Market Brief 05/04/2024

VIETNAM STOCK MARKET

1,255.11

1D -1.04%

YTD 10.90%

239.68

1D -1.14%

YTD 4.21%

1,257.78

1D -0.78%

YTD 11.15%

90.65

1D -0.40%

YTD 3.51%

5.86

1D 0.00%

YTD 0.00%

28,923.77

1D 7.62%

YTD 53.06%

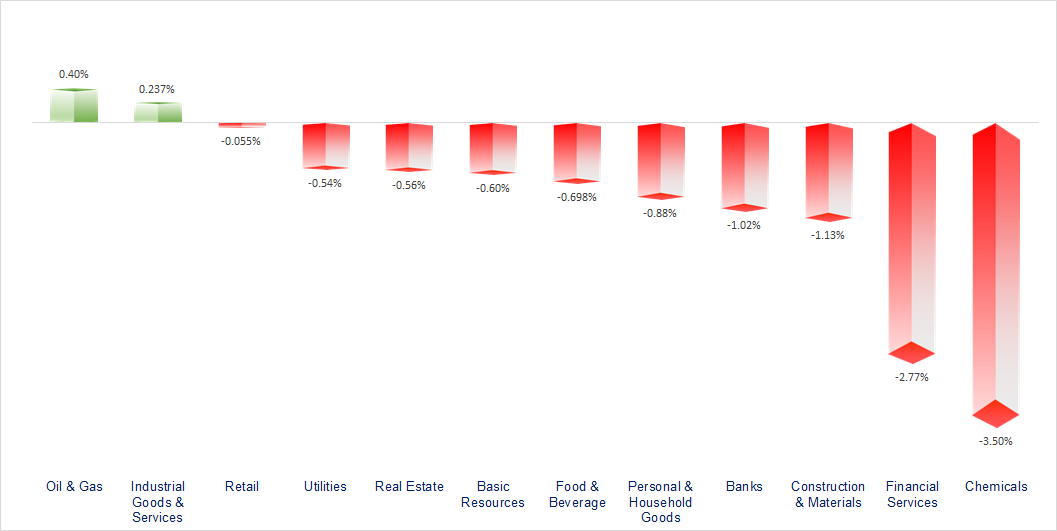

The chemical industry fell the most in today's session, mainly affected by natural rubber and fertilizer stocks. HVN (+6.7%) was the gaining stock that had the most impact on VNIndex. The oil and gas industry had mixed movements, increasing stocks: PVC +5.7%, PVB +1.9%, OIL +1%, BSR +2%; falling stocks: CNG -3.8%, PVD -1.9% , PVS -1.6%.

ETF & DERIVATIVES

21,810

1D -0.41%

YTD 11.67%

14,930

1D -0.80%

YTD 11.00%

15,520

1D -0.51%

YTD 11.98%

18,850

1D -1.15%

YTD 11.01%

20,500

1D -1.39%

YTD 11.41%

30,140

1D -0.56%

YTD 15.79%

16,920

1D -1.05%

YTD 10.81%

1,257

1D -0.63%

YTD 0.00%

1,261

1D -0.71%

YTD 0.00%

1,259

1D -0.87%

YTD 0.00%

1,263

1D -0.53%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

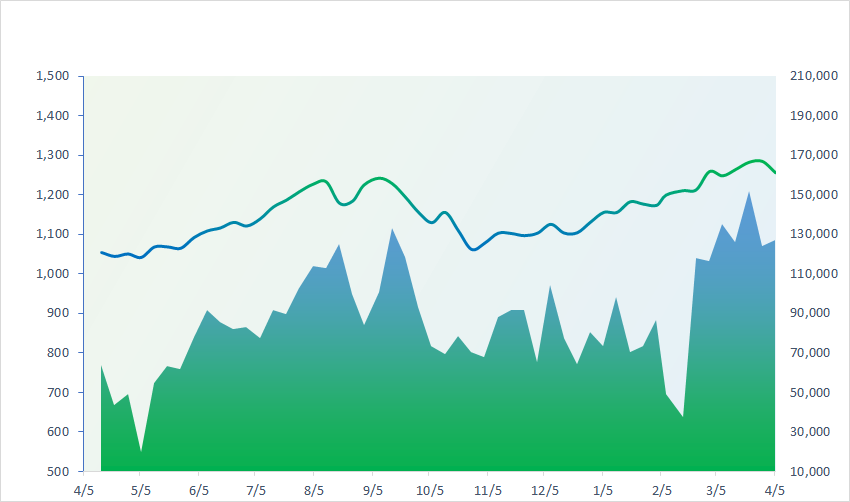

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,992.08

1D -1.96%

YTD 16.52%

3,069.29

1D 0.00%

YTD 3.61%

16,723.92

1D -0.01%

YTD -0.38%

2,714.21

1D -1.01%

YTD 1.66%

74,248.22

1D -0.04%

YTD 3.28%

3,218.26

1D -0.52%

YTD -0.36%

1,375.58

1D 0.12%

YTD -4.03%

90.95

1D 0.07%

YTD 18.08%

2,294.99

1D 0.93%

YTD 10.51%

Japan’s Nikkei 225 led declines in Asia-Pacific markets on Friday as comments from U.S. Federal Reserve officials fueled worries that the central bank could hold off on rate cuts. Hong Kong’s Hang Seng index resumed trading after a public holiday and fell slightly by 0.01%, while mainland China markets were still shut.

VIETNAM ECONOMY

2.58%

1D (bps) -100

YTD (bps) -102

4.70%

YTD (bps) -10

2.25%

1D (bps) -3

YTD (bps) 37

2.78%

1D (bps) 11

YTD (bps) 60

25,130

1D (%) 0.06%

YTD (%) 2.53%

27,879

1D (%) 0.11%

YTD (%) 1.84%

3,520

1D (%) 0.06%

YTD (%) 1.27%

The US dollar headed for its first weekly loss in a month on Friday, but pulled away from two-week lows, ahead of a key U.S. jobs report later in the day.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- FDI attraction has grown in the first quarter of 2024;

- France wishes to continue promoting their strategic partnership more intensively and comprehensively with Vietnam;

- Wood exports in the first quarter increased nearly 19% over the same period;

- Central banks bolster gold reserves further in February, albeit at a slower pace;

- The world faces a natural gas glut not seen in decades;

- Rebounding US dollar crucial for central banks.

VN30

BANK

94,900

1D -1.15%

5D 0.00%

Buy Vol. 1,529,764

Sell Vol. 1,803,508

50,200

1D -1.57%

5D -3.65%

Buy Vol. 2,680,297

Sell Vol. 3,009,766

33,200

1D -1.04%

5D -6.61%

Buy Vol. 21,013,204

Sell Vol. 22,008,580

45,200

1D -1.74%

5D -4.94%

Buy Vol. 21,516,257

Sell Vol. 24,626,374

19,450

1D 0.78%

5D -1.52%

Buy Vol. 25,059,387

Sell Vol. 22,358,095

23,350

1D -1.89%

5D -8.07%

Buy Vol. 50,473,086

Sell Vol. 48,088,090

23,350

1D 0.00%

5D -3.11%

Buy Vol. 11,016,421

Sell Vol. 9,827,141

18,200

1D -1.09%

5D -4.71%

Buy Vol. 18,856,588

Sell Vol. 20,217,791

29,600

1D -0.34%

5D -6.33%

Buy Vol. 44,718,924

Sell Vol. 39,746,279

22,700

1D -2.16%

5D -7.72%

Buy Vol. 12,589,727

Sell Vol. 20,454,226

27,150

1D -1.45%

5D -4.74%

Buy Vol. 23,473,259

Sell Vol. 27,004,812

11,150

1D -0.45%

5D -2.19%

Buy Vol. 55,507,308

Sell Vol. 31,706,062

21,950

1D -0.23%

5D -0.68%

Buy Vol. 1,847,506

Sell Vol. 2,566,953

VCB: From April 1 - June 30, Vietcombank will reduce up to 0.5 percentage points/year lending interest rates in VND for existing loans and 1.5 percentage points/year for new loans.

OIL & GAS

80,900

1D -0.74%

5D -1.32%

Buy Vol. 3,418,716

Sell Vol. 17,657,829

11,250

1D -0.44%

5D -0.40%

Buy Vol. 20,842,244

Sell Vol. 3,108,401

37,150

1D 0.00%

5D 0.31%

Buy Vol. 2,516,772

Sell Vol. 5,882,406

US oil prices hit a seven-month high this week amidst rising geopolitical risks and falling inventories.

VINGROUP

47,800

1D -0.10%

5D 0.23%

Buy Vol. 4,663,125

Sell Vol. 23,216,257

42,950

1D -0.12%

5D -4.45%

Buy Vol. 18,799,460

Sell Vol. 13,913,792

24,700

1D -2.37%

5D 0.44%

Buy Vol. 12,784,679

Sell Vol. 9,352,207

VIC: In 2024, Vingroup targets revenue of VND200,000 billion and profit after tax of VND4,500 billion.

FOOD & BEVERAGE

67,900

1D -0.44%

5D -3.10%

Buy Vol. 7,497,997

Sell Vol. 8,657,570

71,900

1D -2.04%

5D -1.06%

Buy Vol. 8,699,862

Sell Vol. 1,730,522

56,100

1D -0.71%

5D -3.54%

Buy Vol. 1,800,534

Sell Vol. 3,130,869

VNM: In 2024, Vinamilk plans a total revenue of VND63,163 billion, an increase of 4.4% and a profit after tax of VND9,376 billion, an increase of 4% compared to 2023.

OTHERS

62,600

1D -1.42%

5D -2.46%

Buy Vol. 1,216,807

Sell Vol. 597,494

41,700

1D -0.95%

5D -2.46%

Buy Vol. 590,839

Sell Vol. 597,494

101,900

1D -0.29%

5D -1.07%

Buy Vol. 933,886

Sell Vol. 982,600

113,700

1D -0.26%

5D -2.40%

Buy Vol. 5,804,661

Sell Vol. 4,181,657

51,000

1D 0.59%

5D -0.20%

Buy Vol. 17,130,157

Sell Vol. 14,376,148

31,500

1D -4.83%

5D -4.98%

Buy Vol. 10,972,701

Sell Vol. 12,579,973

36,800

1D -2.26%

5D -4.42%

Buy Vol. 51,520,684

Sell Vol. 51,870,932

29,450

1D -0.51%

5D -2.64%

Buy Vol. 46,960,210

Sell Vol. 41,247,977

HPG: The demand for hot rolled coil steel (HRC) in Vietnam is estimated at 10 - 13 million tons/year but the maximum supply output is about 8 million tons. Currently, only two enterprises, Hoa Phat and Formosa, can produce HRC steel (of which Hoa Phat: 3 million tons, Formosa: more than 5 million tons).

Market by numbers

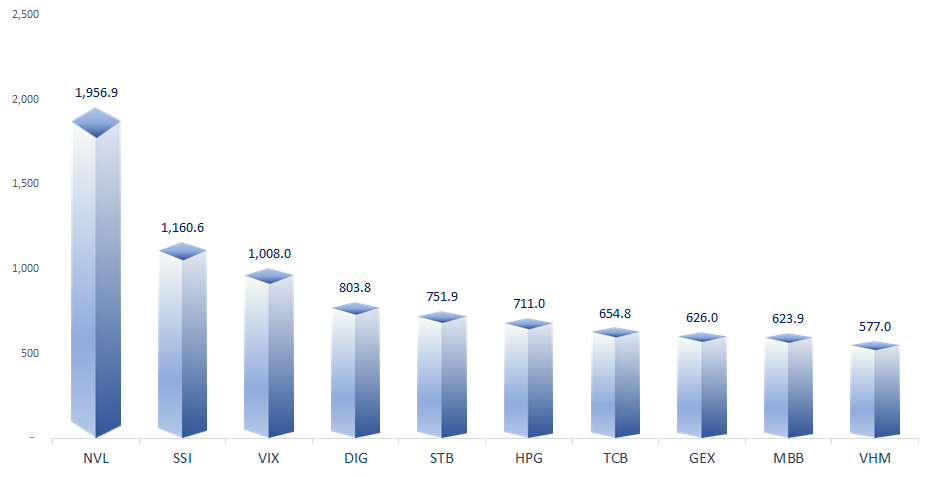

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

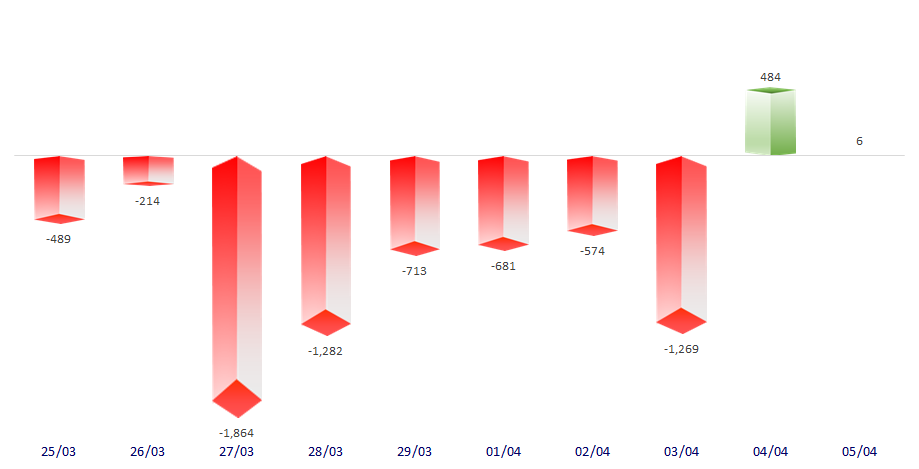

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

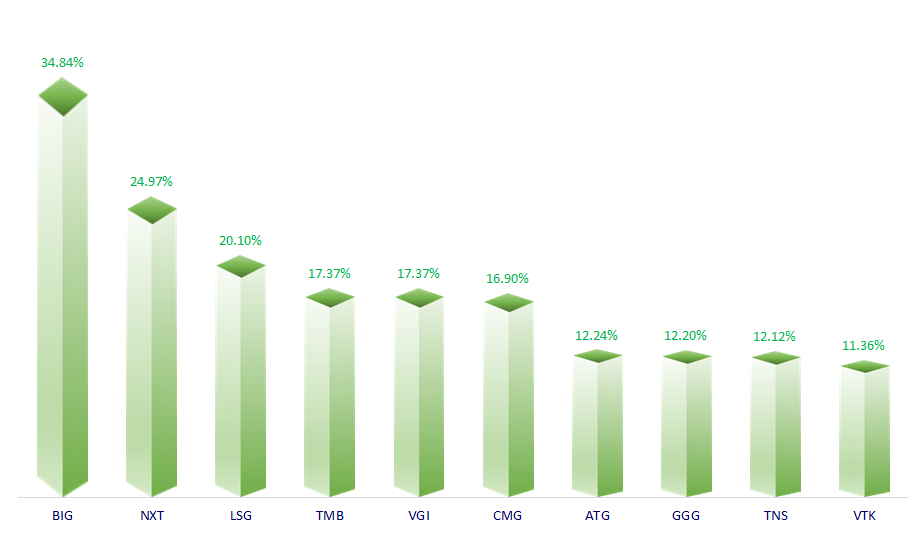

TOP INCREASES 3 CONSECUTIVE SESSIONS

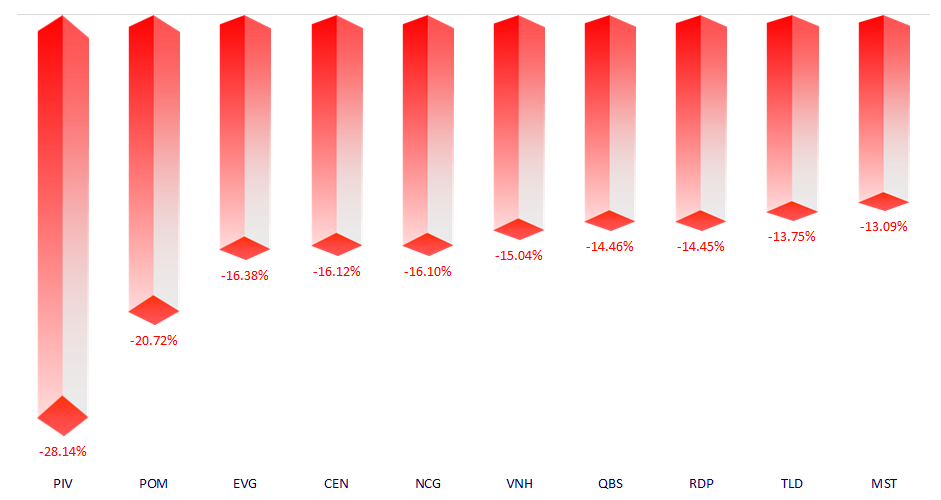

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.