Market brief 14/03/2024

VIETNAM STOCK MARKET

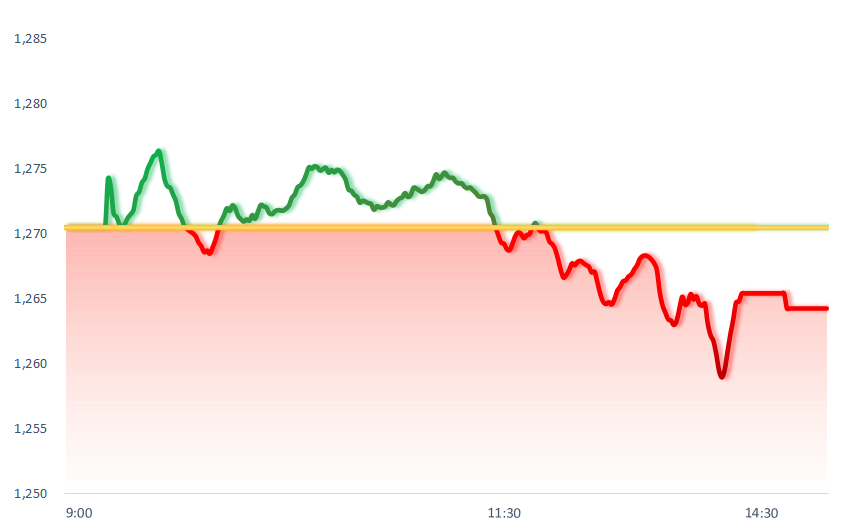

1,264.26

1D -0.49%

YTD 11.71%

239.68

1D 0.62%

YTD 4.21%

1,260.32

1D -0.94%

YTD 11.37%

91.62

1D 0.10%

YTD 4.61%

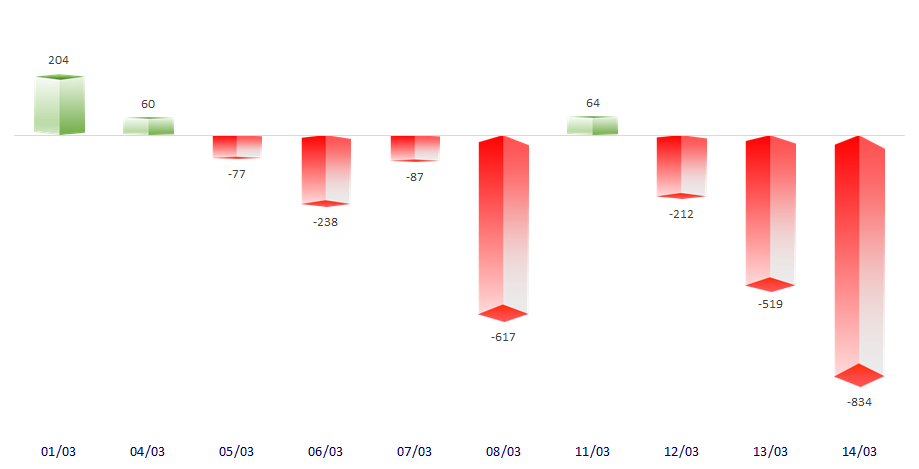

-834.12

1D 0.00%

YTD 0.00%

32,109.83

1D 9.93%

YTD 69.92%

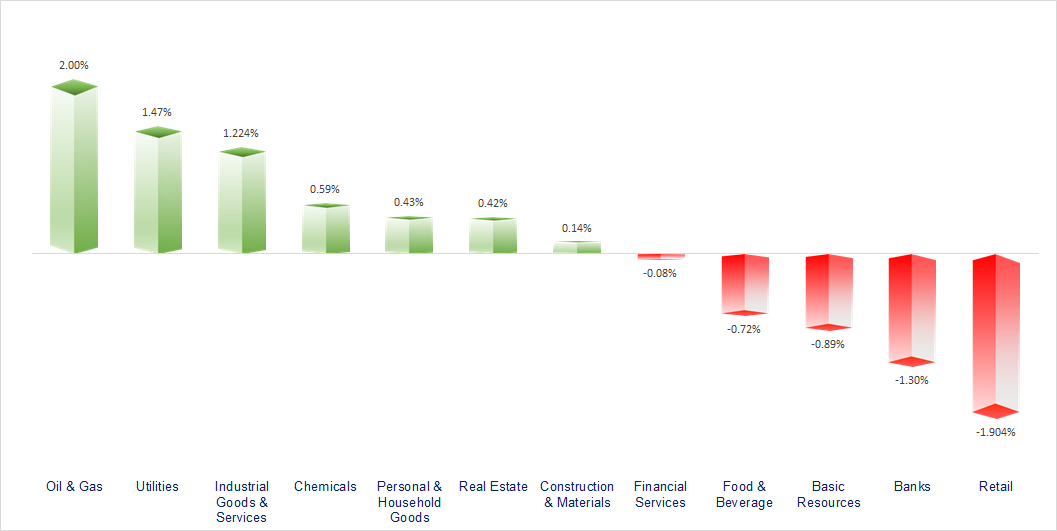

The market has turned down after yesterday's strong increase, when receiving information that credit throughout the system as of the end of February decreased by 0.72% compared to the end of 2023. Oil and gas was the industry with the most positive growth. On the contrary, retail and banking were the industry groups that decreased the most.

ETF & DERIVATIVES

21,800

1D -0.37%

YTD 11.62%

14,900

1D -0.73%

YTD 10.78%

15,550

1D -0.32%

YTD 12.19%

17,900

1D 0.28%

YTD 5.42%

20,480

1D -0.82%

YTD 11.30%

30,080

1D -0.46%

YTD 15.56%

16,950

1D -0.82%

YTD 11.00%

1,261

1D -0.83%

YTD 0.00%

1,263

1D -0.13%

YTD 0.00%

1,262

1D -0.88%

YTD 0.00%

1,263

1D -0.65%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

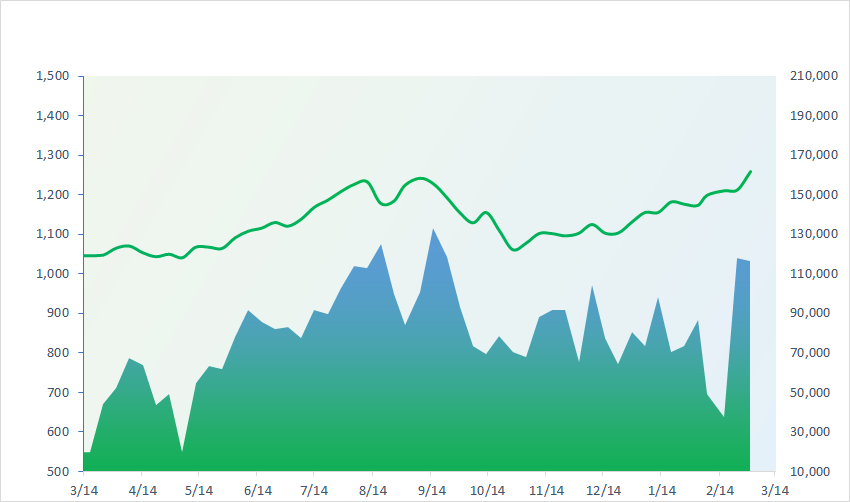

VNINDEX (12M)

GLOBAL MARKET

38,807.38

1D 0.29%

YTD 15.97%

3,038.23

1D -0.18%

YTD 2.56%

16,961.66

1D -0.71%

YTD 1.03%

2,718.76

1D 0.94%

YTD 1.83%

73,097.28

1D 0.40%

YTD 1.68%

3,186.40

1D 0.81%

YTD -1.35%

1,394.93

1D 0.75%

YTD -2.68%

84.53

1D 0.46%

YTD 7.22%

2,170.52

1D -0.21%

YTD 4.51%

Asian stocks also experienced a mixed session today. Despite gaining today's session, Nikkei 225 still recorded the strongest decline in the last 3 months when the BoJ is expected to introduce a policy pivot at the meeting next week.

VIETNAM ECONOMY

1.30%

1D (bps) -16

YTD (bps) -230

4.70%

YTD (bps) -10

1.85%

1D (bps) 2

YTD (bps) -3

2.33%

1D (bps) -4

YTD (bps) 16

24,900

1D (%) 0.16%

YTD (%) 1.59%

27,648

1D (%) -0.54%

YTD (%) 0.99%

3,504

1D (%) 0.06%

YTD (%) 0.81%

On the afternoon of March 14, SJC gold price continued to recover to nearly 82 million VND/tael. At Saigon Jewelry, SJC gold prices were listed at 79.7-81.7 million VND/tael, an increase of 300,000 VND/tael compared to the end of the morning.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Lottery revenue in 2023 reaches VND153,037 billion;

- Make a plan to combat power shortages in this year's dry season;

- Vietnam is still an attractive destination for foreign investors;

- Adidas reported its first loss in 3 decades;

- Broadcom Inc. approved a quarterly dividend of up to USD5.25;

- Gold becomes JPMorgan's top choice, forecast to reach USD2,500.

VN30

BANK

95,000

1D -1.04%

5D -0.84%

Buy Vol. 3,506,439

Sell Vol. 3,614,727

51,700

1D -1.71%

5D -3.00%

Buy Vol. 2,903,346

Sell Vol. 3,871,479

34,450

1D -1.99%

5D -3.77%

Buy Vol. 10,853,699

Sell Vol. 16,563,643

41,400

1D -1.43%

5D -2.82%

Buy Vol. 10,326,795

Sell Vol. 12,722,256

18,800

1D -1.31%

5D -3.34%

Buy Vol. 19,868,088

Sell Vol. 26,069,283

23,450

1D -1.68%

5D -3.89%

Buy Vol. 35,581,484

Sell Vol. 39,256,712

22,950

1D -0.65%

5D -0.86%

Buy Vol. 7,154,462

Sell Vol. 9,069,105

18,750

1D -1.32%

5D -2.60%

Buy Vol. 12,947,268

Sell Vol. 18,366,437

30,450

1D -1.30%

5D -2.72%

Buy Vol. 27,265,408

Sell Vol. 31,062,650

21,700

1D -1.59%

5D -0.69%

Buy Vol. 6,920,288

Sell Vol. 9,579,828

27,250

1D -1.45%

5D -0.91%

Buy Vol. 13,275,420

Sell Vol. 17,697,931

11,450

1D -0.87%

5D -3.78%

Buy Vol. 43,255,746

Sell Vol. 51,551,383

22,600

1D 0.00%

5D -0.66%

Buy Vol. 2,331,227

Sell Vol. 2,131,096

ACB: Regarding the business plan, ACB Bank targets pre-tax profit in 2024 to reach VND22,000 billion, an increase of 10% compared to the previous year. Total target assets increased by 12% to VND805,050 billion.

OIL & GAS

81,000

1D 2.53%

5D -2.11%

Buy Vol. 5,973,683

Sell Vol. 17,828,972

11,600

1D 0.00%

5D -0.40%

Buy Vol. 15,556,483

Sell Vol. 5,865,405

37,350

1D 0.67%

5D 0.77%

Buy Vol. 4,911,053

Sell Vol. 14,765,991

POW: Deputy Prime Minister requested to urgently remove problems for 2 projects of PV Power.

VINGROUP

45,950

1D 2.11%

5D -0.69%

Buy Vol. 10,136,514

Sell Vol. 23,688,214

42,900

1D -0.12%

5D -0.38%

Buy Vol. 19,661,074

Sell Vol. 25,896,273

25,900

1D 0.00%

5D -2.08%

Buy Vol. 21,438,538

Sell Vol. 8,878,108

VIC: VEF shares of Vefac, a subsidiary of Vingroup, increased 65% from the beginning of the year, expecting Vinhomes Co Loa to bring in VND120,000 billion in profit.

FOOD & BEVERAGE

70,500

1D -0.42%

5D -2.35%

Buy Vol. 9,399,770

Sell Vol. 11,010,506

78,900

1D -2.47%

5D -3.14%

Buy Vol. 9,473,126

Sell Vol. 2,848,644

58,700

1D -1.51%

5D -1.59%

Buy Vol. 2,371,056

Sell Vol. 4,034,125

SAB: SAB's subsidiary, WSB will submit to shareholders for consideration the 2023 dividend payment plan, 40% in cash.

OTHERS

67,900

1D -1.88%

5D -2.78%

Buy Vol. 3,996,711

Sell Vol. 1,106,778

43,650

1D -0.80%

5D -2.78%

Buy Vol. 1,113,829

Sell Vol. 1,106,778

102,000

1D -0.20%

5D -1.83%

Buy Vol. 973,655

Sell Vol. 983,382

117,000

1D 0.00%

5D 5.12%

Buy Vol. 5,694,870

Sell Vol. 6,655,390

47,250

1D -2.68%

5D -3.57%

Buy Vol. 20,232,138

Sell Vol. 21,570,255

32,800

1D 1.55%

5D 12.71%

Buy Vol. 10,526,834

Sell Vol. 9,838,550

37,850

1D -0.26%

5D 0.40%

Buy Vol. 61,895,313

Sell Vol. 79,188,421

30,350

1D -1.46%

5D -2.10%

Buy Vol. 51,646,032

Sell Vol. 66,611,237

FPT: FPT is expected to submit a business plan for 2024 with a business revenue target of VND61,850 billion, an increase of 17.5% compared to the previous year's results, of which the technology sector still accounts for a large proportion, reaching VND38,150 billion.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

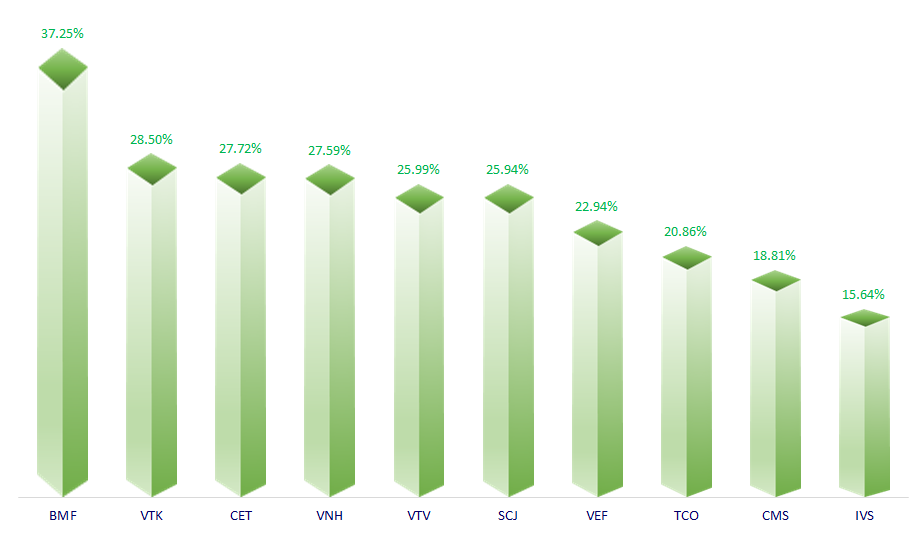

TOP INCREASES 3 CONSECUTIVE SESSIONS

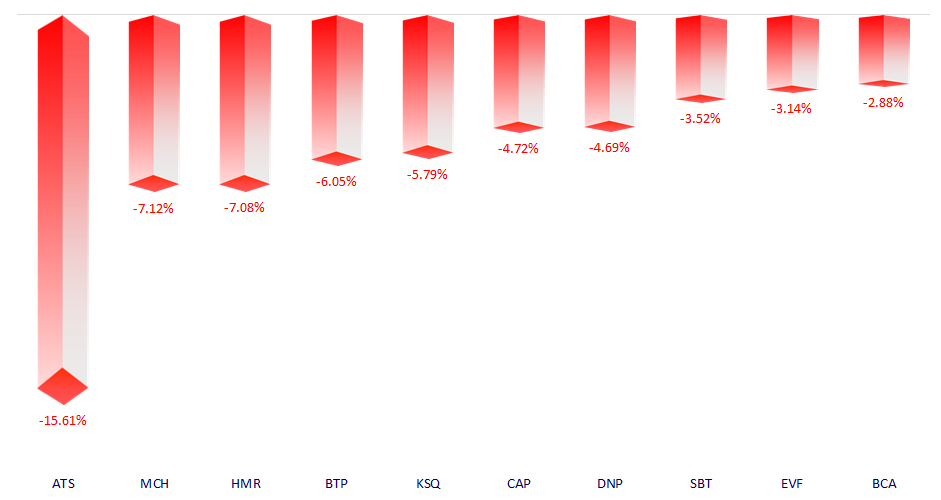

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.