Market Brief 13/12/2023

VIETNAM STOCK MARKET

1,114.20

1D -1.19%

YTD 10.64%

228.42

1D -1.42%

YTD 11.26%

1,106.83

1D -1.28%

YTD 10.11%

85.09

1D -0.30%

YTD 18.76%

-852.82

1D 0.00%

YTD 0.00%

21,392.19

1D 34.62%

YTD 148.29%

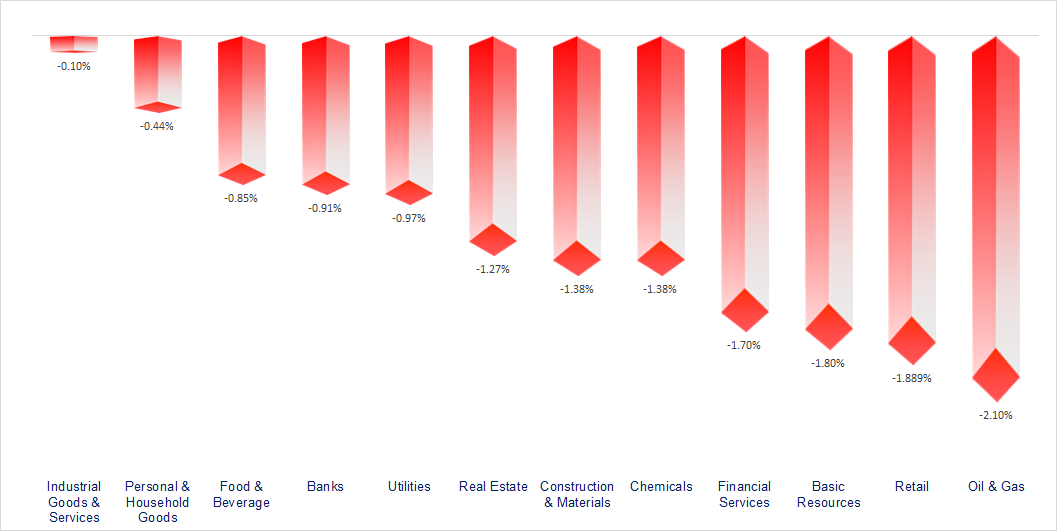

After a series of sideways sessions in a narrow range, VN-Index fell sharply today, mainly in the afternoon session. Most industry groups decreased, the most negative were oil and gas, basic resources and financial services.

ETF & DERIVATIVES

19,100

1D -1.04%

YTD 10.21%

13,110

1D -1.50%

YTD 9.98%

13,640

1D -1.59%

YTD 9.29%

17,100

1D -0.47%

YTD 21.71%

18,000

1D -1.80%

YTD 25.44%

25,370

1D -0.78%

YTD 13.26%

15,040

1D -0.73%

YTD 16.14%

1,107

1D -1.05%

YTD 0.00%

1,107

1D -0.94%

YTD 0.00%

1,104

1D -0.86%

YTD 0.00%

1,103

1D -0.65%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

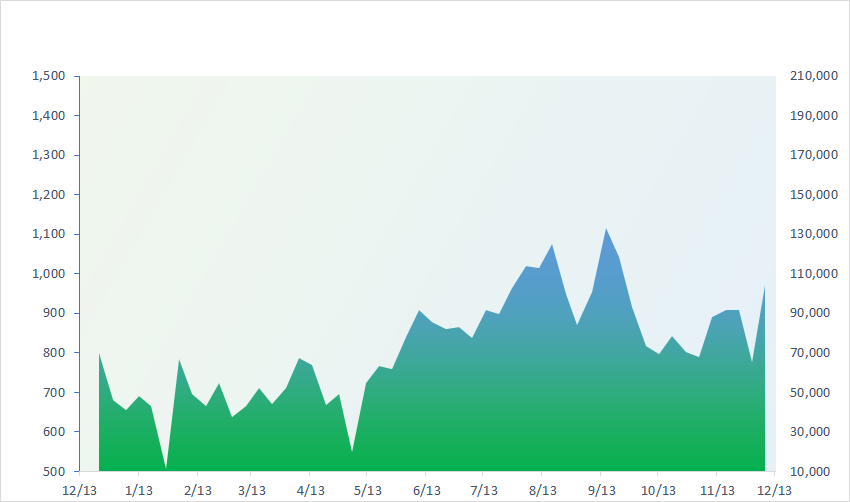

VNINDEX (12M)

GLOBAL MARKET

32,926.35

1D 0.25%

YTD 26.18%

2,968.76

1D -1.15%

YTD -3.90%

9,476.62

1D -1.54%

YTD -13.97%

16,228.75

1D -0.89%

YTD -17.96%

2,510.66

1D -0.97%

YTD 12.26%

69,584.60

1D 0.04%

YTD 14.37%

3,104.26

1D 0.19%

YTD -4.52%

1,357.97

1D -0.99%

YTD -18.70%

73.14

1D -0.14%

YTD -14.86%

1,982.51

1D 0.09%

YTD 8.56%

Asian shares were mixed on Wednesday, while oil prices slid to six-month lows as traders waited for the year's final policy decision from the Federal Reserve and clues on whether the central bank will cut rates next year.

VIETNAM ECONOMY

0.20%

1D (bps) 5

YTD (bps) -477

4.80%

YTD (bps) -260

1.92%

1D (bps) -6

YTD (bps) -287

2.34%

YTD (bps) -256

24,448

1D (%) 0.04%

YTD (%) 2.90%

26,918

1D (%) -0.02%

YTD (%) 4.91%

3,450

1D (%) -0.03%

YTD (%) -1.00%

The US dollar ticked up slightly on Wednesday as traders prepared for the conclusion of a Federal Reserve policy meeting that could offer some insight into when the U.S. central bank will begin lowering interest rates. In the domestic market, VCB adjusted an increase of VND30 in both buying and selling rates. The State Bank also increased the central exchange rate by VND9 compared to the closing session on December 12, to 23,941 VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- BIDV, Agribank, Vietinbank reduced 12-month deposit interest rates to 5%/year;

- Vietnam has the opportunity to increase exports thanks to decreasing world rice inventories;

- Construction steel prices may continue to increase;

- China's steel output in 2023 may increase despite the real estate industry remaining difficult;

- Chinese pork prices tumbled, adding to growing concerns around deflation in Asia’s biggest economy;

- The US Treasury Secretary once again affirmed that the economy will have a soft landing.

VN30

BANK

83,700

1D -0.59%

5D -2.56%

Buy Vol. 1,939,709

Sell Vol. 2,351,017

41,600

1D -0.72%

5D 4.00%

Buy Vol. 1,391,079

Sell Vol. 1,503,320

26,750

1D -0.93%

5D 0.38%

Buy Vol. 5,990,021

Sell Vol. 8,624,454

30,500

1D -1.77%

5D 0.33%

Buy Vol. 4,567,391

Sell Vol. 5,926,818

19,200

1D -1.29%

5D -1.03%

Buy Vol. 16,253,993

Sell Vol. 19,608,134

18,050

1D -1.10%

5D -0.28%

Buy Vol. 13,751,479

Sell Vol. 19,023,550

18,850

1D 0.27%

5D 1.34%

Buy Vol. 12,809,047

Sell Vol. 10,962,488

17,000

1D -2.02%

5D -2.58%

Buy Vol. 5,292,480

Sell Vol. 7,484,740

27,450

1D -1.96%

5D -2.31%

Buy Vol. 34,560,631

Sell Vol. 34,894,054

19,050

1D -0.78%

5D -0.78%

Buy Vol. 5,221,648

Sell Vol. 7,007,514

22,300

1D -0.89%

5D 0.00%

Buy Vol. 5,799,329

Sell Vol. 9,295,259

10,900

1D -1.80%

5D -0.91%

Buy Vol. 35,410,216

Sell Vol. 52,381,443

22,600

1D -0.22%

5D -0.44%

Buy Vol. 1,352,662

Sell Vol. 2,235,480

CTG: Vietinbank has just completed increasing its charter capital to VND53,700 billion, ranking third in the Big4 group, higher than Agribank and lower than BIDV and Vietcombank.

OIL & GAS

76,900

1D -1.66%

5D -1.30%

Buy Vol. 10,353,994

Sell Vol. 11,247,814

11,400

1D -1.72%

5D -3.34%

Buy Vol. 1,528,867

Sell Vol. 1,771,729

34,700

1D -2.12%

5D 2.57%

Buy Vol. 7,954,346

Sell Vol. 8,791,793

POW: In December, PV Power set an electricity output target of nearly 1.83 billion kWh, revenue target of VND3,439 billion.

VINGROUP

43,900

1D -0.79%

5D 0.74%

Buy Vol. 17,066,999

Sell Vol. 20,645,616

40,750

1D -0.73%

5D 0.44%

Buy Vol. 7,717,007

Sell Vol. 8,360,358

23,000

1D -2.75%

5D -0.44%

Buy Vol. 6,634,034

Sell Vol. 6,995,515

VIC: On December 8, Vingroup approved a plan to contribute additional capital of VND10,000 billion to Vinpearl JSC.

FOOD & BEVERAGE

68,200

1D -1.73%

5D 5.96%

Buy Vol. 5,090,455

Sell Vol. 4,957,870

65,800

1D -0.60%

5D -1.84%

Buy Vol. 1,369,575

Sell Vol. 1,542,907

64,000

1D -1.54%

5D -3.18%

Buy Vol. 848,102

Sell Vol. 828,396

VNM: On December 13, foreign investors strongly net sold VNM with a value of VND130 billion.

OTHERS

63,900

1D -0.78%

5D 1.12%

Buy Vol. 1,634,324

Sell Vol. 1,723,741

40,500

1D 1.00%

5D 1.12%

Buy Vol. 1,634,324

Sell Vol. 1,723,741

105,000

1D 0.48%

5D -0.76%

Buy Vol. 1,307,131

Sell Vol. 1,347,698

95,200

1D -1.65%

5D 0.21%

Buy Vol. 3,683,550

Sell Vol. 4,817,654

41,700

1D -1.88%

5D 1.83%

Buy Vol. 16,844,252

Sell Vol. 22,635,872

19,950

1D -1.97%

5D -4.09%

Buy Vol. 2,996,102

Sell Vol. 5,149,031

32,000

1D -1.84%

5D -4.76%

Buy Vol. 39,490,132

Sell Vol. 43,773,935

27,350

1D -2.15%

5D -0.91%

Buy Vol. 49,142,304

Sell Vol. 71,895,821

MWG: In November, MWG ranked second in the top 10 stocks with the strongest net selling by foreign investors with a value of more than VND1,500 billion.

Market by numbers

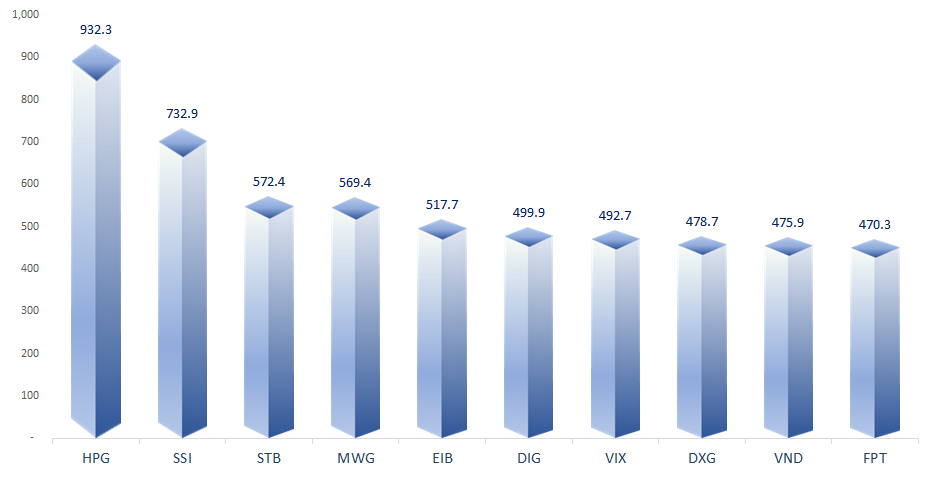

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

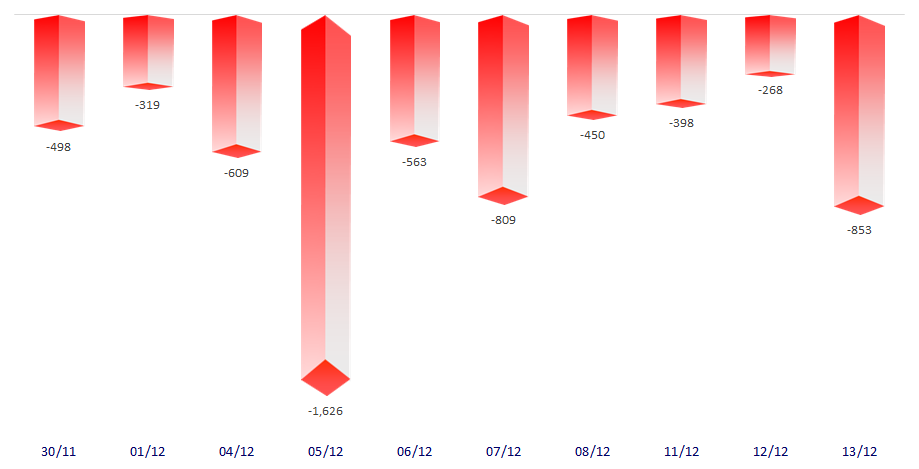

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

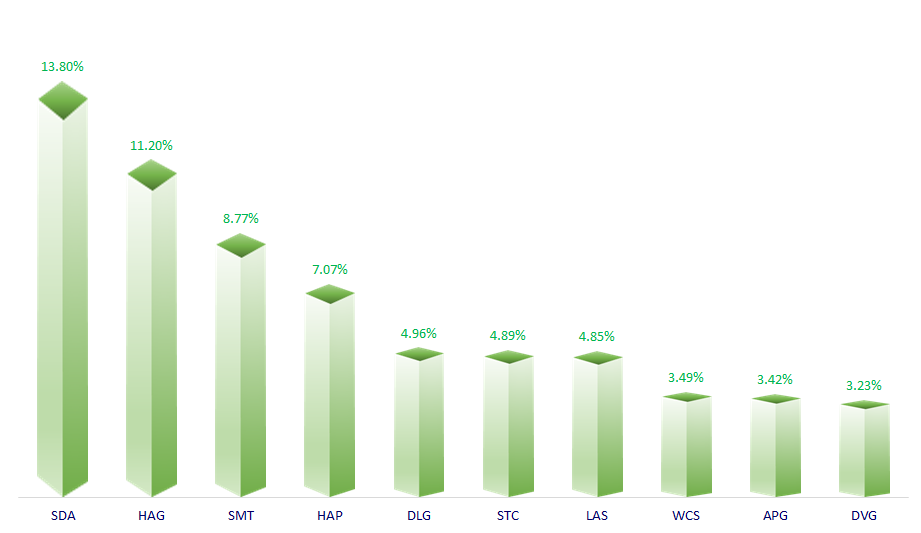

TOP INCREASES 3 CONSECUTIVE SESSIONS

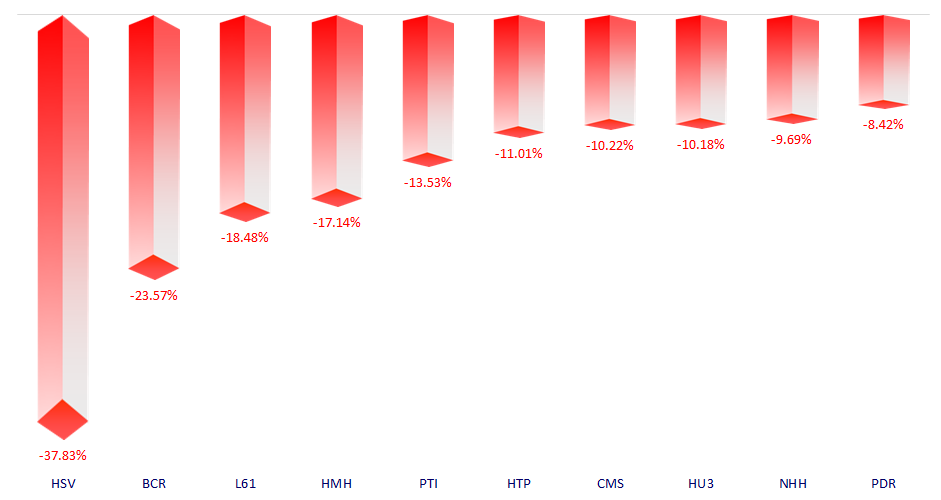

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.