Market brief 03/11/2023

VIETNAM STOCK MARKET

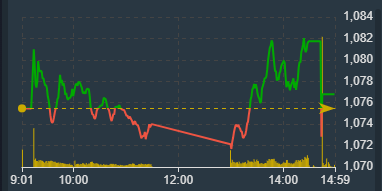

1,076.78

1D 0.12%

YTD 6.92%

1,086.19

1D -0.12%

YTD 8.06%

217.75

1D -0.10%

YTD 6.06%

84.16

1D 0.23%

YTD 17.46%

225.34

1D 0.00%

YTD 0.00%

17,528.33

1D 0.52%

YTD 103.44%

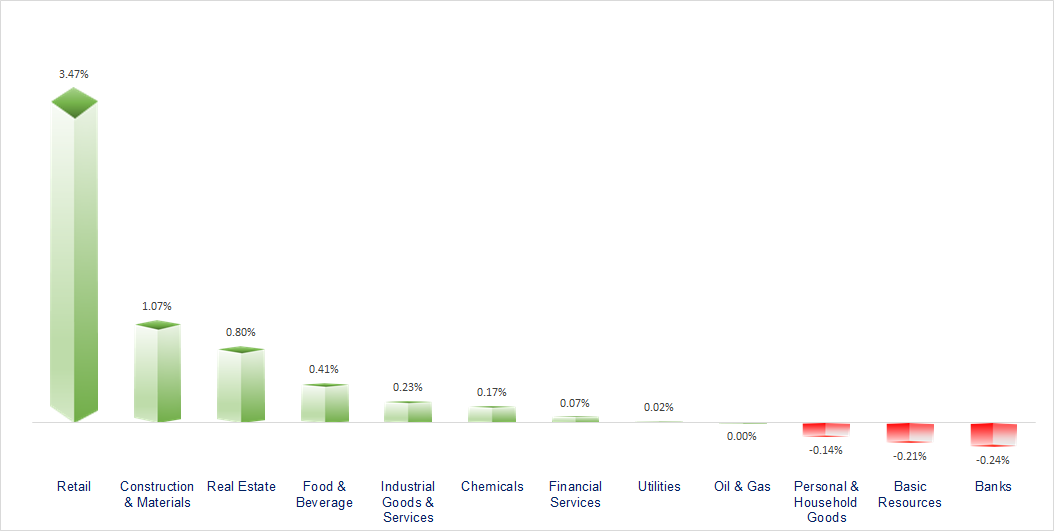

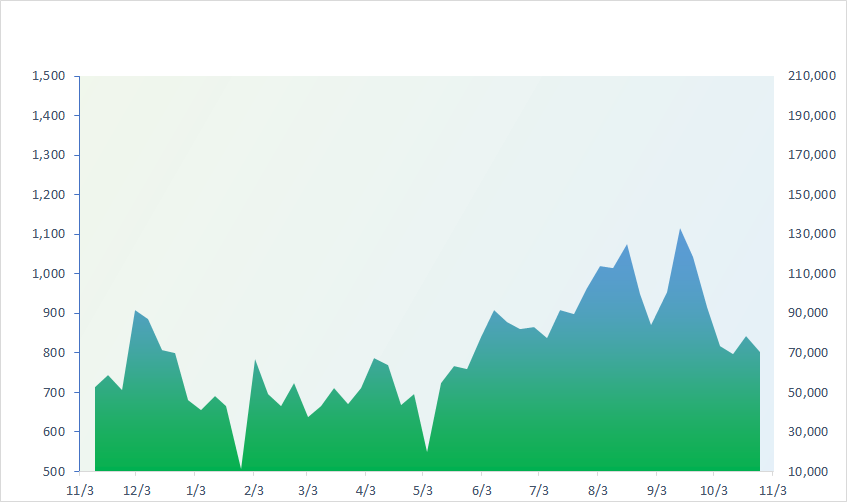

The market adjusted slightly after 2 strong increasing sessions and is expected to have successfully bottomed. Retail was the industry with the most positive increase today with 3.47%, mainly supported by MWG. On the contrary, FPT's deep decline had a negative effect to technology sector.

ETF & DERIVATIVES

18,830

1D 0.91%

YTD 8.66%

12,910

1D 0.39%

YTD 8.31%

13,570

1D 1.65%

YTD 8.73%

16,600

1D 0.67%

YTD 18.15%

17,710

1D 0.74%

YTD 23.41%

24,190

1D 0.46%

YTD 7.99%

14,500

1D 0.00%

YTD 11.97%

1,087

1D 0.00%

YTD 0.00%

1,089

1D 0.49%

YTD 0.00%

1,084

1D 0.36%

YTD 0.00%

1,079

1D 0.01%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

31,949.89

1D 1.10%

YTD 22.44%

3,030.80

1D 0.71%

YTD -1.89%

9,853.89

1D 1.22%

YTD -10.55%

17,664.12

1D 2.52%

YTD -10.70%

2,368.34

1D 1.08%

YTD 5.90%

64,363.78

1D 0.44%

YTD 5.79%

3,143.66

1D 1.98%

YTD -3.31%

1,419.76

1D 1.12%

YTD -15.00%

86.84

1D 1.16%

YTD 1.08%

1,987.24

1D 0.05%

YTD 8.82%

Asian stocks all increased in session on November 3, before many important economic news announced this week and next week. In the Hong Kong - China market, stock indexes simultaneously recovered after yesterday's decline. Next week, global investment bankers and asset managers will gather in Hong Kong for a meeting to discuss how to redefine China's position after many of the country's weak economic data.

VIETNAM ECONOMY

1.00%

1D (bps) -4

YTD (bps) -397

5.10%

YTD (bps) -230

2.24%

YTD (bps) -255

2.67%

1D (bps) 2

YTD (bps) -223

24,745

1D (%) 0.00%

YTD (%) 4.15%

26,558

1D (%) -1.04%

YTD (%) 3.50%

3,423

1D (%) -0.15%

YTD (%) -1.78%

Oil prices rose more than 2 USD/barrel and ended a series of three consecutive price declines as risk appetite returned to financial markets after the US Federal Reserve (Fed) kept original interest rate.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam attracted more than USD500 million of US investment capital in 10 months;

- The price of 24k gold rings reversed and increased sharply to 60 million VND/tael;

- Hanoi: Realization of investment capital from the budget increased by 6.3%;

- Japan announced a USD113 billion spending package to fight inflation;

- Reduced rice output in India paves the way for prolonged export restrictions;

- Sugar prices are forecast to skyrocket after Thailand's new move.

VN30

BANK

88,900

1D -0.11%

5D 4.59%

Buy Vol. 1,553,701

Sell Vol. 2,377,382

41,500

1D -0.36%

5D -1.19%

Buy Vol. 852,926

Sell Vol. 1,553,457

28,000

1D -0.88%

5D -0.71%

Buy Vol. 8,279,009

Sell Vol. 5,568,535

31,000

1D 5.62%

5D 4.91%

Buy Vol. 13,332,173

Sell Vol. 13,596,988

19,800

1D -2.46%

5D -1.98%

Buy Vol. 32,598,778

Sell Vol. 20,389,374

17,400

1D -1.69%

5D -0.29%

Buy Vol. 36,816,679

Sell Vol. 17,680,434

18,350

1D 4.26%

5D 6.38%

Buy Vol. 21,566,400

Sell Vol. 27,891,587

16,050

1D -2.13%

5D -0.93%

Buy Vol. 12,140,493

Sell Vol. 9,646,918

28,500

1D -1.72%

5D -0.70%

Buy Vol. 47,468,046

Sell Vol. 40,225,748

18,600

1D 0.27%

5D 2.76%

Buy Vol. 7,374,241

Sell Vol. 6,851,770

22,050

1D -1.12%

5D 2.32%

Buy Vol. 6,871,420

Sell Vol. 11,215,677

10,700

1D -1.83%

5D 3.88%

Buy Vol. 28,501,613

Sell Vol. 36,971,148

24,300

1D -6.36%

5D -4.89%

Buy Vol. 3,929,426

Sell Vol. 2,562,551

TCB: FiinRatings, a partner of Standard&Poor Global Ratings, has just announced the results of the long-term Issuer Credit Rating for Techcombank at "A+", with a "Stable" rating outlook.

OIL & GAS

11,100

1D -0.13%

5D 0.91%

Buy Vol. 12,684,014

Sell Vol. 13,540,465

33,100

1D 0.00%

5D 0.30%

Buy Vol. 978,317

Sell Vol. 1,390,406

41,600

1D -0.90%

5D 0.00%

Buy Vol. 7,482,302

Sell Vol. 8,971,012

GAS: In the third quarter of 2023, PV GAS continued to see profits decrease over the same period because of falling oil prices.

VINGROUP

40,500

1D 0.36%

5D 3.32%

Buy Vol. 11,708,505

Sell Vol. 13,970,583

24,400

1D 1.38%

5D 6.55%

Buy Vol. 16,424,744

Sell Vol. 16,875,809

70,000

1D 4.95%

5D 2.94%

Buy Vol. 2,686,583

Sell Vol. 3,274,969

VHM: From the beginning of the year until now, Vinhomes expanded its land fund by more than 1,800 hectares from 5 projects in Hai Phong, Khanh Hoa, Long An.

FOOD & BEVERAGE

63,900

1D -1.27%

5D 10.55%

Buy Vol. 2,589,310

Sell Vol. 3,368,487

63,900

1D 1.91%

5D 1.27%

Buy Vol. 1,468,484

Sell Vol. 1,285,758

58,500

1D 4.07%

5D -0.85%

Buy Vol. 530,140

Sell Vol. 394,665

MSN: Masan has completed payment of debt obligations due in 2023. In 2024, the group's total bond maturity is only VND 6,000 billion.

OTHERS

40,400

1D -0.51%

5D 2.28%

Buy Vol. 433,849

Sell Vol. 551,468

40,400

1D -0.49%

5D 2.28%

Buy Vol. 433,849

Sell Vol. 551,468

106,500

1D 1.53%

5D 6.71%

Buy Vol. 1,286,053

Sell Vol. 1,256,990

87,000

1D -2.25%

5D 0.00%

Buy Vol. 13,185,779

Sell Vol. 6,501,868

38,950

1D 5.27%

5D -7.26%

Buy Vol. 22,647,968

Sell Vol. 23,914,642

18,500

1D 0.00%

5D -4.15%

Buy Vol. 2,879,626

Sell Vol. 2,778,717

28,900

1D 0.00%

5D -1.87%

Buy Vol. 48,620,342

Sell Vol. 50,375,978

25,100

1D -0.59%

5D 7.49%

Buy Vol. 45,224,601

Sell Vol. 40,298,062

MWG: For the purpose of financial balance, Sao Phuong Bac Investment and Construction Joint Stock Company has just registered to sell 1.1 million HPG shares of Hoa Phat Group. Northern Star Company is an organization related to Mr. Tran Tuan Duong, Vice Chairman of the Board of Directors of HPG and also a member of the Board of Directors of Northern Star.

Market by numbers

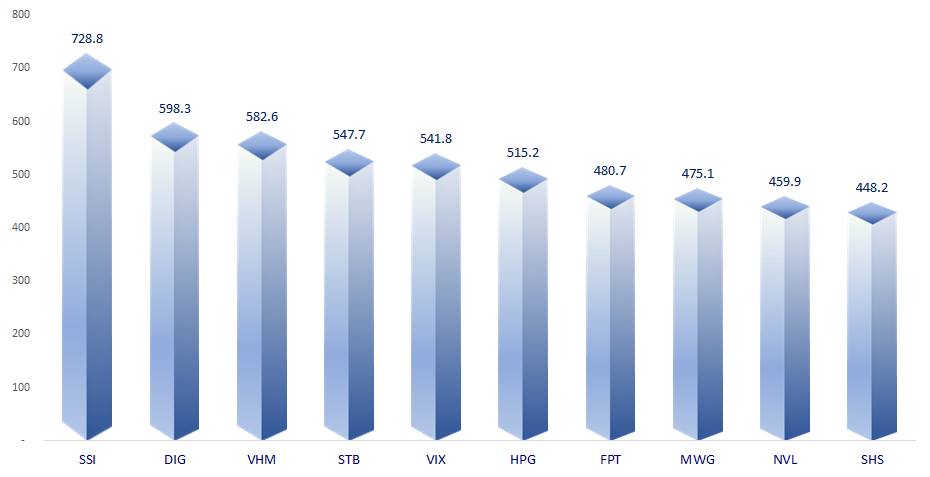

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

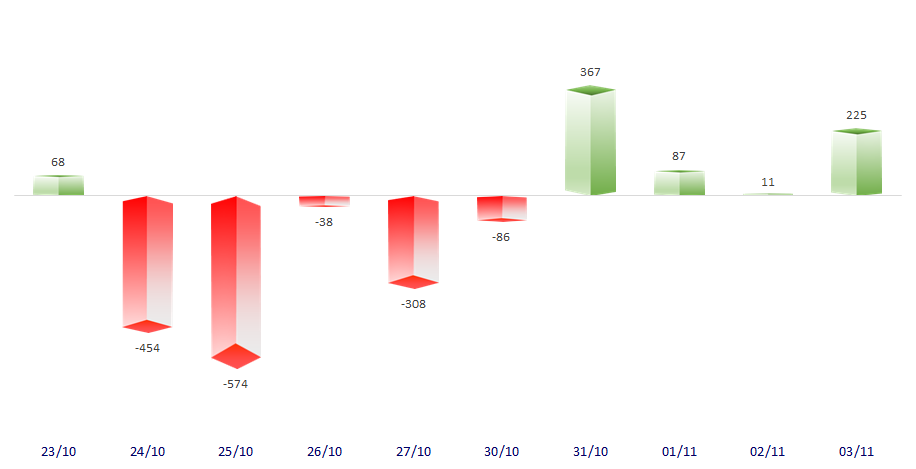

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

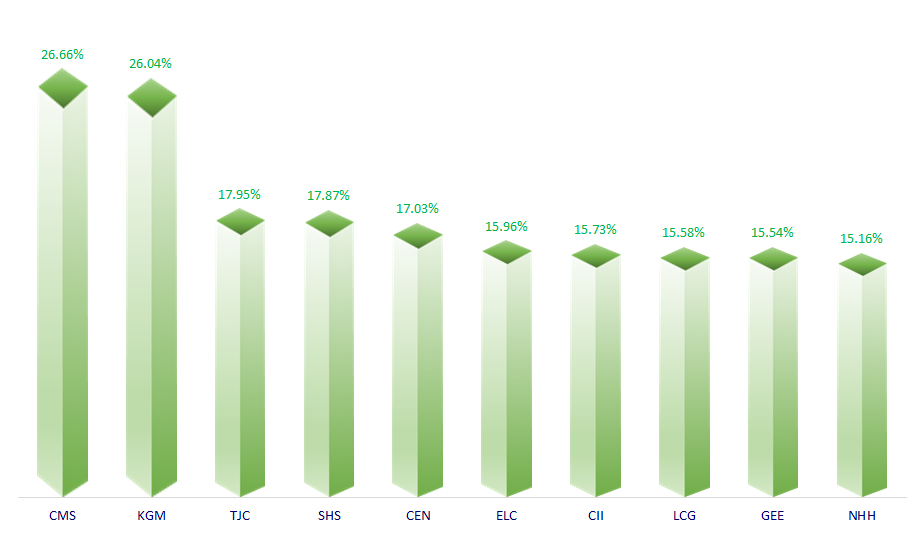

TOP INCREASES 3 CONSECUTIVE SESSIONS

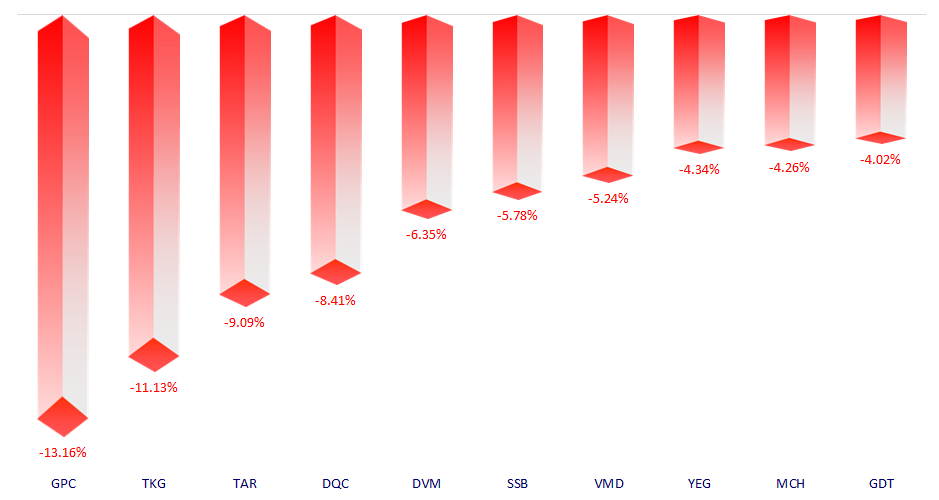

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.