Market brief 06/11/2023

VIETNAM STOCK MARKET

1,089.66

1D 1.20%

YTD 8.20%

1,103.52

1D 1.60%

YTD 9.78%

219.59

1D 0.85%

YTD 6.96%

85.05

1D 1.06%

YTD 18.70%

553.55

1D 0.00%

YTD 0.00%

15,986.60

1D -8.80%

YTD 85.55%

The stock market had its fourth consecutive recovery session from the bottom amid investor doubts. Basic resources, banks and financial services were among the most positive sectors today.

ETF & DERIVATIVES

19,050

1D 1.17%

YTD 9.92%

13,050

1D 1.08%

YTD 9.48%

13,790

1D 1.62%

YTD 10.50%

16,600

1D 0.00%

YTD 18.15%

17,840

1D 0.73%

YTD 24.32%

24,380

1D 0.79%

YTD 8.84%

14,490

1D -0.07%

YTD 11.89%

1,106

1D 1.75%

YTD 0.00%

1,100

1D 1.03%

YTD 0.00%

1,097

1D 1.44%

YTD 0.00%

1,095

1D 1.47%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

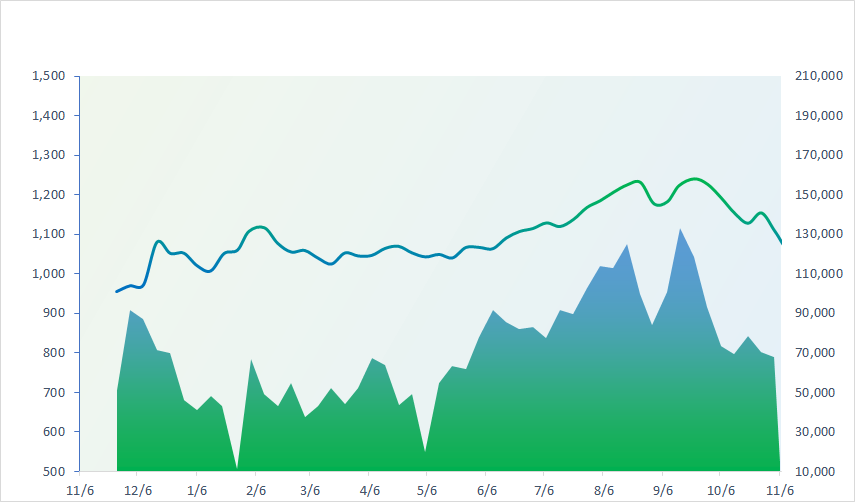

VNINDEX (12M)

GLOBAL MARKET

32,708.48

1D 2.37%

YTD 25.35%

3,058.41

1D 0.91%

YTD -1.00%

10,071.56

1D 2.21%

YTD -8.57%

17,966.59

1D 1.71%

YTD -9.17%

2,502.37

1D 5.66%

YTD 11.89%

64,910.77

1D 0.85%

YTD 6.69%

3,180.53

1D 1.17%

YTD -2.18%

1,417.21

1D -0.18%

YTD -15.16%

86.06

1D 1.07%

YTD 0.17%

1,986.53

1D -0.61%

YTD 8.78%

Asian shares rose sharply today, as markets soon priced in interest rate cuts in the US and Europe. Nikkei 225 increased 2.37%, continuing last week's strong increase after the BoJ got closer to achieving its inflation target, but still not enough to end the country's super-loosening policy. The Kospi index also increased 5.6% after authorities re-imposed a ban on short selling until mid-2024.

VIETNAM ECONOMY

1.00%

YTD (bps) -397

5.10%

YTD (bps) -230

2.35%

1D (bps) 11

YTD (bps) -244

2.73%

1D (bps) 31

YTD (bps) -217

24,513

1D (%) -0.78%

YTD (%) 3.17%

26,893

1D (%) -0.55%

YTD (%) 4.81%

3,418

1D (%) -0.35%

YTD (%) -1.92%

On November 6, the central exchange rate was listed by the State Bank at 24,064 VND/USD, down 20 VND/USD compared to the weekend and down nearly 50 points compared to the peak in October. USD at Commercial banks also went down.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Proposal to discipline 2 senior officials of Vietnam Electricity Group;

- Accelerate import and export in the last 2 months of the year;

- Implement to support businesses with a loan package of VND40 trillion that has not met the requirements;

- Korea bans short selling of stocks;

- ECB President: Inflation will fall to target 2% by 2025;

- The Russian economy can achieve growth of 2.8% in 2023.

VN30

BANK

89,500

1D 0.67%

5D 3.11%

Buy Vol. 1,219,379

Sell Vol. 1,739,444

41,800

1D 0.72%

5D 3.98%

Buy Vol. 1,331,087

Sell Vol. 1,526,165

28,550

1D 1.96%

5D 3.07%

Buy Vol. 4,166,666

Sell Vol. 4,350,903

31,000

1D 0.00%

5D 11.91%

Buy Vol. 9,149,912

Sell Vol. 6,900,194

20,800

1D 5.05%

5D 4.00%

Buy Vol. 27,105,207

Sell Vol. 16,436,336

17,950

1D 3.16%

5D 4.97%

Buy Vol. 20,441,109

Sell Vol. 16,767,949

18,250

1D -0.54%

5D 6.10%

Buy Vol. 11,734,359

Sell Vol. 14,257,161

16,600

1D 3.43%

5D 5.06%

Buy Vol. 14,092,640

Sell Vol. 10,015,848

29,450

1D 3.33%

5D 9.07%

Buy Vol. 55,926,687

Sell Vol. 44,505,264

18,900

1D 1.61%

5D 5.59%

Buy Vol. 7,548,163

Sell Vol. 5,561,207

22,200

1D 0.68%

5D 3.74%

Buy Vol. 6,108,027

Sell Vol. 11,098,785

11,000

1D 2.80%

5D 8.91%

Buy Vol. 40,968,664

Sell Vol. 38,100,714

25,300

1D 4.12%

5D -1.94%

Buy Vol. 1,471,505

Sell Vol. 1,320,667

VPB: According to the published announcement, VPBank will finalize the list of shareholders on November 10 to pay a 10% cash dividend. The expected time to pay dividends is November 20, 2023. With more than 7.9 billion outstanding shares, VPBank will spend more than VND7,900 billion to pay dividends to shareholders. This is the first time in more than 10 years that VPBank has paid dividends in cash.

OIL & GAS

11,250

1D -0.13%

5D 6.13%

Buy Vol. 17,475,965

Sell Vol. 12,811,142

33,250

1D 1.35%

5D 4.23%

Buy Vol. 835,006

Sell Vol. 1,068,051

42,100

1D 0.45%

5D 3.95%

Buy Vol. 7,144,811

Sell Vol. 9,056,742

PLX: Petrolimex announced the establishment of Bac Ninh Petroleum Company.

VINGROUP

41,000

1D 1.20%

5D 5.13%

Buy Vol. 10,248,978

Sell Vol. 10,384,036

24,000

1D 1.23%

5D 8.11%

Buy Vol. 8,710,715

Sell Vol. 10,596,525

71,000

1D -1.64%

5D 4.41%

Buy Vol. 2,234,192

Sell Vol. 2,925,253

VIC: Ending November 3, VFS shares traded around 5.94 USD/share, up 6.07% compared to the previous session. Overall for the past week, VFS shares increased by 10.61%.

FOOD & BEVERAGE

64,000

1D 1.43%

5D 9.97%

Buy Vol. 1,848,884

Sell Vol. 2,490,873

66,200

1D 0.16%

5D 16.75%

Buy Vol. 971,954

Sell Vol. 1,060,513

59,400

1D 3.60%

5D 1.37%

Buy Vol. 661,499

Sell Vol. 531,021

VNM: Fubon Fund set a record in terms of scale, aggressively gathering HPG, VCB, VNM and 3 Vingroup stocks.

OTHERS

40,700

1D 1.54%

5D 4.63%

Buy Vol. 396,910

Sell Vol. 497,733

40,700

1D 0.74%

5D 4.63%

Buy Vol. 396,910

Sell Vol. 497,733

107,300

1D 0.75%

5D 8.38%

Buy Vol. 1,470,266

Sell Vol. 1,606,586

88,500

1D 1.72%

5D 6.63%

Buy Vol. 3,411,611

Sell Vol. 2,507,960

38,050

1D -2.31%

5D 0.93%

Buy Vol. 23,475,777

Sell Vol. 21,591,457

18,500

1D 0.00%

5D 9.47%

Buy Vol. 2,212,171

Sell Vol. 2,381,208

29,000

1D 0.35%

5D 12.62%

Buy Vol. 36,018,850

Sell Vol. 36,467,009

25,750

1D 2.59%

5D 11.96%

Buy Vol. 45,857,285

Sell Vol. 48,799,587

HPG: In October, Hoa Phat Group produced 619,000 tons of crude steel, down 3% compared to the previous month. Sales output of hot rolled coil (HRC) steel products, construction steel, and steel billets reached 635,000 tons, up 29% over the same period last year and also the highest level since June 2022.

Market by numbers

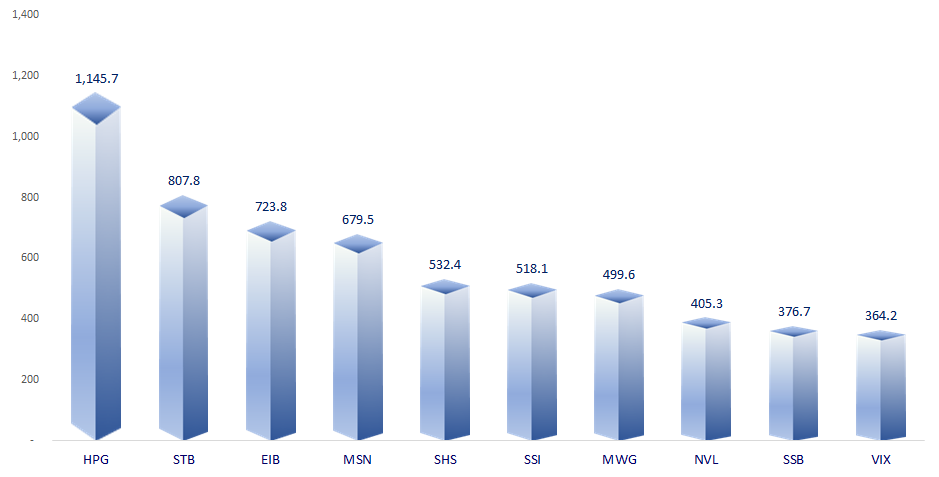

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

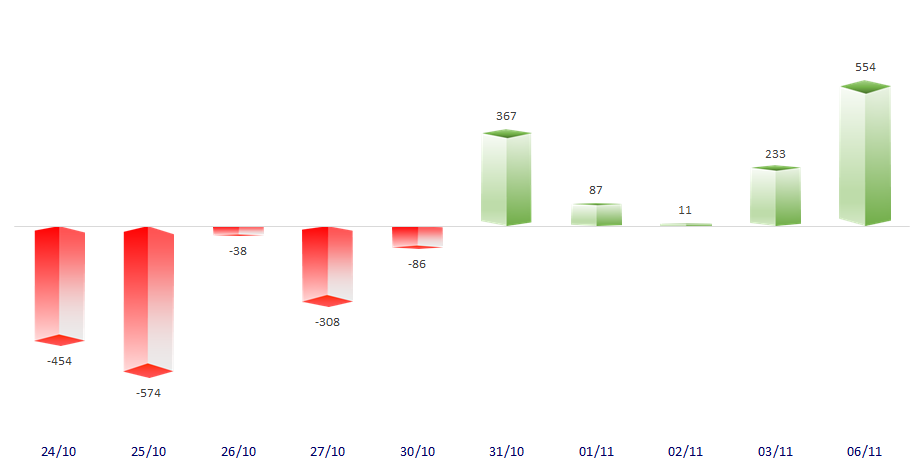

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

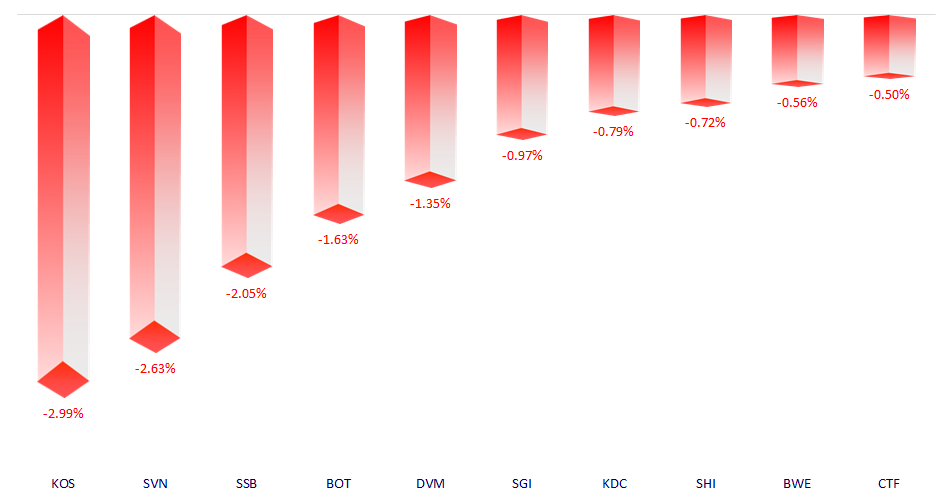

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.