Market Brief 07/11/2023

VIETNAM STOCK MARKET

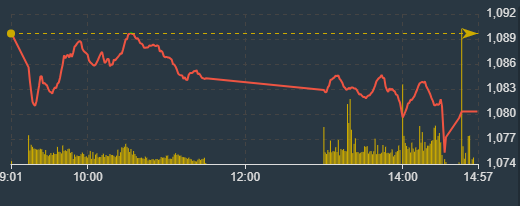

1,080.29

1D -0.86%

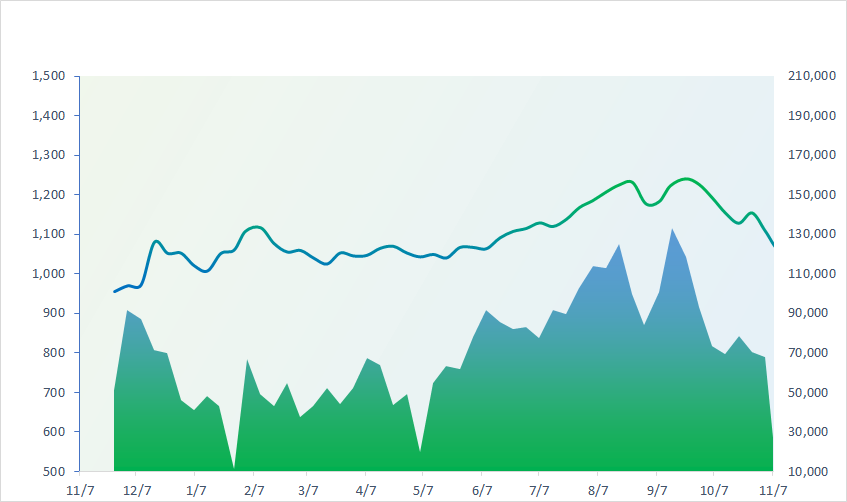

YTD 7.27%

1,092.71

1D -0.98%

YTD 8.71%

218.29

1D -0.59%

YTD 6.32%

84.61

1D -0.52%

YTD 18.09%

-197.09

1D 0.00%

YTD 0.00%

15,002.47

1D -6.16%

YTD 74.12%

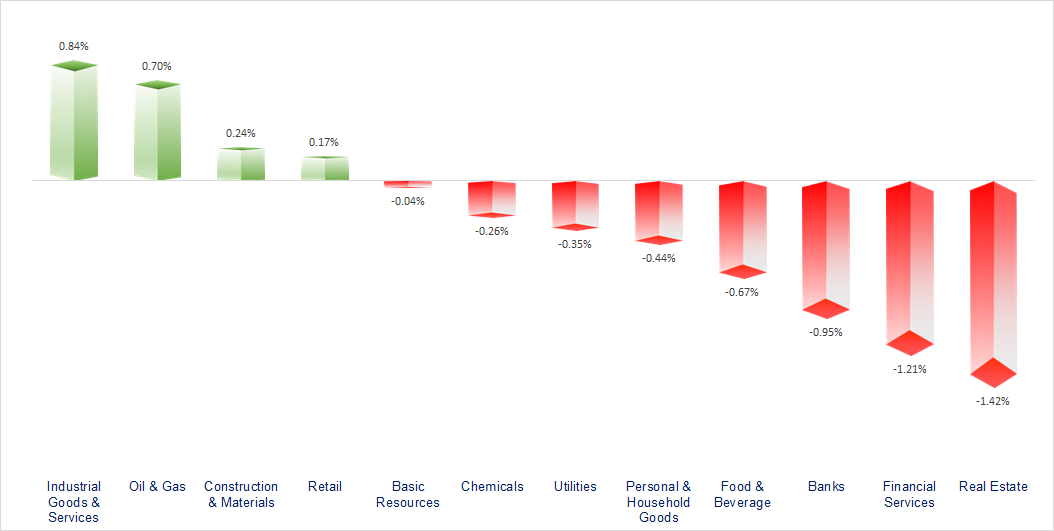

The market had its first losing session after a series of recoveries from the bottom. VNIndex traded below the reference mark most of the time during the session. Oil and gas, construction are the most positive industries today, while real estate and securities are the two most negative industries.

ETF & DERIVATIVES

18,880

1D -0.89%

YTD 8.94%

12,960

1D -0.69%

YTD 8.72%

13,620

1D -1.23%

YTD 9.13%

16,400

1D -1.20%

YTD 16.73%

17,680

1D -0.90%

YTD 23.21%

24,440

1D 0.25%

YTD 9.11%

14,580

1D 0.62%

YTD 12.59%

1,095

1D -0.96%

YTD 0.00%

1,093

1D -0.66%

YTD 0.00%

1,092

1D -0.47%

YTD 0.00%

1,086

1D -0.85%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

32,271.82

1D -1.34%

YTD 23.67%

3,057.27

1D -0.04%

YTD -1.04%

10,056.49

1D -0.15%

YTD -8.71%

17,672.19

1D -1.64%

YTD -10.66%

2,443.96

1D -2.33%

YTD 9.28%

64,762.09

1D -0.30%

YTD 6.45%

3,173.81

1D -0.21%

YTD -2.38%

1,408.30

1D -0.63%

YTD -15.69%

83.54

1D -1.52%

YTD -2.76%

1,964.36

1D -0.54%

YTD 7.57%

Asian markets fell today, after a series of gaining sessions after China's weak economic data was released. The Shanghai Composite and Hang Seng both fell as Chinese exports weakened more than expected in October while imports unexpectedly rose, sending the trade surplus to its worst level in 17 months.

VIETNAM ECONOMY

1.02%

1D (bps) 2

YTD (bps) -395

5.10%

YTD (bps) -230

2.31%

1D (bps) -4

YTD (bps) -248

2.71%

1D (bps) -2

YTD (bps) -219

24,545

1D (%) 0.12%

YTD (%) 3.30%

26,470

1D (%) -1.24%

YTD (%) 3.16%

3,411

1D (%) -0.23%

YTD (%) -2.12%

On November 8, the State Bank announced the central exchange rate at 24,014 VND/USD, down VND50 compared to the listed rate at the beginning of the week. The listed selling rate decreased by 53 VND, bringing the trading range to 23,400 - 25,164 VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The price of gold rings soared to over 60 million VND/tael - the highest level in history;

- Long Phu 1 thermal power plant can be restarted and completed in 2026;

- IPangasius exports to the EU in the fourth quarter have not been able to recover to the level of the same period;

- US gas prices plummeted 7% due to record high output;

- The risk of recession in Eurozone economies increases;

- Barclays forecasts that the Fed will raise interest rates in January 2024.

VN30

BANK

88,300

1D -1.34%

5D 1.73%

Buy Vol. 701,896

Sell Vol. 964,880

41,800

1D 0.00%

5D 3.98%

Buy Vol. 938,307

Sell Vol. 1,445,964

28,550

1D 0.00%

5D 3.07%

Buy Vol. 4,679,811

Sell Vol. 4,027,917

30,600

1D -1.29%

5D 10.47%

Buy Vol. 3,509,401

Sell Vol. 3,680,707

20,700

1D -0.48%

5D 3.50%

Buy Vol. 18,304,372

Sell Vol. 17,458,869

17,800

1D -0.84%

5D 4.09%

Buy Vol. 10,504,667

Sell Vol. 14,225,225

18,000

1D -1.37%

5D 4.65%

Buy Vol. 11,403,542

Sell Vol. 12,908,851

16,550

1D -0.30%

5D 4.75%

Buy Vol. 11,587,138

Sell Vol. 6,958,596

29,000

1D -1.53%

5D 7.41%

Buy Vol. 23,206,650

Sell Vol. 20,704,877

18,700

1D -1.06%

5D 4.47%

Buy Vol. 7,565,827

Sell Vol. 6,008,836

22,100

1D -0.45%

5D 3.27%

Buy Vol. 4,578,824

Sell Vol. 6,368,716

10,850

1D -1.36%

5D 7.43%

Buy Vol. 33,269,560

Sell Vol. 32,689,849

24,400

1D -3.56%

5D -5.43%

Buy Vol. 2,125,838

Sell Vol. 2,379,826

According to the latest data from the State Bank, as of the end of September 2023, the ratio of short-term capital for medium and long-term loans of the entire system has decreased to 28.39% from 28.78% at the end of August. This ratio at state-owned commercial banks decreased from 24.67% to 24.31%; this ratio at joint stock commercial banks also decreased slightly to 39% but the number is still higher than the allowed ceiling of 34% applied in the period October 1, 2022 - September 30, 2023.

OIL & GAS

11,150

1D -0.25%

5D 5.19%

Buy Vol. 12,610,709

Sell Vol. 9,437,098

33,150

1D -0.89%

5D 3.92%

Buy Vol. 1,107,405

Sell Vol. 1,547,609

42,050

1D -0.30%

5D 3.83%

Buy Vol. 6,536,007

Sell Vol. 7,534,908

GAS: GAS is one of three businesses on the stock exchange with the largest amount of deposits and cash.

VINGROUP

40,000

1D -0.12%

5D 2.56%

Buy Vol. 6,597,867

Sell Vol. 8,355,861

23,150

1D -2.44%

5D 4.28%

Buy Vol. 9,078,493

Sell Vol. 8,278,376

70,800

1D -3.54%

5D 4.12%

Buy Vol. 2,501,360

Sell Vol. 2,825,163

VRE: On November 7 session, VRE was net sold strongly by foreign investors with a value of nearly VND100 billion.

FOOD & BEVERAGE

62,000

1D -0.28%

5D 6.53%

Buy Vol. 2,340,345

Sell Vol. 3,178,086

65,100

1D -3.13%

5D 14.81%

Buy Vol. 754,432

Sell Vol. 929,557

58,200

1D -1.66%

5D -0.68%

Buy Vol. 492,859

Sell Vol. 404,895

VNM: Export revenue recorded a positive highlight when reaching VND1,246 billion in Q3, up 5% over the same period.

OTHERS

40,400

1D -2.02%

5D 3.86%

Buy Vol. 358,675

Sell Vol. 407,009

40,400

1D -0.74%

5D 3.86%

Buy Vol. 358,675

Sell Vol. 407,009

106,000

1D -1.21%

5D 7.07%

Buy Vol. 1,016,824

Sell Vol. 1,294,990

88,300

1D -0.23%

5D 6.39%

Buy Vol. 2,947,214

Sell Vol. 2,460,954

38,200

1D 0.39%

5D 1.33%

Buy Vol. 19,755,220

Sell Vol. 18,763,880

18,450

1D -0.27%

5D 9.17%

Buy Vol. 3,770,447

Sell Vol. 3,594,255

28,350

1D -2.24%

5D 10.10%

Buy Vol. 37,422,626

Sell Vol. 36,837,527

25,800

1D 0.19%

5D 12.17%

Buy Vol. 54,964,110

Sell Vol. 43,557,003

FPT: FPT Corp has just announced the acquisition of Cardinal Peak - a 20-year-old technology service provider in North America. Through this deal, FPT expects Cardinal Peak to double revenue from product technical services in the US market within the next two years.

Market by numbers

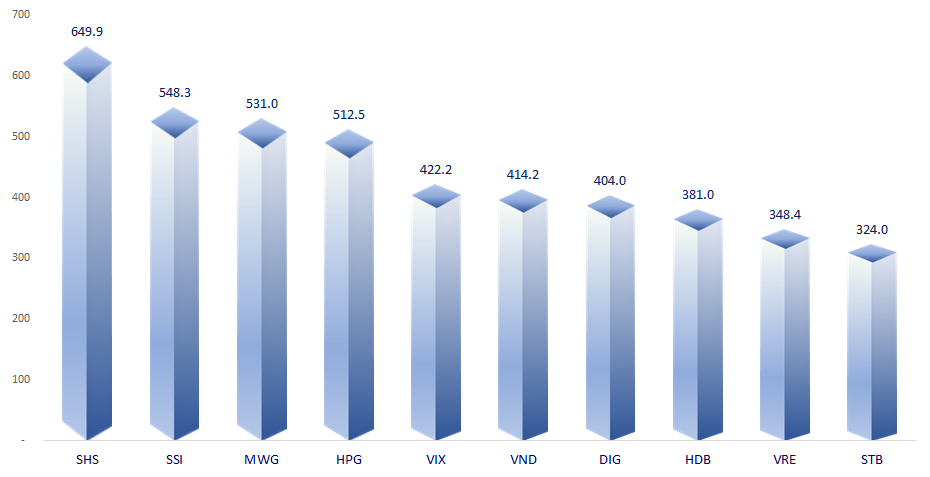

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

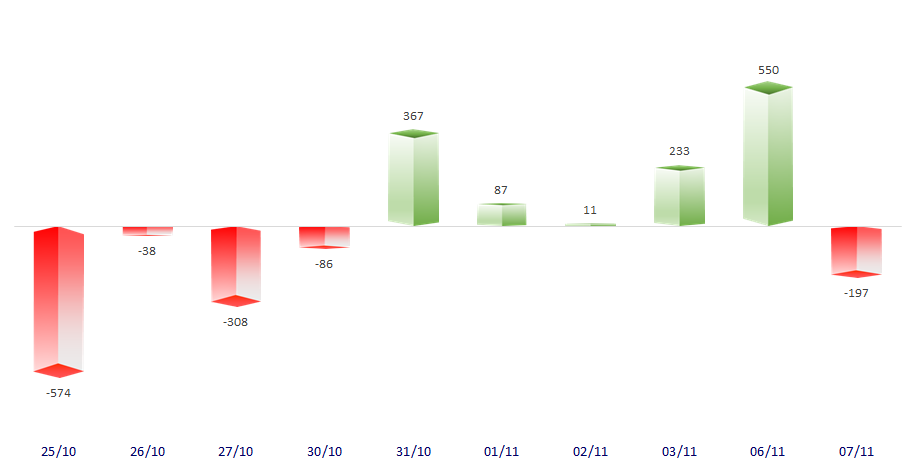

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.