Market brief 22/01/2024

VIETNAM STOCK MARKET

1,182.86

1D 0.12%

YTD 4.52%

229.77

1D 0.13%

YTD -0.10%

1,189.56

1D 0.37%

YTD 5.12%

87.72

1D 0.30%

YTD 0.16%

508.62

1D 0.00%

YTD 0.00%

20,527.61

1D 23.79%

YTD 8.63%

The market continued its upward trend in the first session of the new week. Right from the beginning of the session, the market increased by more than 5 points, although there was a weakening later when VNIndex gradually turned red. However, the large cash flow entering at the end of the session helped the market reverse to turn green.

ETF & DERIVATIVES

20,520

1D 0.74%

YTD 5.07%

14,130

1D 0.36%

YTD 5.06%

14,690

1D 1.17%

YTD 5.99%

17,200

1D 0.53%

YTD 1.30%

19,700

1D -0.61%

YTD 7.07%

27,320

1D 0.26%

YTD 4.96%

15,910

1D 0.57%

YTD 4.19%

1,194

1D 0.34%

YTD 0.00%

1,195

1D 0.59%

YTD 0.00%

1,191

1D 0.50%

YTD 0.00%

1,190

1D 0.88%

YTD 0.00%

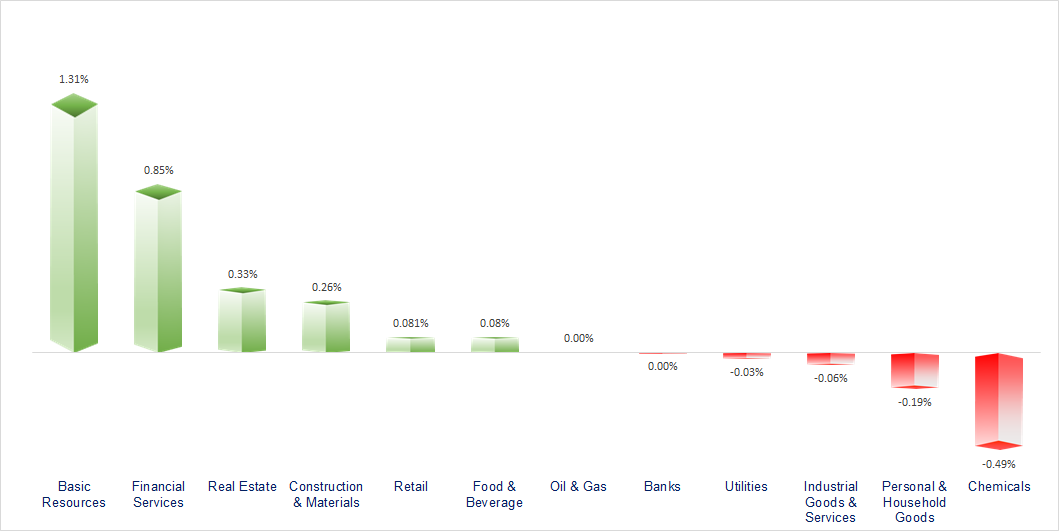

CHANGE IN PRICE BY SECTOR

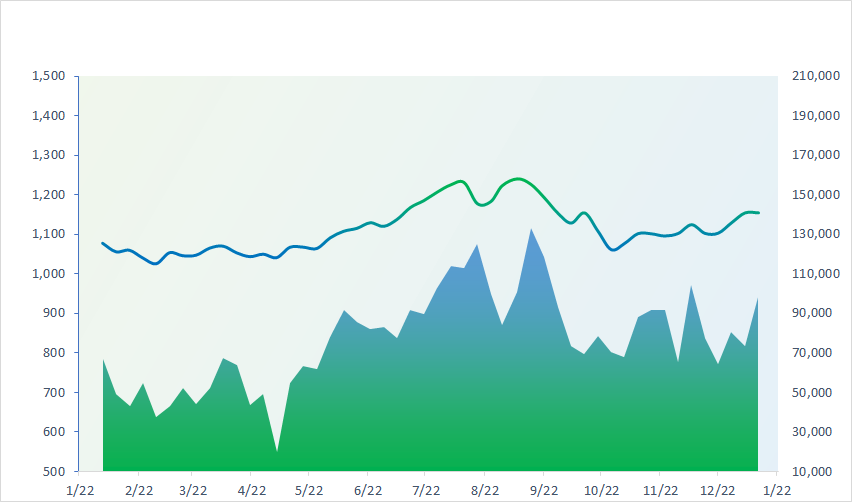

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

36,546.95

1D 1.62%

YTD 9.21%

2,756.34

1D -2.68%

YTD -6.95%

14,961.18

1D -2.27%

YTD -10.88%

2,464.35

1D -0.34%

YTD -7.70%

71,423.65

1D -0.36%

YTD -0.65%

3,149.12

1D -0.08%

YTD -2.50%

1,369.92

1D -0.81%

YTD -4.43%

78.58

1D -0.56%

YTD -0.33%

2,022.04

1D -0.43%

YTD -2.63%

Asian stock markets were mixed again today. Nikkei 225 continues to surge as the BOJ is expected to keep its dovish monetary policy intact at the end of its meeting on Tuesday. In contrast, Hong Kong and Chinese stocks fell amid continued concerns about the country's slowing economic recovery.

VIETNAM ECONOMY

0.19%

1D (bps) 4

YTD (bps) -341

4.70%

YTD (bps) -10

1.66%

1D (bps) -12

YTD (bps) -22

2.16%

1D (bps) 5

YTD (bps) -2

24,740

1D (%) 0.08%

YTD (%) 0.94%

27,498

1D (%) 0.03%

YTD (%) 0.45%

3,484

1D (%) 0.06%

YTD (%) 0.23%

On January 22, the "black market" buying price for USD is currently popular at 25,000 VND, the selling price is about 25,100 VND. Since the beginning of the year until now, the "black market" USD price has increased about 1.6%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Industry and Trade requires a review of petroleum business licenses;

- Hanoi commits to the progress of Belt 4 before the National Assembly and the Government;

- Hai Duong urges localities to soon hand over the site for the 500kV circuit 3 line project;

- China continues to keep interest rates unchanged to support the economy;

- European manufacturers and retailers are facing difficulties due to the Red Sea crisis;

- IMF: The market is too optimistic about the possibility of cutting interest rates.

VN30

BANK

92,000

1D -0.65%

5D 2.22%

Buy Vol. 1,448,471

Sell Vol. 2,438,329

49,800

1D -0.10%

5D 6.87%

Buy Vol. 3,564,001

Sell Vol. 4,550,297

32,650

1D 0.15%

5D 3.98%

Buy Vol. 18,762,422

Sell Vol. 14,651,231

34,950

1D 0.00%

5D 1.90%

Buy Vol. 6,692,031

Sell Vol. 9,496,352

19,800

1D 0.51%

5D 2.33%

Buy Vol. 27,268,446

Sell Vol. 31,843,447

22,100

1D 0.23%

5D 3.03%

Buy Vol. 75,384,085

Sell Vol. 50,390,067

21,200

1D 1.19%

5D 0.95%

Buy Vol. 11,884,830

Sell Vol. 10,633,404

18,650

1D 0.27%

5D 1.91%

Buy Vol. 16,371,632

Sell Vol. 16,940,456

30,250

1D -0.17%

5D 1.51%

Buy Vol. 23,651,750

Sell Vol. 28,872,821

21,100

1D 0.00%

5D 2.40%

Buy Vol. 6,953,201

Sell Vol. 9,415,205

26,300

1D 1.35%

5D 3.95%

Buy Vol. 20,507,002

Sell Vol. 18,968,547

12,150

1D 0.00%

5D 0.00%

Buy Vol. 68,515,197

Sell Vol. 76,163,997

23,250

1D 0.65%

5D -0.21%

Buy Vol. 2,376,775

Sell Vol. 2,536,737

TPB: Tien Phong Commercial Joint Stock Bank (TPBank) recently announced its financial report for the fourth quarter of 2023. The bank's profit before tax in the fourth quarter of 2023 is at VND630 billion, down 67% compared to the same period in 2022. The main reason is that risk provision costs skyrocketed from VND115 billion (quarter 4/2022) up to VND1,970 billion (quarter 4/2023).

OIL & GAS

76,300

1D -0.52%

5D 1.32%

Buy Vol. 1,082,765

Sell Vol. 13,941,440

11,550

1D 0.00%

5D 0.29%

Buy Vol. 13,265,758

Sell Vol. 942,847

34,750

1D -0.29%

5D 0.58%

Buy Vol. 623,862

Sell Vol. 3,911,695

POW: Profit after tax in 2023 PV Power is estimated to reach VND1,194.1 billion, exceeding 34% of the year's plan.

VINGROUP

43,300

1D 0.00%

5D 3.37%

Buy Vol. 2,910,777

Sell Vol. 10,204,812

43,000

1D -0.12%

5D 4.14%

Buy Vol. 7,765,851

Sell Vol. 13,371,496

23,900

1D 0.21%

5D 1.94%

Buy Vol. 9,257,985

Sell Vol. 4,880,075

VRE: Vincom Retail will have an additional 160,000 square meters of commercial floor space in 2024.

FOOD & BEVERAGE

68,300

1D 0.44%

5D 3.20%

Buy Vol. 3,629,146

Sell Vol. 3,965,076

67,700

1D -0.15%

5D 0.83%

Buy Vol. 3,149,256

Sell Vol. 946,925

60,900

1D -0.81%

5D 2.86%

Buy Vol. 704,137

Sell Vol. 1,166,138

MSN: After acquired by Masan, NET reported that its profit in the fourth quarter of 2023 doubled compared to the same period in 2022.

OTHERS

61,200

1D 0.00%

5D 0.49%

Buy Vol. 864,085

Sell Vol. 687,373

41,200

1D -0.12%

5D 0.49%

Buy Vol. 412,118

Sell Vol. 687,373

105,600

1D 0.57%

5D 0.38%

Buy Vol. 723,490

Sell Vol. 837,282

96,400

1D 0.10%

5D 1.05%

Buy Vol. 1,954,425

Sell Vol. 2,700,371

46,150

1D 0.22%

5D 7.58%

Buy Vol. 13,389,057

Sell Vol. 12,407,600

21,050

1D -1.17%

5D 2.43%

Buy Vol. 5,513,336

Sell Vol. 5,113,795

33,950

1D 0.74%

5D 2.88%

Buy Vol. 35,812,063

Sell Vol. 35,156,700

28,300

1D 1.80%

5D 4.43%

Buy Vol. 108,708,058

Sell Vol. 119,759,908

HPG: Hoa Phat Group Joint Stock Company has just announced its business results for the fourth quarter of 2023. Accordingly, in the fourth quarter of 2023, Hoa Phat Group recorded the total revenue reaching VND34,925 billion, an increase of 33% compared to the same period in 2022. Profit after tax recorded VND2,969 billion, an increase of 48% compared to the previous quarter.

Market by numbers

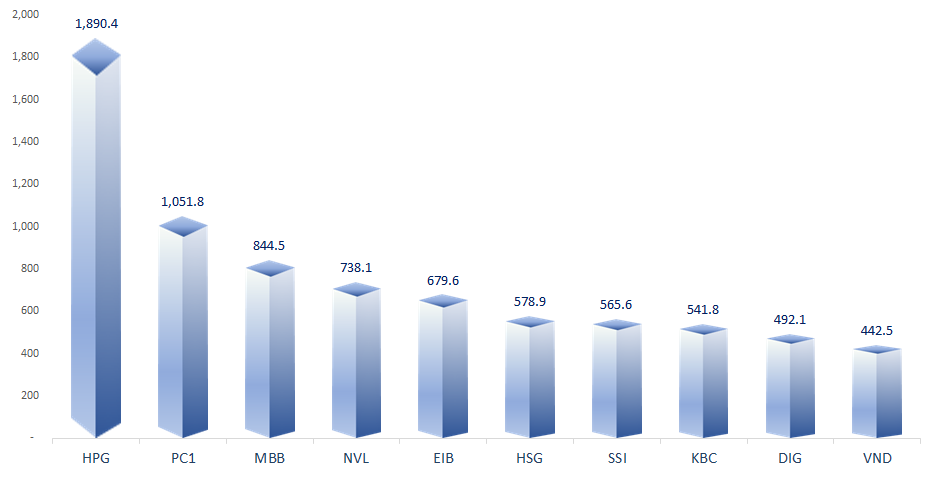

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

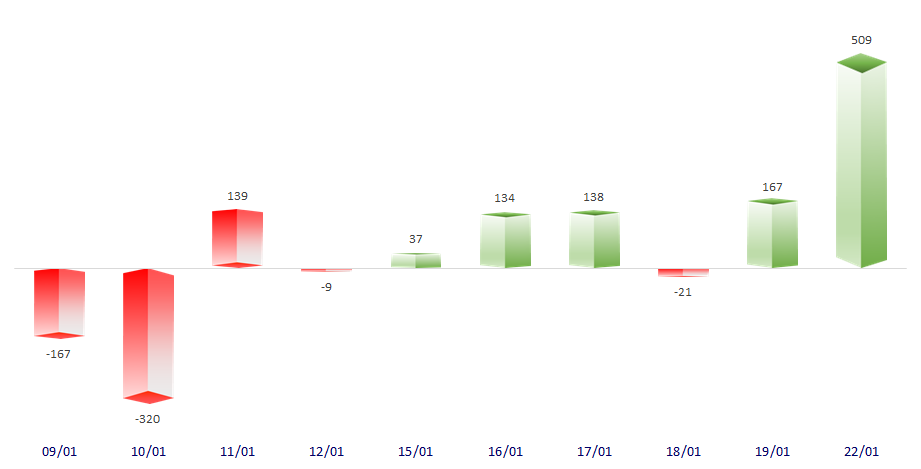

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

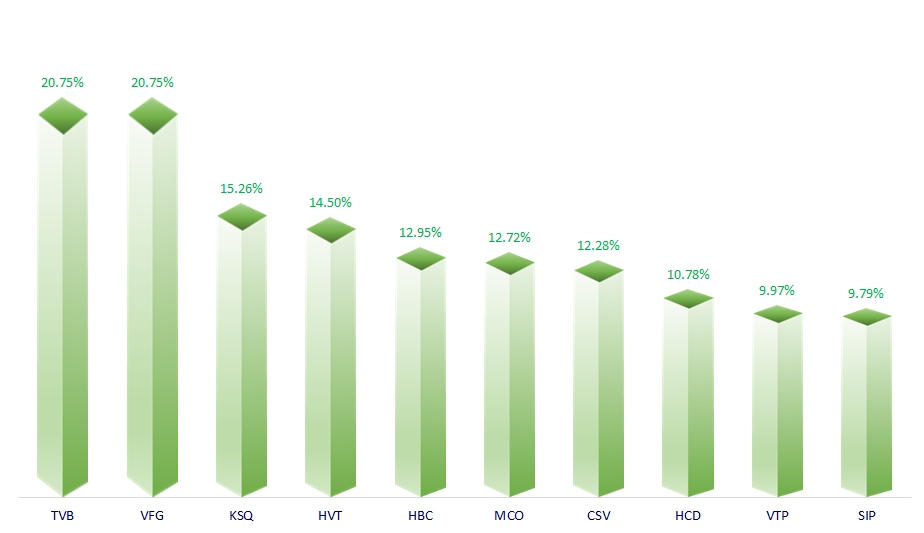

TOP INCREASES 3 CONSECUTIVE SESSIONS

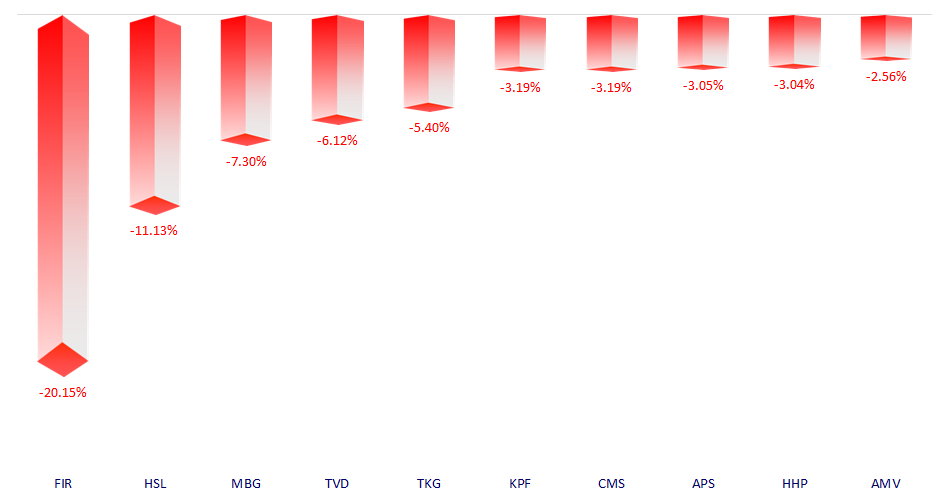

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.