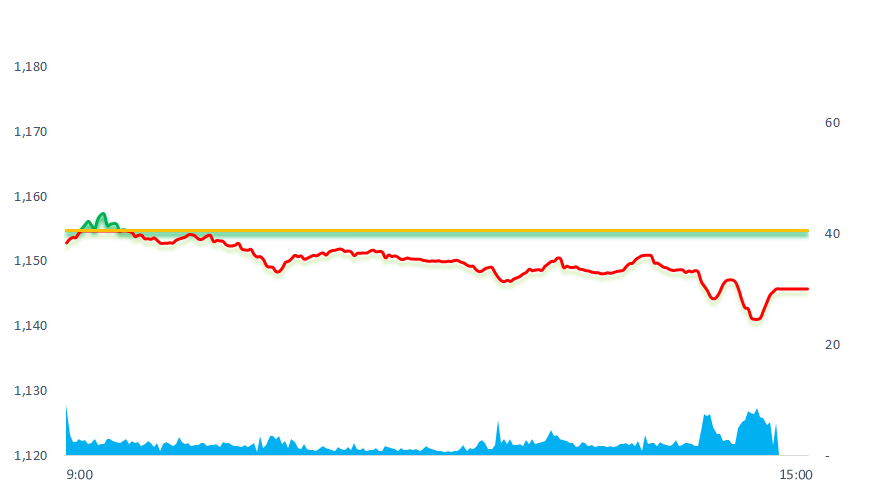

Today, the stock market only showed a glimmer of green in the early morning session, most of the time the VNIndex traded below the reference level. Since 2:00 p.m., profit-taking pressure has increased significantly, causing the index to lose quite a lot of points.

ETF & DERIVATIVES

19,750

1D -1.55%

YTD 13.96%

13,640

1D -1.30%

YTD 14.43%

14,130

1D -0.98%

YTD 13.22%

18,330

1D -5.76%

YTD 30.46%

18,570

1D 0.00%

YTD 29.41%

26,040

1D -1.62%

YTD 16.25%

15,450

1D -0.19%

YTD 19.31%

1,147

1D -1.26%

YTD 0.00%

1,145

1D -1.28%

YTD 0.00%

1,144

1D -1.07%

YTD 0.00%

1,138

1D -0.83%

YTD 0.00%

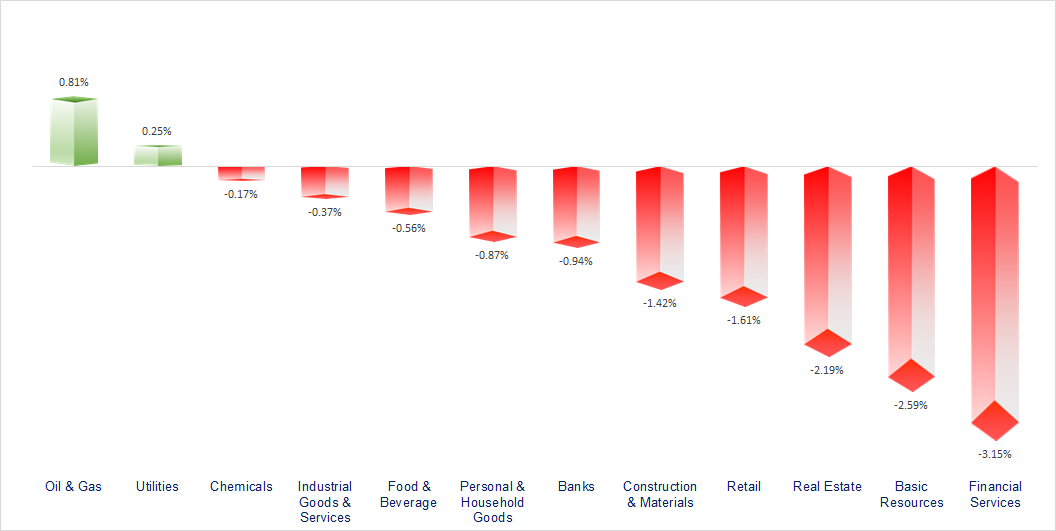

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

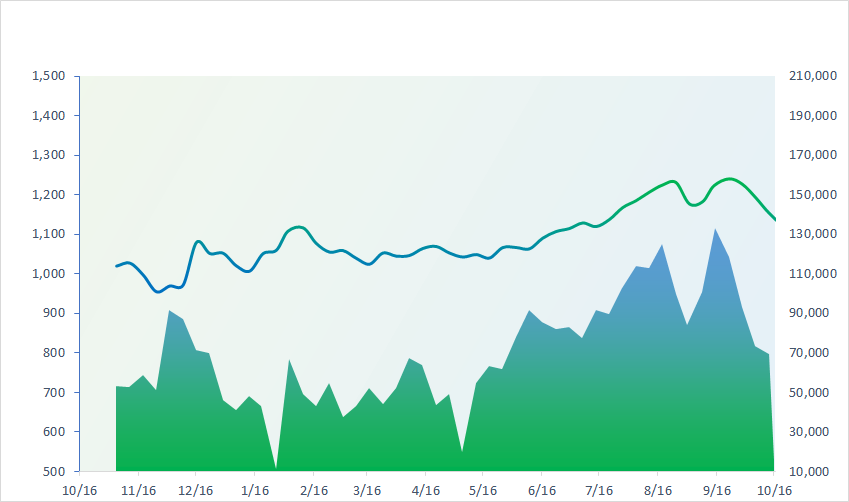

VNINDEX (12M)

GLOBAL MARKET

31,659.03

1D -2.03%

YTD 21.32%

3,073.81

1D -0.46%

YTD -0.50%

9,924.92

1D -1.42%

YTD -9.90%

17,640.36

1D -0.97%

YTD -10.82%

2,436.24

1D -0.81%

YTD 8.94%

66,246.44

1D -0.06%

YTD 8.89%

3,161.27

1D -0.81%

YTD -2.77%

1,424.10

1D -1.84%

YTD -14.74%

90.83

1D 0.15%

YTD 5.73%

1,916.13

1D -0.34%

YTD 4.92%

Asian stocks all fell on Monday due to concerns about the Israel-Hamas war. Nikkei 225 fell the most in the region with a drop of 2.03% with technology stocks bearing the brunt of the sell-off. The index had surged last week as expectations of a dovish Bank of Japan and the relative strength of Japanese companies attracted a flurry of foreign buyers.

VIETNAM ECONOMY

0.35%

1D (bps) -5

YTD (bps) -462

5.30%

YTD (bps) -210

2.32%

1D (bps) -2

YTD (bps) -247

2.80%

YTD (bps) -210

24,640

1D (%) 0.06%

YTD (%) 3.70%

26,524

1D (%) 0.22%

YTD (%) 3.37%

3,416

1D (%) -0.03%

YTD (%) -1.98%

As of the end of September, the total outstanding credit balance in Ho Chi Minh City reached more than VND3.3 million billion, an increase of 0.72% compared to August. Banks in HCMC have lent nearly VND470,000 billion VND.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Deputy Prime Minister: GDP is expected to increase only 5% in 2023 but is still in the region's high growth group;

- Rice export prices increased after information that Indonesia bought more reserves;

- The Ministry of Finance proposes to reduce environmental protection tax on gasoline by the end of 2024;

- China's central bank pumps money the most since 2020;

- US: Investors expect the period of declining profits to come to an end;

- BoJ bought more than USD6,700 billion of Japanese Government bonds in September.

VN30

BANK

86,100

1D -0.58%

5D 1.77%

Buy Vol. 764,887

Sell Vol. 873,699

41,650

1D -2.00%

5D -0.72%

Buy Vol. 1,778,783

Sell Vol. 1,644,562

28,800

1D -1.71%

5D -1.20%

Buy Vol. 5,220,312

Sell Vol. 4,024,183

31,800

1D -1.24%

5D -0.93%

Buy Vol. 3,917,608

Sell Vol. 4,328,738

22,500

1D 2.51%

5D 5.14%

Buy Vol. 39,006,011

Sell Vol. 40,592,133

18,200

1D -1.36%

5D -0.55%

Buy Vol. 9,977,929

Sell Vol. 10,689,485

17,400

1D -1.14%

5D 2.05%

Buy Vol. 10,540,443

Sell Vol. 10,955,437

16,800

1D -2.61%

5D -0.30%

Buy Vol. 7,674,083

Sell Vol. 9,265,992

30,200

1D -4.13%

5D -3.21%

Buy Vol. 42,526,510

Sell Vol. 39,562,576

18,850

1D -2.58%

5D -0.53%

Buy Vol. 5,416,814

Sell Vol. 5,736,296

22,600

1D -0.22%

5D 0.44%

Buy Vol. 6,551,431

Sell Vol. 9,891,745

10,600

1D -1.85%

5D -1.40%

Buy Vol. 20,568,768

Sell Vol. 17,690,767

24,800

1D 0.00%

5D 1.02%

Buy Vol. 1,022,815

Sell Vol. 1,299,200

VPB: VPBank will pay dividends at a rate of 10% in cash. The last registration date for dividend payment is November 10, 2023 and the expected time for dividend payment is November 20, 2023. Previously, the bank's Board of Directors also repeatedly affirmed that it would spend about VND8,000 billion from 2022 profits to pay dividends this year.

OIL & GAS

11,350

1D 1.28%

5D 1.34%

Buy Vol. 1,501,027

Sell Vol. 1,838,638

36,800

1D -0.44%

5D 3.08%

Buy Vol. 9,235,065

Sell Vol. 9,312,294

45,000

1D 0.27%

5D -0.44%

Buy Vol. 1,920,581

Sell Vol. 2,816,915

Oil prices jumped nearly 6% in Friday's trading session as investors remained cautious about escalating geopolitical tensions in the Middle East.

VINGROUP

45,550

1D -2.39%

5D -3.09%

Buy Vol. 8,810,670

Sell Vol. 8,808,800

26,700

1D -2.88%

5D -1.29%

Buy Vol. 4,776,364

Sell Vol. 6,316,606

75,200

1D -2.38%

5D 2.04%

Buy Vol. 2,661,774

Sell Vol. 4,776,637

VIC: Chairman of Vingroup announced to donate 99.8% of VinES Energy Solutions JSC to VinFast. After the merger, VinFast will be autonomous in battery technology

FOOD & BEVERAGE

71,600

1D -0.79%

5D -2.59%

Buy Vol. 2,146,998

Sell Vol. 2,459,862

70,900

1D -1.51%

5D 3.05%

Buy Vol. 1,963,022

Sell Vol. 1,661,257

65,700

1D 1.14%

5D -4.64%

Buy Vol. 1,306,223

Sell Vol. 1,036,664

SAB: SMB (Sabeco holds 32.22% of the capital) announced the consolidated financial statements for Q32023 with profit after tax down 9% over the same period, to VND41 billion.

OTHERS

41,650

1D -1.50%

5D -1.30%

Buy Vol. 890,821

Sell Vol. 922,744

41,650

1D -1.54%

5D -1.30%

Buy Vol. 890,821

Sell Vol. 922,744

102,500

1D -1.25%

5D 5.56%

Buy Vol. 1,155,801

Sell Vol. 1,338,075

96,800

1D 0.73%

5D 1.26%

Buy Vol. 8,760,671

Sell Vol. 9,552,063

48,600

1D -1.82%

5D 1.36%

Buy Vol. 12,925,052

Sell Vol. 14,221,918

21,450

1D 0.23%

5D 5.15%

Buy Vol. 6,496,262

Sell Vol. 7,231,555

32,100

1D -4.32%

5D -3.31%

Buy Vol. 52,605,049

Sell Vol. 49,928,477

25,000

1D -2.91%

5D -1.96%

Buy Vol. 27,569,027

Sell Vol. 26,767,289

HPG: In September, Hoa Phat's HRC downstream products including steel pipes and galvanized steel sheets reached more than 48,000 tons and 20,000 tons respectively in the past month, up 20% and 75% respectively compared to August.

Market by numbers

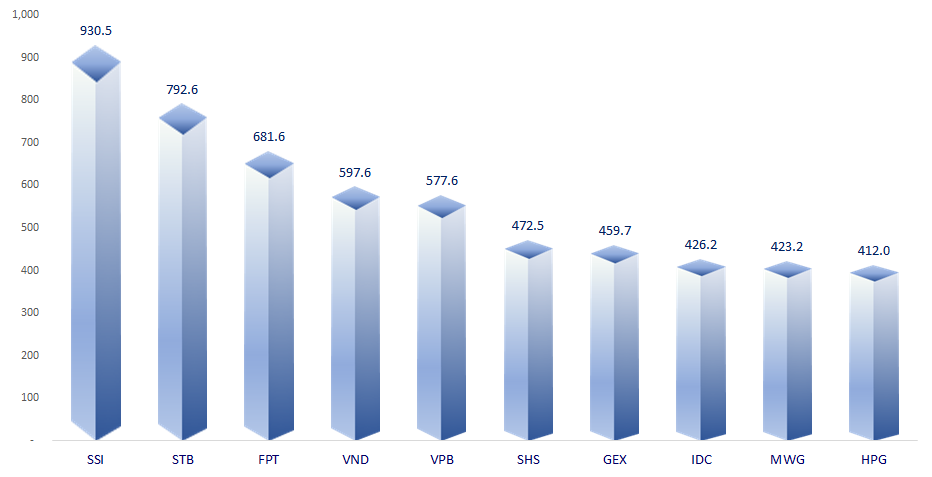

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

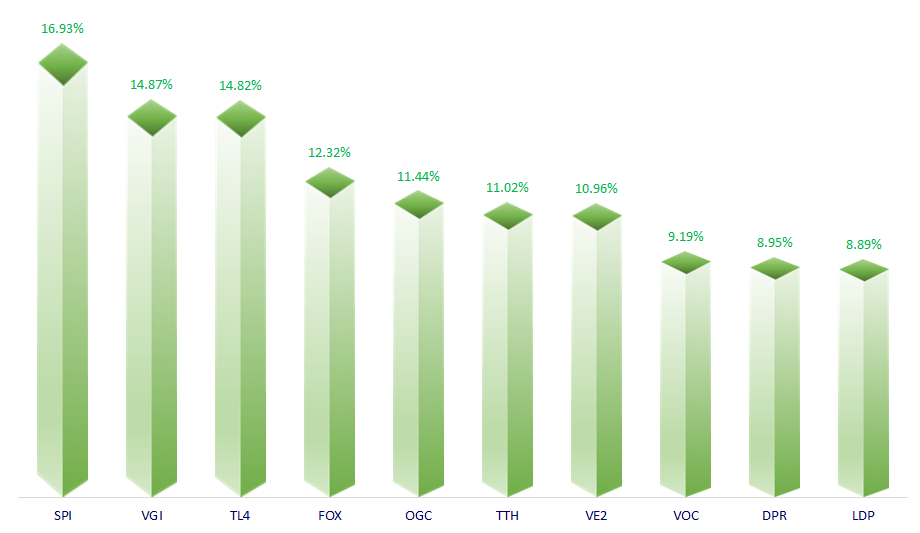

TOP INCREASES 3 CONSECUTIVE SESSIONS

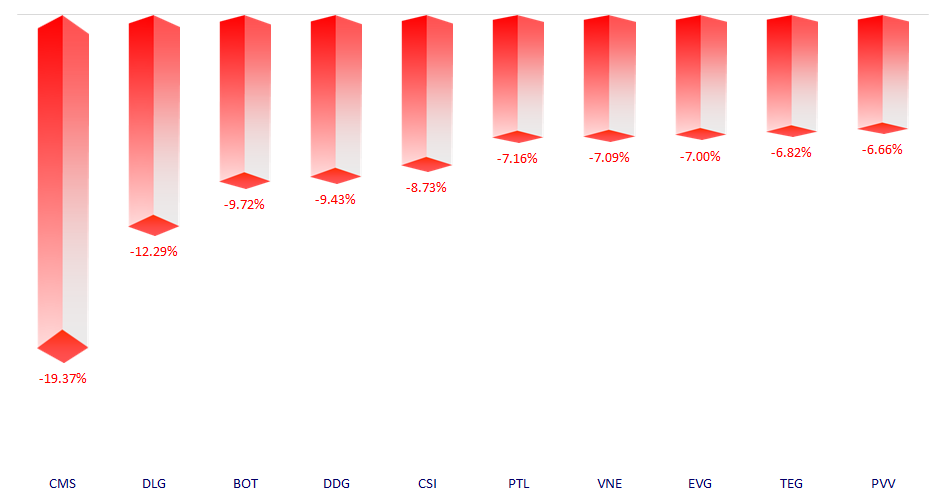

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.