Market Brief 25/12/2023

VIETNAM STOCK MARKET

1,117.66

1D 1.32%

YTD 10.98%

229.45

1D 0.52%

YTD 11.76%

1,111.86

1D 1.31%

YTD 10.61%

86.21

1D 0.08%

YTD 20.32%

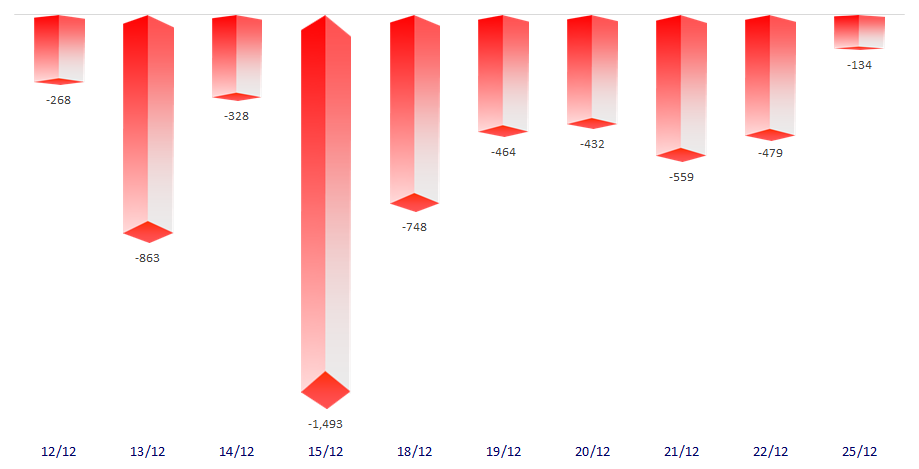

-134.44

1D 0.00%

YTD 0.00%

17,008.09

1D 17.05%

YTD 97.40%

The market had a trading session in the green on Christmas day. From the beginning, VNIndex rebounded strongly and continued to increase until the end of the session. Most industries were positive in today's session, especially the seaport and oil and gas groups.

ETF & DERIVATIVES

19,200

1D 1.32%

YTD 10.79%

13,220

1D 1.15%

YTD 10.91%

13,630

1D 0.66%

YTD 9.21%

16,700

1D 1.09%

YTD 18.86%

18,200

1D 0.61%

YTD 26.83%

25,740

1D 1.74%

YTD 14.91%

15,070

1D 1.14%

YTD 16.37%

1,115

1D 1.58%

YTD 0.00%

1,114

1D 1.53%

YTD 0.00%

1,114

1D 1.86%

YTD 0.00%

1,114

1D 1.86%

YTD 0.00%

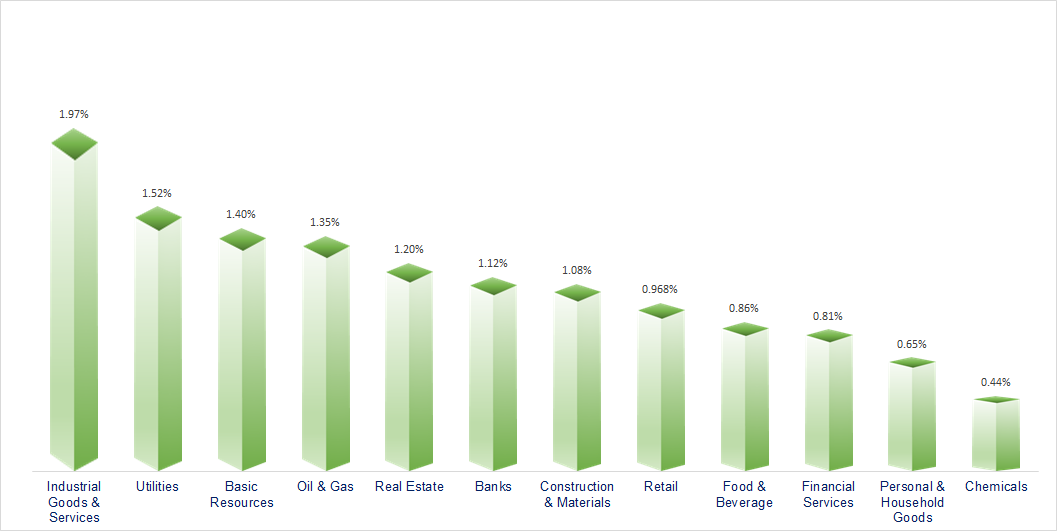

CHANGE IN PRICE BY SECTOR

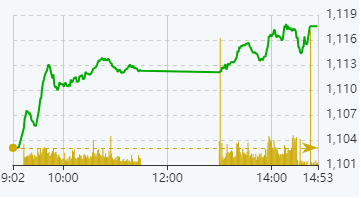

INTRADAY VNINDEX

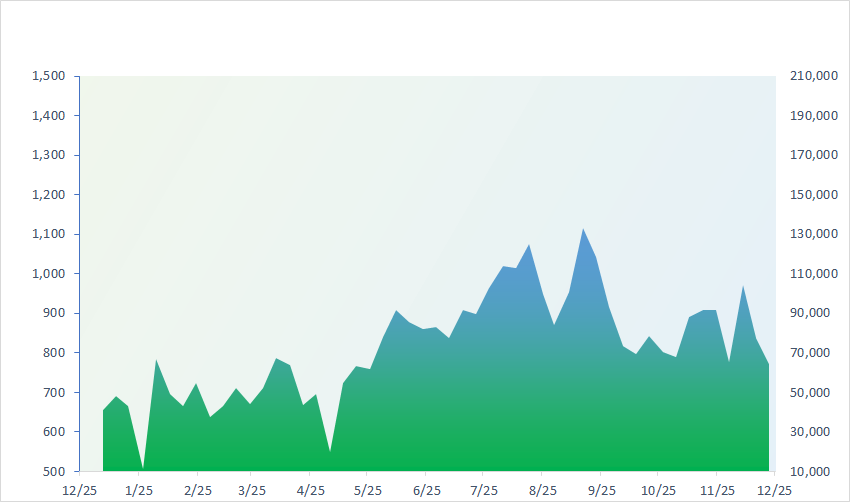

VNINDEX (12M)

GLOBAL MARKET

33,254.03

1D 0.26%

YTD 27.44%

2,918.81

1D 0.14%

YTD -5.52%

16,340.41

1D -1.69%

YTD -17.40%

2,599.51

1D -0.02%

YTD 16.24%

71,106.96

1D 0.34%

YTD 16.87%

3,140.32

1D 0.89%

YTD -3.41%

1,408.21

1D 0.22%

YTD -15.69%

79.07

1D 0.00%

YTD -7.96%

2,053.08

1D 0.00%

YTD 12.42%

Asian stocks were mixed during the Christmas holiday. One of the most active markets was Japan, with the Nikkei 225 index has rallied mainly driven by the Paper & Pulp, Banks and Chemicals sectors. Brent oil and world gold prices are stable as markets are closed for Christmas.

VIETNAM ECONOMY

0.18%

YTD (bps) -479

4.80%

YTD (bps) -260

1.80%

1D (bps) -3

YTD (bps) -299

2.19%

1D (bps) -2

YTD (bps) -271

24,423

1D (%) 0.03%

YTD (%) 2.79%

27,439

1D (%) 0.11%

YTD (%) 6.94%

3,468

1D (%) 0.00%

YTD (%) -0.49%

Vietcombank continues to reduce deposit interest rates for terms under 12 months to the highest level of 3.2%/year. Specifically, for 1-month terms, Vietcombank reduces interest rates from 2.2%/year to 1.9%/year. With 3-month term, interest rate is reduced to 2.2%/year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Deposit interest rates for terms less than 3 months dropped to the lowest in history;

- Banks accelerated bond issuance as the year ended;

- HOSE has not responded about the KRX system;

- S&P 500 increased for 8 consecutive weeks, setting a record since 2017;

- Freight rates set to flare up as shipping lines avoid Red Sea;

- Samsung benefits from the ban on Apple Watch sales in the US.

VN30

BANK

81,800

1D 1.11%

5D 0.37%

Buy Vol. 2,777,426

Sell Vol. 1,981,465

43,200

1D 1.77%

5D 5.37%

Buy Vol. 2,203,657

Sell Vol. 1,914,605

26,900

1D 1.70%

5D 3.26%

Buy Vol. 9,089,844

Sell Vol. 6,711,021

30,950

1D 1.14%

5D 3.00%

Buy Vol. 4,380,732

Sell Vol. 5,205,176

18,500

1D 1.93%

5D 0.54%

Buy Vol. 15,972,029

Sell Vol. 19,298,521

18,400

1D 0.55%

5D 2.22%

Buy Vol. 16,176,241

Sell Vol. 16,198,185

19,150

1D 1.06%

5D 4.08%

Buy Vol. 9,379,011

Sell Vol. 10,928,217

17,050

1D 0.89%

5D 0.89%

Buy Vol. 6,235,552

Sell Vol. 7,008,745

27,500

1D 1.10%

5D 4.56%

Buy Vol. 23,415,318

Sell Vol. 30,425,334

19,050

1D 1.60%

5D 2.70%

Buy Vol. 3,805,688

Sell Vol. 3,691,107

23,350

1D 0.65%

5D 2.41%

Buy Vol. 13,908,865

Sell Vol. 17,835,371

10,750

1D 0.47%

5D 0.47%

Buy Vol. 25,272,881

Sell Vol. 25,131,282

22,650

1D 0.22%

5D 0.22%

Buy Vol. 1,473,834

Sell Vol. 1,791,172

STB: Sacombank's consolidated pre-tax profit in 2023 is estimated to reach more than VND9,500 billion, up 50% over the same period and reaching 100% of the year's plan.

OIL & GAS

76,500

1D 2.41%

5D 1.80%

Buy Vol. 2,384,279

Sell Vol. 9,316,593

11,300

1D 0.44%

5D 2.21%

Buy Vol. 8,434,581

Sell Vol. 1,290,239

34,650

1D 2.51%

5D 0.46%

Buy Vol. 1,265,065

Sell Vol. 4,336,992

On November 30, PetroVietnam Exploration Production Corporation (PVEP) completed the oil and condensate production plan for 2023.

VINGROUP

43,400

1D 0.58%

5D 3.26%

Buy Vol. 3,267,121

Sell Vol. 10,181,149

41,200

1D 2.23%

5D 3.54%

Buy Vol. 9,721,320

Sell Vol. 9,168,422

23,400

1D 1.96%

5D 1.34%

Buy Vol. 5,931,855

Sell Vol. 4,416,897

Today's session, foreign investors net bought Vingroup shares again with the total net buying value of VHM, VIC, and VRE reaching more than VND23 billion.

FOOD & BEVERAGE

67,900

1D 0.44%

5D 5.56%

Buy Vol. 4,170,037

Sell Vol. 5,662,218

66,400

1D 5.40%

5D 0.81%

Buy Vol. 6,219,558

Sell Vol. 937,500

62,000

1D 0.81%

5D 1.98%

Buy Vol. 1,044,930

Sell Vol. 917,390

MSN: MSN has led the list of stocks with the strongest increase contributing to VNIndex today.

OTHERS

61,900

1D 0.16%

5D 0.64%

Buy Vol. 905,542

Sell Vol. 484,358

39,300

1D 1.03%

5D 0.64%

Buy Vol. 600,947

Sell Vol. 484,358

107,800

1D 1.51%

5D 2.67%

Buy Vol. 912,531

Sell Vol. 1,200,733

96,000

1D 1.48%

5D 2.13%

Buy Vol. 3,387,118

Sell Vol. 4,235,887

42,650

1D 0.71%

5D 7.70%

Buy Vol. 15,176,952

Sell Vol. 19,613,914

20,200

1D -0.25%

5D 3.86%

Buy Vol. 3,099,282

Sell Vol. 4,490,144

32,550

1D 0.62%

5D 2.68%

Buy Vol. 27,291,415

Sell Vol. 30,453,617

27,450

1D 1.48%

5D 3.20%

Buy Vol. 40,942,624

Sell Vol. 47,117,451

MWG: MWG has just announced that its revenue for the month reached more than VND9,900 billion, approximately the same period but down 11% compared to October. Specifically, the total revenue of Mobile World and Dien May Xanh reached more than VND6,500 billion, down more than 16% compared to October, mainly due to cooling demand for iPhone. Revenue of the Bach Hoa Xanh chain reached approximately VND3,000 billion, growing 35% over the same period but slightly down 2% compared to the previous month.

Market by numbers

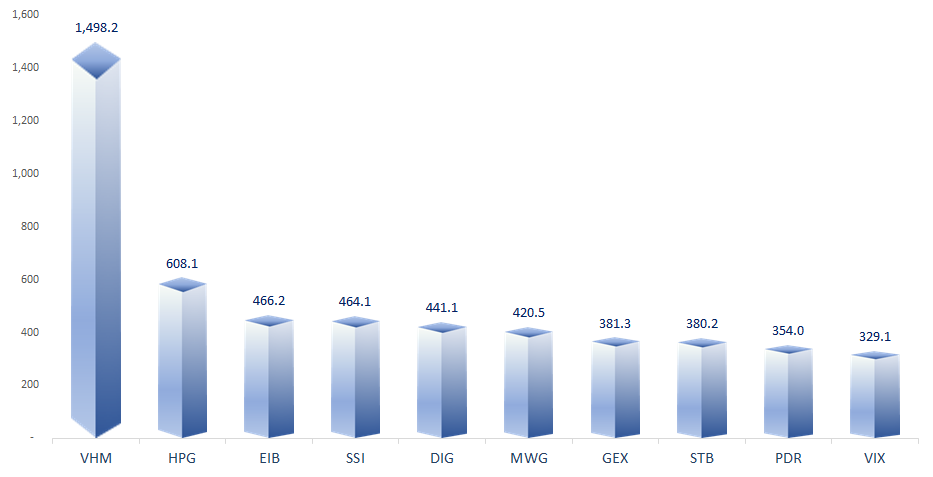

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

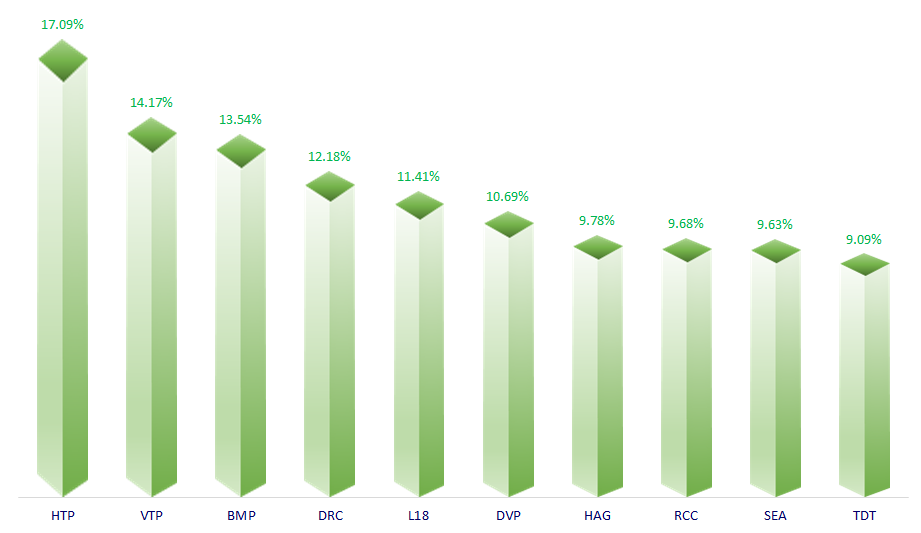

TOP INCREASES 3 CONSECUTIVE SESSIONS

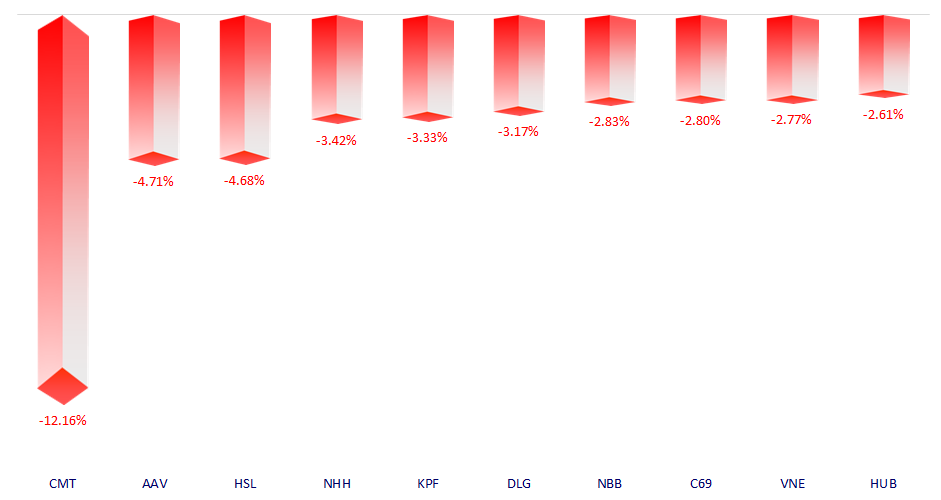

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.