Market brief 09/11/2023

VIETNAM STOCK MARKET

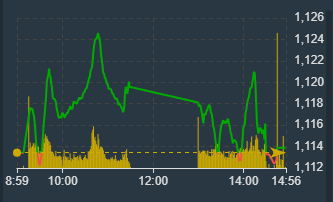

1,113.89

1D 0.04%

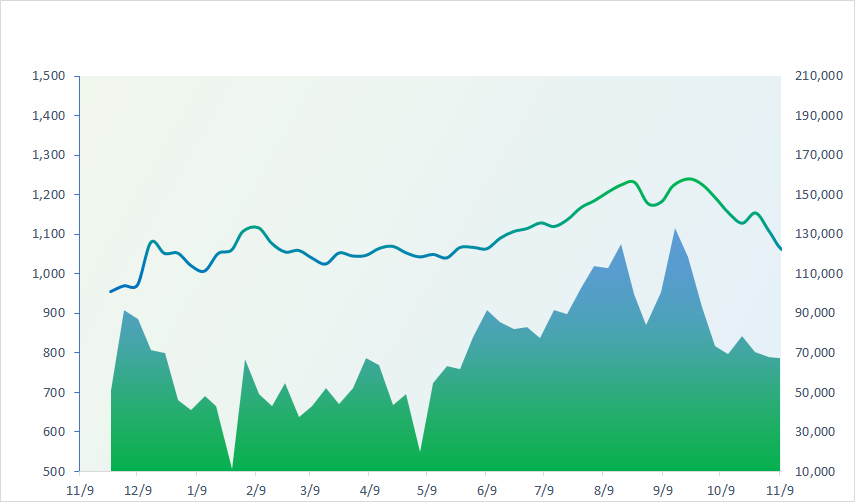

YTD 10.60%

1,122.95

1D -0.62%

YTD 11.72%

228.22

1D 0.52%

YTD 11.16%

86.22

1D 0.06%

YTD 20.33%

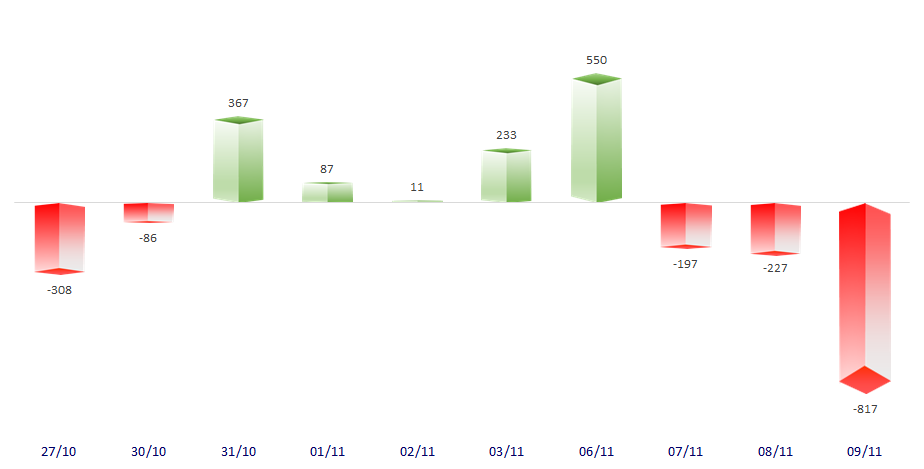

-816.79

1D 0.00%

YTD 0.00%

24,977.25

1D 15.99%

YTD 189.90%

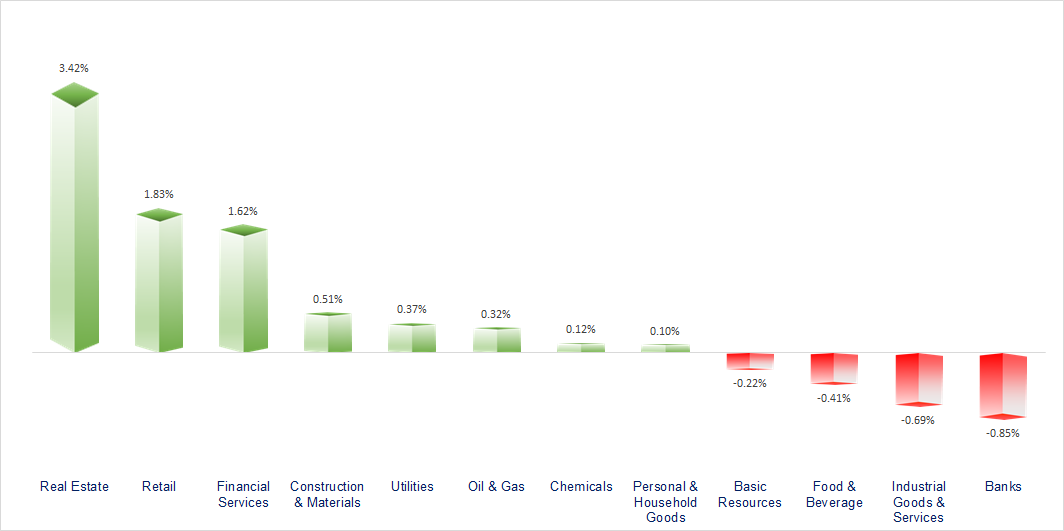

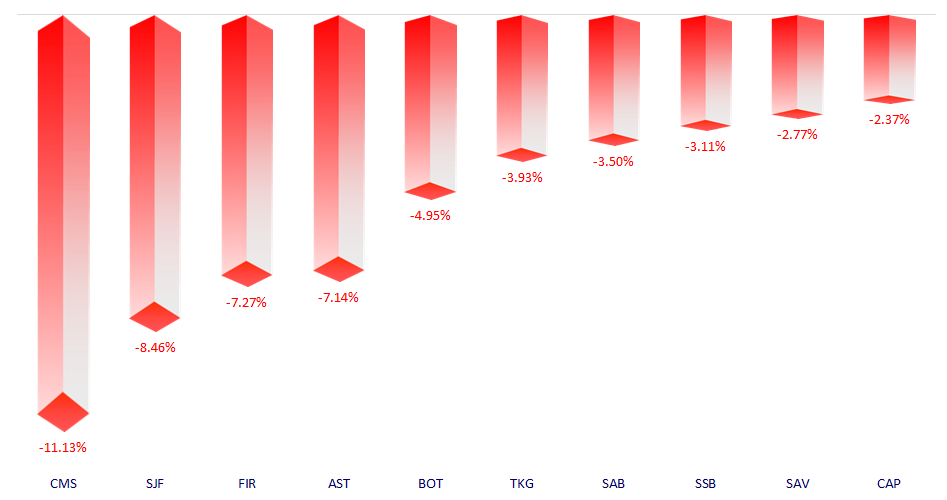

After yesterday's explosive trading session, the stock market struggled in a narrow range today. Real estates and financial services are the two most positive groups today, while banks are the most negative group.

ETF & DERIVATIVES

19,410

1D 0.05%

YTD 12.00%

13,300

1D -0.37%

YTD 11.58%

13,910

1D 0.22%

YTD 11.46%

16,500

1D -1.02%

YTD 17.44%

18,400

1D 0.71%

YTD 28.22%

25,230

1D 0.28%

YTD 12.63%

15,090

1D 0.33%

YTD 16.53%

1,125

1D -0.79%

YTD 0.00%

1,123

1D -0.92%

YTD 0.00%

1,118

1D -0.94%

YTD 0.00%

1,117

1D -0.75%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

32,646.46

1D 1.49%

YTD 25.11%

3,053.28

1D 0.03%

YTD -1.16%

10,032.09

1D -0.20%

YTD -8.93%

17,511.29

1D -0.33%

YTD -11.48%

2,427.08

1D 0.23%

YTD 8.53%

64,897.72

1D -0.04%

YTD 6.67%

3,135.55

1D 0.19%

YTD -3.56%

1,404.97

1D -0.63%

YTD -15.89%

80.22

1D 0.22%

YTD -6.62%

1,949.00

1D -0.27%

YTD 6.72%

Asian markets mostly increased today, despite the return of the wave of selling off real estate stocks in China. In Japan, the Nikkei 225 index increased 1.49%. South Korea's Kospi index increased 0.23%.

VIETNAM ECONOMY

0.82%

1D (bps) -4

YTD (bps) -415

5.10%

YTD (bps) -230

2.36%

1D (bps) 8

YTD (bps) -243

2.61%

1D (bps) -12

YTD (bps) -229

24,525

1D (%) -0.08%

YTD (%) 3.22%

26,785

1D (%) -0.13%

YTD (%) 4.39%

3,413

1D (%) -0.15%

YTD (%) -2.07%

On the morning of November 9, the domestic gold price continued to increase to 400,000 VND/tael. The difference in buying - selling price is 1 million VND/tael, causing gold buyers to take many risks when investing at the present time.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam strives to be in the top 3 of ASEAN in terms of labor productivity growth rate;

- The North - South Expressway has disbursed VND44,500 billion in 10 months;

- Many investment opportunities in Nam Phu Yen Economic Zone;

- China has deflation, recovery is still fragile;

- BOJ may end negative interest rates early next year;

- Saudi Arabia aims to be a global supplier of electric vehicle batteries.

VN30

BANK

87,900

1D -1.79%

5D -1.24%

Buy Vol. 1,653,994

Sell Vol. 2,258,883

42,850

1D -0.12%

5D 2.88%

Buy Vol. 1,704,890

Sell Vol. 1,732,974

29,500

1D 0.85%

5D 4.42%

Buy Vol. 7,112,352

Sell Vol. 8,692,072

31,500

1D -0.94%

5D 7.33%

Buy Vol. 6,795,858

Sell Vol. 9,035,896

20,000

1D -1.72%

5D 3.36%

Buy Vol. 20,706,697

Sell Vol. 28,815,609

18,350

1D 0.00%

5D 3.67%

Buy Vol. 19,902,106

Sell Vol. 21,051,862

18,750

1D -0.27%

5D 6.53%

Buy Vol. 12,547,360

Sell Vol. 17,047,919

17,100

1D -0.87%

5D 4.27%

Buy Vol. 10,519,533

Sell Vol. 11,228,547

29,650

1D -1.17%

5D 2.24%

Buy Vol. 53,150,948

Sell Vol. 40,389,974

19,300

1D -0.52%

5D 4.04%

Buy Vol. 5,270,272

Sell Vol. 5,997,730

22,550

1D -1.10%

5D 1.12%

Buy Vol. 7,108,098

Sell Vol. 15,393,175

11,250

1D -0.88%

5D 3.21%

Buy Vol. 35,731,406

Sell Vol. 49,351,559

24,500

1D -1.80%

5D -5.59%

Buy Vol. 1,734,101

Sell Vol. 2,095,719

CTG: VietinBank recently announced that, with the goal of supporting the business activities of small and medium enterprises (SMEs) in the last months of 2023, VietinBank will continue to reduce lending interest rates with interest rates from only 5.9%/year. The size of the interest rate incentive package is up to VND15,000 billion.

OIL & GAS

11,550

1D 0.00%

5D 4.05%

Buy Vol. 23,848,903

Sell Vol. 22,017,811

33,950

1D 0.43%

5D 1.65%

Buy Vol. 1,629,149

Sell Vol. 1,963,631

45,400

1D -0.73%

5D 9.53%

Buy Vol. 14,216,557

Sell Vol. 14,913,474

Oil prices fell nearly 3% on Wednesday to their lowest level in more than 3 months amid worries about weakening demand in the US and China.

VINGROUP

42,900

1D 5.58%

5D 7.38%

Buy Vol. 27,495,535

Sell Vol. 22,818,111

24,300

1D 4.63%

5D 4.52%

Buy Vol. 12,320,493

Sell Vol. 11,192,739

70,700

1D 2.53%

5D -0.28%

Buy Vol. 5,079,159

Sell Vol. 5,927,030

VIC: Mr. Gautam Adani, the second richest billionaire in India and 23rd in the world discussed with Vingroup Chairman Pham Nhat Vuong about potential investment opportunities.

FOOD & BEVERAGE

62,800

1D -0.98%

5D 0.16%

Buy Vol. 2,937,778

Sell Vol. 3,267,530

63,900

1D -1.57%

5D 4.07%

Buy Vol. 1,779,520

Sell Vol. 1,882,733

61,000

1D -1.84%

5D 3.74%

Buy Vol. 777,794

Sell Vol. 629,153

VNM: Vinamilk forecasts that net profit for the whole year 2023 will increase by 3% compared to 2022, equivalent to profit after tax in the fourth quarter of 2023 will increase by 19%.

OTHERS

41,000

1D 2.35%

5D 0.99%

Buy Vol. 921,307

Sell Vol. 851,664

41,000

1D 0.00%

5D 0.99%

Buy Vol. 921,307

Sell Vol. 851,664

108,400

1D -4.07%

5D 3.34%

Buy Vol. 1,085,381

Sell Vol. 1,567,039

92,500

1D -0.11%

5D 3.93%

Buy Vol. 4,286,434

Sell Vol. 4,408,038

40,300

1D 1.77%

5D 8.92%

Buy Vol. 19,860,843

Sell Vol. 20,707,382

19,700

1D 0.00%

5D 6.49%

Buy Vol. 5,239,216

Sell Vol. 5,265,397

30,850

1D 1.82%

5D 6.75%

Buy Vol. 66,724,091

Sell Vol. 60,189,360

26,700

1D -0.93%

5D 5.74%

Buy Vol. 50,820,845

Sell Vol. 66,431,993

HPG: Hoa Phat Group Joint Stock Company has just announced related transactions of Mr. Tran Dinh Long's family. Specifically, Mr. Tran Vu Minh bought a total of 42.89 million HPG shares from his father (Mr. Tran Dinh Long) and mother (Ms. Vu Thi Hien). After this transaction, Mr. Minh owns more than 133.6 million HPG shares, a ratio of 2.3%.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.