Market brief 11/04/2024

VIETNAM STOCK MARKET

1,258.20

1D -0.03%

YTD 11.18%

239.07

1D 0.12%

YTD 3.95%

1,262.86

1D -0.08%

YTD 11.60%

90.92

1D 0.30%

YTD 3.81%

153.25

1D 0.00%

YTD 0.00%

18,647.15

1D -0.85%

YTD -1.32%

The stock market fluctuated sideways despite the newly announced US inflation data that was hotter than forecast. With positive information from Hoa Phat Shareholders' Meeting, the steel stocks group had the most positive developments today.

ETF & DERIVATIVES

21,840

1D 0.00%

YTD 11.83%

14,980

1D -0.13%

YTD 11.38%

15,530

1D -0.06%

YTD 12.05%

18,870

1D -0.16%

YTD 11.13%

20,700

1D 0.24%

YTD 12.50%

30,310

1D -0.03%

YTD 16.44%

17,090

1D 0.83%

YTD 11.92%

1,263

1D 0.23%

YTD 0.00%

1,264

1D -0.18%

YTD 0.00%

1,264

1D -0.11%

YTD 0.00%

1,265

1D -0.09%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

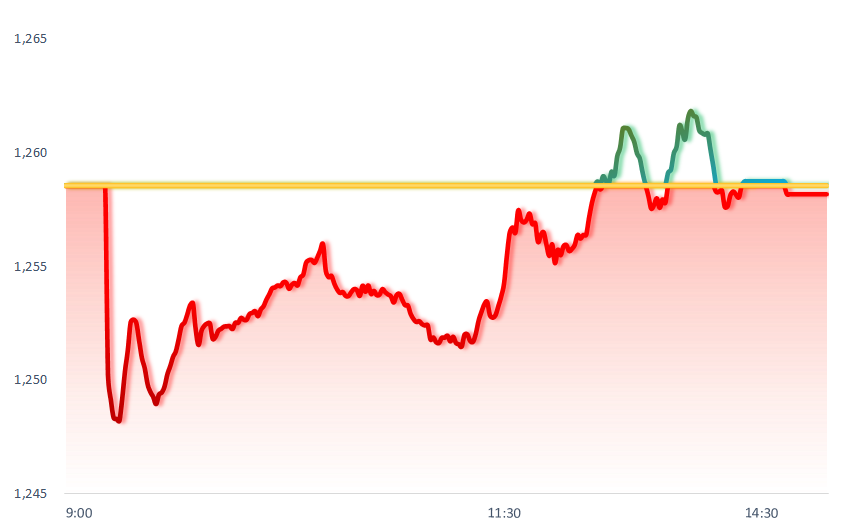

INTRADAY VNINDEX

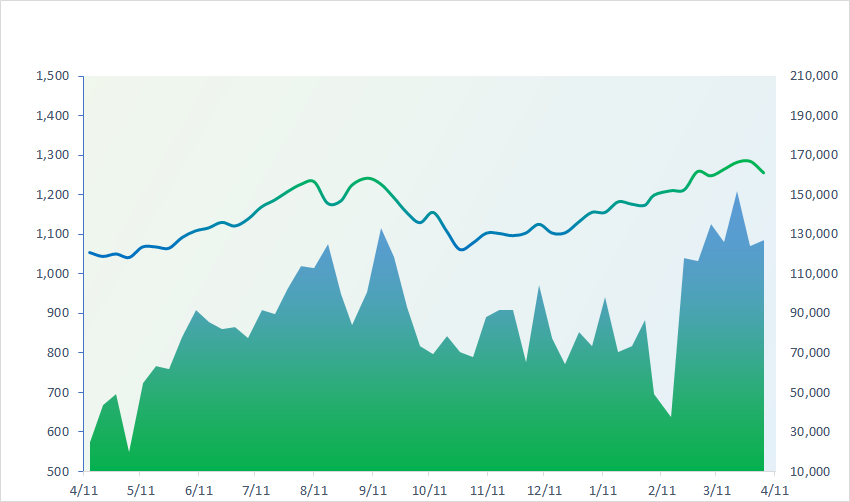

VNINDEX (12M)

GLOBAL MARKET

39,442.63

1D -0.35%

YTD 17.87%

3,034.25

1D 0.23%

YTD 2.43%

17,095.03

1D -0.26%

YTD 1.83%

2,706.96

1D 0.07%

YTD 1.39%

75,038.15

1D 0.00%

YTD 4.38%

3,227.61

1D -0.31%

YTD -0.07%

1,396.38

1D -0.84%

YTD -2.58%

90.00

1D -0.60%

YTD 16.84%

2,339.15

1D -0.06%

YTD 12.63%

Asian stock markets had mixed movements when receiving China's March inflation data. Specifically, China's consumer inflation index in March increased by only 0.1% and in line with market expectations.

VIETNAM ECONOMY

3.82%

1D (bps) -4

YTD (bps) 22

4.70%

YTD (bps) -10

2.29%

1D (bps) -1

YTD (bps) 41

2.62%

1D (bps) -1

YTD (bps) 45

25,195

1D (%) 0.32%

YTD (%) 2.79%

27,454

1D (%) -0.62%

YTD (%) 0.28%

3,522

1D (%) 0.14%

YTD (%) 1.32%

The domestic USD exchange rate simultaneously increased after the US March inflation data was announced which was higher than forecast. Since the beginning of the year until now, USD prices at banks have increased about 3%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Stop implementing the route from Thai Binh city to Nghin bridge in the form of PPP;

- Savings interest rates will increase by 0.5 - 1%/year from the second half of 2024;

- Binh Dinh is about to have a tourist area worth more than VND4,300 billion;

- US: Budget deficit has exceeded USD1,000 billion;

- Fitch lowered China's debt credit outlook to negative level;

- The yen fell to its lowest level in 34 years.

VN30

BANK

94,000

1D -0.53%

5D -2.08%

Buy Vol. 1,724,999

Sell Vol. 1,112,531

53,000

1D 1.92%

5D 3.92%

Buy Vol. 3,911,484

Sell Vol. 5,005,747

33,700

1D 0.15%

5D 0.45%

Buy Vol. 10,348,495

Sell Vol. 7,585,662

45,100

1D -1.20%

5D -1.96%

Buy Vol. 21,667,035

Sell Vol. 18,591,380

19,350

1D 0.00%

5D 0.26%

Buy Vol. 27,614,757

Sell Vol. 30,184,158

23,750

1D -0.21%

5D -0.21%

Buy Vol. 27,541,990

Sell Vol. 17,966,238

24,000

1D 0.21%

5D 2.78%

Buy Vol. 8,904,817

Sell Vol. 8,661,552

18,350

1D 0.00%

5D -0.27%

Buy Vol. 14,192,196

Sell Vol. 14,464,773

28,850

1D -0.86%

5D -2.86%

Buy Vol. 19,916,287

Sell Vol. 19,102,016

22,900

1D 0.00%

5D -1.29%

Buy Vol. 11,080,944

Sell Vol. 11,611,303

27,150

1D 0.18%

5D -1.45%

Buy Vol. 20,606,983

Sell Vol. 20,522,029

11,100

1D -0.89%

5D -0.89%

Buy Vol. 28,874,729

Sell Vol. 31,542,725

22,050

1D 0.23%

5D 0.23%

Buy Vol. 3,331,636

Sell Vol. 2,829,830

VIB: International Commercial Joint Stock Bank (VIB) has just announced the resolution of the Board of Directors on the time to finalize the list of shareholders to pay the remaining 6.5% cash dividend in 2023 (VND650 per share). Accordingly, the final date for paying the second cash dividend is April 19, 2023 and the payment date is May 17, 2024.

OIL & GAS

78,800

1D -0.51%

5D -0.88%

Buy Vol. 1,471,734

Sell Vol. 15,692,429

11,200

1D -0.88%

5D -2.29%

Buy Vol. 13,067,371

Sell Vol. 1,534,520

36,300

1D -0.82%

5D 0.94%

Buy Vol. 1,724,268

Sell Vol. 6,181,966

PLX: In 2024, Petrolimex plans to have consolidated revenue of VND188,000 billion and pre-tax profit of VND2,900 billion, down 32% and 26% respectively compared to 2023 performance.

VINGROUP

48,300

1D -0.41%

5D 2.67%

Buy Vol. 5,219,156

Sell Vol. 24,333,057

44,150

1D -0.11%

5D -5.53%

Buy Vol. 18,578,779

Sell Vol. 7,268,599

23,900

1D -1.44%

5D -2.35%

Buy Vol. 8,179,200

Sell Vol. 5,819,181

VIC: Vingroup successfully divests Vincom Retail with a deal value of up to VND39,100 billion.

FOOD & BEVERAGE

66,600

1D -0.30%

5D -2.18%

Buy Vol. 6,706,720

Sell Vol. 5,849,365

71,800

1D -0.97%

5D -1.95%

Buy Vol. 6,719,496

Sell Vol. 1,217,921

55,400

1D 0.18%

5D -5.04%

Buy Vol. 1,357,250

Sell Vol. 2,026,294

VNM: Vinamilk expects revenue and profit to increase 4% over the same period, maintaining 38.5% cash dividend.

OTHERS

60,300

1D -1.63%

5D -1.54%

Buy Vol. 1,265,761

Sell Vol. 417,605

41,450

1D -0.24%

5D -1.54%

Buy Vol. 444,641

Sell Vol. 417,605

101,000

1D -0.98%

5D -1.17%

Buy Vol. 1,217,104

Sell Vol. 1,148,649

114,900

1D 0.97%

5D 0.79%

Buy Vol. 3,630,517

Sell Vol. 3,676,711

52,300

1D 0.58%

5D 3.16%

Buy Vol. 12,956,229

Sell Vol. 14,560,915

31,900

1D 0.79%

5D -3.63%

Buy Vol. 7,194,618

Sell Vol. 5,813,549

37,150

1D 0.54%

5D -1.33%

Buy Vol. 29,391,939

Sell Vol. 26,312,657

29,900

1D 0.84%

5D 1.01%

Buy Vol. 37,325,722

Sell Vol. 40,478,370

HPG: Despite many difficulties, in the first quarter of 2024, Hoa Phat Group still achieved VND31,000 billion in revenue, profit after tax of VND2,800 billion, not including the provision of VND200 billion to compensate for exchange rate differences.

Market by numbers

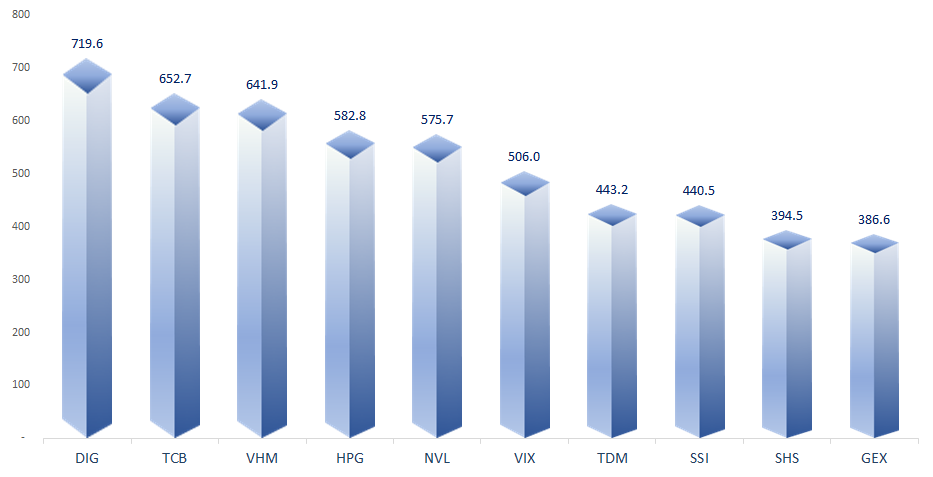

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

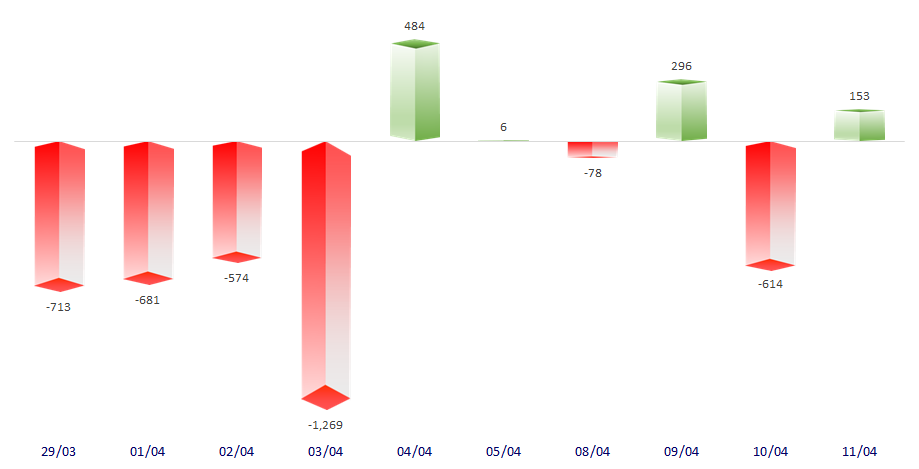

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

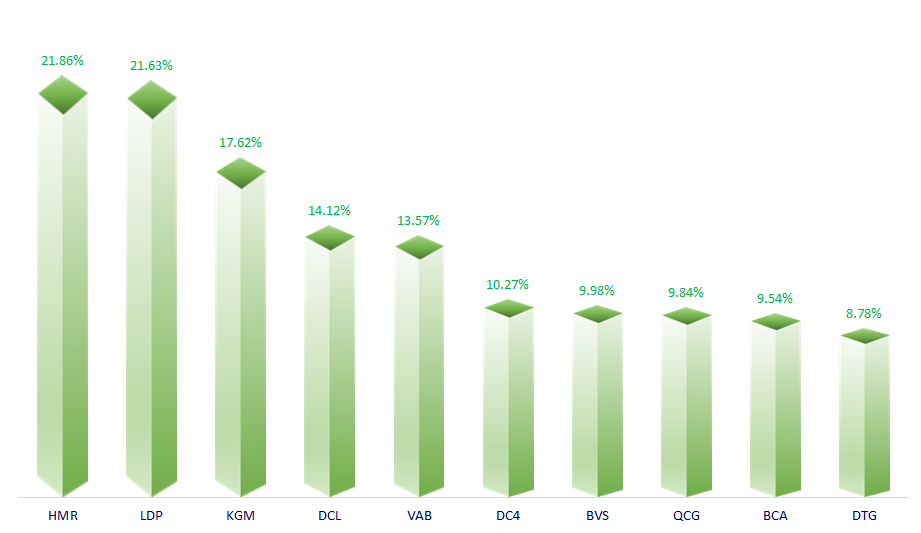

TOP INCREASES 3 CONSECUTIVE SESSIONS

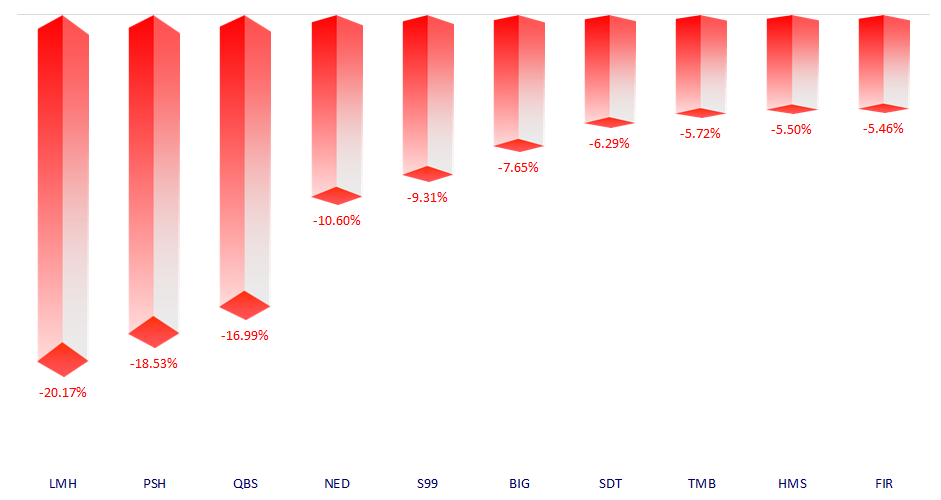

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.