Market Brief 16/11/2023

VIETNAM STOCK MARKET

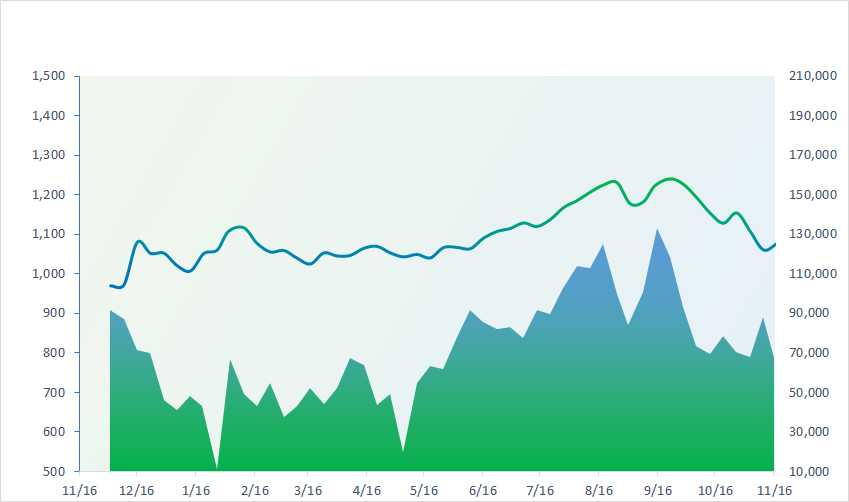

1,125.53

1D 0.27%

YTD 11.76%

1,132.60

1D 0.06%

YTD 12.68%

229.56

1D 0.74%

YTD 11.81%

87.13

1D 0.15%

YTD 21.61%

-208.52

1D 0.00%

YTD 0.00%

17,613.23

1D -21.73%

YTD 104.43%

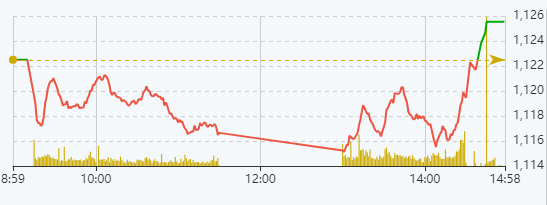

The market had an emotional derivatives expiration session. VN-Index was in the red for most of the trading time. After 2:00 p.m, VNIndex had a strong rebound from the bottom to end the session in green. Chemicals and construction were two of the most positive groups in the market today.

ETF & DERIVATIVES

19,480

1D -0.41%

YTD 12.41%

13,410

1D 0.00%

YTD 12.50%

13,920

1D -0.57%

YTD 11.54%

16,750

1D -1.64%

YTD 19.22%

18,520

1D -0.96%

YTD 29.06%

25,510

1D -0.58%

YTD 13.88%

15,120

1D -0.46%

YTD 16.76%

1,125

1D -0.78%

YTD 0.00%

1,137

1D 0.58%

YTD 0.00%

1,129

1D -0.06%

YTD 0.00%

1,128

1D 0.10%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

33,424.41

1D -0.28%

YTD 28.09%

3,050.93

1D -0.71%

YTD -1.24%

9,954.40

1D -1.23%

YTD -9.64%

17,832.82

1D -1.36%

YTD -9.85%

2,488.18

1D 0.06%

YTD 11.26%

66,124.01

1D 0.71%

YTD 8.68%

3,134.83

1D 0.09%

YTD -3.58%

1,415.34

1D 0.01%

YTD -15.27%

80.84

1D 0.22%

YTD -5.90%

1,968.00

1D 0.50%

YTD 7.76%

Asian stocks fell today as investors sold to take profits. The Chinese and Hong Kong markets fell sharply due to the decline in investor confidence in the Chinese economy. According to the latest data, house prices in China have continuously decreased until October, showing that the real estate market is still under pressure. The real estate sector accounts for about 25% of China's GDP.

VIETNAM ECONOMY

0.25%

1D (bps) -5

YTD (bps) -472

5.00%

YTD (bps) -240

2.18%

1D (bps) -5

YTD (bps) -261

2.48%

1D (bps) -15

YTD (bps) -242

24,471

1D (%) 0.00%

YTD (%) 2.99%

27,097

1D (%) 0.02%

YTD (%) 5.60%

3,422

1D (%) -0.03%

YTD (%) -1.81%

The dollar held its ground on Thursday after a volatile two days. The dollar index (DXY) was steady at 104.33. It gained 0.31% on Wednesday, following a 1.51% plunge the previous day - its largest drop for a single trading day in a year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Domestic gold price rebounded;

- Novaland's latest move at the Aqua City super project;

- TOP 10 banks with the highest ROE in the first 9 months of 2023;

- Rabobank: Global food prices to ease in 2024;

- The size of unfinished, pre-sold homes in China is about 20 times the size of developer Country Garden;

- India signed many agreements to export new season basmati rice.

VN30

BANK

88,000

1D 0.34%

5D 0.11%

Buy Vol. 1,818,876

Sell Vol. 2,397,626

43,750

1D -0.91%

5D 2.10%

Buy Vol. 1,633,944

Sell Vol. 2,186,108

30,250

1D 0.17%

5D 2.54%

Buy Vol. 4,599,683

Sell Vol. 4,805,305

31,700

1D 0.48%

5D 0.63%

Buy Vol. 4,558,805

Sell Vol. 4,916,418

19,900

1D -0.25%

5D -0.50%

Buy Vol. 19,689,251

Sell Vol. 19,882,777

18,500

1D -0.27%

5D 0.82%

Buy Vol. 10,217,008

Sell Vol. 13,542,006

18,950

1D 0.26%

5D 1.07%

Buy Vol. 9,975,132

Sell Vol. 12,803,574

17,500

1D -1.13%

5D 2.34%

Buy Vol. 10,368,714

Sell Vol. 11,373,015

30,200

1D 0.67%

5D 1.85%

Buy Vol. 25,096,556

Sell Vol. 18,565,033

19,600

1D -0.25%

5D 1.55%

Buy Vol. 5,821,991

Sell Vol. 4,834,556

23,300

1D 0.22%

5D 3.33%

Buy Vol. 15,307,672

Sell Vol. 23,271,161

11,600

1D 0.43%

5D 3.11%

Buy Vol. 24,770,931

Sell Vol. 33,395,136

23,450

1D -0.21%

5D -4.29%

Buy Vol. 2,278,579

Sell Vol. 2,829,096

TPB: On November 15, TPBank continued to reduce the 6-months deposit interest rate to below 5%/year. In particular, TPBank reduced deposit interest rates for the first time since mid-September 2023. For the 6-months term, TPBank reduced the interest rate by 0.2 percentage points to 4.8%/year; For a 12-months term, the interest rate has decreased to 5.35%/year.

OIL & GAS

11,850

1D -0.12%

5D 2.60%

Buy Vol. 13,823,240

Sell Vol. 12,655,883

34,450

1D 0.85%

5D 1.47%

Buy Vol. 1,665,500

Sell Vol. 2,445,320

45,100

1D 1.32%

5D -0.66%

Buy Vol. 4,061,273

Sell Vol. 7,380,222

GAS: PV GAS surpassed Vingroup and Vinhomes to become the enterprise with the third largest capitalization in the stock market.

VINGROUP

41,150

1D -0.66%

5D -4.08%

Buy Vol. 9,378,201

Sell Vol. 10,855,289

23,850

1D -0.72%

5D -1.85%

Buy Vol. 7,843,613

Sell Vol. 7,695,362

70,300

1D -1.04%

5D -0.57%

Buy Vol. 3,999,159

Sell Vol. 4,260,337

VIC: At the Conference on Rapid and Sustainable Development of Vietnam Tourism, Vingroup representatives proposed a flexible visa exemption policy for some key markets.

FOOD & BEVERAGE

66,000

1D -0.57%

5D 5.10%

Buy Vol. 2,750,551

Sell Vol. 3,249,139

64,200

1D 0.30%

5D 0.47%

Buy Vol. 1,578,813

Sell Vol. 1,364,132

62,400

1D 1.58%

5D 2.30%

Buy Vol. 702,024

Sell Vol. 656,307

MSN: Masan Consumer Holdings reached a gross profit margin of 45.4% in the first 9M2023, an increase of 420 basis points compared to 41.2% in the first 9M2022.

OTHERS

41,300

1D 0.65%

5D 0.73%

Buy Vol. 1,100,211

Sell Vol. 1,302,423

41,300

1D 0.98%

5D 0.73%

Buy Vol. 1,100,211

Sell Vol. 1,302,423

108,500

1D -0.18%

5D 0.09%

Buy Vol. 1,106,829

Sell Vol. 1,121,093

93,000

1D 0.65%

5D 0.54%

Buy Vol. 3,966,941

Sell Vol. 8,096,355

41,500

1D -0.95%

5D 2.98%

Buy Vol. 19,502,576

Sell Vol. 16,176,147

19,700

1D 1.02%

5D 1.79%

Buy Vol. 2,238,302

Sell Vol. 2,559,209

32,300

1D 1.10%

5D 4.70%

Buy Vol. 41,105,286

Sell Vol. 34,516,535

27,200

1D 0.74%

5D 1.87%

Buy Vol. 33,876,763

Sell Vol. 34,584,946

BVH: Bao Viet Group has approved the payment of cash dividends at a rate of 9.54% on par value, equivalent to more than VND708 billion. The last registration date is the date November 28, 2023, payment date is December 28, 2023.

Market by numbers

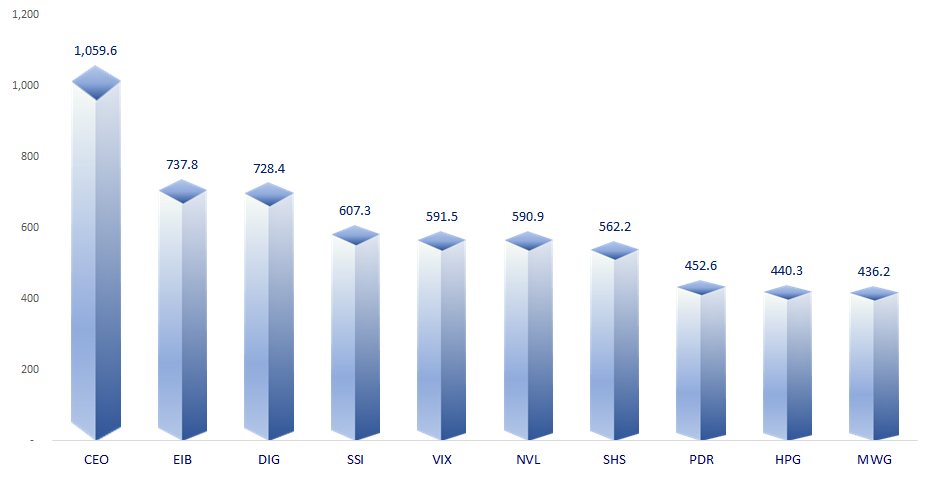

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

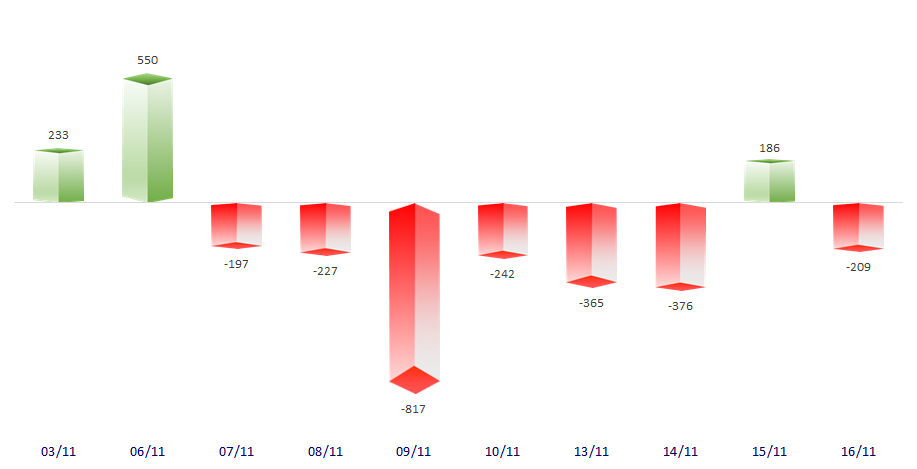

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

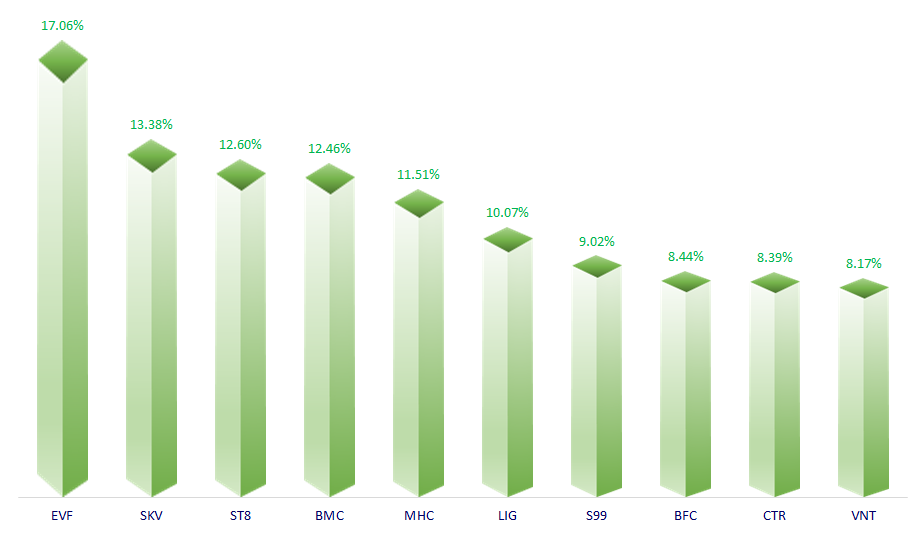

TOP INCREASES 3 CONSECUTIVE SESSIONS

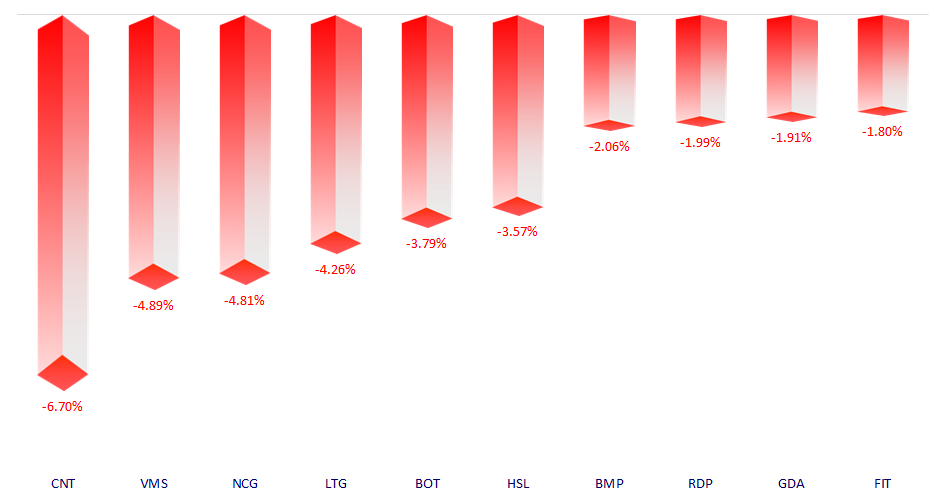

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.