Market brief 29/02/2024

VIETNAM STOCK MARKET

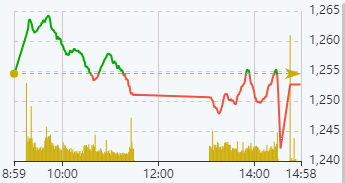

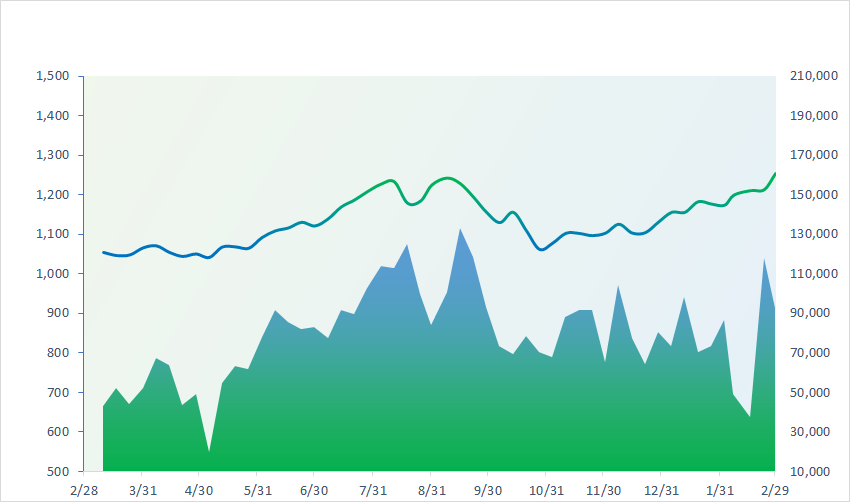

1,252.73

1D -0.15%

YTD 10.69%

235.46

1D 0.13%

YTD 2.38%

1,265.75

1D 0.03%

YTD 11.85%

90.63

1D 0.10%

YTD 3.48%

-417.23

1D 0.00%

YTD 0.00%

28,842.68

1D 13.77%

YTD 52.63%

The stock market had a slow session after surpassing its peak at 1250 points. Cash flow was circulating between industry groups. Retail and financial services were the two industry groups with the strongest growth today. In contrast to yesterday's session, banking and oil and gas were the two industry groups that decreased the most.

ETF & DERIVATIVES

21,850

1D 0.41%

YTD 11.88%

14,990

1D 0.00%

YTD 11.45%

15,560

1D 0.06%

YTD 12.27%

17,970

1D 0.00%

YTD 5.83%

20,870

1D 0.58%

YTD 13.42%

29,220

1D 0.41%

YTD 12.26%

16,850

1D 0.48%

YTD 10.35%

1,263

1D -0.27%

YTD 0.00%

1,264

1D -0.17%

YTD 0.00%

1,263

1D 0.08%

YTD 0.00%

1,260

1D -0.17%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

39,166.19

1D -0.11%

YTD 17.04%

3,015.17

1D 1.94%

YTD 1.79%

16,511.44

1D -0.15%

YTD -1.65%

2,642.36

1D -0.37%

YTD -1.03%

72,578.63

1D 0.38%

YTD 0.95%

3,141.85

1D 0.09%

YTD -2.73%

1,370.67

1D -0.82%

YTD -4.37%

81.96

1D 0.18%

YTD 3.96%

2,033.09

1D 0.31%

YTD -2.10%

Similar to the US market, Asian stocks were mostly weaker today, before important US economic data was released. The only bright spot was that Chinese stocks have recovered after falling sharply yesterday. Specifically, the Shanghai index increased by 1.94% while the Kospi and Nikkei closed in the red.

VIETNAM ECONOMY

1.47%

1D (bps) -86

YTD (bps) -213

4.70%

YTD (bps) -10

1.72%

1D (bps) 2

YTD (bps) -17

2.19%

1D (bps) 3

YTD (bps) 1

24,822

1D (%) 0.05%

YTD (%) 1.27%

27,474

1D (%) 0.17%

YTD (%) 0.36%

3,496

1D (%) 0.11%

YTD (%) 0.58%

The price of USD at commercial banks today also increased by about 20-30 VND. Although it has also increased quite strongly recently, the price of bank USD has not yet exceeded the peak of 24,880VND recorded at the end of 2022. The price difference between bank USD and black market USD was quite large, up to 600VND.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- February CPI increased by 3.98% over the same period;

- Attracting high-tech FDI is a trend;

- A US enterprise that produces high-tech chips wants to build a USD200 million factory in Northern Vietnam;

- Country Garden faces the risk of asset liquidation;

- Betting heavily on Bitcoin, El Salvador has gained 40%;

- Qatar increases LNG production capacity to meet Asian demand.

VN30

BANK

97,300

1D -0.10%

5D 8.72%

Buy Vol. 3,663,054

Sell Vol. 3,646,383

53,000

1D -1.67%

5D 6.53%

Buy Vol. 2,193,674

Sell Vol. 2,476,886

35,550

1D -1.11%

5D -0.42%

Buy Vol. 21,348,246

Sell Vol. 24,732,027

42,200

1D 0.00%

5D 4.71%

Buy Vol. 14,390,074

Sell Vol. 14,678,866

19,900

1D 0.00%

5D 1.02%

Buy Vol. 31,448,214

Sell Vol. 42,153,456

24,150

1D -1.02%

5D 0.84%

Buy Vol. 45,438,151

Sell Vol. 43,762,493

23,300

1D 0.43%

5D 1.75%

Buy Vol. 7,981,948

Sell Vol. 11,501,555

19,850

1D -0.75%

5D 1.53%

Buy Vol. 54,433,365

Sell Vol. 61,990,044

31,550

1D 0.48%

5D 1.61%

Buy Vol. 44,040,865

Sell Vol. 47,807,783

21,900

1D -0.90%

5D -2.67%

Buy Vol. 11,572,124

Sell Vol. 11,957,777

28,000

1D 0.00%

5D 1.27%

Buy Vol. 15,477,446

Sell Vol. 21,041,707

11,800

1D -0.84%

5D -2.48%

Buy Vol. 60,100,384

Sell Vol. 83,909,242

22,900

1D -0.22%

5D -0.43%

Buy Vol. 2,022,616

Sell Vol. 2,616,870

CTG: VietinBank recently announced the auction of debt worth more than VND1,500 billion of Vo Thi Thu Ha Trading Import-Export Company Limited (HCMC) with a starting price of VND142 billion, which is not equal to 1/10 of the debt.

OIL & GAS

77,400

1D -0.77%

5D -0.85%

Buy Vol. 2,166,899

Sell Vol. 19,069,230

11,650

1D -1.27%

5D 0.00%

Buy Vol. 13,977,524

Sell Vol. 2,222,196

35,850

1D -0.97%

5D -5.46%

Buy Vol. 1,608,154

Sell Vol. 8,400,138

POW: PV Power's credit rating (IDR) was upgraded by Fitch Ratings from BB to BB+.

VINGROUP

45,000

1D -1.32%

5D -3.13%

Buy Vol. 6,576,730

Sell Vol. 19,845,309

43,400

1D -2.25%

5D 0.38%

Buy Vol. 17,246,745

Sell Vol. 43,167,283

26,500

1D -4.68%

5D 0.56%

Buy Vol. 44,252,129

Sell Vol. 12,493,118

VIC: VinFast received two awards at the Indonesia International Auto Show.

FOOD & BEVERAGE

72,000

1D -0.28%

5D 3.38%

Buy Vol. 12,092,995

Sell Vol. 16,915,815

70,400

1D 3.07%

5D 0.86%

Buy Vol. 15,988,742

Sell Vol. 4,976,090

58,500

1D 1.39%

5D -2.76%

Buy Vol. 4,884,573

Sell Vol. 2,164,422

MSN: Masan Group Chairman Nguyen Dang Quang returns to Forbes' list of USD billionaires.

OTHERS

63,300

1D -0.16%

5D 1.78%

Buy Vol. 1,439,914

Sell Vol. 1,765,903

42,900

1D 1.06%

5D 1.78%

Buy Vol. 1,262,991

Sell Vol. 1,765,903

103,100

1D -0.29%

5D -0.48%

Buy Vol. 904,709

Sell Vol. 947,332

109,000

1D 0.46%

5D 4.21%

Buy Vol. 4,708,869

Sell Vol. 5,442,502

46,200

1D 1.99%

5D 1.99%

Buy Vol. 20,972,240

Sell Vol. 27,002,602

28,600

1D -1.04%

5D 2.33%

Buy Vol. 10,550,076

Sell Vol. 10,992,960

37,000

1D 2.49%

5D 6.78%

Buy Vol. 84,475,041

Sell Vol. 84,906,362

31,000

1D 1.31%

5D 8.58%

Buy Vol. 54,993,244

Sell Vol. 62,015,915

MWG: According to information from Reuters, CDH Investments from China is negotiating to buy back 5-10% of the shares of the Bach Hoa Xanh chain from Mobile World Investment Joint Stock Company (MWG). If an agreement is reached, the valuation of the Bach Hoa Xanh chain could reach USD1.7 billion.

Market by numbers

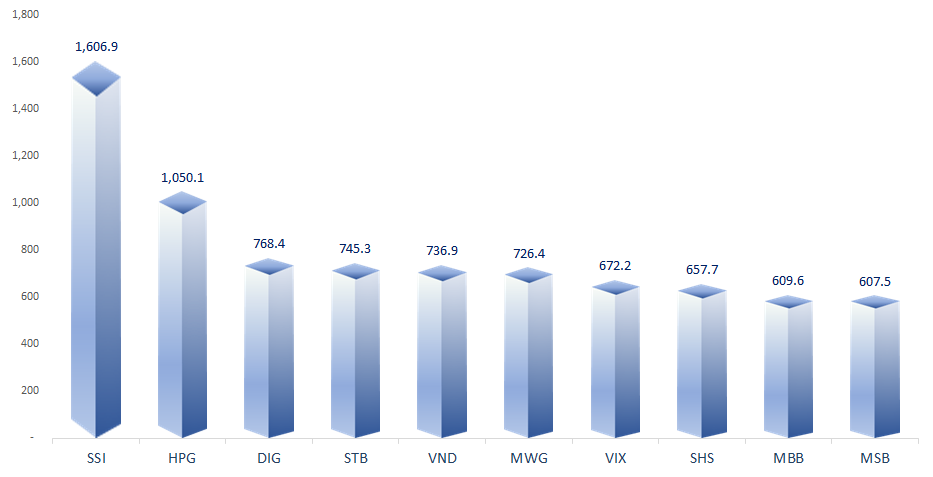

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

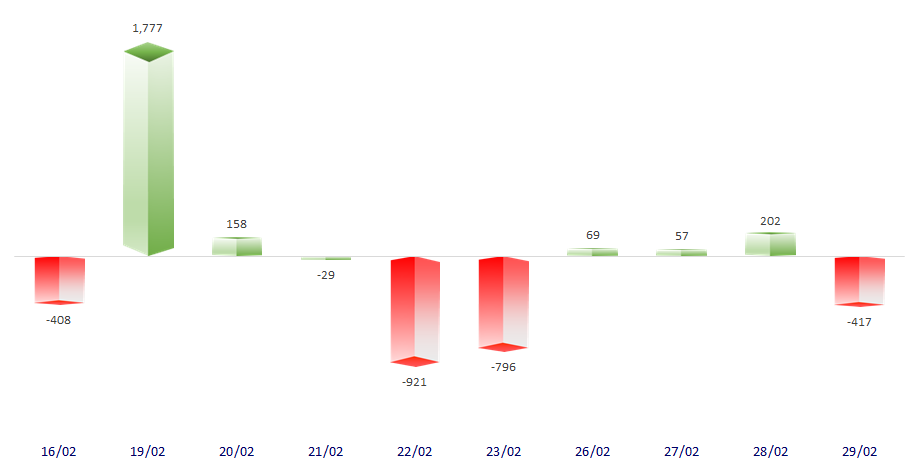

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

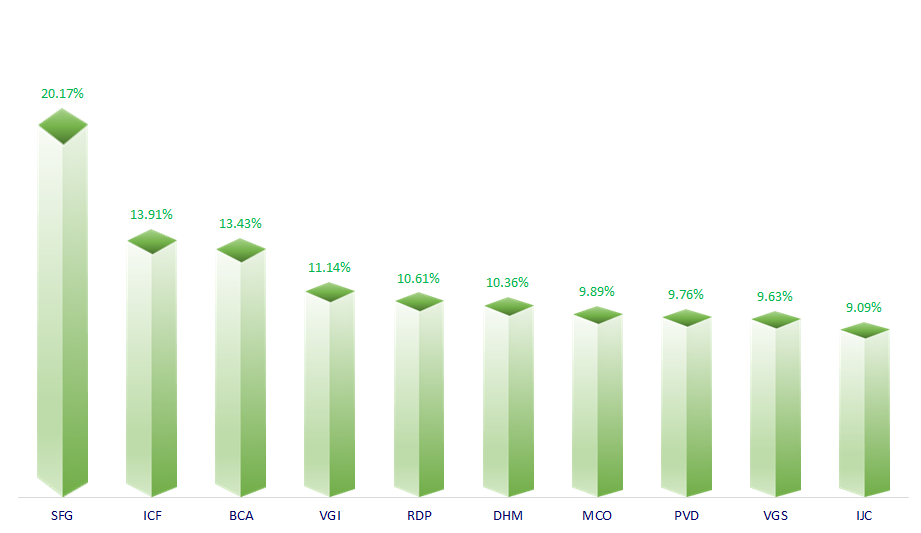

TOP INCREASES 3 CONSECUTIVE SESSIONS

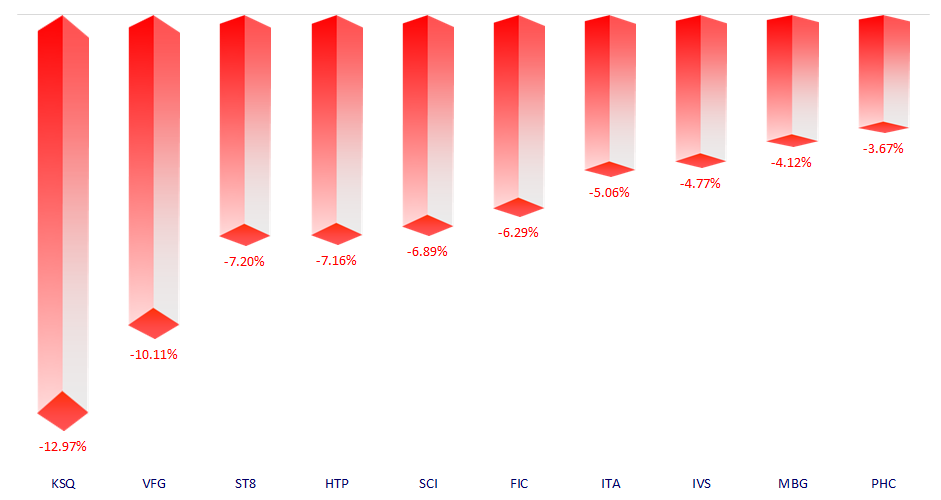

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.