Market Brief 19/04/2024

VIETNAM STOCK MARKET

1,174.85

1D -1.52%

YTD 3.81%

220.80

1D -2.39%

YTD -4.00%

1,194.03

1D -1.38%

YTD 5.51%

87.16

1D -1.12%

YTD -0.48%

651.63

1D 0.00%

YTD 0.00%

26,916.14

1D 26.31%

YTD 42.44%

In just 4 consecutive sessions, VNIndex has dropped nearly 100 points. Securities stocks continued to decline sharply, even though some securities companies reported positive business results in Q1/2024. Specifically, CTS, BSI, VDS hit the floor, SHS -6.5%, FTS -5.8%, HCM -4.8%, SSI -3.5%,..

ETF & DERIVATIVES

20,670

1D -1.85%

YTD 5.84%

14,120

1D -2.22%

YTD 4.98%

14,900

1D -0.33%

YTD 7.50%

18,040

1D -2.80%

YTD 6.24%

19,400

1D -1.02%

YTD 5.43%

28,800

1D -1.30%

YTD 10.64%

15,950

1D -1.91%

YTD 4.45%

1,192

1D -1.59%

YTD 0.00%

1,196

1D -1.36%

YTD 0.00%

1,198

1D -2.12%

YTD 0.00%

1,198

1D -1.53%

YTD 0.00%

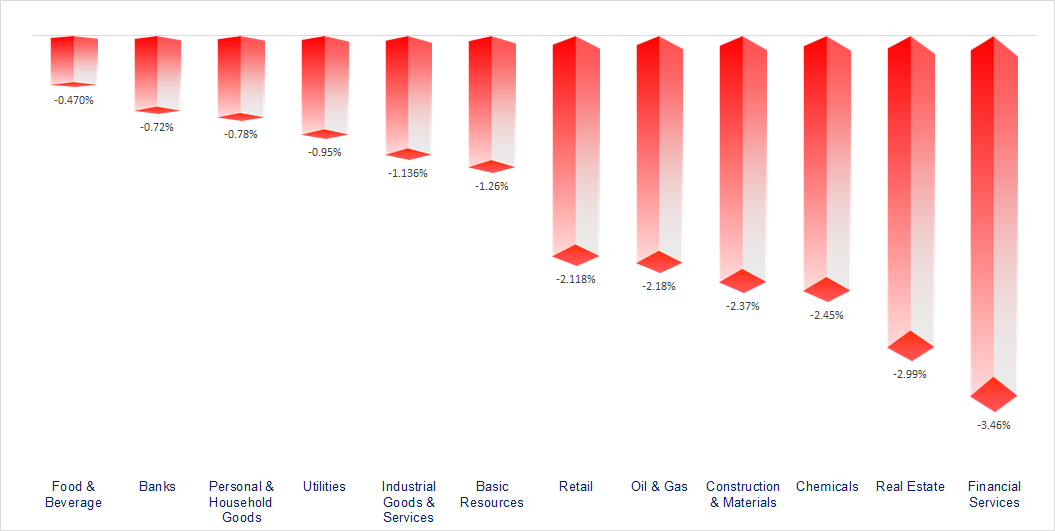

CHANGE IN PRICE BY SECTOR

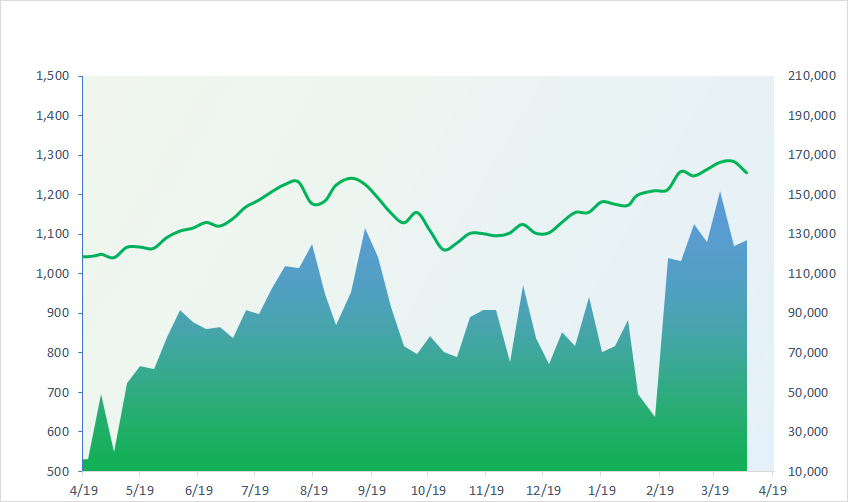

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

37,068.35

1D -2.66%

YTD 10.77%

3,065.26

1D -0.29%

YTD 3.48%

16,224.14

1D -0.99%

YTD -3.36%

2,591.86

1D -1.63%

YTD -2.92%

73,082.83

1D 0.82%

YTD 1.66%

3,176.51

1D -0.35%

YTD -1.65%

1,333.02

1D -2.06%

YTD -7.00%

87.63

1D 0.76%

YTD 13.77%

2,383.02

1D 0.17%

YTD 14.75%

Asian equities declined as a person familiar with the matter told NBC News that Israel carried out a limited strike in Iran. Stocks and risk assets tumbled, while safe havens rose. Gold hit an all-time high. Japan’s Nikkei 225 was down 2.66%, paring earlier losses. On Friday, Japan released its March inflation data, with the headline inflation rate coming in at 2.7%, down from the 2.8% seen in February. The core inflation rate — which strips out fresh food prices — stood at 2.6%, in line with expectations from economists polled by Reuters.

VIETNAM ECONOMY

3.96%

1D (bps) -96

YTD (bps) 36

4.70%

YTD (bps) -10

2.30%

1D (bps) -1

YTD (bps) 42

2.83%

YTD (bps) 65

25,473

1D (%) 0.00%

YTD (%) 3.93%

27,957

1D (%) 0.33%

YTD (%) 2.12%

3,585

1D (%) 0.08%

YTD (%) 3.14%

This morning (April 19), Mr. Pham Chi Quang - Director of the Monetary Policy Department, said that the State Bank has taken stronger measures to stabilize the foreign currency market. From today, the State Bank will intervene by selling foreign currency to credit institutions, with an intervention selling price of VND25,450.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- From April 19, the State Bank of Vietnam publicly sold USD to stabilize exchange rates;

- The State Bank will auction gold on April 22;

- By the end of March, credit growth reached 1.34%;

- Iran's oil exports hits a 6 year high;

- Israel launches missile strikes into Iran, U.S. military official says;

- Foreign investors hold a record amount of US government bonds.

VN30

BANK

90,500

1D 0.00%

5D -4.33%

Buy Vol. 1,973,791

Sell Vol. 1,876,023

48,350

1D 0.52%

5D -9.46%

Buy Vol. 4,414,538

Sell Vol. 4,047,018

31,600

1D -3.36%

5D -11.98%

Buy Vol. 23,501,713

Sell Vol. 23,852,723

44,500

1D -0.78%

5D -6.12%

Buy Vol. 25,040,668

Sell Vol. 20,762,846

18,100

1D -0.28%

5D -8.12%

Buy Vol. 28,051,889

Sell Vol. 26,786,434

22,700

1D -1.73%

5D -7.91%

Buy Vol. 48,941,334

Sell Vol. 47,465,872

22,250

1D -3.26%

5D -8.44%

Buy Vol. 12,262,970

Sell Vol. 15,407,377

16,600

1D -2.35%

5D -11.23%

Buy Vol. 15,343,167

Sell Vol. 14,950,612

26,800

1D 0.00%

5D -7.90%

Buy Vol. 39,838,573

Sell Vol. 33,092,356

21,100

1D -1.86%

5D -7.94%

Buy Vol. 16,131,336

Sell Vol. 13,249,314

26,600

1D -0.56%

5D -5.00%

Buy Vol. 19,060,938

Sell Vol. 16,632,086

11,150

1D 0.45%

5D -1.33%

Buy Vol. 65,972,104

Sell Vol. 87,622,818

22,100

1D -0.45%

5D -2.21%

Buy Vol. 2,592,500

Sell Vol. 4,602,127

MBB: In 2024, MBB targets pre-tax profit growth of 6 - 8%. Specifically, MBB's consolidated pre-tax profit is expected to reach from VND27,884 billion to VND28,411 billion.

OIL & GAS

75,000

1D -0.13%

5D -5.78%

Buy Vol. 1,706,595

Sell Vol. 19,356,917

10,600

1D -3.20%

5D -5.97%

Buy Vol. 14,138,232

Sell Vol. 1,450,879

34,650

1D -1.84%

5D -12.07%

Buy Vol. 1,052,846

Sell Vol. 6,583,993

POW: In 2024, PV Power will carry out major and minor repairs to its factories, so it is forecast that profits will decrease sharply.

VINGROUP

42,600

1D -5.33%

5D -6.74%

Buy Vol. 5,128,453

Sell Vol. 20,682,903

41,500

1D -0.72%

5D -11.80%

Buy Vol. 17,891,063

Sell Vol. 13,059,838

21,300

1D -3.18%

5D -3.75%

Buy Vol. 15,185,957

Sell Vol. 6,710,677

VinFast's total revenue reached VND7,264 billion in the first quarter, an increase of 269.7% over the same period in 2023.

FOOD & BEVERAGE

64,200

1D 0.00%

5D -7.51%

Buy Vol. 7,173,589

Sell Vol. 7,991,500

66,500

1D -0.45%

5D -6.25%

Buy Vol. 8,443,291

Sell Vol. 2,109,204

52,500

1D -2.78%

5D -15.41%

Buy Vol. 2,173,225

Sell Vol. 2,103,717

VNM: VNM was net bought by foreign investors for the second consecutive session with a value of VND93.5 billion.

OTHERS

51,600

1D -4.97%

5D -8.11%

Buy Vol. 2,056,450

Sell Vol. 953,507

38,500

1D -0.26%

5D -8.11%

Buy Vol. 1,034,825

Sell Vol. 953,507

103,300

1D -0.10%

5D -3.46%

Buy Vol. 1,274,390

Sell Vol. 1,140,562

109,000

1D -2.50%

5D -5.63%

Buy Vol. 9,374,611

Sell Vol. 7,215,859

48,200

1D -2.43%

5D -7.31%

Buy Vol. 15,148,812

Sell Vol. 14,962,666

28,100

1D -1.92%

5D -12.19%

Buy Vol. 13,955,896

Sell Vol. 10,984,655

33,200

1D -3.49%

5D -11.58%

Buy Vol. 50,395,475

Sell Vol. 51,264,312

27,800

1D -0.71%

5D -7.18%

Buy Vol. 45,189,342

Sell Vol. 47,359,407

SSI: SSI announced the parent company's business results for the first quarter. Specifically, operating revenue reached VND1,920 billion and profit after tax was VND727 billion, up 33% and 51%, respectively over the same period last year.

Market by numbers

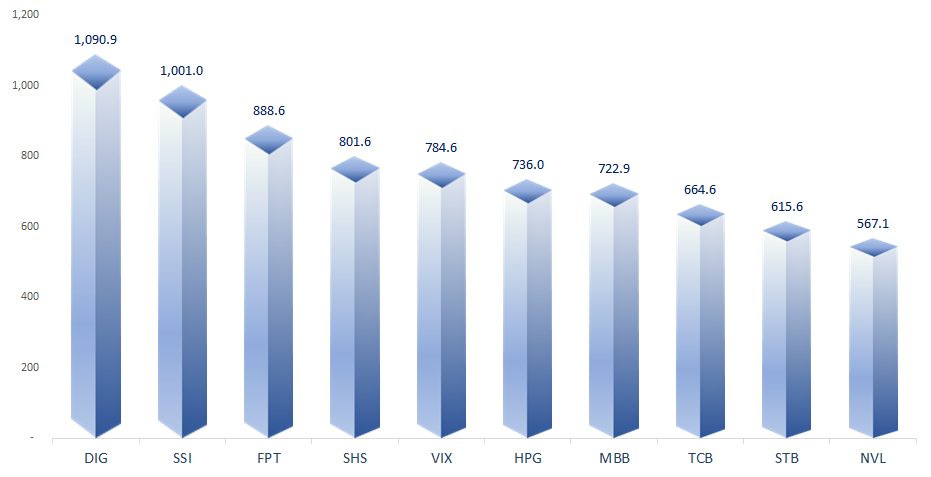

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

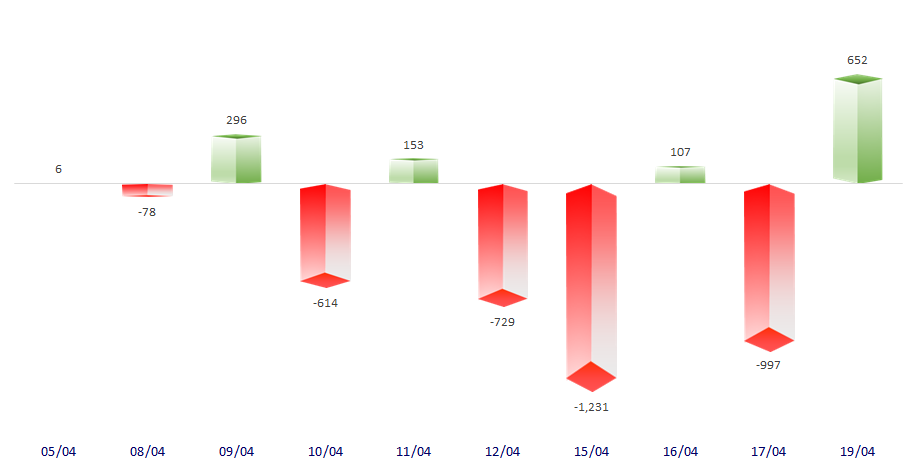

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

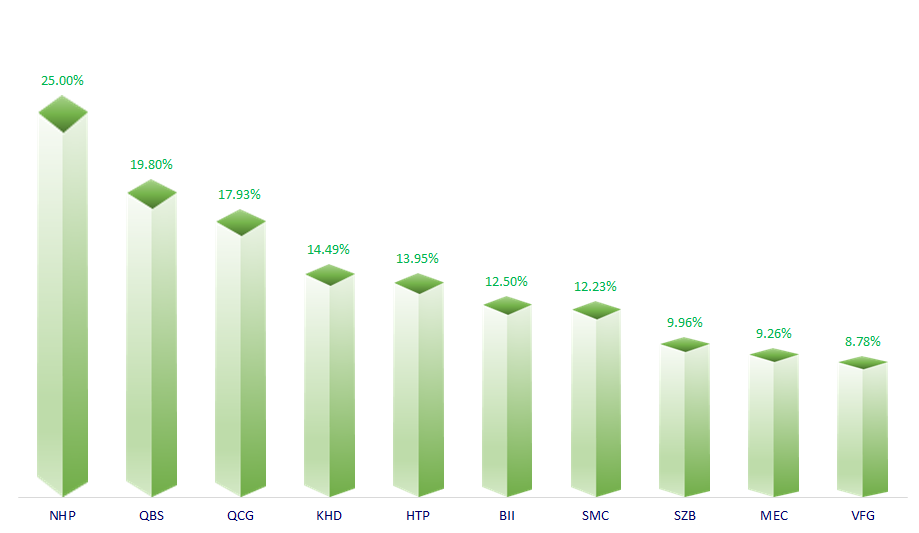

TOP INCREASES 3 CONSECUTIVE SESSIONS

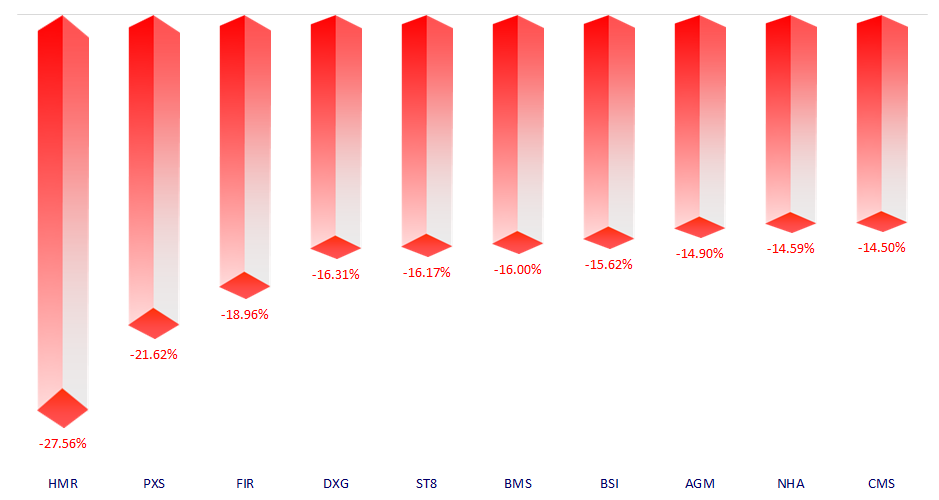

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.