Market brief 22/04/2024

VIETNAM STOCK MARKET

1,190.22

1D 1.31%

YTD 5.17%

225.31

1D 2.04%

YTD -2.03%

1,206.64

1D 1.06%

YTD 6.63%

88.02

1D 0.99%

YTD 0.50%

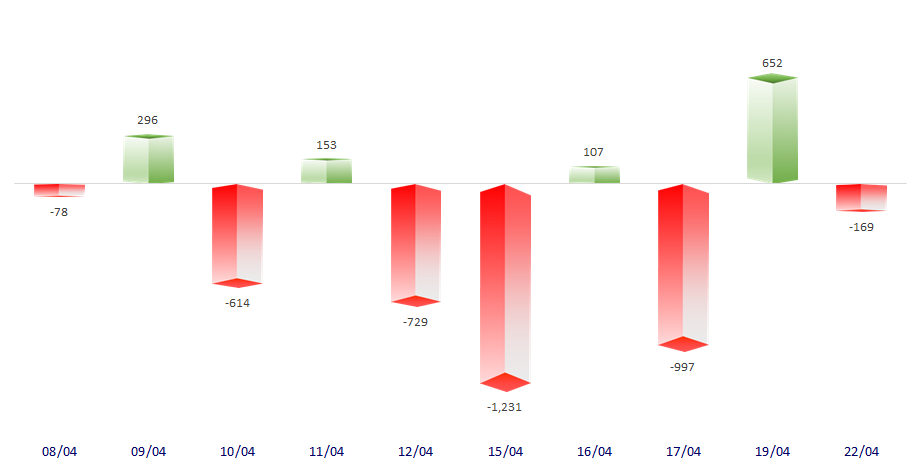

-169.44

1D 0.00%

YTD 0.00%

17,832.77

1D -33.75%

YTD -5.63%

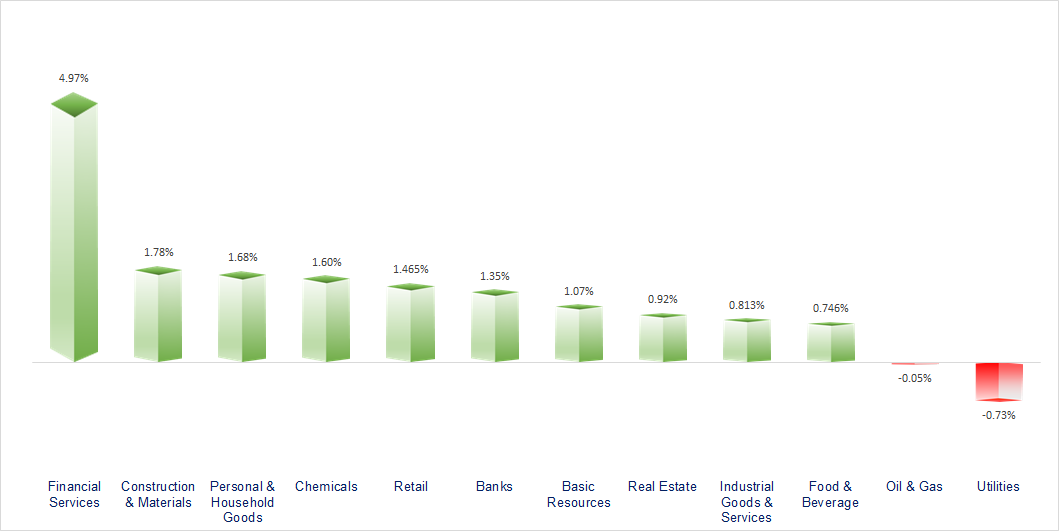

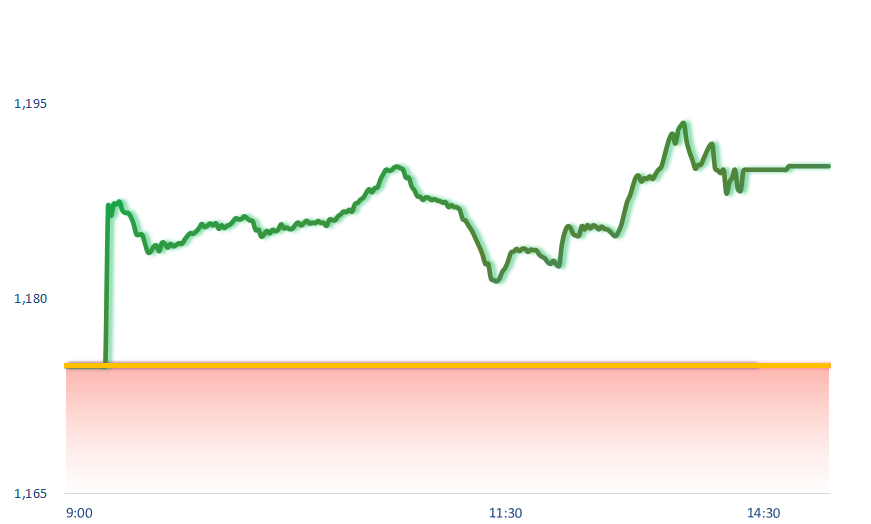

The market had a strong recovery session after a series of 4 consecutive days of decline following the information that the KRX system will officially be put into operation on May 2. The most active group of securities stocks in the market today, followed by construction and chemicals.

ETF & DERIVATIVES

20,930

1D 1.26%

YTD 7.17%

14,330

1D 1.49%

YTD 6.54%

14,860

1D -0.27%

YTD 7.22%

19,170

1D 6.26%

YTD 12.90%

19,800

1D 2.06%

YTD 7.61%

29,010

1D 0.73%

YTD 11.45%

16,100

1D 0.94%

YTD 5.44%

1,205

1D 1.14%

YTD 0.00%

1,208

1D 0.96%

YTD 0.00%

1,210

1D 0.98%

YTD 0.00%

1,210

1D 1.02%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

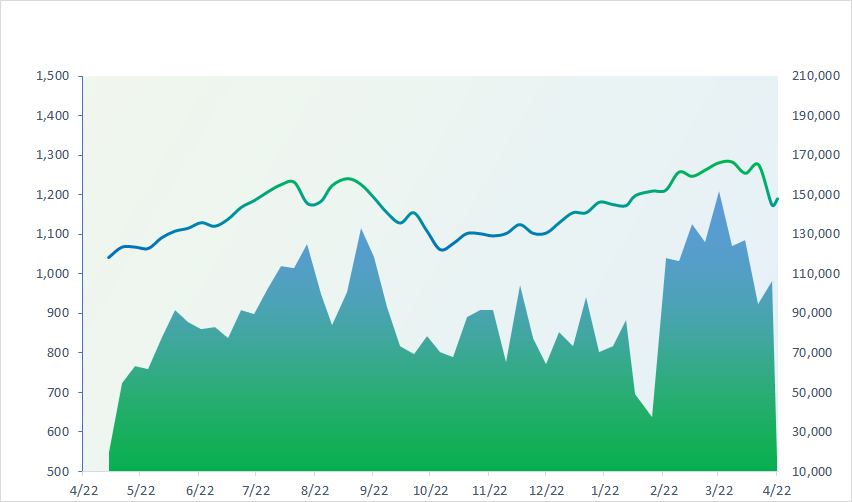

VNINDEX (12M)

GLOBAL MARKET

37,438.61

1D 1.00%

YTD 11.88%

3,044.60

1D -0.67%

YTD 2.78%

16,511.69

1D 1.77%

YTD -1.65%

2,629.44

1D 1.45%

YTD -1.51%

73,477.52

1D 0.54%

YTD 2.20%

3,222.91

1D 1.46%

YTD -0.22%

1,348.91

1D 1.19%

YTD -5.89%

86.35

1D -0.39%

YTD 12.11%

2,359.61

1D -0.82%

YTD 13.62%

Asian markets simultaneously recovered after last Friday's sell-off, when investors were focusing all their attention on new signals from China. Specifically, the market just received information that China has decided to keep the base lending interest rate for 1-year and 5-year terms unchanged at 3.45% and 3.95%.

VIETNAM ECONOMY

3.95%

1D (bps) -1

YTD (bps) 35

4.70%

YTD (bps) -10

2.35%

1D (bps) 5

YTD (bps) 47

2.83%

YTD (bps) 65

25,485

1D (%) 0.05%

YTD (%) 3.98%

27,946

1D (%) -0.04%

YTD (%) 2.08%

3,582

1D (%) -0.08%

YTD (%) 3.05%

The selling price of USD at banks simultaneously increased to a new ceiling of VND25,485 right after opening on the morning of April 22. The USD price on the free market also increased sharply to around VND25,900.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank deployed dual measures to stop the hot rise of exchange rates;

- Goods exports are forecast to surge in the second quarter and the whole year 2024;

- SJC gold price rebounded strongly after the news that the State Bank canceled the gold bar auction;

- Asia steps up currency defense as Middle East conflict erupts;

- BOJ signals the possibility of raising interest rates if a weak yen increases inflation;

- IMF: US and Chinese debt pose risks to global public finances.

VN30

BANK

90,600

1D 0.11%

5D -1.52%

Buy Vol. 1,721,536

Sell Vol. 1,505,888

50,100

1D 3.62%

5D 0.80%

Buy Vol. 2,484,163

Sell Vol. 2,111,191

32,300

1D 2.22%

5D -3.44%

Buy Vol. 19,079,448

Sell Vol. 16,860,345

45,250

1D 1.69%

5D 1.91%

Buy Vol. 12,178,548

Sell Vol. 12,339,914

18,300

1D 1.10%

5D -1.61%

Buy Vol. 14,436,922

Sell Vol. 17,299,646

22,600

1D -0.44%

5D -3.42%

Buy Vol. 34,227,837

Sell Vol. 33,594,899

22,400

1D 0.67%

5D -4.68%

Buy Vol. 12,841,199

Sell Vol. 13,056,175

17,500

1D 5.42%

5D 0.00%

Buy Vol. 27,162,556

Sell Vol. 16,353,934

27,650

1D 3.17%

5D 0.55%

Buy Vol. 23,110,818

Sell Vol. 22,838,314

21,200

1D 0.47%

5D -2.98%

Buy Vol. 9,006,447

Sell Vol. 8,794,700

26,800

1D 0.75%

5D -0.19%

Buy Vol. 11,749,412

Sell Vol. 12,203,187

11,250

1D 0.90%

5D -0.88%

Buy Vol. 38,014,746

Sell Vol. 45,624,012

22,150

1D 0.23%

5D -0.89%

Buy Vol. 2,734,750

Sell Vol. 3,170,303

SSB: Southeast Asia Commercial Joint Stock Bank (SeABank) successfully organized the 2024 Annual General Meeting of Shareholders. Many important goals were approved at the Meeting, including the 2024 business plan with pre-tax profit reached more than VND5,888 billion, an increase of 28% compared to 2023 and increased charter capital to VND30,000 billion.

OIL & GAS

75,000

1D 0.00%

5D -4.48%

Buy Vol. 1,356,393

Sell Vol. 8,578,202

10,650

1D 0.47%

5D -3.75%

Buy Vol. 7,812,124

Sell Vol. 1,021,900

34,650

1D 0.00%

5D -10.64%

Buy Vol. 726,156

Sell Vol. 5,218,125

POW: Pre-tax profit in the first quarter of 2024 is estimated to decrease by 93%.

VINGROUP

42,000

1D -1.41%

5D -2.24%

Buy Vol. 4,801,806

Sell Vol. 15,985,977

41,450

1D -0.12%

5D -0.44%

Buy Vol. 13,061,266

Sell Vol. 12,512,193

22,400

1D 5.16%

5D -1.39%

Buy Vol. 13,520,841

Sell Vol. 4,868,151

VIC: Vingroup has just successfully renewed half of a batch of international bonds worth USD625 million.

FOOD & BEVERAGE

64,000

1D -0.31%

5D 0.00%

Buy Vol. 3,194,111

Sell Vol. 6,690,170

66,900

1D 0.60%

5D -3.27%

Buy Vol. 5,109,350

Sell Vol. 845,786

53,200

1D 1.33%

5D -7.22%

Buy Vol. 759,630

Sell Vol. 661,227

MSN: According to HSBC, if the listing of Masan Consumer on HoSE is successful, Masan can push back CrownX's IPO progress.

OTHERS

52,700

1D 2.13%

5D -0.25%

Buy Vol. 891,045

Sell Vol. 1,024,774

39,600

1D 2.86%

5D -0.25%

Buy Vol. 939,402

Sell Vol. 1,024,774

103,300

1D 0.00%

5D -2.46%

Buy Vol. 1,006,541

Sell Vol. 980,949

110,300

1D 1.19%

5D -1.16%

Buy Vol. 5,615,581

Sell Vol. 4,037,494

48,600

1D 0.83%

5D -2.61%

Buy Vol. 18,441,405

Sell Vol. 16,544,252

28,700

1D 2.14%

5D -3.69%

Buy Vol. 5,097,584

Sell Vol. 5,158,474

35,100

1D 5.72%

5D 0.43%

Buy Vol. 36,049,076

Sell Vol. 35,529,228

28,000

1D 0.72%

5D -1.75%

Buy Vol. 19,781,550

Sell Vol. 26,344,253

FPT: FPT Group has just announced preliminary business results for the first 3 months of 2024 with estimated revenue of VND14,093 billion and pre-tax profit of VND2,534 billion, up 20.6% and 19.5% respectively compared to with the same period in 2023.

Market by numbers

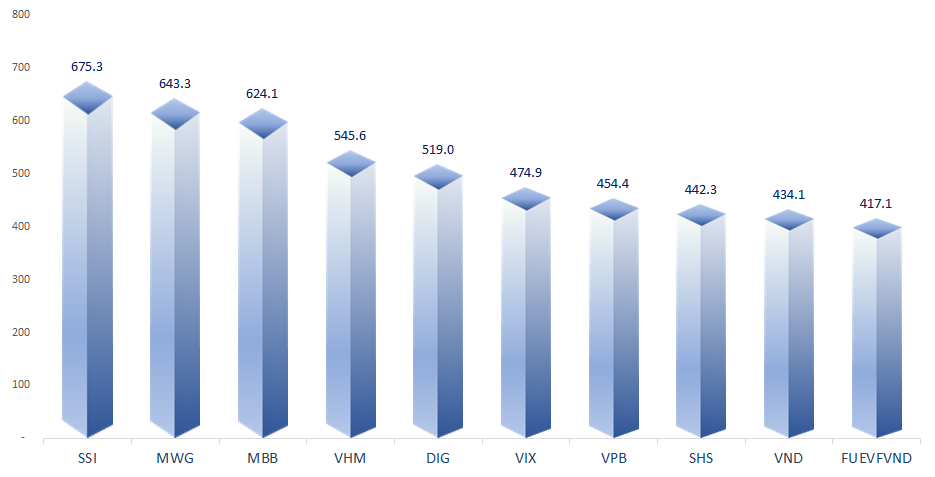

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

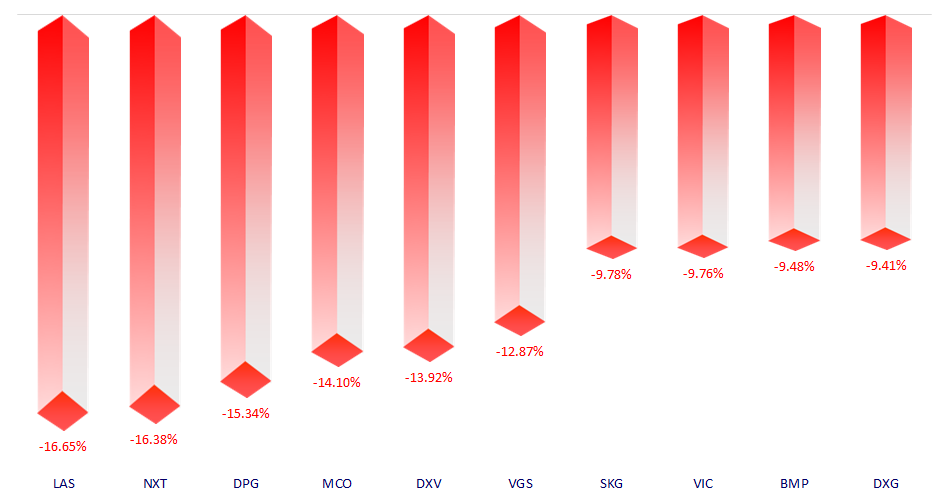

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.